No Kathleen Valley stope this month – Liontown

The firm is aiming to shift to underground production next month, and maintains everything is on schedule

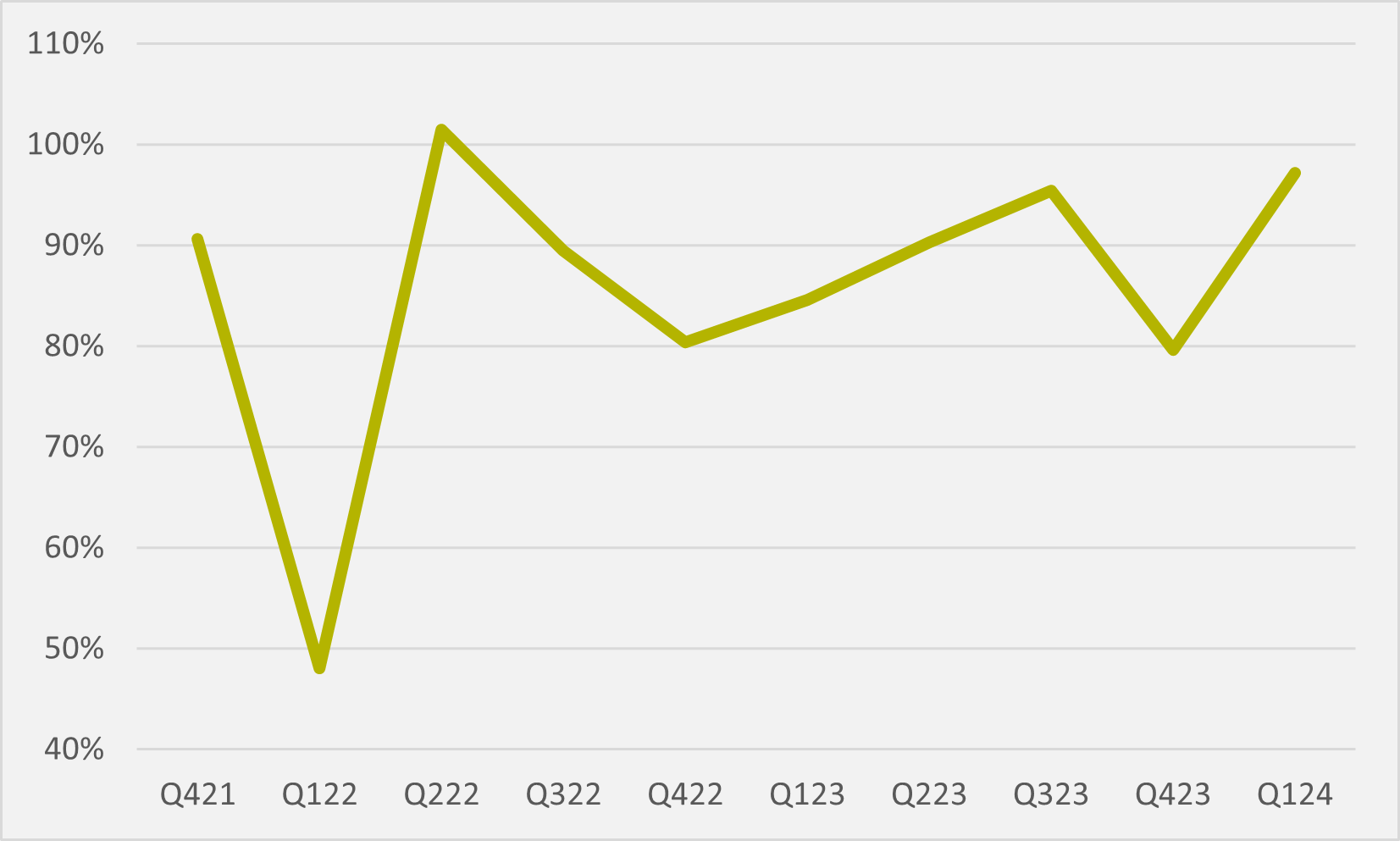

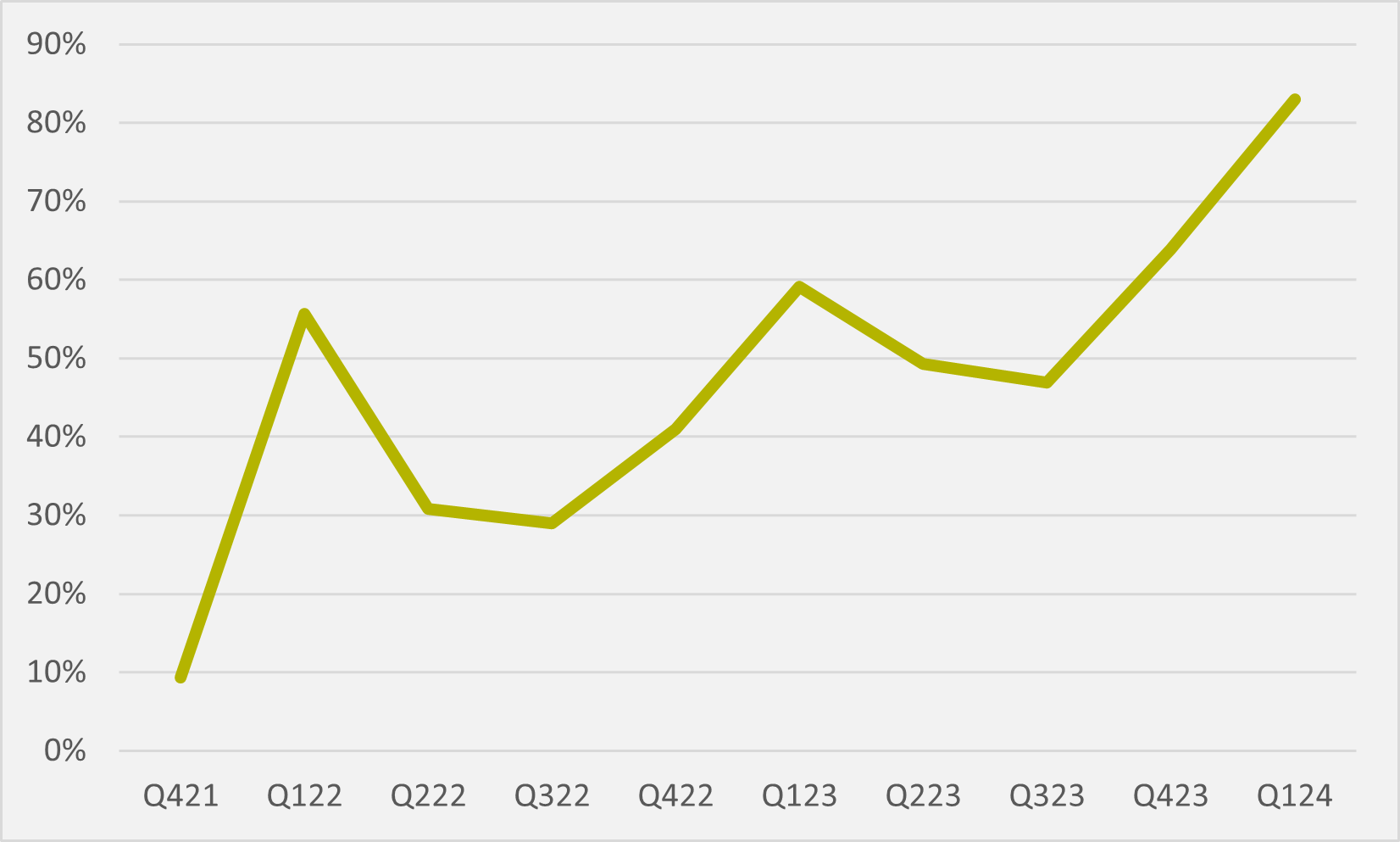

US EV pure play Rivian saw its conversion rate — the number of vehicles delivered compared to those produced — in the first quarter rebound to 97pc after Q4’s slide to less than 80pc. But, as the company produced more vehicles than it sold for a ninth quarter out of 10 since it began commercial operations, its implied inventory of unsold stock continued to rise (see main image).

Rivian produced 13,980 units and delivered 13,588 in Q1, for year-on-year rises of 49pc and 71pc respectively — although, unsurprisingly, given the relative strengths of Q4 and Q1 for vehicle buying, both numbers were lower quarter-on-quarter.

Despite a much quicker first three months of production compared to 2023, Rivian is sticking by forecasts that it will produce the same c.57,000 vehicle in 2024 as it did last year.

While the conversion rate was much healthier than in Q4 (see Fig.1), Rivian still produced almost 400 vehicles more than it sold. That lifted its implied inventory — the cumulative difference between all the vehicles it has reported as produced since Q4’21 and all those it has recorded delivered — to just over 11,6000.

This implied stock now stands at more than 80pc of the units it produced in Q1. This overhang was at less than 50pc of quarterly production as recently as Q3’23 (see Fig.2).

Insider Focus LTD (Company #14789403)