Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

Chinese brand targeting Europe’s largest BEV market by penetration

China’s Zeekr, a marque of Geely, has opened orders for its Zeekr 001 electric shooting brake and Zeekr X e-SUV models in Norway, where more than 19 of every 20 new passenger cars sold last month was a BEV.

The Zeekr X will initially be offered with a fixed interest rate of 0.99pc or leasing from just NOK2,990 ($278) per month.

Having started first European sales late last year, Zeekr is currently available in the Dutch and Swedish markets, while its website offers the opportunity to order in Germany but it has not yet recorded any sales there. Its progress in Europe has thus far been slow.

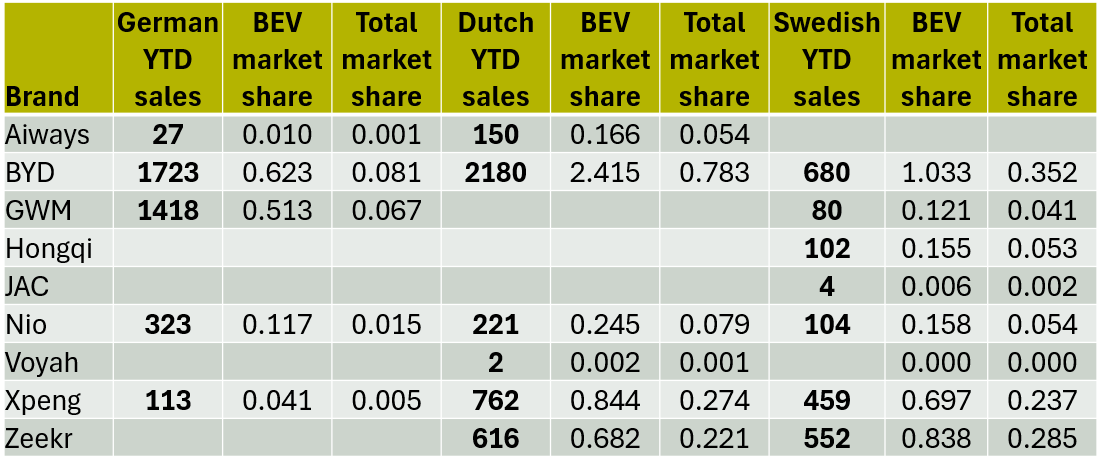

In Sweden, the firm has sold just 330 001s and 222 Xs for total sales of 552 units in the first nine months of this year, giving it a market share of just 0.3pc. In the Netherlands, the equivalent figures are 374 001s and 242 Xs for total units of 616 and market share of just 0.2pc.

Lack of appetite

But its travails are not uncommon for Chinese brands — as opposed to Chinese-made cars from western brands (e.g. Tesla, BMW, Mini, Renault, Dacia) or Chinese-owned or -headquartered European heritage marques (e.g. Volvo, MG, Smart) — in northwest European markets, with few showing any signs of making a material breakthrough.

BYD may have made most progress, but its share of the German, Dutch and Swedish BEV markets thus far this year stand at 0.6pc, 2.4pc and 1pc respectively. For the overall car markets in these countries, its market share is less than 1pc in all three cases (see Fig.1).

And it is even less promising reading for other Chinese brands, with none of them even being able to boast a 1pc share of any of German, Dutch or Swedish all-electric sales.

Insider Focus LTD (Company #14789403)