No Kathleen Valley stope this month – Liontown

The firm is aiming to shift to underground production next month, and maintains everything is on schedule

The Sino-Swedish automaker sees a new high for BEV share of sales in April

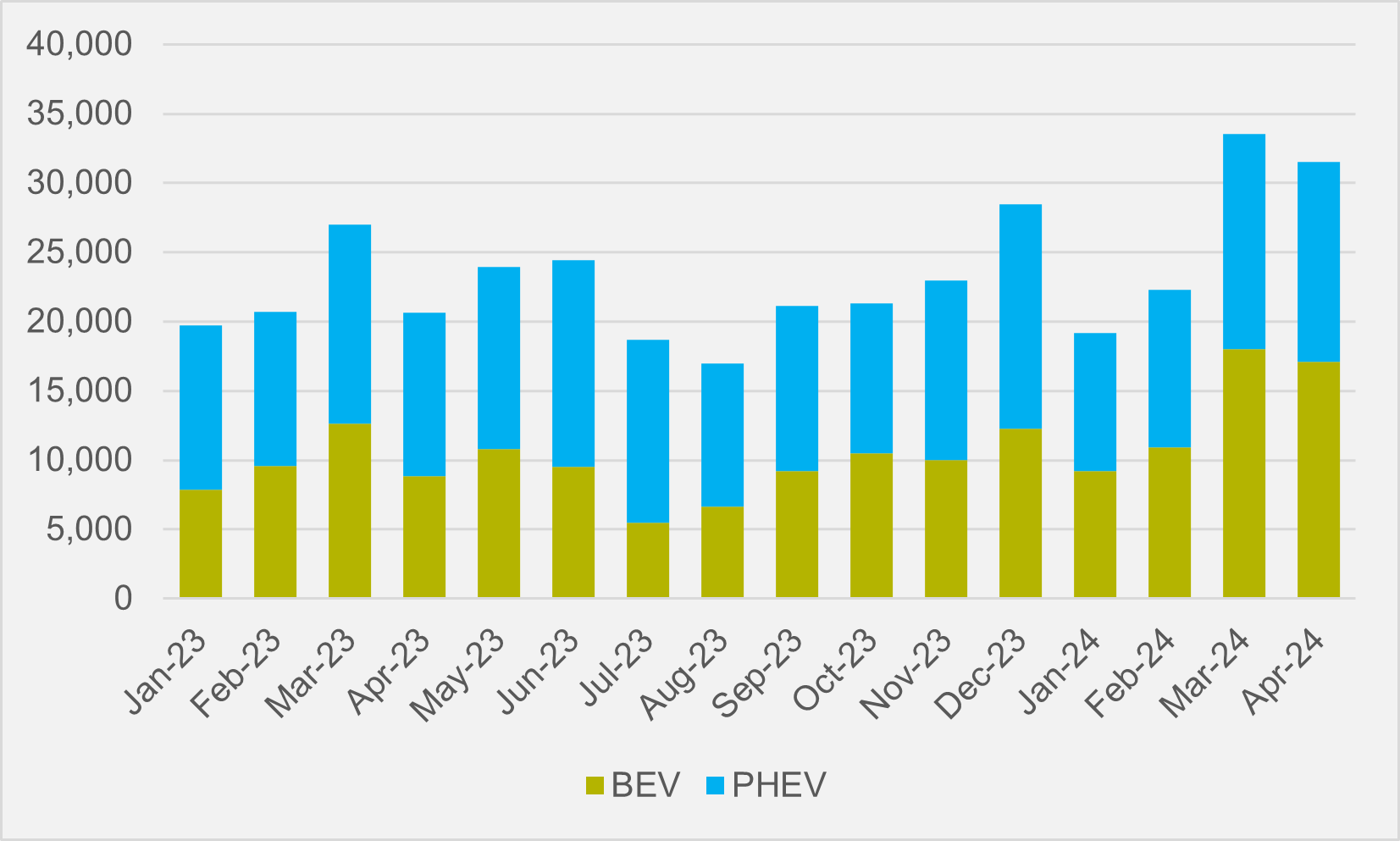

More than a quarter of the vehicles Gothenburg-headquartered OEM Volvo Cars sold globally in April were all-electric, the highest-ever monthly share of BEVs in the firm’s sales mix. And this 26pc slice of the pie combined with 21.9pc of sales being PHEV meant that almost 48pc of all cars Volvo sold last month had a plug (see main image).

Sales of both BEVs and PHEVs were slightly lower month-on-month, at just over 17,000 and just under 14,500 respectively, compared to March (see Fig.1). But with overall Volvo global sales falling substantially, both made progress in terms of sales mix.

Volvo’s sales picture remains varied on a regional basis, however. Around half of its sales in April, and for the first four months of the year as a whole, are in Europe.

And the firm’s BEVs, including growth driver the compact EX30 SUV, are by far most popular on its home continent. All-electric sales grew by 156pc year-on-year in April to 13,880 units, while growth across the first four months of the year is currently running at 70pc.

More than 80pc of the total BEVs Volvo has sold in Jan-Apr have been in Europe. And all-electric makes up more than 40pc of all European sales in that same period.

Colder reception

In stark contrast, there is limited demand for the firm’s BEVs in either the US or Chinese markets. Well over 90pc of Volvo sales in China, both in April and in the first four months of the year are ICE or HEV, and around one-in-three of all non-electrified vehicles the firm sells are in China.

The US is more receptive to Volvo’s PHEV range, where volumes are up by 89pc in April and by 55pc Jan-Apr, compared to BEV demand that has collapsed by 76pc and 69pc, respectively. But ICE and HEVs still make up c.70pc of US sales, representing around 20pc of all the non-electrified units Volvo shifts.

Insider Focus LTD (Company #14789403)