Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

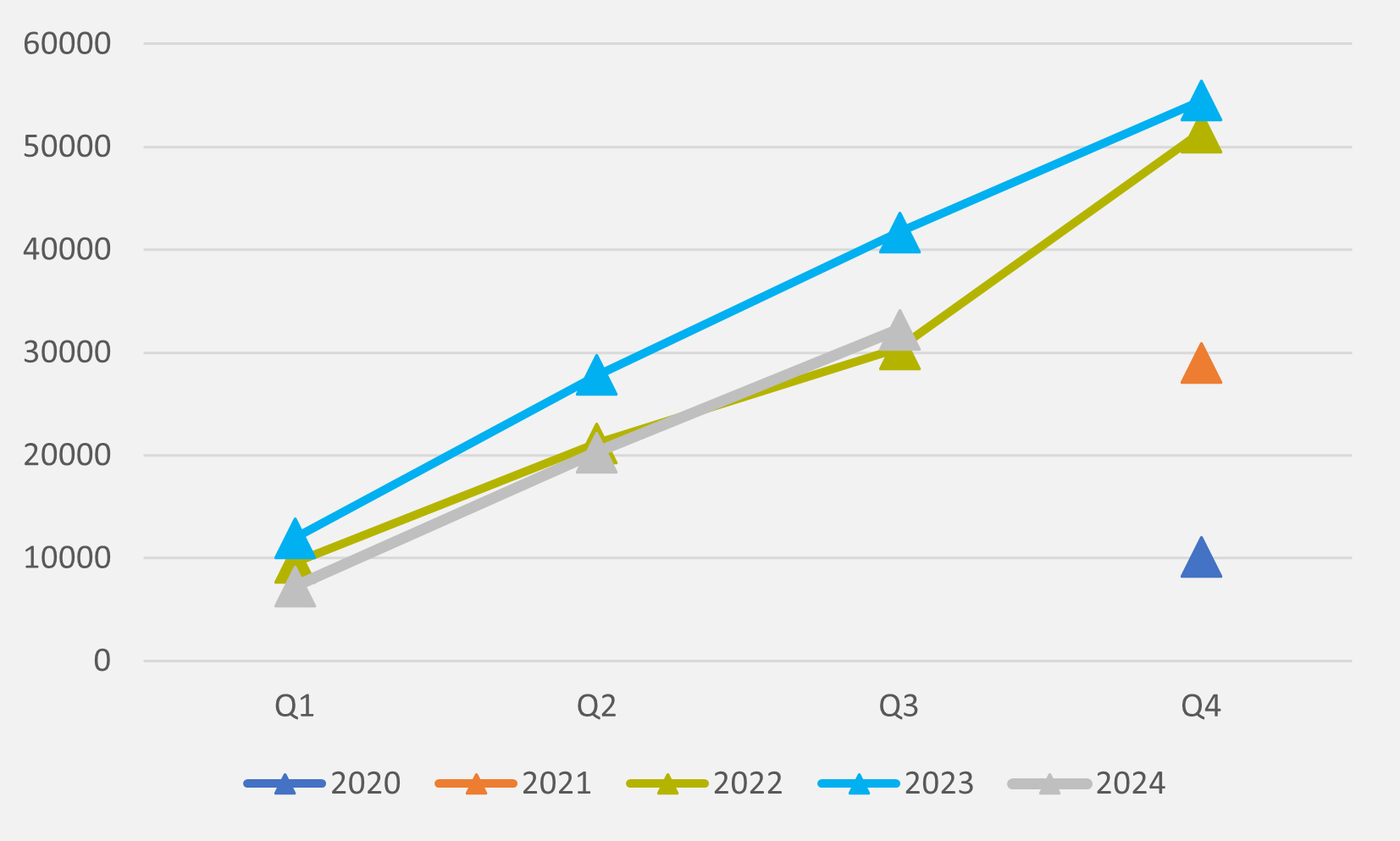

Q3 sales remain stubbornly behind last year at 2022 levels

The drivers on which Sino-Swedish EV pure play start-up Polestar is relying to take it to scale — the launch of the new Polestar 3 and 4 and a new sales model — failed to move the needle on sales in Q3. And there are worrying signs of potentially more investor pain to come.

Polestar delivered c.11,900 cars in Q3’24, marking a fourth consecutive quarter of lower sales year-on-year (see main image). At least the gap to 12 months earlier is narrowing — following c.40pc annual declines seen in Q4’23 and Q’24, Q2 saw the deficit cut to 17pc and Q3 to 14pc.

Total deliveries for the first nine months of the year stand at just over 32,000, down from almost 42,00 in Q1-3 ’23 and remaining on a trajectory much more in line with 2022 than 2023 (see Fig.1).

The firm reports that the “first markets to implement active sales model [are] showing solid order intake”. But there will be concerns, both that sales are not showing more growth — leading to an admission that 2025 sales are also likely to disappoint — but also that Polestar is signalling it may breach the terms of some of its debt and it will not be releasing full data on Q3 performance any time soon.

Polestar and its largest shareholder, China’s Geely, are “engaged in constructive dialogue with its club loan lenders, who remain supportive, regarding its loan covenants”, the firm admits.

And the firm will wait until mid-January to release “select Q3 financial and operational highlights”, rather than full reporting around the middle of Q4. “Reducing Q3 reporting disclosures will help focus company resources on the ongoing business and strategy review and on fulfilling 2024 annual reporting requirements,” Polestar says.

The firm admitted in May that, owing to not having filed its annual report for the 2023 fiscal year, the company has received a deficiency notice from the Nasdaq exchange. And while it published preliminary unaudited financial and operational results for last year just before a promised end-of June deadline, these included a non-cash impairment charge of c.$450mn relating to Polestar 2 assets and inventory impairment.

It only managed to file its Form 20-F annual report in mid-August, so reconciling the books has clearly been an issue. Replacing the CEO, with Michael Lohscheller’s finance background switching in for Thomas Ingenlath’s design expertise, and appointing a permanent CFO looked like efforts to shore up that facet of the business.

Polestar expects revenue in 2024 to be similar to 2023, with “current market conditions and announced import duties” as headwinds. Most Polestars are still made in China, meaning hits for imports from Geely facilities on both sides of the Atlantic until it can ramp up production from its new plant in the US and contract manufacturing in South Korea kicks in next year.

It still hopes to achieve a positive gross profit margin in the fourth quarter and cash flow break-even towards the end of 2025. But it warns that the latter will be “at lower volume than previously targeted”, i.e. it now expects to sell fewer cars next year than previous expectations.

But Lohscheller is still putting in a brave face. “A key to our future success will be the development of our commercial capabilities: going from showing to actively selling cars. Adopting a more active sales model is already supporting our ambitions, as the first markets to implement it are showing solid order intake,” he says.

“Polestar has a great foundation to build upon, with access to the best EV technology, a global manufacturing capability and strong support from Geely,” he insists.

Insider Focus LTD (Company #14789403)