Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

EV pure play’s ambitions have dependencies that may change under a Republican regime

US challenger firm Rivian has ambitions to record a “modest” gross profit in the fourth quarter of 2024, and to be gross profit profitable for 2025 as a whole, albeit not necessarily in every quarter next year. But it may face challenges should the US regulatory environment change dramatically.

We know that the US will now face four years of a Trump presidency, that the Senate will be Republican for at least the next two years and increasingly that the House of Representatives will also turn red. We do not, though, yet what, if any, impacts this political shift will have on the US EV landscape.

One area of EV buying support that has been flagged as potentially at risk is the customer credit. This is unlikely to impact on a majority of current Rivian buyers, but it could impact those who lease the firm’s vehicles.

“In terms of the percentage of sales that receives the $7,500 credit, it is largely our population of leased consumers that are able to take advantage of that credit,” says Rivian CEO RJ Scaringe. “Given the price point of our vehicles and the overall income levels, most of our customers do not qualify on a finance or cash purchase.”

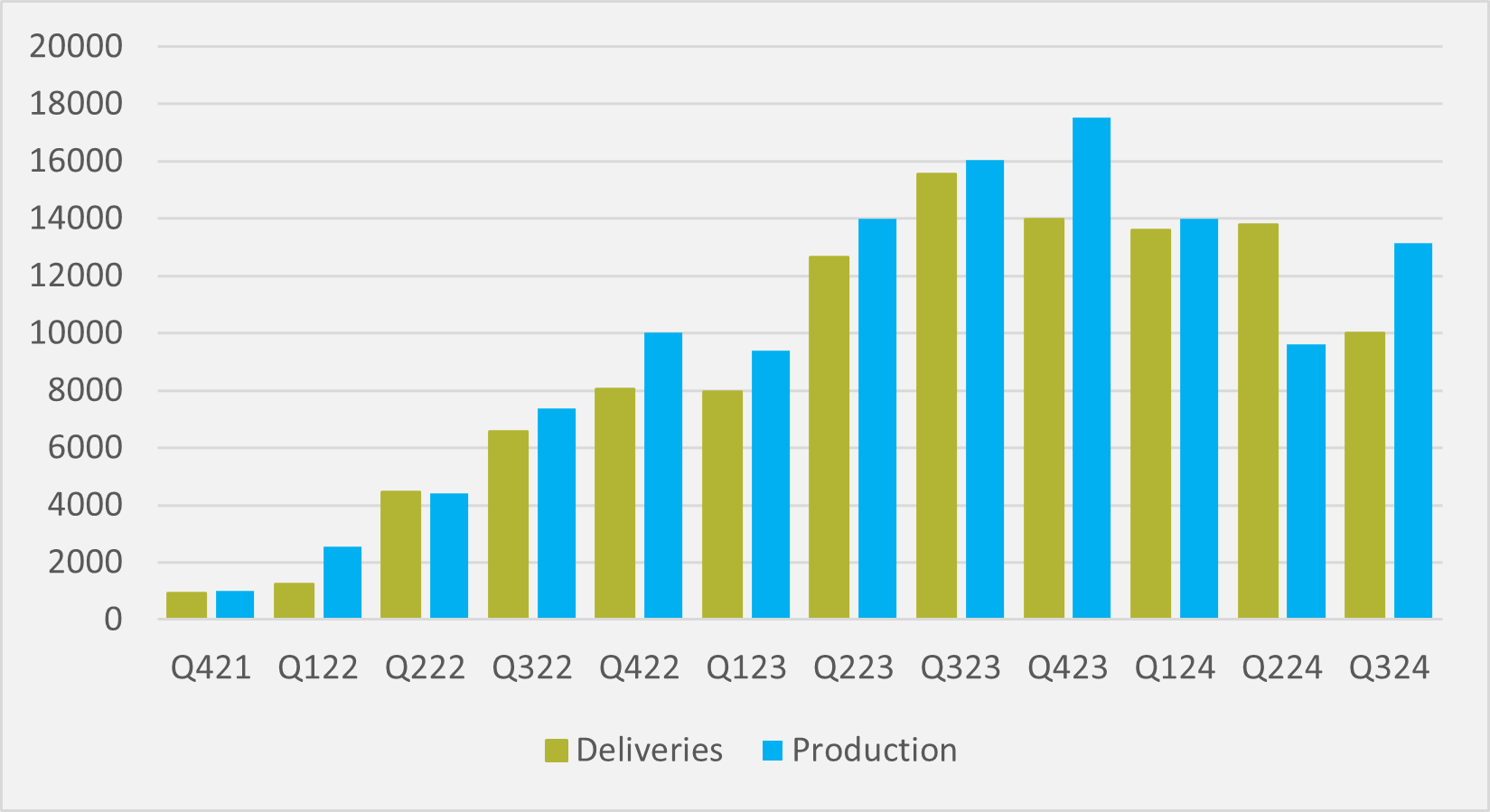

But leasing made up 42pc of Rivian’s just over 10,000 deliveries in Q3 (see Fig.1), so there could be a material number of those receiving Rivian’s via lease that are impacted by any changes.

Potentially much more damaging to the firm’s hopes of staunching its losses before the arrival of the more mass-market R2 in the first half of 2026, would be any changes to the US’ regulatory credit regime. “We now expect to have a total of approximately $300mn of regulatory credit sales in 2024,” says Rivian CFO Claire McDonough, with a similar amount forecast for 2025.

Given that Goldman Sachs analyst Mark Delaney had been expecting “closer to $200mn” for this year’s regulatory credit proceeds, the higher figure was a welcome surprise when Rivian reported Q3 results last week. "As we have gone throughout the course of this year, we have seen an increase in the underlying value of the regulatory credits that we’ve been selling to many of the OEM counterparties,” McDonough explains.

“This is a highly complex puzzle as our team manages our credit portfolio relative to the needs of other OEMs on a state-by-state basis as a whole. And so this is just a demonstration of the progress that our team has been able to make to achieve the great outcome of being able to bring in $300mn of value to Rivian through the sale of these regulatory credits,” the finance chief adds.

So these regulatory credits are an important part of Rivian’s fledgling business, and any move by Republicans holding the federal levers of power to move the goalposts could be damaging. On the other hand, another major beneficiary for many years of these credits has been Elon Musk’s Tesla.

Musk’s full-throated support of Trump is likely to come with some strings attached, and protecting the regulatory credit stream of income that benefits Tesla and other EV pure plays, such as Rivian, could be one of those. Scaringe probably already has reasons to be cheerful about Musk’s lurch into right-wing extremism — with liberal potential Tesla buyers moving to alternatives such as his firm’s products. The Tesla chief helping keep the regulatory credit spigot open could be another.

But Scaringe is also relying on more general supportive regulatory environment to help accelerate US EV adoption — “the path towards ultimately 100pc of new vehicle sales being electric,” to which he referred on the Q3 analyst call. And the framework to drive those sort of penetration rates in even the medium term might now be in doubt, given the changed political winds.

Supply chain changes

One risk that Rivian has been trying to mitigate is even more protective legislation around a domestic/’friend-sourced’ battery supply chain. “The R2 sourcing process is something we have looked at very strategically and certainly have contemplated, even prior to the election, just what the impact would be, should the overall approach to tariffs change,” Scaringe admits.

“A lot of our focus has been on sourcing suppliers that are not going to be subject to large tariffs and — in places where we have sourced suppliers that are overseas that could be subject to changes in tariff structure — designed the contracts and designed the relationships in such a way that we're not carrying much of the risk,” he continues.

“There are a lot of policy elements here that are in play, and we are watching it very closely. I think what is going to be interesting is how far this reaches into the upstream supply chain. As we think about raw materials, that is something that every manufacturer, certainly ourselves included, are thinking about.”

Compelling offerings

Where Scaringe remains positive is in the appeal of his products to target markets. “The R1S is the most popular SUV over $70,000 in California,” he notes.

“That is not just the most popular electric SUV, it is the most popular SUV sold in California. We are hoping to see that level of excitement continue and carry through with R2.

“One of the biggest unlocks we believe, for overall demand of EVs… is the need for a lot of customer choice and a lot more choice than we have today,” Scaringe continues. “And there are very, very few compelling options in that sub-$50,000 price range.

“We believe R2 is going to be an important product for giving customers choice. Having spent a lot of time in and around the vehicle, I can say I hae never been as excited as for a product as I am for R2,” he enthuses.

Insider Focus LTD (Company #14789403)