Musk offers bittersweet glimpse into what might have been

Tesla could still be a contender. But only if its CEO faces a few home truths and reprioritises

Nio sees EV sales decline year-on-year, while Xpeng and Li Auto NEV sales growth also come under pressure

Chinese EV makers Li Auto, Xpeng, and Nio have all reported material sequential dips in their EV sales for the first quarter of 2024, despite two of the three maintaining solid year-on-year growth figures.

Beijing-headquartered Li has posted 52.9pc year-on-year growth for Q1'24 after selling 80,400 NEVs in the quarter and just under 29,000 NEVs in March — albeit less than an initial c.100,000 forecast. The company's delivery figures for March amount to 39.2pc growth over March '23 on the back of a rapidly growing sales and delivery infrastructure network.

The company says it now has 474 retail stores in 142 cities across China, as well as 357 branded supercharging stations.

"The cumulative deliveries of Li Auto vehicles reached 713,764 as of the end of March 2024, establishing Li Auto as the first Chinese emerging new energy automaker to reach a milestone of 700,000 cumulative deliveries," Li says.

Li is joined by Chinese NEV rivals Xpeng and Nio in posting steady growth figures for the first quarter.

"Overall, Xpeng delivered 21,821 Smart EVs in the first quarter of 2024, a 20pc increase from last year," Xpeng says.

"In March 2024, Xpeng delivered 9,026 smart EVs, representing a 99pc increase over the prior month and 29pc increase year-over-year. The Xpeng X9 maintained its position as the top-selling all-electric MPV in China, with 3,946 units delivered in March and nearly 8,000 units delivered since its launch," the firm continues.

And out of the three automakers, Li Auto's growth is all the more impressive considering it is producing and delivering NEVs at a higher scale than both Xpeng and Nio.

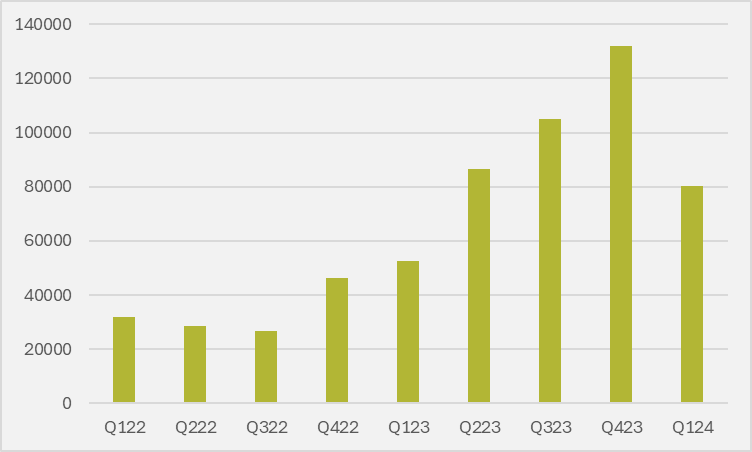

Li Auto has been posting considerable quarterly growth in its sales across 2023 after a relatively flat 2022. This perhaps distorts the 52.9pc year-on-year growth figure somewhat, given Q1's 80,000 unit sales also marks a 64pc sequential decline from the final quarter of 2023, in which the company delivered 131,805 NEVs.

Rival EV maker Nio saw a year-on-year decline in EV sales, having delivered 30,053 vehicles in the first quarter compared to 31,041 in the same period last year. This is despite year-on-year growth for the month of March.

The sharp sequential dips for the three automakers are to some extent, but not totally, down to seasonal factors, as Xpeng and Li saw quarter-on-quarter growth in Q1 of last year.

Insider Focus LTD (Company #14789403)