No Kathleen Valley stope this month – Liontown

The firm is aiming to shift to underground production next month, and maintains everything is on schedule

The EV pure play start-up hopes to reverse recent fortunes with the arrival of its third product

Sino-Swedish EV maker Polestar has begun first deliveries of its Polestar 3 e-SUV, meaning that both of the new offerings it hopes will drive it to scale in the short term are available to customers. Buyers in both Europe and the US will now start receiving their purchases.

In Europe, first deliveries are in Polestar’s home country of Sweden — where 48 sales of the new vehicle in the year up to the end of May have been registered — Norway and Germany while, in the US, California, Illinois, Indiana and New York are the initial states where Polestar 3s will go out to customers. Deliveries are “set to accelerate throughout the summer”, the firms says, with North American rollout boosted by additional Polestar 3 manufacturing that will also start later this summer.

The firm is optimistic about the impact of the new product, to go alongside the established Polestar 2 fastback and the Polestar 4 e-SUV that began deliveries late last year. With a three-product line-up, “Polestar is becoming a global player with the most attractive electric product range”, according to CEO Thomas Ingenlath.

“We always knew the Polestar 3 was going to be popular, but even we were blown away by the global media’s reviews and the response to opening up test drive bookings,” adds Kristian Elvefors, global head of commercial at Polestar. “It is testament to the excitement in the market for this car and customer interest to get behind the wheel of our flagship electric SUV.”

Sales figures in some of Europe’s largest national markets this so far this year illustrate how much Polestar needs to move the needle. Across Germany, Sweden, Belgium, Denmark, Norway and Switzerland, the firm’s sales are down by 1.3pc year-on-year across the first five months of the year, mainly owing to a 43pc drop in sales of the Polestar 2 in Germany (see main image).

There are some brighter spots, though, with Swedish and Danish sales up by 35pc and 30pc respectively, and an almost 150pc increase in Norwegian units sold. The firm is also expanding its retail footprint as part of a shift to a non-genuine agency sales model in Europe and plans to enter seven new markets — France, Czech Republic, Slovakia, Hungary, Poland in Europe, as well as Thailand and Brazil internationally, via local distribution partnerships — in 2025.

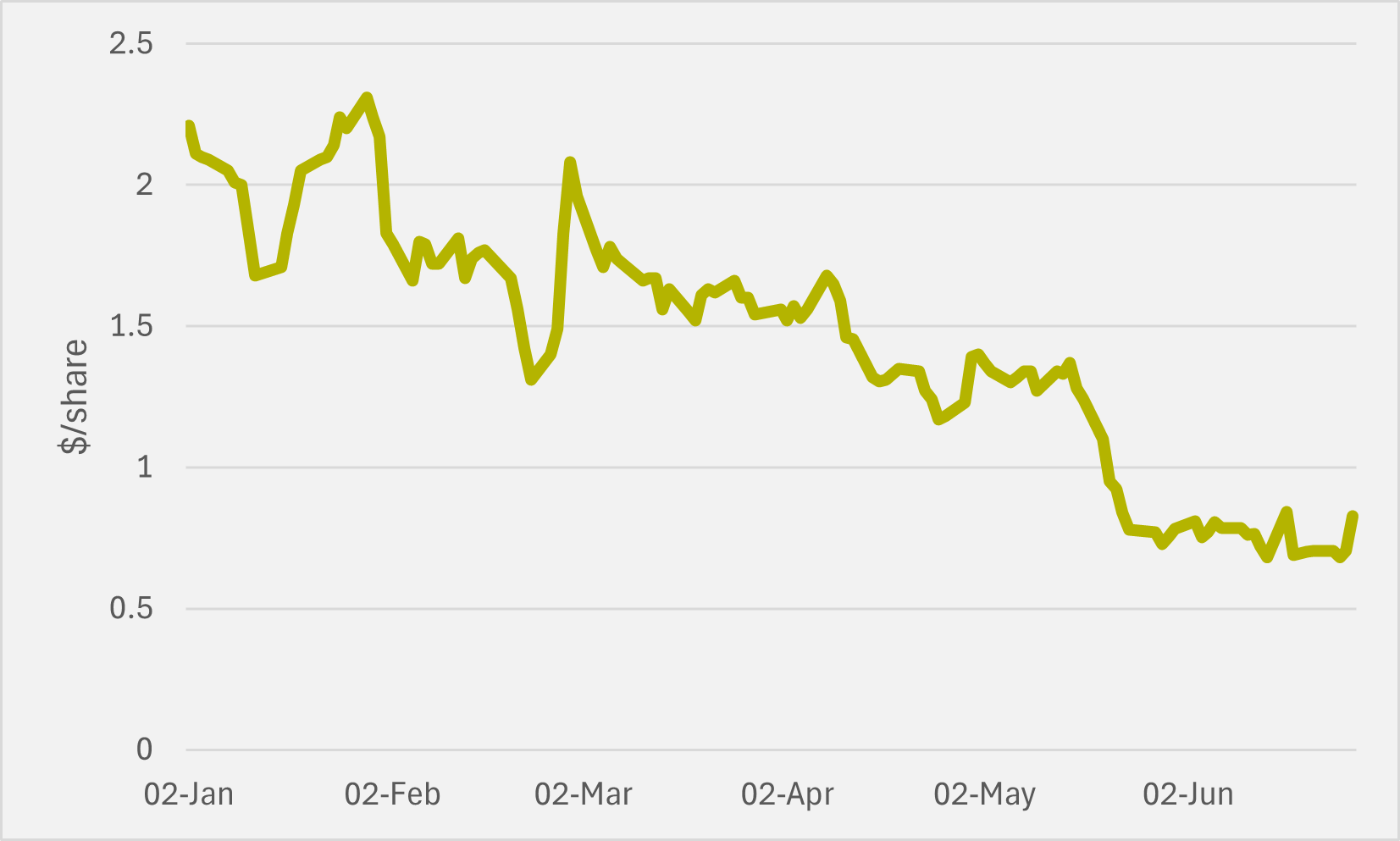

Polestar’s share price has taken a battering in recent months, tumbling from almost $5/share in July of last year to spend the last month in a $0.70-0.85/share range (see Fig.1), on concerns over the pace of its sales growth and the firm’s ability to continue to fund itself before reaching scale. Last month, Polestar had to admit that, owing to not having filed its annual report for the 2023 fiscal year, the company has received a deficiency notice from the Nasdaq exchange, further dampening investor sentiment.

The firm's end-of-May commitment to file the 2023 report by the end of this month was made partially good, with just two days (neither of them working days) to spare, as it published preliminary unaudited financial and operational results for last year. And these included a non-cash impairment charges of c.$450mn relating to Polestar 2 assets — which have now been split out from the new 3 and 4, as well as a fourth bucket for preliminary projects — and inventory impairment.

Inventory impairment charges recognised in cost of sales for 2023 amounted to $120.1mn, triggered by lower-than-anticipated demand in certain key markets, which led to fewer cars being sold and an inventory build-up. Used cars, which have started to come into Polestar's inventory "in a more meaningful way", also negatively impacted.

And the firm's revenue decreased by $67.3mn, or by 3pc, mainly driven by higher discounts and lower sales of carbon credits, partially offset by an increase in vehicle sales volumes.

It still has not filed its Form 20-F annual report by end of June as promised , expecting to do so "in the coming weeks" And an additional commitment to publish preliminary results for the first quarter of this year by the same deadline has been missed, with those figures now due on 2 July instead.

Insider Focus LTD (Company #14789403)