No Kathleen Valley stope this month – Liontown

The firm is aiming to shift to underground production next month, and maintains everything is on schedule

November all-electric sales reach a 25pc market share

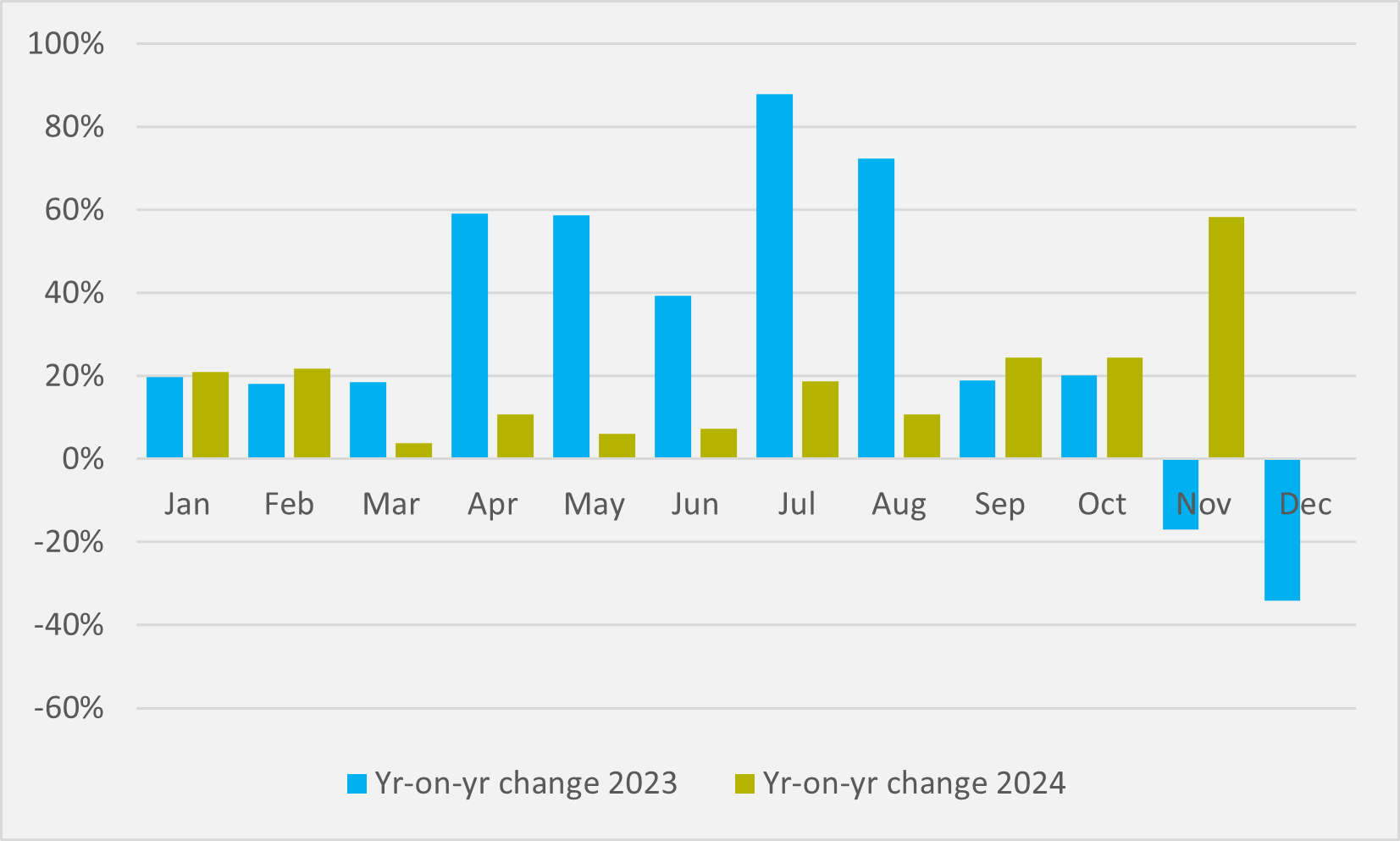

One in four new registrations on the UK last month were all-electric, according to data from the country’s automotive lobby group the Society of Motor Manufacturers and Traders (SMMT). And that was enough to lift cumulative BEV sales for the year as a whole above last year’s total with December figures still to come (see main image).

November BEV sales totalled 38,581, the highest seen in a month outside of March and September new numberplate peaks since a spike in December 2022 — also the last time BEVs took a 25pc+ share of the overall mix.

Year-on-year, all-electric sales were up by 58pc, representing a third consecutive month of the strongest annual growth this year as OEMs ramp up their zero emissions vehicles (ZEV) Mandate compliance efforts, and the largest year-on-year jump in a month since August ’23 (see Fig.1).

For 2024 as whole, new BEVs registered stands at almost 340,000, topping 2023 as whole where just shy of 315,000 new vehicles were registered. Year-to-date, all-electric makes up 18.7pc of all sales, still below the headline 22pc target for the first year of the mandate, although sellers of hybrids and ICE vehicles with improved environmental performance may have lower individual thresholds.

Credit mountain

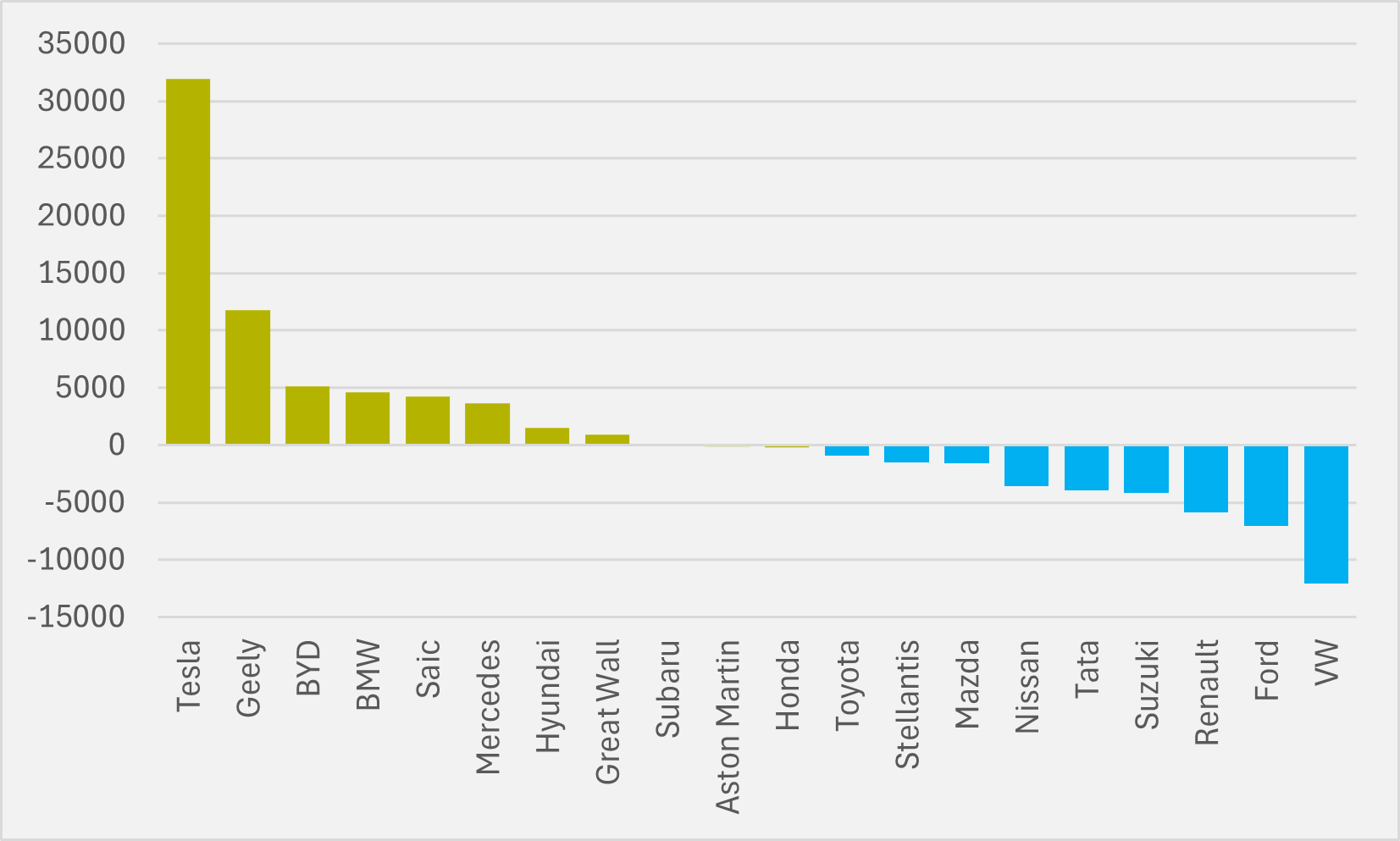

According to consultancy New Automotive, as of the end of November, nine of 22 automotive groups it tracks that sell in the UK car market had surplus credits relative to their mandate targets — albeit ranging from US EV pure play Tesla’s almost 32,000 additional credits, to just seven held by Japan’s Subaru (see Fig.2). Of the 13 therefore in deficit, the least well-placed to make end-of-year targets are US OEM Ford and the German VW group that includes the Volkswagen, Audi, Skoda and Seat/Cupra brands, although New Automotive suggests both outperformed their targets in November itself.

Other legacy brands that New Automotive saw having strong BEV performance last month included BMW-owned Mini, where BEVs accounted for more than 37pc of its sales, Tata’s Jaguar and Stellantis’ Vauxhall (each 36pc), Mercedes (35pc), Stellantis’ Peugeot (29pc), Renault and Saic’s MG (each 27pc) and VW’s Skoda (23pc).

“When out-performance against CO2 targets are taken into account, the ZEV Mandate credit surplus has almost doubled — from more than 13,000 last month to 22,000 today,” the consultancy says. “The industry-wide ‘credit mountain’ means that no manufacturer will need to make buyout payments to government to meet targets.

“A fourth strong month in a row for battery electric sales means many manufacturers have improved their position against the mandate. Stellantis has cut its deficit by almost one third — from 2,263 to 1,514 — meaning that it now only needs an increase of 0.8pc in EV market share to end the year in credit.

“The glut of credits means that this is a buyer’s market. For example, every firm with a deficit could close it by buying from Tesla, BMW, Mercedes and Hyundai alone,” New Automotive continues.

Peak petrol

Separately, UK online marketplace Auto Trader has concluded that 2024 has seen the country reach ‘peak petrol’, with the number of petrol cars on the road forecast to tumble by almost half over the next decade. Its forecast shows the number of petrol cars in the UK’s 32.8mn vehicle car parc is set to decline from a current 18.7mn to just 11.1mn by 2034.

Over the same period, the number of BEVs on the UK’s roads is set to rise from 1.25mn to 13.7mn, while the overall stock of diesel engine vehicles slides from 10mn to just 4.3mn, according to Auto Trader’s data.

“Peak petrol is a genuine landmark for the UK,” says Auto trader commercial director Ian Plummer. “We expect to see a seismic shift in British motoring over the next decade as the number of petrol cars falls by nearly half and EVs take a much bigger share.”

And the marketplace also sees “increased affordability” in the UK’s used BEV market. According to its data, one in three used BEVs are priced under £20,000 ($25,500) — a 25pc increase on 2023 — while a growing number of three-to-five-year-old BEVs cost the same or less than their petrol or diesel counterparts. As a result, these ‘middle-aged’ electrics are selling in just 19 days, 11 days faster than the overall average.

But the firm forecasts that the share of the new UK car market taken by BEVs is set to rise from c.18pc in 2024 to 23pc next year, below the 28pc target for 2025 sales under the progressively tightening ZEV Mandate.

Insider Focus LTD (Company #14789403)