Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

Sino-Swedish firm growing all-electric sales in Europe but struggling in US and China

Gothenburg-headquartered Volvo Cars sold more BEVs than ever before in March. But its all-electric success is not global, with growth centred almost exclusively on the European market while Chinese and US volumes fall.

The firm shifted more than 18,000 BEVs in March, far outstripping a previous high of c.12,600 set in the same month last year (see main image). The firm’s new small e-SUV the EX30 “contributed to the sales growth”.

But this all-electric growth was almost entirely centred in Europe, where sales rose by 66pc to just shy of 15,000. In contrast, BEV sales ex-Europe/US/China rose by only 8pc year-on-year, whereas they fell by 15pc in China and by a substantial 66pc in the US.

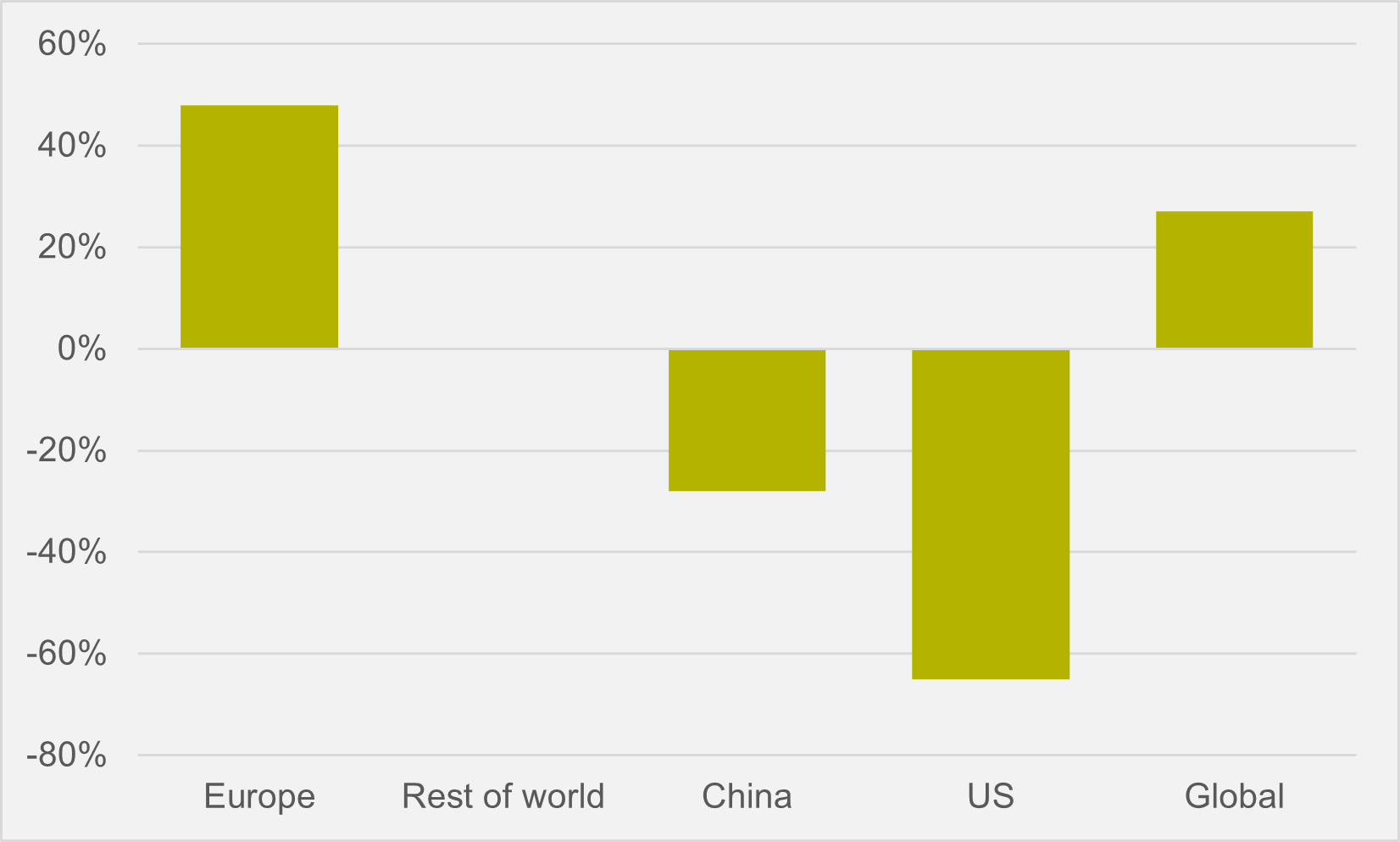

It was a similar pattern for Q1’24 as whole. European BEV sales rose by 48pc, Rest of the world was largely flat, while China performance sagged by 28pc and the US by 65pc (see Fig.1).

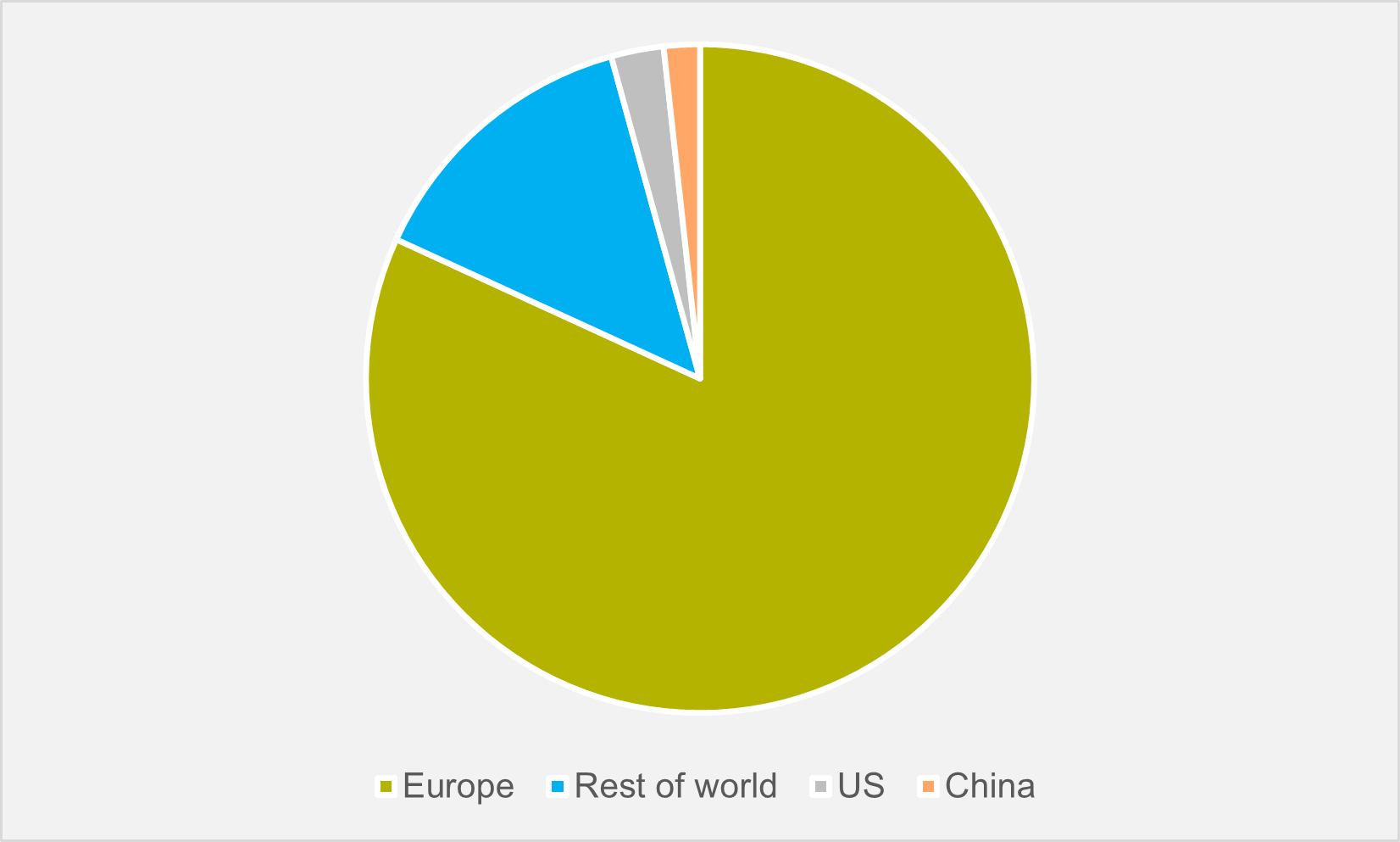

But, because Europe is Volvo’s largest all-electric market, overall BEV sales in the quarter were up by 27pc. For Q1 as a whole, 82pc of Volvo’s BEV sales were in Europe, 14pc in Rest of the world, but just 2.5pc in the US and 1.7pc in China (see Fig.2).

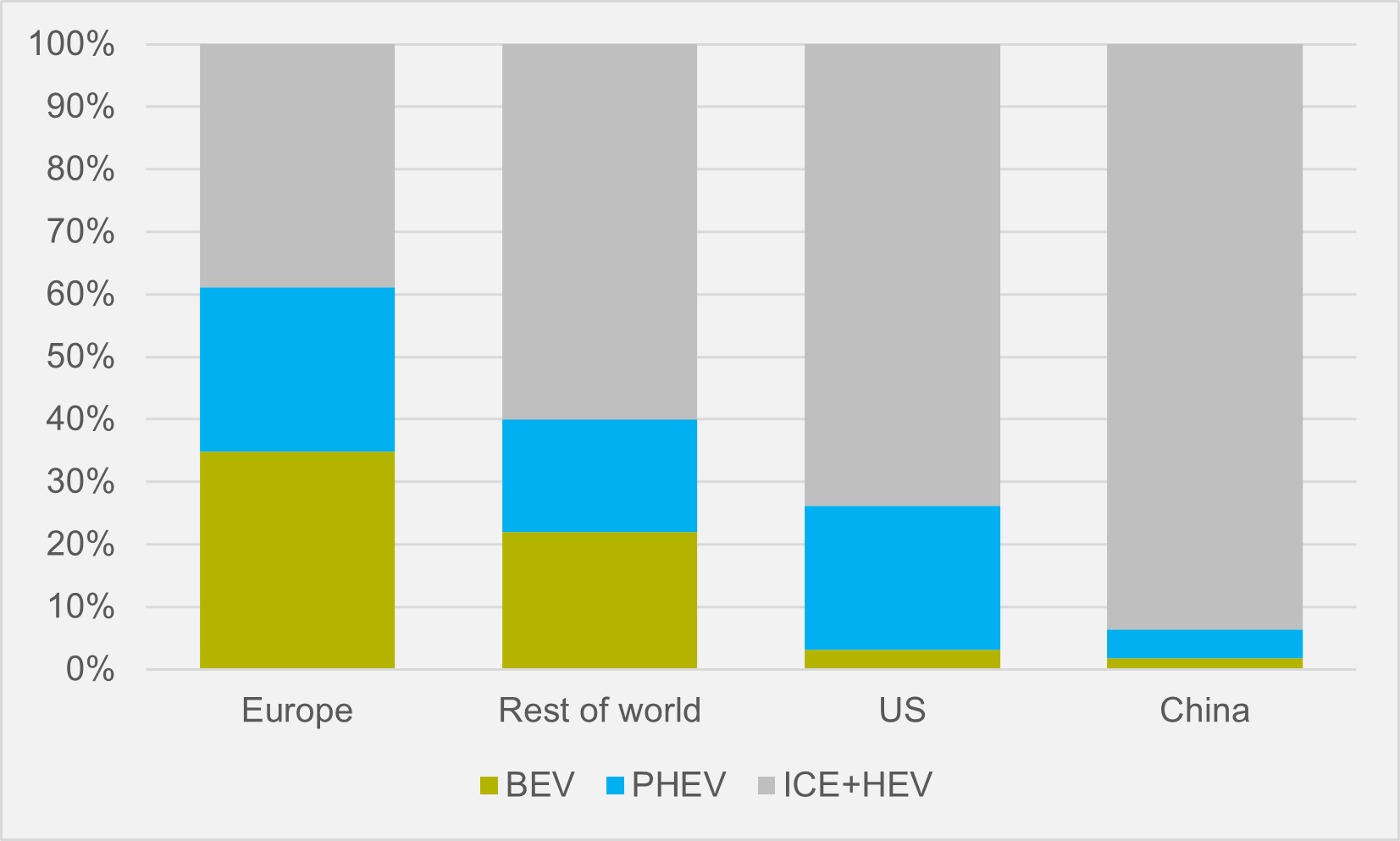

These regional differences are also observable in the respective shares of BEVs, PHEVs and ICE+HEVs that Volvo sells. In Europe in Q1, BEVs made up 35pc of total volumes, plug-ins 26pc and ICEs and non-plug-ins 39pc. For other regions these breakdowns look very different: Rest of world 22/18/60; US 3/23/74; China 2/5/94 (see Fig.3).

Outside of Europe, US PHEVs stand out as a rare bright spot in Volvo’s electrified vehicles strategy. They grew by a substantial 76pc in March and by 44pc for the year as a whole.

Enjoying EV inFocus? Hit follow on Google News to get us in your feed.

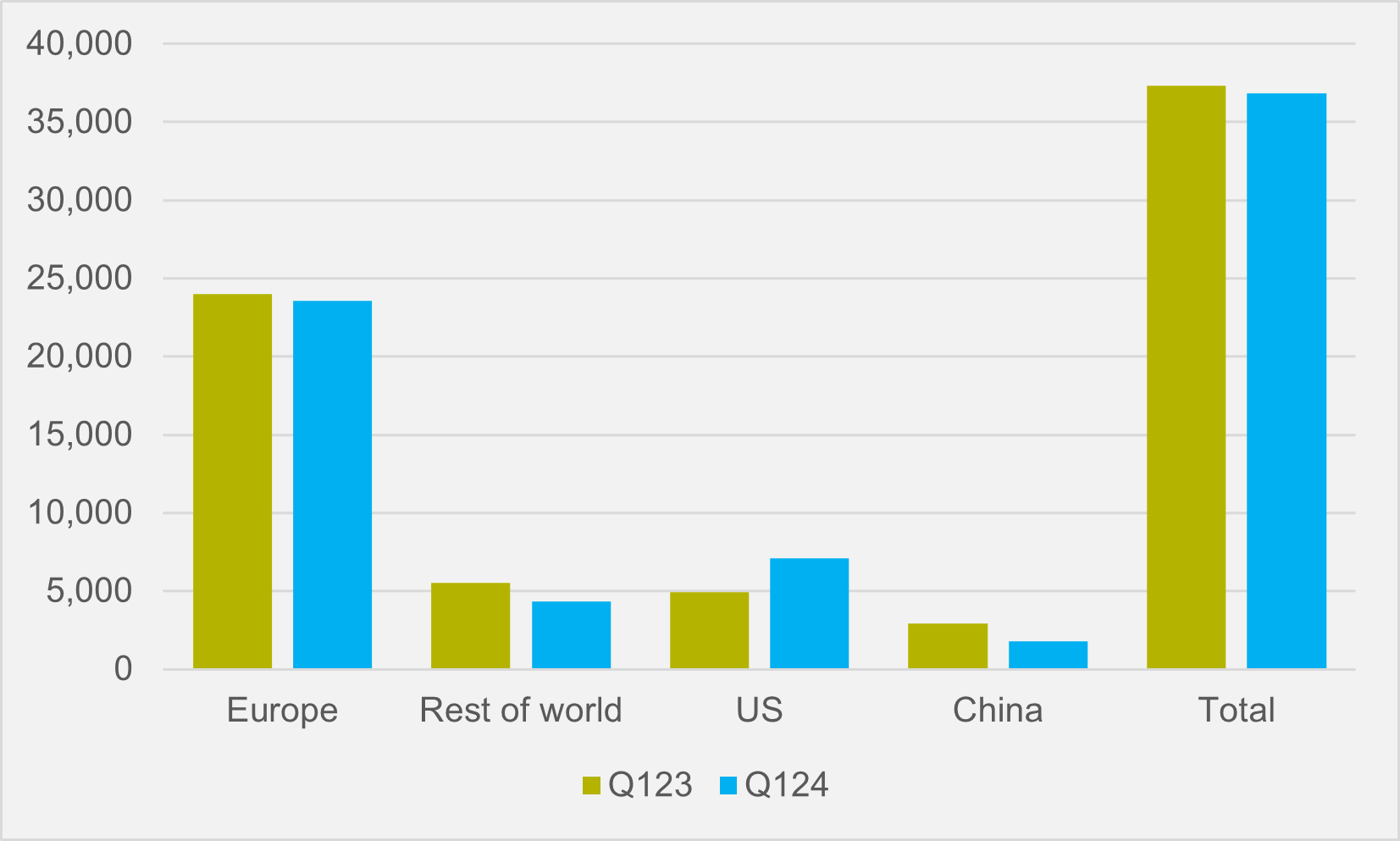

But, with PHEV volumes moderating slightly in Europe in Q1 and falling by c.20pc year-on-year in the Rest of the world and by almost 40pc in China, Volvo’s global plug-in sales were still lower in Q1’24 than the same period last year (see Fig.4).

Insider Focus LTD (Company #14789403)