No Kathleen Valley stope this month – Liontown

The firm is aiming to shift to underground production next month, and maintains everything is on schedule

OEMs targeting the e-pickup segment may need to rely on customers who have not previously bought trucks

The early stages of legacy automakers’ EV transition plans in the US have heavily involved attempts to conquer the pickup market, the quintessential American automotive segment.

In attempting to build on its historical strength in ICE pickups, Detroit Three player Ford has repeatedly cited its EV strategy is “to go after customers we know really well,” as CEO Jim Farley reiterated on the company’s Q3 results call in October.

“If [Musk] wants to design a Cybertruck for Silicon Valley people, fine. But... I know how to design a truck," Farley said back in June.

Nor is Ford alone in getting excited about the e-pickup segment. Once the Chevrolet Silverado and GMC Sierra EV Denali arrive next year, rival GM will have three e-pickups in the market. The third big Detroit automaker Stellantis will also be joining the party next year with the Jeep Ram 1500 BEV, although it has also announced plans for an extended range EV version as if it is beginning to realise that BEV pickups may not be a home run.

One of the reasons that Germany’s VW is reviving the Scout brand is to try to target the BEV segments of the US pickup and SUV markets in which it has struggled to make inroads. And Japan’s Toyota displayed its latest EPU e-pickup concept at the Japan Mobility Show, admittedly without having ever committed to bringing an electric truck to the US.

To be clear, US EV pure plays have also been seduced by the margins and customer appetite for buying trucks in the ICE space translating across to BEVs. Leaving aside the Tesla Cybertruck to which Farley was playfully referring in June, Californian challenger Rivian has also got its R1-T offering out there.

And a string of start-ups have had plans or still hope to launch e-pickups, including the Fisker Alaska, the Alpha Wolf and the Canoo Pickup. The Endurance of ill-fated Lordstown, now in Chapter 11 bankruptcy, got as far as even being available for sale, which is more than can be said of the Atlis XT after parent Nxu pivoted away from automaking to charging. Other names that you may never have heard of, but testify to the hunger to crack e-pickups, include the Neuron EV T.One, the Edison Future EF1-T and the Hercules Alpha.

Lack of appetite

But new consumer data from market research firm Autopacific finds that only a fraction of current ICE pickup drivers are considering the switch to electric and that ICE and e-pickup markets are “vastly different groups”, throwing into doubt the size of the e-pickup customer pool.

“Consumer demand for electric pickup trucks is among the lowest compared to other intended segments. Just 12pc of future mid-size and 8pc of future full-size pickup truck intenders plan to take the plunge into going all-electric,” the research says.

“What this data shows is that EV pickup truck intenders are a different breed,” says Autopacific product and consumer insights analyst Robby DeGraff.

And if this is worrying, it can hardly come as a surprise to, say, Ford, whose own CEO told analysts on the firm’s Q3 call that “the markets where we are in, like F-150, Super Duty Pro, they are not duty cycles that are going to go EV”.

E-pickup strategy

So what does that mean for OEMs that have heavily backed the segment? Ford, again as an example, saw the electric version of its flagship pickup, the F-150 Lightning, rose to become the company’s top-selling EV in October, but while its sales rose again in November, it was once again overtaken by the Mustang Mach-E crossover.

And it is still selling only just over 4,000 F-150 Lightnings a month. Worse, while begging patience for a second generation of BEVs that will be more competitive, the only vehicle that has been teased out of Ford’s next-gen EVs line-up is another e-pickup.

Farley extolled the virtues of the planned new vehicle on the company’s Q3 call, saying that “our Gen 2 all-new full-size pickup truck, for example, is one of the most thrilling vehicles I have ever seen in my career”.

“Stunning performance like no truck has ever performed, building unexpected innovation for truck customers far beyond the normal truck attributes, a super flexible cabin that feels like a lounge or a tiny office,” he added.

The hope for Ford, GM, Jeep, VW, Toyota if it decides to play, and the EV pure plays may be that — while few ICE truck buyers may be tempted to go BEV in the near future — other BEV enthusiasts might be tempted into the pickup space by their offerings.

New market

“The buyers of the Rivian R1T and even F-150 Lightning are likely mostly not traditional pick-up owners,” suggests Loren McDonald of automotive consultancy EVadoption, on the possibility that e-pickups could create their own new customer segment.

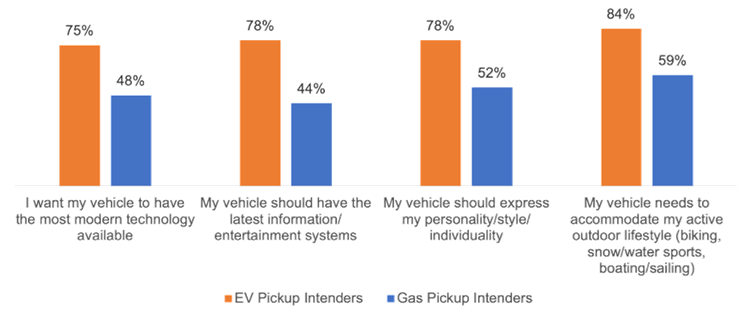

And Autopacific’s research also supports the thesis that potential e-pickup customers are a different buyer pool entirely. “EV pickups look to have the most adventurous and feature-demanding buyers, giving automakers the opportunity to introduce many new features and technologies,” the research finds.

“EV pickups offer the perfect home for them as demand for modern technology and features is much higher among EV pickup intenders. With 75pc of EV pickup intenders (see Fig.1) saying they want their next vehicle to have the most modern technology available — compared to less than half of ICE pickup intenders — automakers clearly have a welcoming buyer,” Autopacific expands on this differentiated market segment.

Ford management at least seems to have grasped this consumer trend, with Farley boasting of the next-gen e-pickup that one can “take the wheels off this truck, and it is still a mind-blowing product and a digital experience that totally is immersive and personalised”.

But the question remains how big this buyer pool is. The Autopacific research polls only those who already own electric and ICE pickups, so cannot help to answer it.

“The fact that the R1S, the 3-row large SUV from Rivian, is outselling its own pickup, the R1T, by 2 to 1 from my estimates, further supports that — whether new or traditional truck buyers — the pickup market is going to be one of, if not the last, vehicle segments to see strong EV sales,” McDonald warns.

Insider Focus LTD (Company #14789403)