Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

The Franco-Italian conglomerate’s all-electric sales reports a good start to the year, but the devil is in the detail

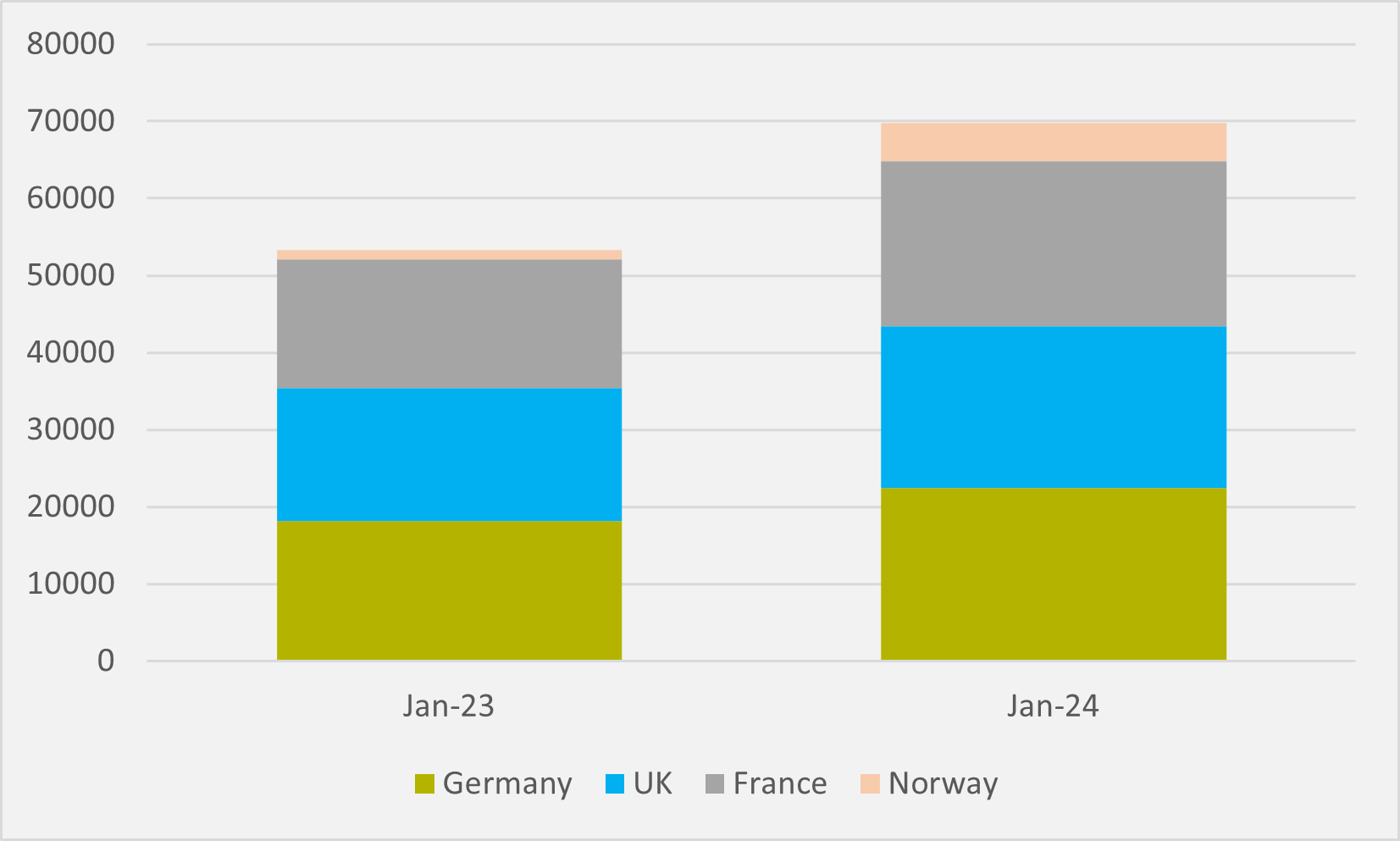

It is worth noting that, amid the sombre mood around European January BEV sales figures so far, the number of all-electric sales across the German, UK, French and Norwegian markets is up by 30pc year-on-year (see Fig.1). Stellantis, the umbrella brand of Citroen, Fiat, Opel and Peugeot, took advantage of some of that annual progress to record its own year-on-year European sales rises.

In the BEV market, across both passenger cars and commercial vehicles, Stellantis has seen a 20pc increase in January volumes compared to the same month last year, “with double-digit growth in almost all countries”. Its market share in the European all-electric market was 13.7pc, which it says is higher than in Q4’23.

Stellantis’ commercial vehicles in Europe recorded in January a 29pc market share in the BEV segment, up by almost two percentage points compared to December.

Its Citroen and Peugeot brands, where overall sales were up by 23pc and 23.7pc, Opel (+35.9pc) and Fiat are identified by Stellantis as “growing in the BEV segment”, across passenger and commercial vehicles.

With the introduction of several new models in 2024, Stellantis is on track to double its all-electric model offering in Europe by the end of the year.

The firm, which frustratingly does not give out sales numbers like its peers but deals entirely in year-on-year percentages and market shares, earlier this week also shared some of this limited information on Peugeot’s BEV progress in 2023.

The French brand was market leader in the European electric B segment with its E-208 and E-2008 models and in the electric light commercial vehicle segment with its E-Partner, E-Expert and E-Boxer offerings. In last year’s mix, 18pc of Peugeots sold in the EU and UK were electrified (BEVs or PHEVs).

Up from a low point

The only problem with looking at January on a year-on-year basis in Europe is that January 2023 was such a terrible month in Germany and Norway in particular — as both markets adapted to an end-of-2022 — and unremarkable in the UK and France too, that the January ’24 numbers can be up annually, but still disappointing.

To put that into context, Norway last month saw its second-lowest BEV sales month in the last 25, ahead only of January ’23. For Germany, it was the fourth worst in 25. Even in the UK, eight months last year outperformed its January BEV sales.

Insider Focus LTD (Company #14789403)