Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

The French firm is among the laggards in terms of European OEMs expanding their all-electric sales

France’s Renault Group sold a combined 109,307 of its Megane E-Tech and Dacia Spring BEVs in 2023 (see main image), a year-on-year rise of 33.5pc. But that measure might be slightly distorted by the fact that Megane E-Tech did not enjoy a full year of sales in 2022, and still puts it firmly in the bottom half among European OEMs in percentage growth in all-electric units shifted.

These figures may not give a full picture of Renault’s BEV performance, as the firm does not provide any data on the Renault Zoe, sales of which it is discontinuing. Sales of the two BEV products that are continuing into 2024 are, though, more relevant than those of model it will no longer sell going forward.

Renault reports that the Megane’s 47,504 sales — up by 44pc year-on-year, although the car was only introduced midway through 2022, so that full-year percentage may be somewhat misleadingly high — give it a 2.2pc market share of all-electric vehicles in Europe.

The Spring, made by its Romanian subsidiary Dacia and which Renault regularly touts as Europe’s ‘most affordable’ BEV, shifted 61,803 units globally. That gave it a 26.4pc year-on-year increase and, Renaults says, maintained its place in the top three best-selling BEVs in the European private buyer segment.

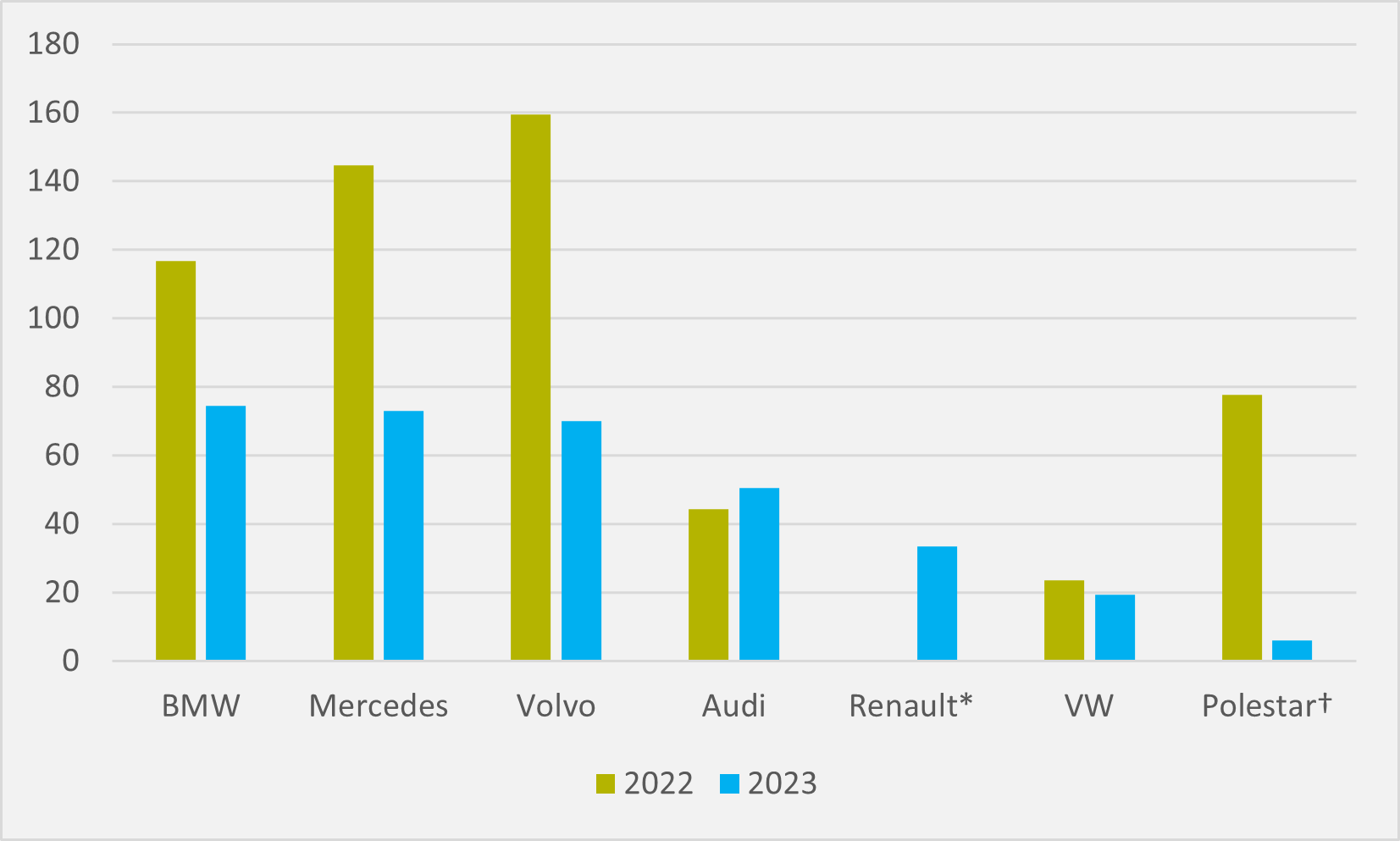

Compared to other European OEMs, Renault’s 2023 BEV sales performance looks wan (see Fig.1). Germany’s BMW and Mercedes were able to boost sales by over 70pc year-on-year, while Sweden’s Volvo also got within touching distance of 70pc annual growth.

Falling behind

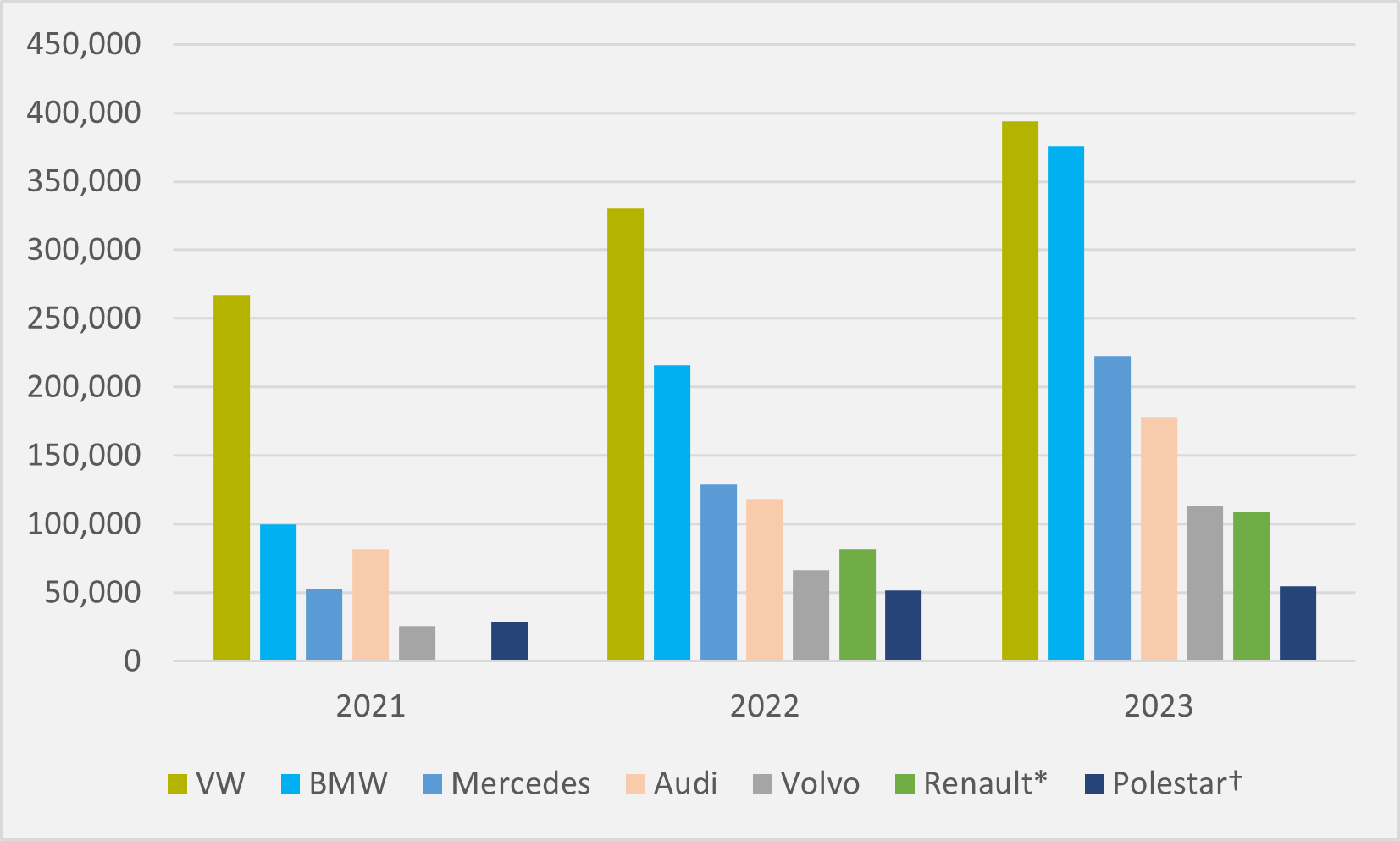

And this lifted BEV volumes for the Gothenburg-headquartered, although ultimately Chinese-controlled, firm above units shifted by Renault’s two continuing models. In 2022, Renault's all-electric Meganes and Springs outsold Volvo’s BEV offerings by c.15,000. But last year, the Sino-Swedish firm sold c.4,000 more BEVs than the two Renault Group products (see Fig.2).

Renault year-on-year all-electric sales growth also lagged the German Audi brand’s c.50pc increase. But it was higher than Audi’s fellow VW Group Volkswagen marque, which recorded a sub-20pc jump in BEV sales in 2023 — albeit still recording the highest outright sales number among European brands.

The French firm, which has now spun off its BEV business into a new electric-only firm called Ampere (although it is unclear if the Spring will be part of Ampere going forward or remain within the Dacia subsidiary), is aiming for a better year in 2024 with several BEV launches.

An all-new version of the Spring is pencilled in for this summer, while the Renault brand will add the Scenic E-Tech, offering more than 600 km of WLTP range, and the B-segment Renault 5 E-tech to its BEV line-up. The premium Alpine marque will also welcome its first all-electric offering this year in the shape of the A290 hot hatch.

Polestar travails

Another European-headquartered OEM hoping for new launches to herald a better 2024 is EV pure play Polestar. It launched the Polestar 4 in China before year-end — where it “has been very well received”, according to the firm's CEO Thomas Ingenlath — and will commence sales in Europe and Australia in the next few weeks. The Polestar 3 will follow in the summer.

But 2023 sales of 54,600 represent year-on-year growth of only 6pc, far below the progress made by other European automakers in boosting their all-electric volumes. Analysis firm Fox Advisors has described Polestar’s 12,800 deliveries in Q4, down both quarter-on-quarter and year-on-year as a “big disappointment”.

That is not unsurprising, given that it had been estimating a figure of 18,183, broadly in line the company’s own guidance of c.18,200. The research house is also concerned by the “surprising” departure of Polestar’s CFO after little over two years in the role.

Polestar’s growth struggles are perhaps testament to the obstacles a start-up challenger faces compared to the brand recognition and existing large distribution networks that legacy OEMs enjoy. In 2021, the firm sold 29,000 cars (albeit some of these were likely Polestar 1 PHEVs alongside Polestar 2 BEVs), a higher number than the volume of BEVs its parent Volvo sold in the same year.

But — in part hampered by production delays that have seen the Polestar 3 slip from 2022 to 2024, the Polestar 4 largely shift from 2023 to 2024 and the Polestar 5, once targeted for 2024, no longer having a specified launch date — it has struggled to match its stablemate’s progress. In 2023, Volvo sold more than double the number of BEVs than Polestar did.

Insider Focus LTD (Company #14789403)