Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

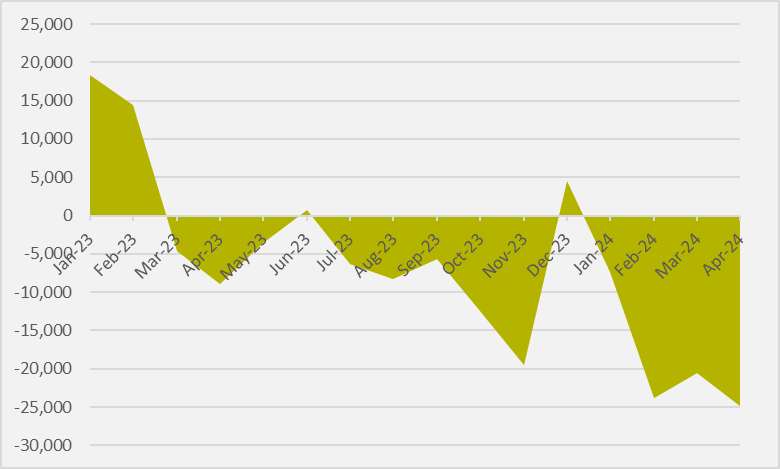

BEVs trailed HEVs by 25,000 units in April, the largest gap since August 2021

The differential between US BEV and non plug-in hybrid sales has grown to its widest gap in nearly three years, as the country's BEV registrations showed only 2pc year-on-year growth in April, according to data from the Argonne National Laboratory.

The US registered 93, 598 BEVs in April, which trailed the number of HEVs registered by just under 25,000 units (see maim image). This is despite sequential decline in HEV registrations — albeit it is the second strongest month ever recorded for hybrids, trailing only last month.

The strong month for hybrids also saw the technology become the first non-ICE powertrain to break the threshold of 9pc share of the entire US light vehicle market in a month.

BEVs have rarely outsold HEVs in any given month and all-electric vehicles have been slowly falling further behind. However, this is not a trend that begun only since alarm bells on the BEV demand outlook have begun ringing. Instead alle-lectric vehicle sales have been broadly losing ground on hybrids for around a year, bar two exceptional months in June and December 2023 (see Fig.1).

Several OEMs, including legacy US manufacturers GM and Ford, have recently announced their intention to rely more on HEVs, and on PHEVs as compliance vehicles, to bridge the gap until their next-generation BEVs are ramped up.

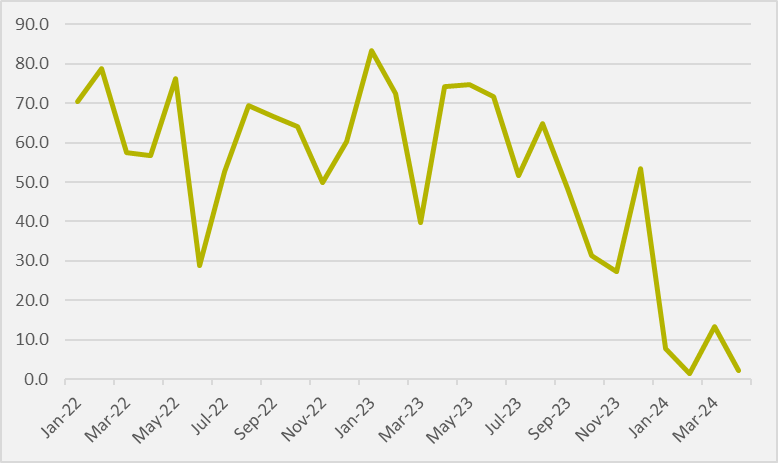

But while year-on-year BEV growth is broadly slowing in the US, it is still positive growth (see Fig.2). BEV registrations are also susceptible a high degree of seasonal variation, with the first month of each quarter, such as April, typically being weaker. Indeed, March was the third strongest month ever for US BEV registrations, with over 100,000 units sold for only the fourth time.

Automotive consultancy JD Power last week found that 24pc of US shoppers say they are “very likely” to consider purchasing an EV, down from 26pc a year ago, while the percentage of shoppers who say they are “overall likely” to consider purchasing an EV has decreased to 58pc from 61pc in 2023.

"This year, it has been more incremental. Several automakers have deferred EV launch and production plans and have shifted more focus toward hybrids and plug-in hybrids, so we are seeing a lot of shoppers who still have not found an EV that checks all the boxes," says JD Power executive director Stewart Stropp.

Separate data from research firm Motor Intelligence finds that 50.5pc of the 90,598 BEVs registered in April were Teslas. Although Tesla's sales are showing signs of a slowdown, the firm's market share has not been materially dented since slipping to around the 50pc mark during 2023.

But despite relatively flat growth on a year-on-year basis, all-electric vehicles marginally outgrew the US auto market as a whole on a month-on-month basis, and claimed a 7.13pc share of the market.

Insider Focus LTD (Company #14789403)