No Kathleen Valley stope this month – Liontown

The firm is aiming to shift to underground production next month, and maintains everything is on schedule

Firm says January increases will be topped later in the year

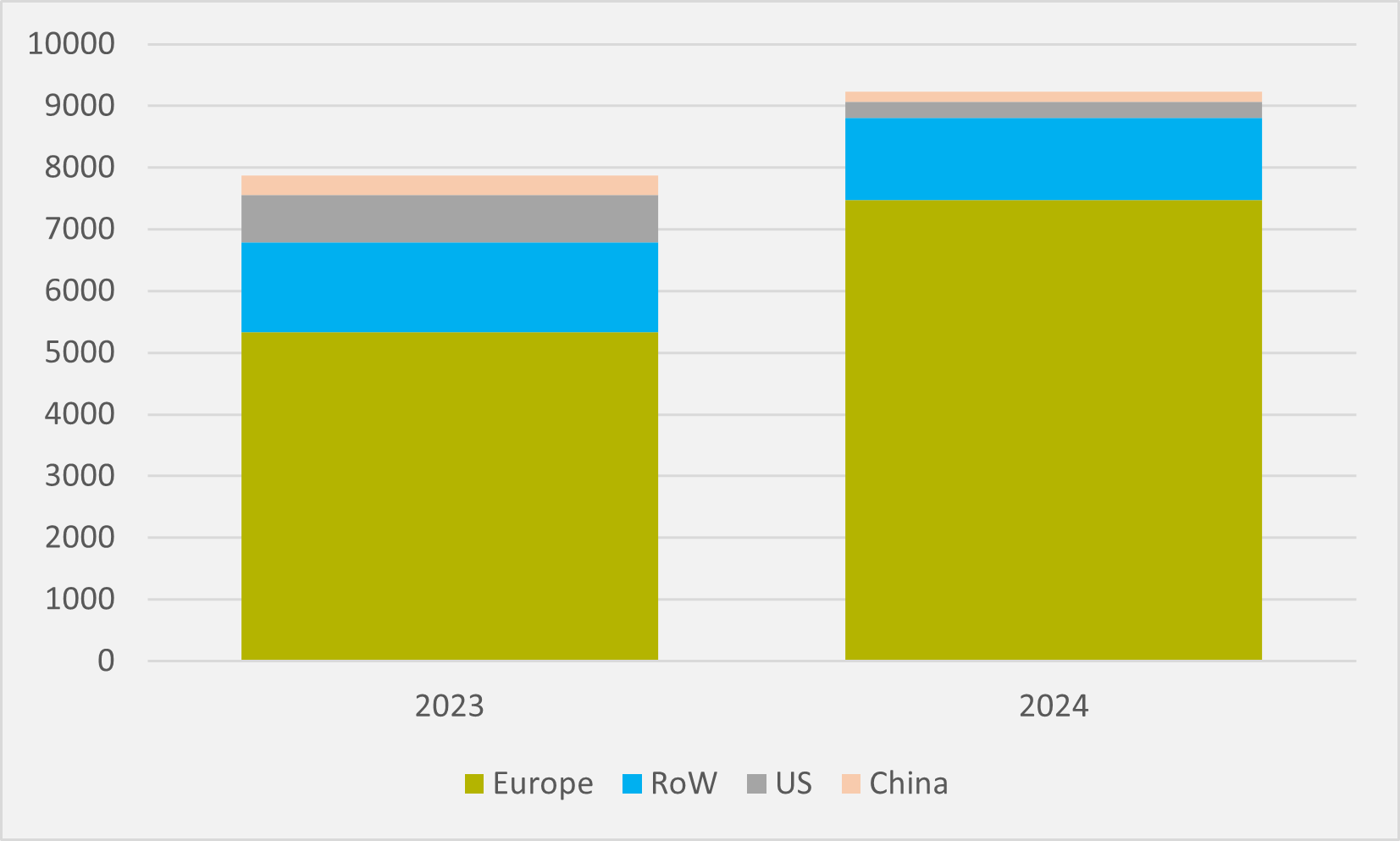

Sino-Swedish OEM Volvo Cars sold 9,226 BEVs in January, a 17pc increase year-on-year. But the firm is predicting that annual progress on its all-electric sales will be even better later in the year.

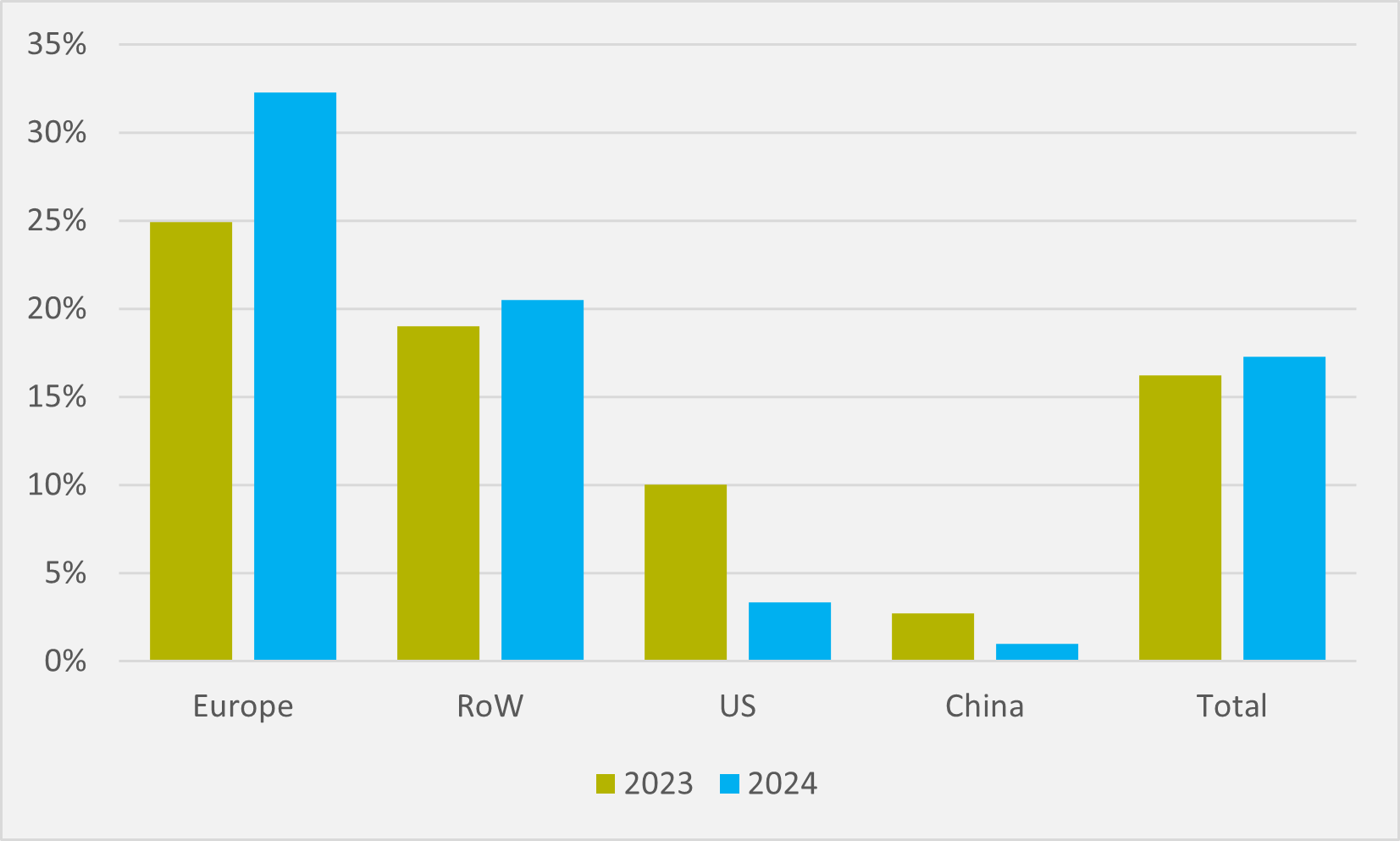

In Volvo’s home European market, it sold 7,471 of these BEVs, for a 40pc year-on-year increase (see Fig.1). All-electric vehicles comprised 32pc of all its sales on the continent, up from 25pc in January ’23, compared to an overall 17pc BEV share of Volvo’s global sales.

Europe was, though, a lone island of growth. In its next biggest market, Rest of the World (RoW), Volvo’s BEV sales slipped by 8pc year-on-year to 1,334 — albeit, with falling overall sales outside the world’s three largest markets, the share of BEVs in Volvo’s RoW mix did edge up from 19pc to 20.5pc.

In China, January BEV sales were down by 50pc annually to just 161. In January ’23, all-electric sales were 2.7pc of all the units it shifted in China. Last month, that dropped to just 1pc (see Fig.2).

And the US, sales fell by 66pc to 260. Share of BEVs in Volvo’s US mix fell from 10pc 12 months ago to less than 4pc.

But Volvo executives are expecting a better BEV performance for 2024 as a whole than that reflected in January’s numbers, albeit China growth may be less material owning to strategy differences there. And it also expects the profitability of its BEV sales to increase too.

BEV launches the driver

Overall year-on-year sales growth in January of “9-to-10pc is a little bit lower than what we are guiding for towards the full year”, according to Volvo chief commercial officer Bjorn Annwall. “We are saying we are going to grow faster in June in ‘24 than we did in ‘23, and in ‘23 we grew by 50pc. Clearly the big delta is that this week we released the [compact e-SUV] EX30 in Europe and now we are starting to shift the EX30.”

In fact, all three of Volvo’s key releases expected to drive 2024 sales growth are BEVs, with the EX30 joined by the EX90 full-sized, seven-seat e-SUV and the EM90 targeted at the Chinese luxury MPV segment. The ramp-up of these models, if Volvo’s ambitions for them are met, will drive both sales growth and an increase in the share of BEVs in Volvo’s sales mix.

“When we look at 2023, we grew by 70pc in our BEV segment and that was really just with two cars, the XC40 and the C40, both of which are, of course, the same size,” says Volvo CEO Jim Rowan. “Effectively on one platform and two cars, we saw that growth.

“This year, we will see the EX30, the EX90, and the EM90, all in full production by the half-year. So we expect to grow considerably in the EV segment this year and to take further market share.”

Two-speed market

Nor is Rowan fazed by the noise around a slowdown in BEV demand growth. “The reason I think there is so much narrative around slowing in EVs is that there are two different segments — there is the premium segment, and there is the mass market.

“I think, in the mass market segment, maybe that has been affected by some companies not getting to price parity with ICE. In the premium segment, we do not see that. We see the premium segment growing, and we are taking market share in that,” he says.

Some 40,000 EX30s have already left the factory. And the firm reiterates that it expects gross margins of 15-20pc of the EX30, a step up from the 13pc margin it achieve from the existing BEVs in its portfolio in Q4’23.

Having released the car to European customers in late January, Volvo is expecting rapid rollout of global deliveries. “Japan will open up next week, and then, Brazil [and] Latin America, and the US comes in around summertime,” says Annwall.

“It will be a quite quick ramp-up during the spring; that is the plan. You are going to see decent EX30 numbers in Q1 and, from thereon, it is going to start to get really high,” he predicts.

China pressure

But not so much in China, where the EX30 will have “a quite different strategy”. “We are a premium electrified company, and the core part of the electrification strategy in China is around EM90 and EX90 to really position Volvo as the premium electric car company,” Annwall explains.

“EX30 will play more a niche role there — value over volume. It will play a premium role, and we have taken down the volume requirements for that car in China and will rather use it as a stepping stone to really building that premium electrified position in China.”

In contrast, in the rest of the world, Volvo sees “extremely strong demand for the EX30 at the price we have priced it at, so we do not see any reason to adjust pricing for that car”, even when German competitors have been discounting in Europe and North America. “The short story is we feel very strong about the pricing outside China,” Annwall says.

For the EM90 MPV in China, Volvo is “taking orders at a higher pace than we had in the plan”, according to Annwall. And Rowan outlines how Volvo has thought hard about specific Chinese use cases for the MPV — catering specifically to an executive who spends large amounts of time being chauffeured between Chinese cities during the working week, with a fully-reclining ‘captain’s seat’ offering massage, but who might drive the car himself with children and grandparents during the weekend.

“You have got your whole family in there, and everybody has a really comfortable seat,” says the Volvo chief. “That is the part that has been missed, I think, when we look at it from the Western perspective. We do not see it like that, but it is a very different use case for that MPV, and it is resonating extremely well.”

Insider Focus LTD (Company #14789403)