No Kathleen Valley stope this month – Liontown

The firm is aiming to shift to underground production next month, and maintains everything is on schedule

The conglomerate tries to get beyond reports of idled production

The Fiat marque of Amsterdam-headquartered OEM Stellantis has hailed the sales performance of its 500e A-segment all-electric city car, a different story to press reports of production pauses for the vehicle as it struggles to get traction. But the devil remains in the detail.

Stellantis is notoriously coy about providing concrete sales volumes, preferring instead to talk about changes in year-on-year performance or podium places in various segments or national markets. And it is a familiar story with its latest disclosure on the 500e.

Over the first nine months of the year, “the Fiat 500e has emerged as the top-selling electric city car in its segment across Europe, boasting a market share of 63pc in September and 45pc year-to-date”, the firm says. In Italy, it boasts a 29pc market share, in France 49pc, in Germany 48pc, and in the UK a resounding 80pc.

The obvious question, given the reports of slow sales, is exactly how big the all-electric A segments are in these national markets. In the UK for example, it may be no coincidence that it has achieved its market dominance in a country where the first Dacia Spring, the budget A-segment BEV from the Romanian arm of France’s Renault that is styled as Europe’s cheapest BEV, is only arriving in dealerships this month.

In Germany, the 500e might still have almost half the market, but sales have slumped from over 16,000 units in the first nine months of last year to less than 7,000 in the same period in 2024 (see main image) as the wider German BEV market shrinks.

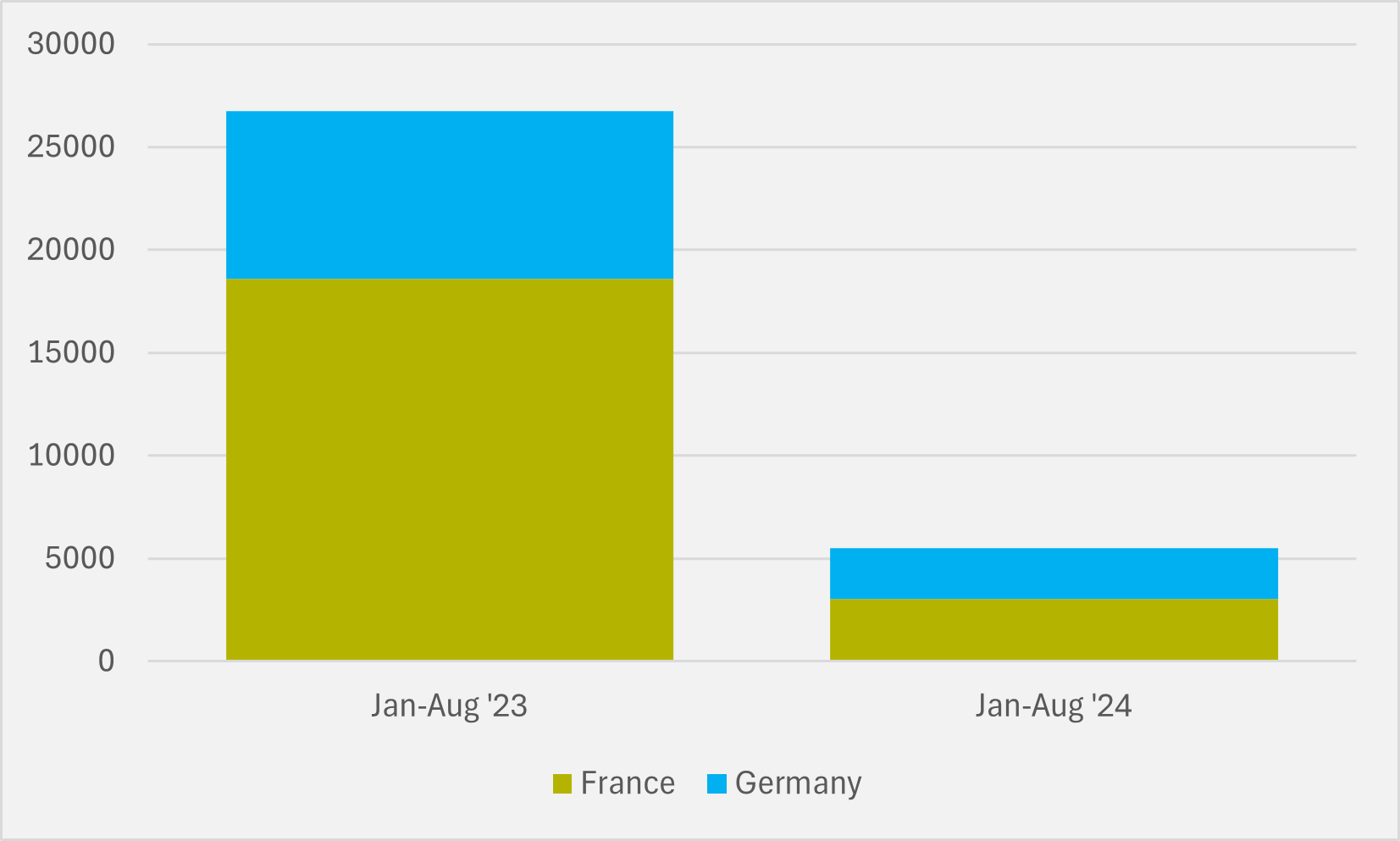

And it is not just in Germany where it is likely the all-electric A segment as a whole is under pressure. In France, the withdrawal of subsidies on Chinese-made BEVs has had a catastrophic impact on sales of the Spring, made by Renault’s Chinese partner Dongfeng, there. Over the first eight months of the year, Spring volumes are down by 84pc from over 18,500 in Jan-Aug ’23, making the Spring France’s 15th best-selling model, to just over 3,000 units and relegating it to 89th place (see Fig.1).

In Germany too, the Spring has slipped by almost 70pc from over 8,000 units sold in Jan-Aug ’23 to under 2,500 units in the first eight months this year. That again points to a shrinking of the overall European all-electric A segment, meaning Stellantis’ boast of the 500e having a 45pc share of it may be less impressive than it first appears.

And the firm is only going to make things tougher for the 500e with the introduction at the start of this month of the Leapmotor T03. The A-segment BEV from Stellantis' joint venture with its Chinese partner will retail at €18,900 (c.$21,050), materially lower than Fiat's offering.

Stellantis also trumpets that, since its first delivery to customers in July, the Fiat Topolino has “taken the lead” in Italy’s electric quadricycle market with a 47pc market share, as well accounting for 28pc of total European sales. But again, it offers no supporting data on the size of these markets to quantify these deliveries in volume terms.

Insider Focus LTD (Company #14789403)