No Kathleen Valley stope this month – Liontown

The firm is aiming to shift to underground production next month, and maintains everything is on schedule

The CEO’s pivot to the far right risks polluting EV enthusiasts’ feeds

EV in Focus has never been a prolific user of X, formerly Twitter, the social media platform bought by Elon Musk, CEO of EV firm Tesla, in 2022. Part of that is personal preference, part that a B-2-B media service trying to bring intelligent analysis of the EV sector is not particularly suited to the platform compared to alternatives such as LinkedIn.

But be there we must. And, given that it is one of few places where Tesla and its quixotic CEO share information, in the absence of a media relations team at the firm, follow Elon Musk there we must also.

Nonetheless, my checking-in to the EV inFocus feed on X is sporadic. Today was one of those mornings. And I have to confess that what I found left me surprised, and slightly nauseous.

Sewer content

Because we follow Musk, we get his retweets, which this morning seem to be dominated by a really quite horrible account called End Wokeness. But the algorithm seems also to have decided that following Musk means EV inFocus is therefore interested in far-right crackpots from both the US and UK, spewing their bile and lies into our feed.

Even worse, of the EV content that has survived being crowded out by racist and xenophobic poison, most is mindless and inaccurate Tesla boosterism, not useful e-mobility content.

Of course, a more prolific and engaged X user can, I am sure, counteract some of this impact with more careful curation of one’s feed. I have spent material time this morning blocking every far-right account whose posts have appeared on ours, so crossing fingers for the bots to get the message that I find this sort of content sickening.

But the point remains that I should not have to do so. EV inFocus has never taken any interest in right-wing politics, with the potential exception of attempts to draw EVs into the culture wars via FUD disseminated by right-wing media outlets. Simply because we are interested in Elon Musk from an EV point of view, it should not then be on us to extricate ourselves from a flood of ignorant hate speech on X.

And it inevitably intensifies feelings that we already have about Musk’s politics, and by extension towards Tesla and its institutional investors — we know from the pay package saga that the firm’s board are no more than sock puppets — that are not prepared to tackle him over how the CEO of a listed company should behave and, if he does not rein in his behaviour, defenestrate him.

Cali pales

Nor are we alone in having concerns over the impact on Tesla of Musk's rightward shift. Analysts have been worried for several months while, in early August, a German pharmacy chain became a first corporate buyer to reject Teslas in their fleet explicitly because of the political views express by Musk on social media.

And the data from California, one of the US’ most liberal states and the cradle of the country’s EV and Tesla buying growth, shows clearly that Tesla has a problem with BEV buyers going elsewhere.

An ageing model line-up and more competitive alternatives will play a role in that. But Musk’s social pronouncements, amplified by what that might pull onto the feeds of the EV enthusiasts among his X followers, is also part of the challenge.

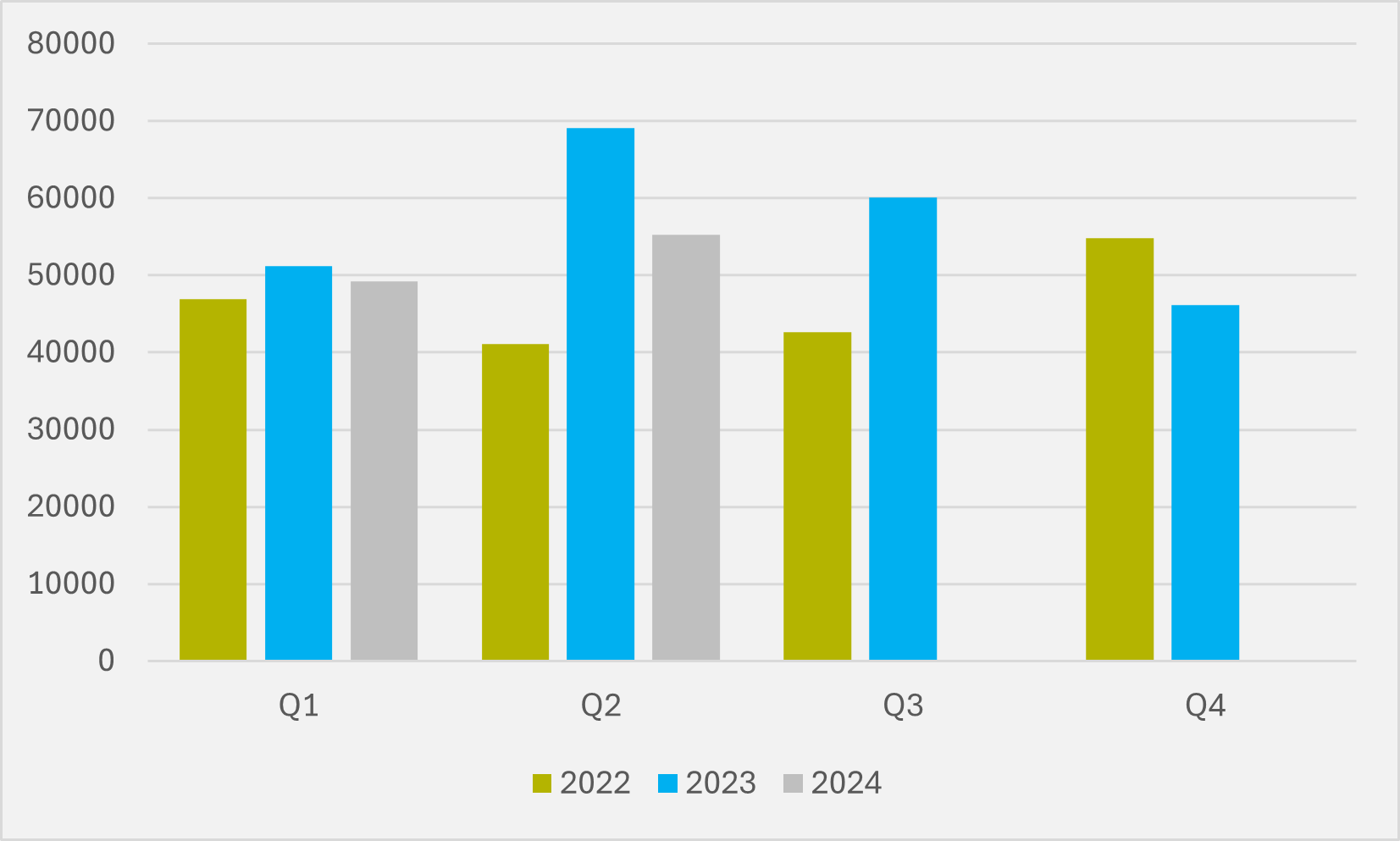

For the past three quarters, Tesla CA sales have fallen year-on-year, down by 16pc in Q4’23, by 4pc in Q1’24 and by a whole 20pc in Q2’24 (see Fig.1). And this is in an overall California BEV market that, until the most recent quarter, has still been growing — Q2’24 all-electric sales were over 100,000 units for only the second quarter ever, but were down slightly in Q2’23 record high.

This means Tesla’s market share has been rapidly eroding. In Q1’22 almost four out of every five BEVs sold in CA were Teslas. For the last three quarters, Tesla’s market share has been under 55pc. Not a total collapse, admittedly, but a worrying trend and one unlikely to be helped by Musk’s ever louder Trump fandom.

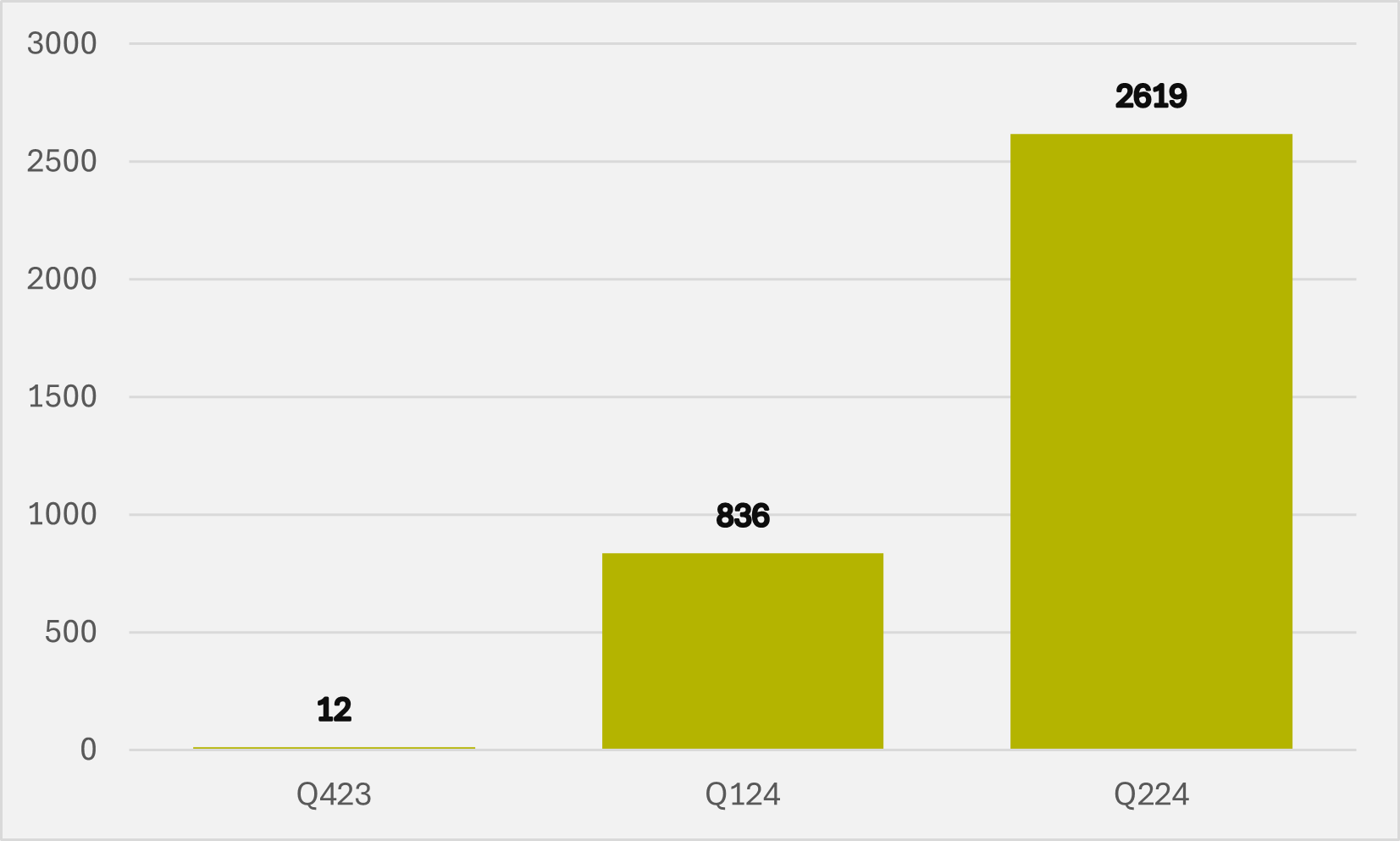

Things would look even bleaker, but for the first signs of some green shoots in deliveries of Tesla’s Cybertruck e-pickup in CA. Having shifted a handful in Q4, Q1 deliveries rose towards four figures, while Q2 saw volumes top 2,500 (see Fig.2).

These Cybertruck sales are still marginal — and struggle to back up the “Model 3s are everywhere. The same story is unfolding for the Cybertruck” narrative that the Teslaconomics account offered up on our X feed this morning… — representing only 4.7pc of all Teslas sold in CA in Q2. And they do nothing to dispel our view that Cybertruck will reman only a niche product for the foreseeable future. Nonetheless, more BEV sales remains a win in our book, no matter the OEM or vehicle involved.

Insider Focus LTD (Company #14789403)