No Kathleen Valley stope this month – Liontown

The firm is aiming to shift to underground production next month, and maintains everything is on schedule

Widely anticipated annual production guidance beat overshadowed by inventory conerns

US EV pure play Rivian sold less than 80pc of the vehicles it produced in the fourth quarter of 2023, marking the first time that the company's usually high conversion rate has dipped so low since the company reached scaled production.

The automaker sold 13,972 of the 17,541 EVs it manufactured in the period, equalling a conversion rate of 79.7pc. It is a sharp decline from the rate of 97pc that the company posted in the third quarter. Analysts have previously identified Rivian's high conversion rate as a strength of the company.

"If you look at that delivery to production conversion rate which is relevant to these EV new entrants, Rivian is on track and they have actually explicitly guided to a 90pc delivery to production ratio, which seems quite reasonable since the 10pc is really just in transit units," BNP Exane analyst James Picariello told EV inFocus after Rivian posted its Q2 results.

Q4's shrinking conversion rate comes partly as a result of a drop in sales quarter-over-quarter, as the company delivered almost 1,600 fewer EVs than Q3's total of 15,564. While analysts anticipated a decline in sales compared to Q3, the magnitude of the drop off still underwhelmed expectations.

"The delivery tally was slightly below the consensus expectation of analysts for 14,111 vehicles," says financial analyst and journalist Clark Schultz.

"On a full-year 2023 basis, the electric vehicle upstart produced 57,232 vehicles and delivered 50,122, which topped the most recent full-year 2023 production guidance from Rivian of 54,000 vehicles," Schultz adds.

However, Rivian was widely expected to exceed its official 54,000 production guidance by the end of 2023, with Cantor Fitzgerald lead automotive analyst Andres Sheppard telling EV inFocus that "the company is still fresh from last year when they had to revise their guidance down by 50pc, so I think now they are in a situation where they want to under-promise and over-deliver”.

Enjoying this article? Take control of your Google News feed and follow us!

Inventory

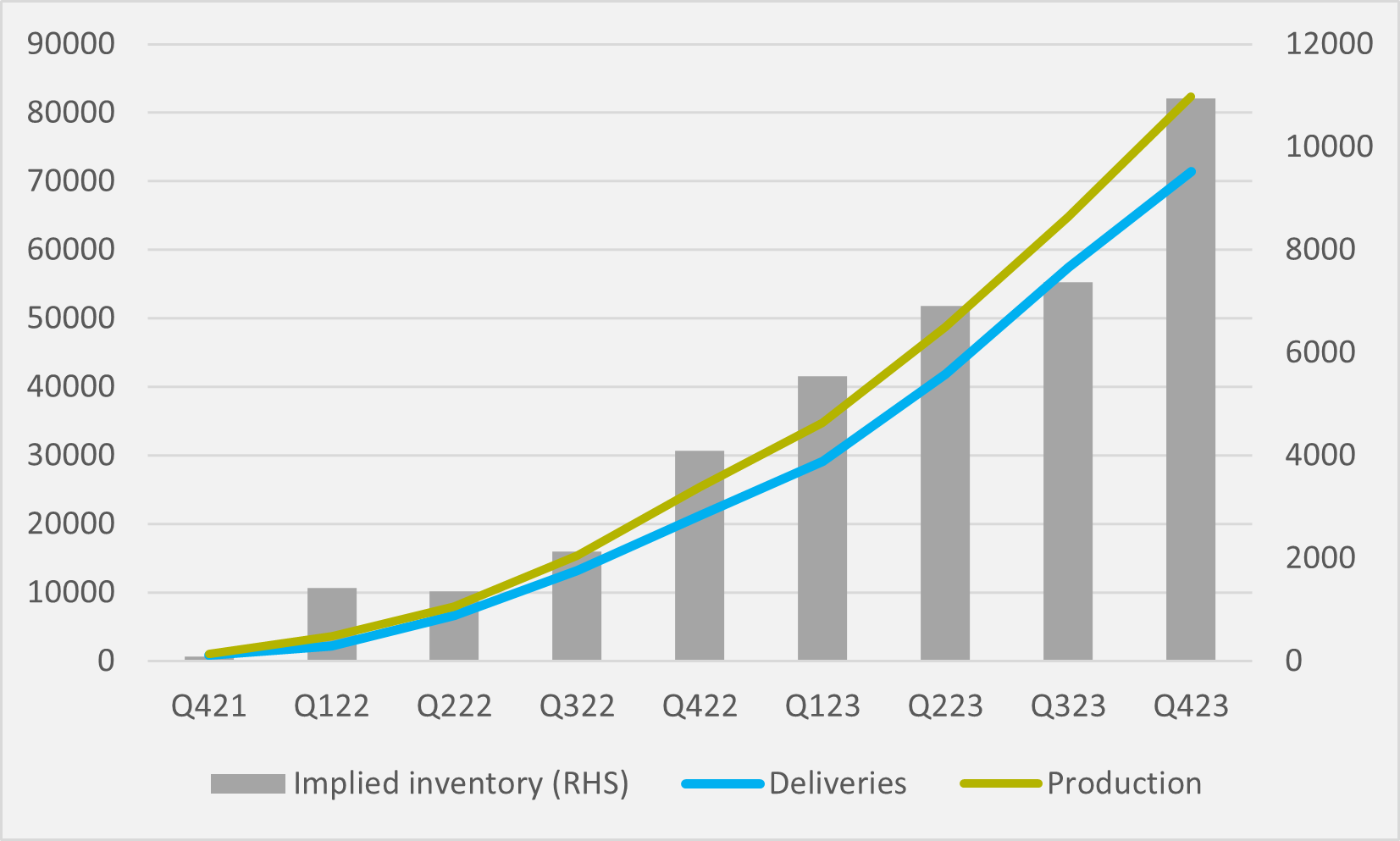

The fourth quarter delivery slump relative to production signals that Rivian's cumulative inventory since it began production increased by 3,569 vehicles during the quarter and now sits just below 11,000 (see Fig.1). But Rivian's website currently allows customers to purchase its R1T pickup for delivery within one to four weeks, while displaying no online inventory for the R1S SUV.

This implies that a significant proportion of the inventory build-up is in Rivian's e-pickup, rather than its SUV. And that could further add weight to the hypothesis that the US consumer's appetite to buy all-electric pickups has been grossly overestimated by a slew of US automakers.

That said, Rivian's electric commercial offering, the EDV, could also account for a chunk of the growing inventory. Last month, Rivian announced a deal with telecoms heavyweight AT&T to supply EDVs, as well as some unspecified vehicles from the R1 range, on a trial basis, in addition to its pre-existing supply deal with retailer Amazon, but that will not have translated into any sales in Q4 itself.

"It is hard to ascertain if the fall in deliveries was due to commercial EDV or consumer R1T and R1S numbers. Holiday schedules likely slowed down deliveries vs production, much like with other makers," says Vitaly Golomb of investment firm Drake Star.

Rivian's inventory is still a manageable levels, with the firm's cumulative conversion rate since beginning production standing at 86.7pc. However, with a -36pc gross margin and losses of $30,000/vehicle, a high conversion rate is a key ingredient to the company's path to breakeven.

"[Further inventory build-up] means an increase in working capital and increased cash consumption. With [Rivian's] Q3 cash balance I still see some comfort, but it must not get worse," notes Piotr Chmielewski, vice-president of business development at financial services firm NaaS.

Insider Focus LTD (Company #14789403)