Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

One could see the glass as half-full or half-empty

The latest data on US October new BEV sales from the Department of Energy’s Argonne National Laboratory can be spun positively or negatively. And doubtless it will be, depending on whether you fall into the camp of EV booster or sceptic.

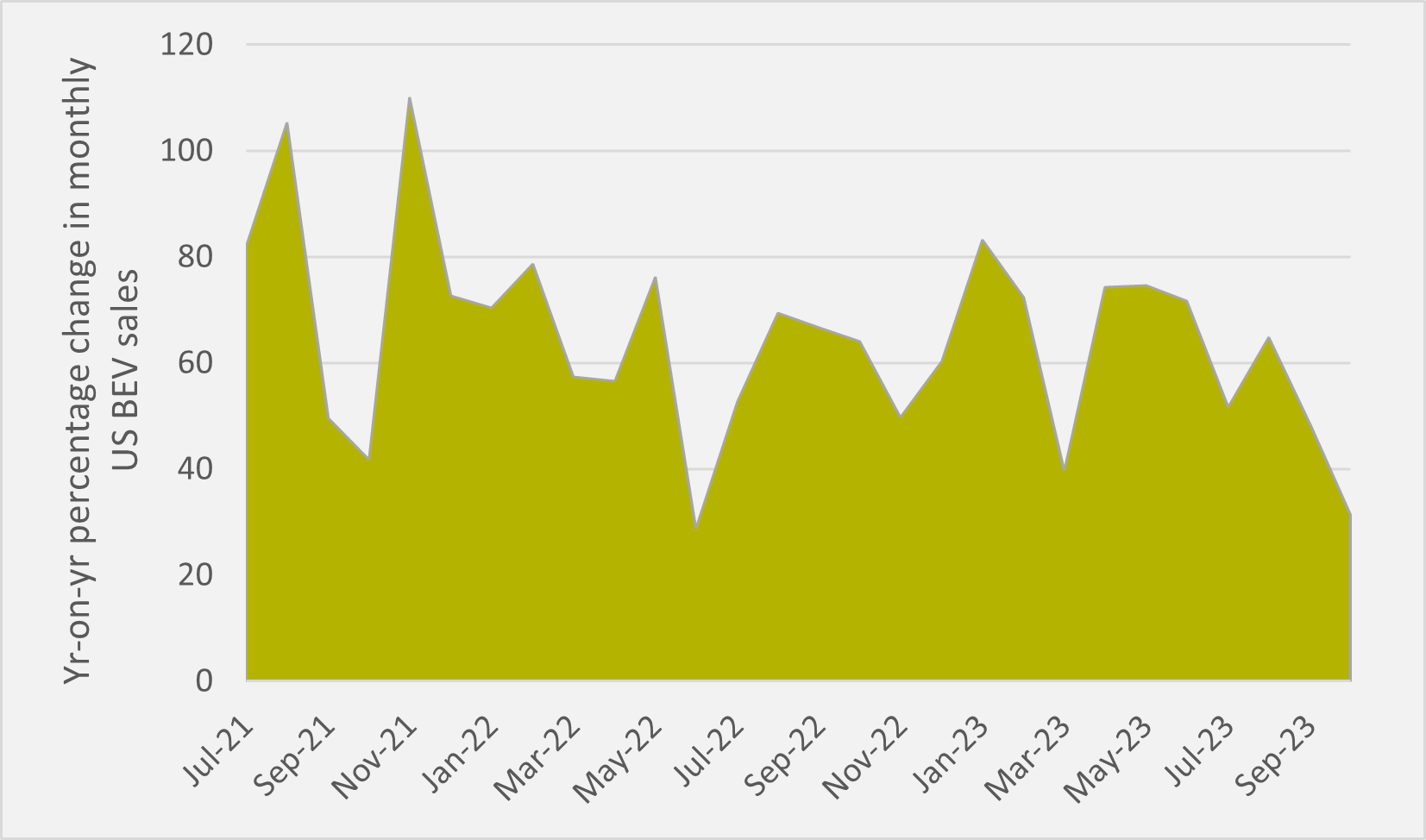

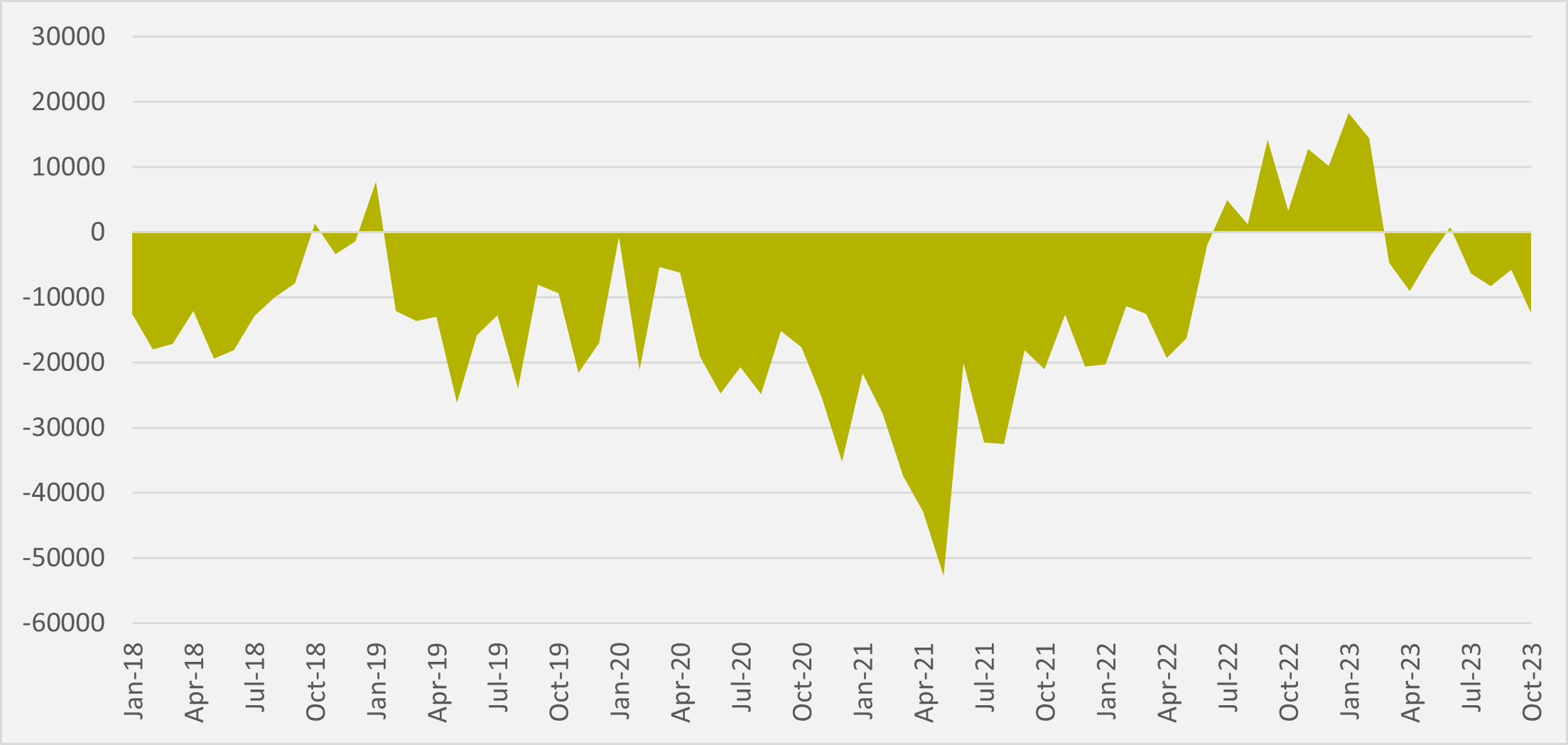

There are clearly reasons to be concerned over the rate of growth in adoption hitting a plateau. Over 12,000 fewer units were sold compared to the previous month, a decrease of 12pc. And the year-on-year increase for the month, at 31.3pc, was its lowest since June ’22 and the second lowest in the last 33 months (see Fig.1).

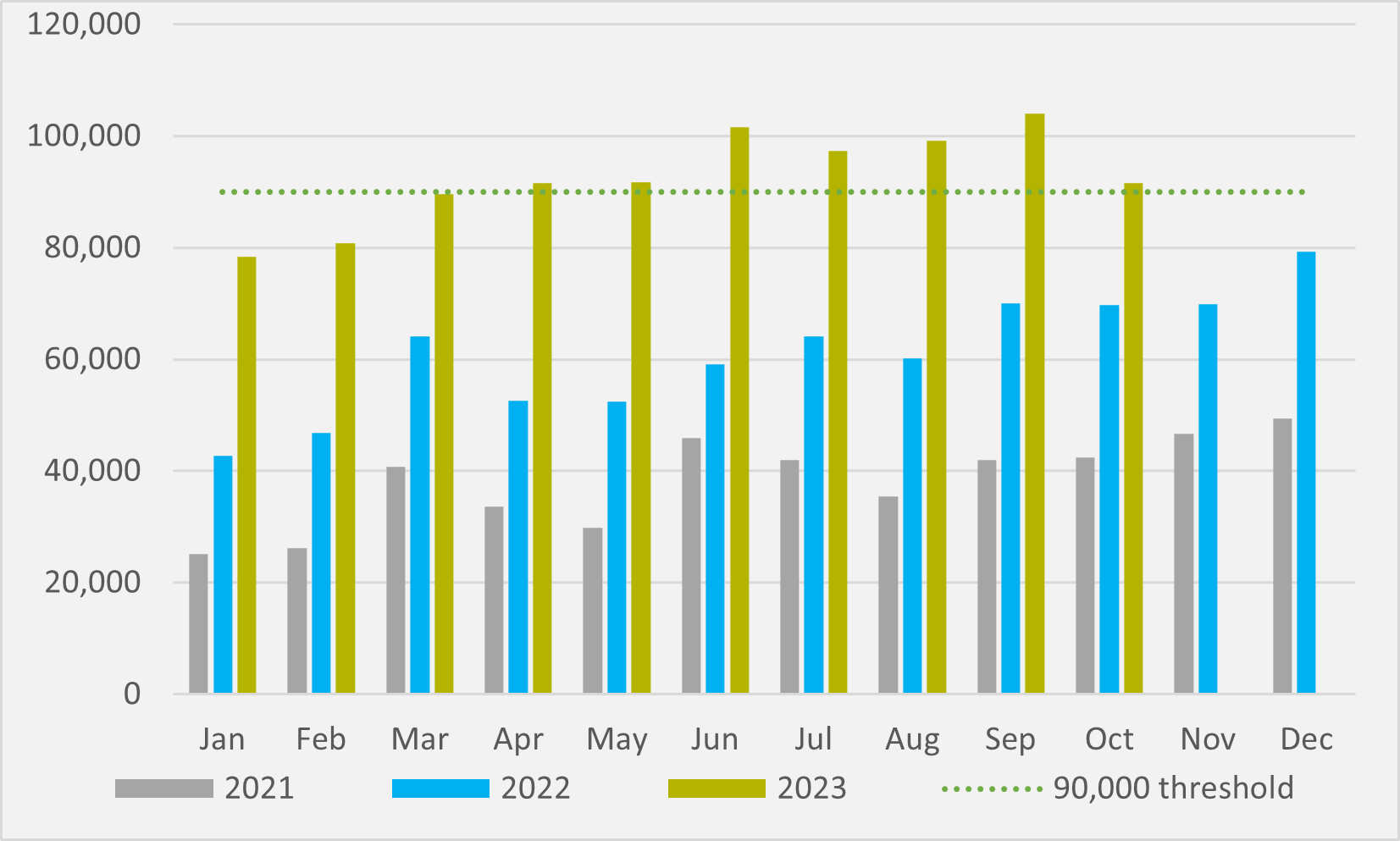

On the other hand, October represented a seventh consecutive month when US new BEV sales topped 90,000 (and March got within 352 vehicles of also doing so), when the monthly record prior to this year was less than 80,000 (see Fig.2). And, at 7.63pc, BEVs made up their second highest ever share of the US new sales mix in October, behind only September’s record.

Cumulative sales of EVs of any hue, including PHEVs and HEVs, have also topped 2mn for the first time (see main image). They finished last year as whole at less than 1.7mn. And EV combined market share held at over 18pc of the mix.

It is worth putting in context that October was not a good month for US light-duty vehicle (LDV) sales overall. After seven months of being around to comfortably over 1.3mn LDVs sold, they slipped back to 1.2mn, the lowest figure since February. That suggests macroeconomic headwinds like high interest rates are having an impact across LDV sales a whole.

Thus, while BEV sales dipped slightly more than the wider market — perhaps unsurprisingly given their relatively higher sticker price vulnerability to rises in monthly repayments — a percentage point contraction in market share of less than 0.2 should not set off particular alarm bells.

But, equally, there should be no complacency about the rate of growth of BEV penetration. Year-on-year growth in cumulative BEV sales has fallen for four consecutive months. At the end of June, 2023 sales were 67.8pc ahead of the first half last year, but that annual growth rate has slipped to 59pc at end of October.

Again, though, some of that is law of bigger numbers. H2’22 BEV sales were almost 100,000 higher than those seen in H1’22. So as we get later into 2023, the challenge for this year to outsell last by another two-thirds gets stiffer.

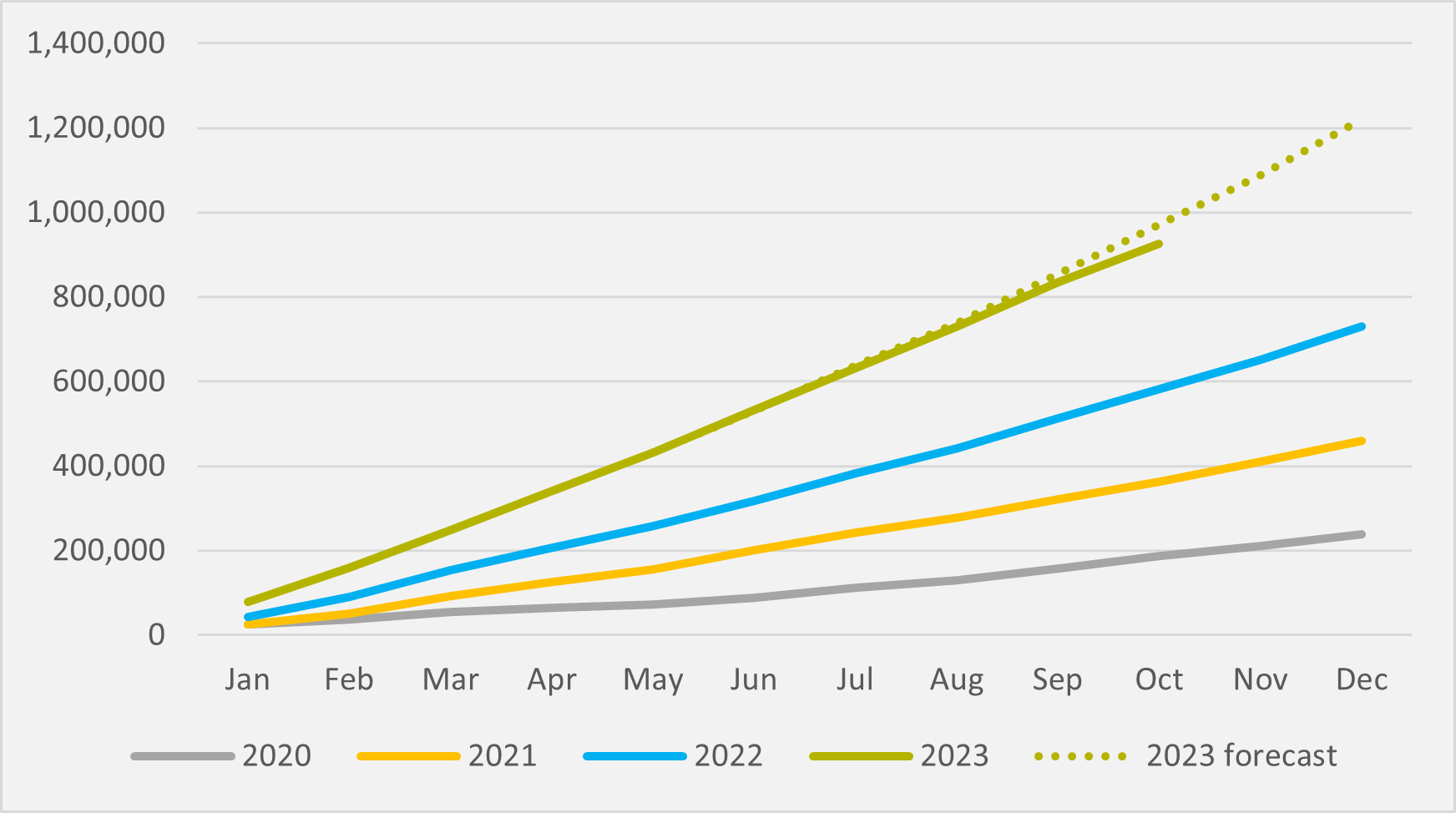

For example, at the end of May, annual growth in cumulative sales was at that point just shy of 67pc. EV inFocus extrapolated that same growth rate out of to the end of 2023, which showed that cumulative annual sales could top 1.2mn by year end (see Fig.3).

Actual numbers as we have gone further into the second half the year have begun to lag that forecast. But that should not necessarily be a surprise — 67pc year-on-year growth would have meant over 115,000 BEVs sold in September, October and November as last year’s sales in these months jumped up to around the 70,000 mark. And maintaining that same growth for December would need over 130,000 BEVs sold, after Dec’22 saw almost 80,000 unit shifted.

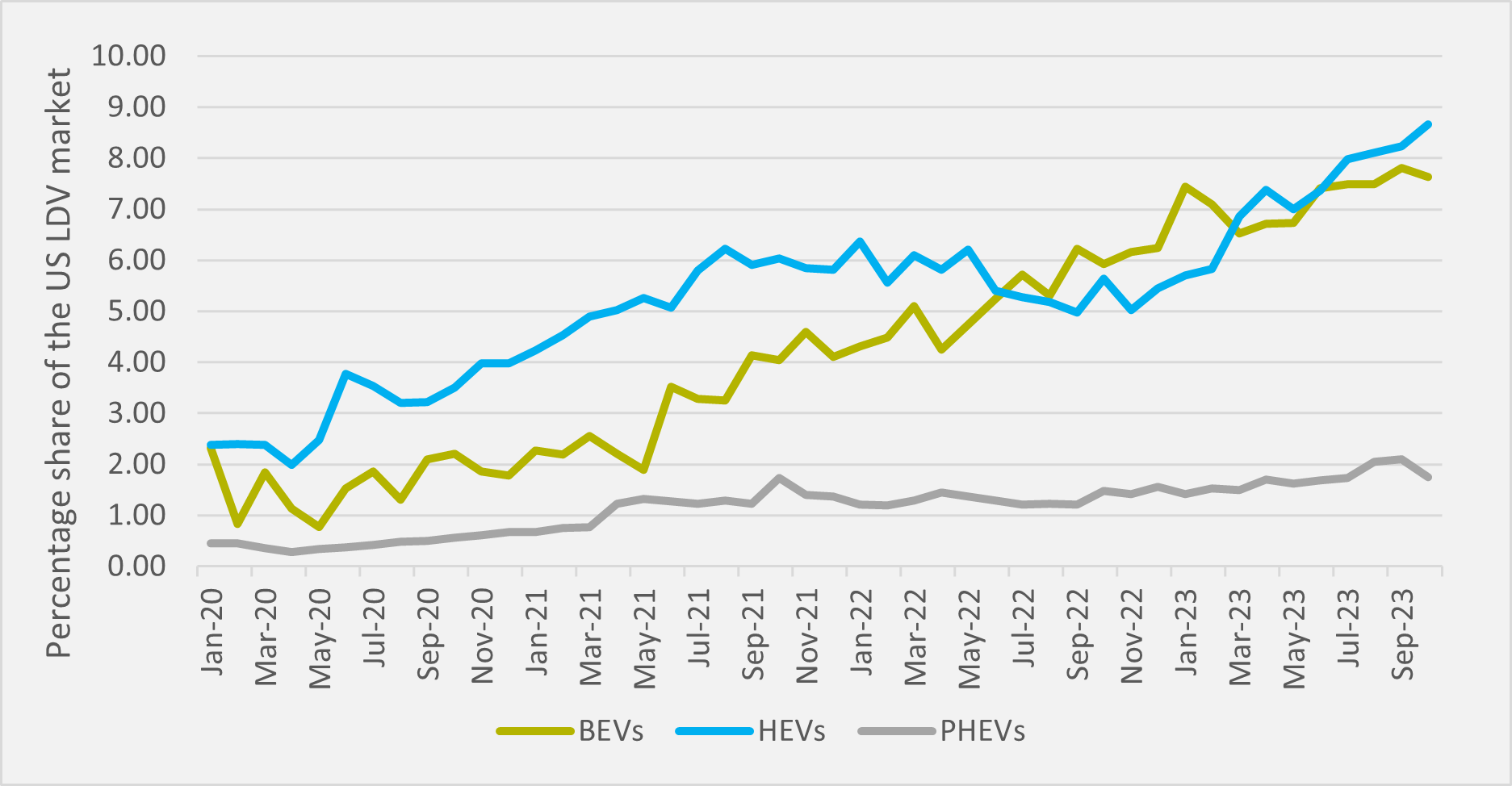

US appetite for HEVs dipped slightly month-on-month in real terms, but the class set a new record for market share (owing to the overall dip in LDV sales in the month). Light hybrids made up 8.7pc of US October new sales (see Fig.4).

For a seventh month out of eight, HEVs outsold BEV, and by more than five figures for the first time since May of last year (see Fig.5). American buyers are definitely feeling more love for hybrids than BEVs at present.

But, while HEVs might be an imperfect long-term solution compared to all-electric, they still represent a good first step for the consumer taking the psychological step of moving away from ICE. Thus combined BEV+PHEV+HEV sales of over 215,000 in October lifting annual cumulative sales through the 2mn barrier for the first time is a major landmark for the wider US LDV sales picture.

Tesla bounces back

According to separate data from North Carolina-based consultancy Motor Intelligence, BEV market leader Tesla sold 50,666 units in October. When integrated with the Argonne laboratory data, this suggests Tesla’s share of US BEV sales in the month was 55.3pc.

This is a material bounce-back after the same datasets suggested a 49.5pc share of September sales for the Elon-Musk led firm, a first dip below 50pc for the company since it started ramping sales.

Insider Focus LTD (Company #14789403)