Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

The Japanese OEM has already admitted its first BEV has received a lukewarm reception

Japan’s Toyota is upgrading its only all-electric passenger vehicle, the bZ4X mid-sized SUV, in an effort to boost momentum for a product that has underwhelmed customers thus far.

In the first nine months of 2023, Toyota sold 560,088 electrified vehicles in Europe, consisting almost entirely of HEV and PHEV models. The bZ4X sold only 14,318 units in the same period.

And it is not just in Europe where the bZ4X has struggled for traction. “Toyota has received messages from customers that they think there is still room for improvement, particularly with the bZ4X,” Yoichi Miyazaki, Toyota’s CFO, said of Chinese customer feedback in November.

Technical adjustments have now been made to the bZ4X’s battery heating system to reduce battery charging times in cold climates using a DC fast-charging power supply. A new water-to-water heat exchanger and a heating adjustment valve have been added to the heating circuit to help increase battery temperature.

Toyota expects these changes to reduce 10-80pc DC fast charging times for the bZ4X, especially in cold and even sub-zero temperatures. It is also upgrading the car’s heating and rear-end collision avoidance systems. And it will offer a new digital key on the higher-end model.

Lessons from Norway

The focus on cold weather charging performance may reflect Toyota’s ambitions in northern Europe, a key regional BEV market. “Toyota BZ4X is already one of the best-selling cars in Norway,” says Piotr Pawlak, president of Toyota Norway.

The bZ4X shifted 5,395 units in Norway in 2023, according to Pawlak, making it the country’s third best-selling car. But Norway may also illustrate why Toyota struggles to shift its mindset when it comes to BEVs.

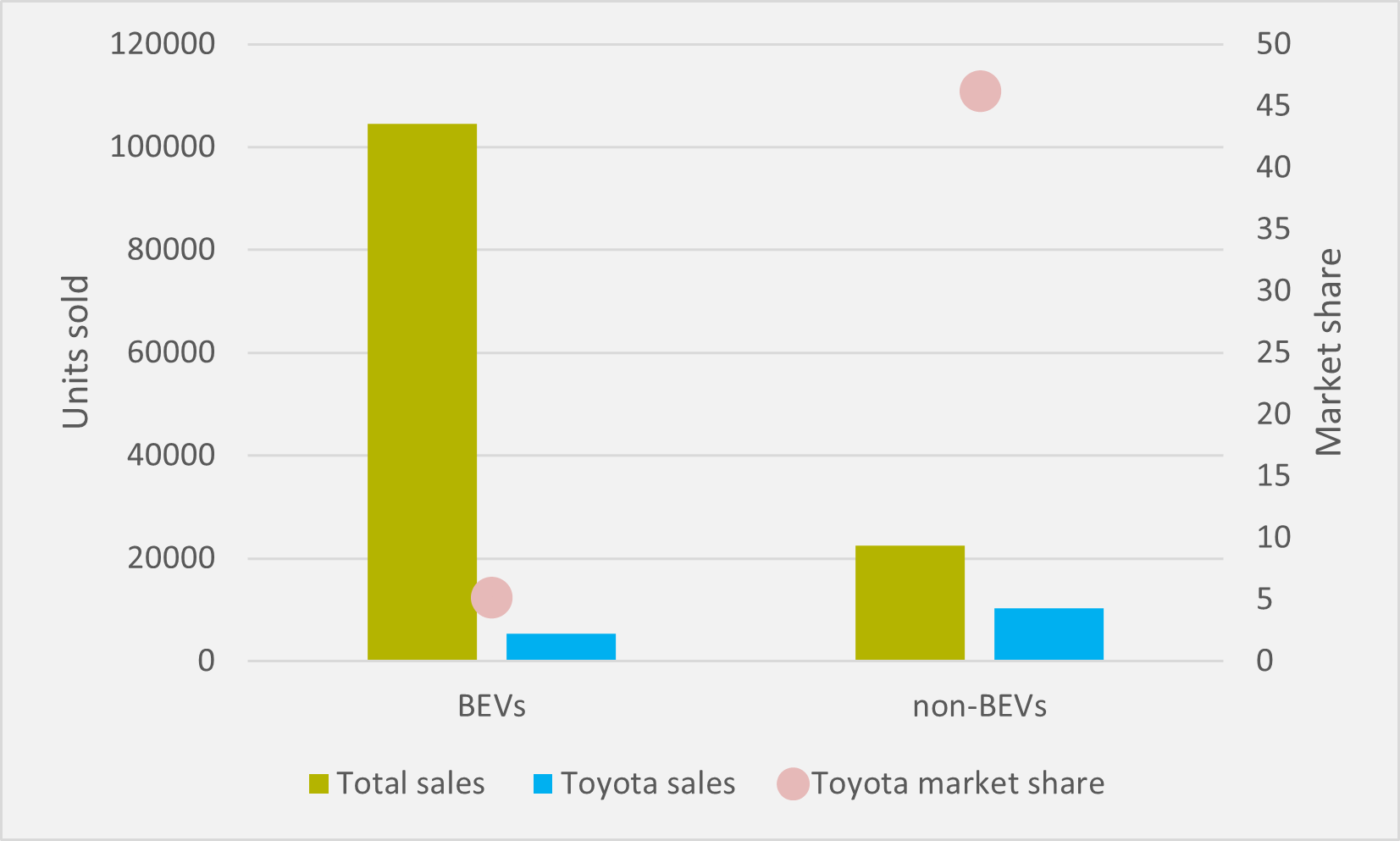

Given new Norwegian BEV registrations in 2023 were just shy of 105,000 — 82pc of total national new sales market — the bZ4X captured only 5.2pc of the total addressable BEV market (see Fig.1). But Pawlak points out that Toyota’s overall Norwegian passenger vehicle market share was much higher, at 12.4pc.

This means that Toyota sold around 10,350 non-BEV passenger vehicles, either HEVs or ICEs, in Norway in 2023 and captured 46pc of this non-BEV market. That drove Toyota to be the country’s leading brand by sales in December and Q4 as a whole.

And it allows it to boast of having grown sales by 7.5pc in a market that shrank by 23pc — when only two other brands in the top 10 managed to achieve year-on-year volume growth — and having achieved a best market share result since 2010.

But it does not disguise the fact that it has only c.5pc of the dominant segment in the country’s car sales, propped up by almost 50pc of legacy technologies that account for less than one in five of all new passenger vehicle sales.

The question, of course, is what is Toyota able to do. It needs to sell cars where it can and, while it aims for 20pc of its European sales to be BEVs by 2026, this is predicated on having six BEVs in its range when it only currently has one.

As long as it privately acknowledges, while trumpeting short-term success, that Norway paints a troublesome picture in the medium-to-long term, there may be no issue. The fear is that Toyota’s jumbled narratives do not install confidence that said internal conclusion is being clearly drawn.

Insider Focus LTD (Company #14789403)