Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

All-electric’s position as the Sino-Swedish OEM’s best-selling vehicle type in Europe suffers October setback

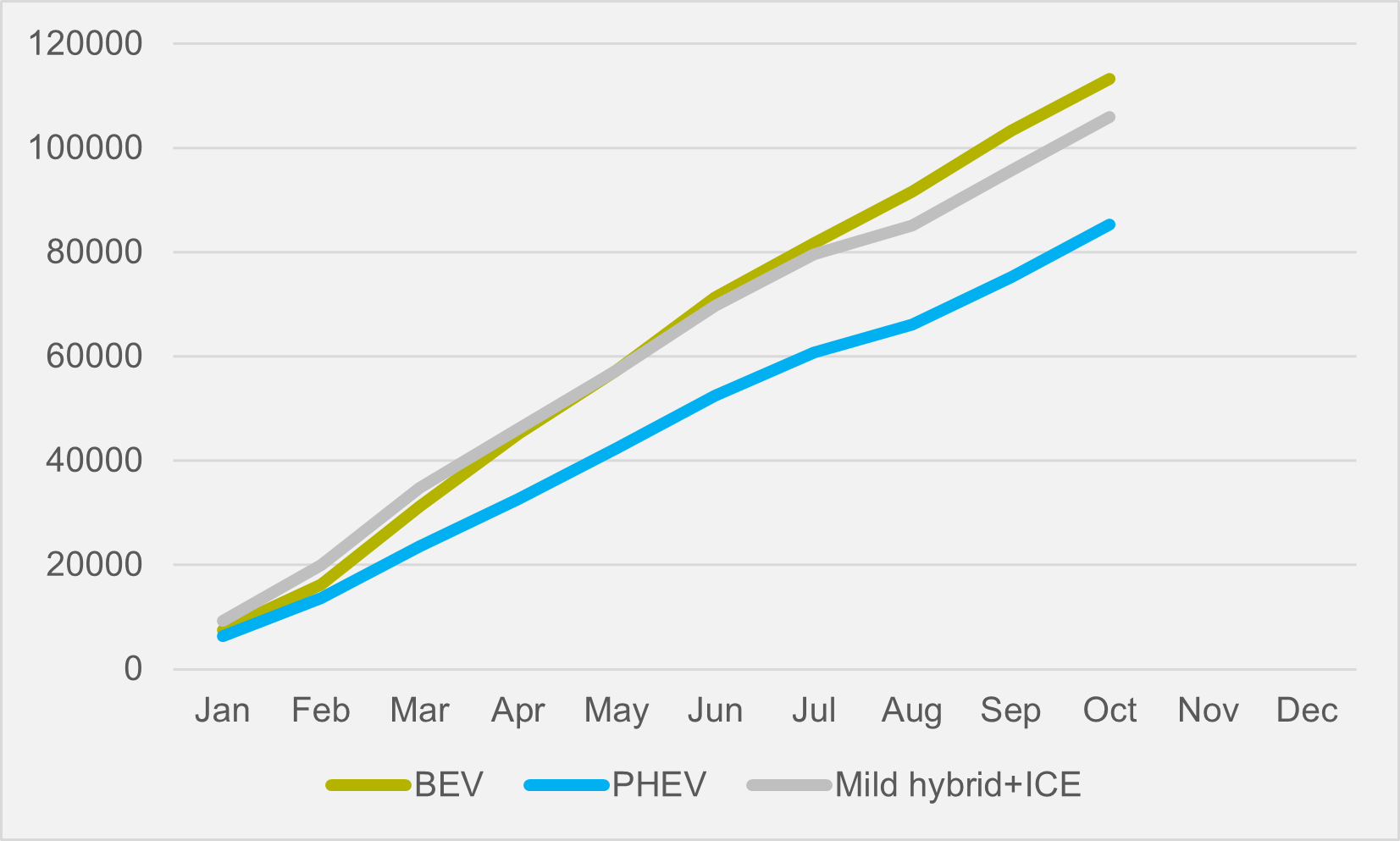

Gothenburg-headquartered Volvo Cars sold fewer BEVs in Europe in October than either PHEVs or mild hybrids+ICE, reversing a trend that has seen all-electric outsell plug-ins every previous month this year on the continent and, since March, also outperform plug-less sales (see main image).

The firm shifted over 9,800 BEVs in Europe in October, still up by 40pc compared to the same month last year. But PHEVs recorded a year-on-year jump of 52pc in October to almost 10,150 units. And while Volvo’s sales of mild hybrids+ICE were down by 9pc annual, they still clocked in a just shy of 10,200.

One month’s data should not overshadow that Volvo’s BEVs have had a strong year in Europe thus far. At cumulative volumes above 110,000 for the ten months of the years so far, they are up by 90pc year-on-on-year. And Volvo has sold more all-electric vehicles on the continent so far in 2024 than mild hybrids+Ice — c.106,000 units, up by 12pc — and PHEVs — c.85,000 units, up by 8pc (see Fig.1).

Nonetheless, given Volvo is the poster child for legacy OEMs fully embracing and making a success of electrification — even after jettisoning its 2030 all-electric target — its October numbers are further evidence of all-electric travails in Europe of late.

As Volvo has nothing to worry about around incoming tighter EU rules on CO2 emissions at the start of next year, its late-2024 BEV sales are not likely to be impacted by deliberate slowing of transactions to push them into 2025 as we may be observing with other legacy OEMs.

China and US BEV struggles

In the world’s two other largest markets, China and the US, Volvo’s all-electric offering continues to struggle to cut through. In China, it sold just 241 BEVs in October, largely flat to the same month last year. Cumulative all-electric Chinese sales are up by 16pc but, at just under 3,200 units, they remain minimal.

Like other Western OEMs, it continues to rely heavily on its ICE offering in China, with plug-less sales making up around 90pc of its Chinese mix in October and year-to-date. But these are down by 9pc year-onyear, matching an overall decline in Volvo’s Chinese volumes compared to the first ten months of 2023.

In the US, PHEVs continue to be Volvo’s big success story, with volumes up by 67-68pc in both October and year-to-date. The firm still sells mainly mild hybrids+ICE in the US, with about two-thirds of its sales in 2024 thus far and c.60pc of October sales not having a plug.

But these numbers are down by 30pc year-on-year for October and by 11pc year-to-date. But these declines are shallow compared to the slump in US appetite for Volvo’s all -electric offerings. Its US BEV volumes are down by 54pc in October and by 64pc for 2004 thus far.

The firm’s performance in the rest of the world looks more like Europe. BEV sales rose by 40pc in October and are up by almost 60pc cumulatively for the year.

PHEVs enjoyed a good October, with volumes up by 52pc, although year-to-date plug-in sales remaining slightly lower than in 2023. Volvo shifted 27pc fewer mild hybrids+ICEs in the rest of the world in October, with year-to-date plug-less sales tracking 17pc lower.

Insider Focus LTD (Company #14789403)