No Kathleen Valley stope this month – Liontown

The firm is aiming to shift to underground production next month, and maintains everything is on schedule

Year-to-date sales are still below minimum requirements

All-electric vehicles made up 22.6pc of total new car sales in the UK in August, according to data from industry lobby group the Society of Motor Manufacturers and Traders (SMMT). This marks the first month where BEV sales have surpassed the 22pc of total sales threshold laid down in the first year of the country’s ZEV Mandate, which came into force at the start of January.

August saw over 19,000 BEVs sold, up by 10.8pc year-on-year in an overall market that shrank by 1.3pc compared to August ’23. But, while cumulative all-electric sales across the first eight months of the year remain 10.5pc higher than in the same period last year (see main image), BEV market penetration in 2024 thus far is still below the ZEV Mandate minimum threshold at 17.2pc.

The SMMT expects this to rise further to 18.5pc by the end of the year, driven by increasing model choice. It forecasts 364,000 BEVs registrations for the year as a whole, which would represent 15.7pc annual growth.

Ahead of the UK government’s next budget, due at the end of October, the lobby industry is calling for more assistance to get closer to ZEV Mandate requirements, which will rise again at 25pc next year, including binding targets on public charge point provision, the reintroduction of incentives for private buyers and removal of disincentives, including the planned inclusion next year of BEVs in a supplementary road tax charged on cars costing over £40,000 ($52,700).

The SMMT data is roughly in line with separate data on the UK market released earlier in the week by consultancy New Automotive, which saw BEVs taking a 23.2pc share of the August sales it recorded.

Tesla squeezed

There was some rare good news for previous EV darling Tesla in the SMMT’s August data, with both its Models 3 and Y among the months ten best-selling models. But Tesla’s cumulative UK new sales so far this year are down by 14.4pc at just over 28,500 units and its market share of the UK BEV market over the first eight months of the year has fallen from 17.2pc to 13.3pc.

“In previous years, the UK's electric car sales have been heavily dependent on Tesla, which was the dominant brand in the electric segment. In every monthly bulletin for the last year, we have seen Tesla shed its share of the market,” agrees New Automotive.

“Growth in EV sales has not come from Chinese brands either, many of which recorded a significant fall in EV sales in August. [It] is coming from a broad range of brands, notably led by BMW, Mercedes and the Stellantis-owned brands. Almost a third of BMWs sold in the last 12 months are battery electric, and a quarter of new Mercedes cars have no tailpipe,” it continues.

“Ministers should also be reassured that the predicted flood of Chinese electric cars is still barely a trickle, and the strong sales data are largely the result of action by European manufacturers," adds New Automotive CEO Ben Nelmes.

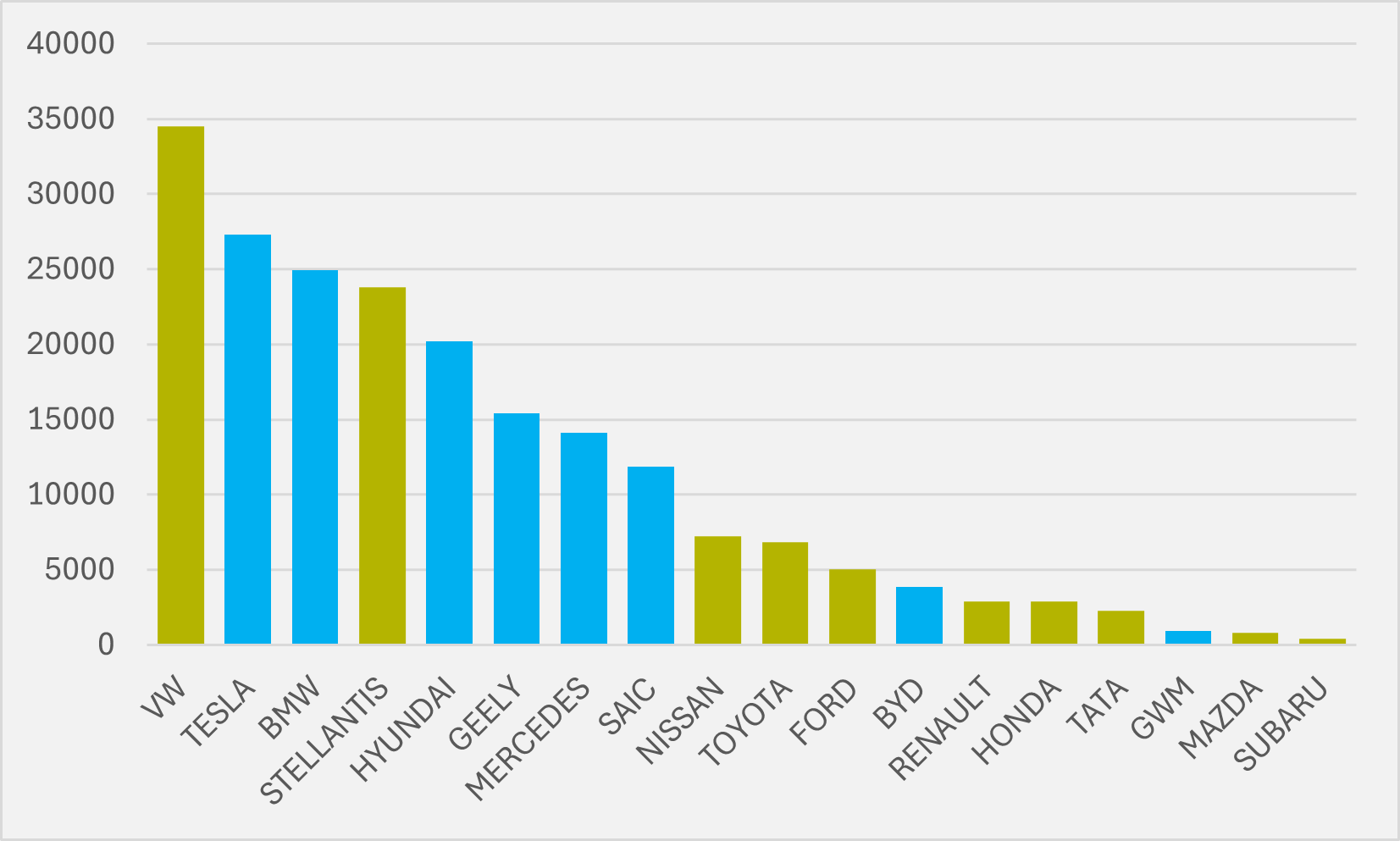

But that does not tell the entire story. While the VW Group brands — mainly Volkswagen, Skoda, Cupra, Audi and Porsche — that sell the most BEVs in the UK, over 34,500 so for this year by New Automotive’s count (see Fig.1), are mainly manufactured in Europe, that is not the case for all other big sellers. Tesla remains in second, according to the consultancy’s estimates, and many of its vehicles will be China imports.

Similarly, third-placed OEM BMW makes a chunk of BEVs for the European market in China, as does Geely (Volvo Cars and Polestar) in sixth and Saic (MG) in eighth. New Automotive’s numbers for Mercedes in seventh will almost certainly include sales by its Chinese joint venture Smart, which SMMT sees as having materially boosted its sales from less than 250 in the first eight months of last year to 1,263 in the same period of 2024.

Other Chinese challengers are also growing, albeit from similarly small bases. The SMMT sees BYD’s sales so far this year up to over 4,000 units, from c.200 in Jan-Aug ’23, while GWM’s volumes have more than doubled to 960 units.

It also records the first sales for the Omoda brand from China’s Chery, which launched in the UK this summer, with 46 cars sold thus far. So, while China is by no means a dominant player in the UK BEV market, it may be slightly disingenuous to try to convince the country’s politicians of an absence of any material Chinese element of influence.

Insider Focus LTD (Company #14789403)