No Kathleen Valley stope this month – Liontown

The firm is aiming to shift to underground production next month, and maintains everything is on schedule

But Audi lags behind with only a 50pc year-on-year increase in BEV sales

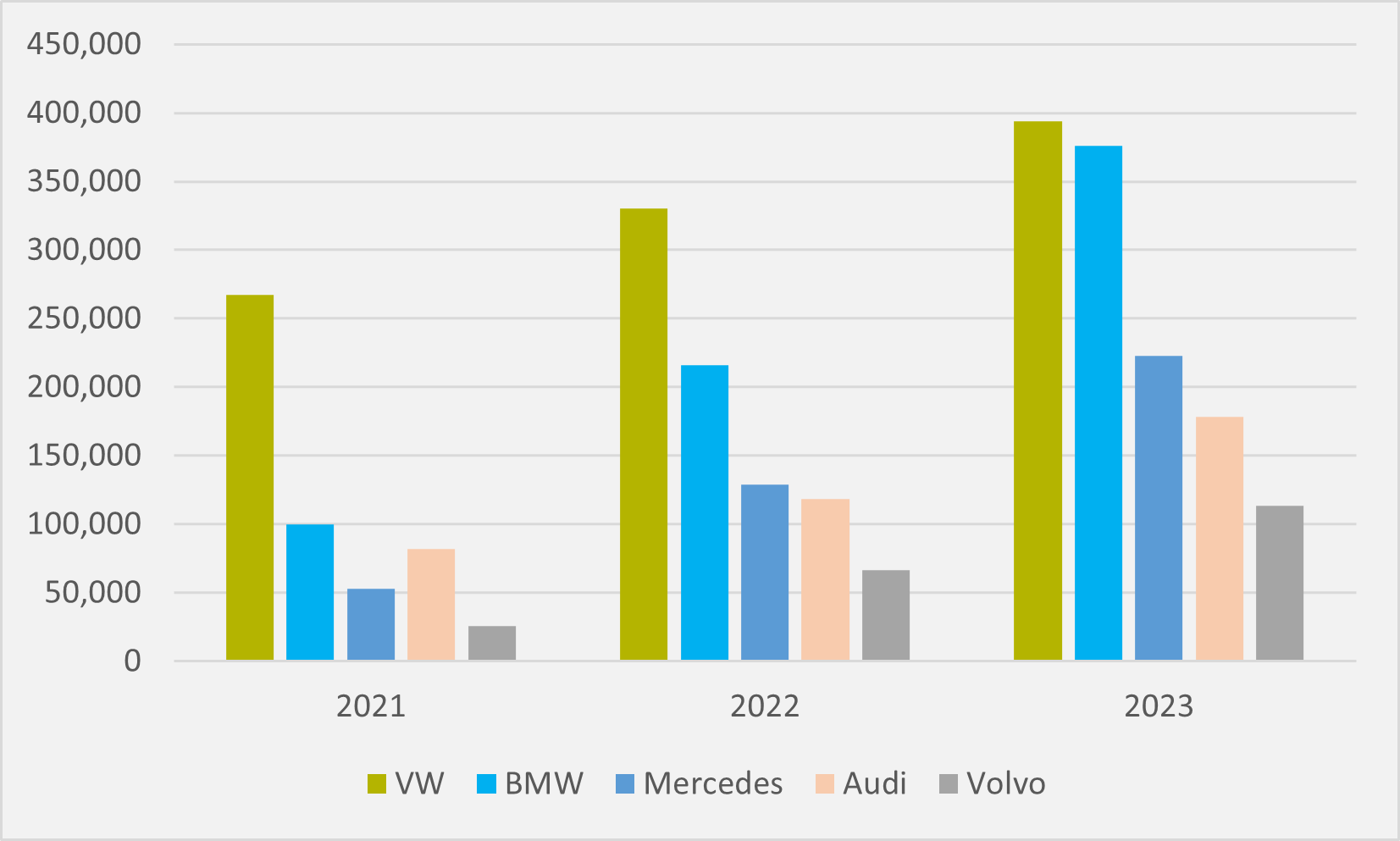

Germany’s Mercedes joined domestic rival BMW and Sweden’s Volvo in posting annual increases in its BEV sales at or north of 70pc in 2023 (see main image). Fellow German Audi saw its growth rate at a healthy 50.6pc, but trailing its fellow European marques.

It did, though, enjoy much greater BEV sales progress in 2023 than the Volkswagen brand with which it shares the VW Group stable. Its year-on-year growth was less than 20pc.

Mercedes sold 222,600 BEVs in 2023 (see Fig.1), equivalent to 11pc of overall sales — with PHEVs making up another 8pc of Mercedes’ sales mix. Mercedes remains a distance behind the Volkswagen brand and BMW, which both sold more than 350,000 BEVs in 2023.

But it pulled further ahead of Audi, which sold just shy of 180,000 BEVs last year. The firm in particular hailed sales of the EQE Sedan, which surged by 120pc globally. And its US BEV sales soared by 167pc year-on-year, driven by the new EQE SUV.

BEVs boosted Mercedes at both the highest and entry levels of its business. A 4pc rise in overall sales in its Mercedes-AMG division was underpinned by a 76pc year-on-year jump rise in high-performance BEVs. And another 4pc increase in its entry-level business was driven by strong demand for the EQA (+57pc) and EQB (+109pc) products.

“Electric vehicle sales continue to rise and particularly the new E-Class is being well received,” says chairman of the Mercedes management board Ola Kallenius.

In the US, BEVs made up 15pc of Mercedes' passenger car sales. And there was strong year-on-year growth for key models in the top-end, core and entry segments.

The top-end fully electric EQS SUV posted 8,989 total units in the US in 2023, a 216pc increase from 2022.

In the year's final quarter, the core EQE BEV sedan shifted 1,195 units, an increase of 211pc. And the entry-level fully electric EQB recorded 5,093 unit sales, an increase of 446pc from Q4'22.

Audi advancing

A more than doubling of sales of the Q4 e-tron, up by 112pc yr-on-year, was a major driver of Audi’s progress. But neither BEVs in general or the Q4 e-tron were able to match their global growth in Audi’s home European market, recording 30pc and 68pc increases respectively. German BEV sales were up by an even slimmer margin at c.13pc to 13,000.

In the US, BEV growth slightly outstripped Audi’s overall rate, rising by 55pc to 25,000 units.

“In 2024 and 2025, we will also strengthen and rejuvenate our portfolio with numerous new models. The focus will be on our groundbreaking electric cars,” says Audi CEO Gernot Doellner.

First up will be the launch of the Q6 e-tron at the end of 2004’s first quarter, which will also mark the debut of VW’s PPE platform for its premium BEVs.

Insider Focus LTD (Company #14789403)