Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

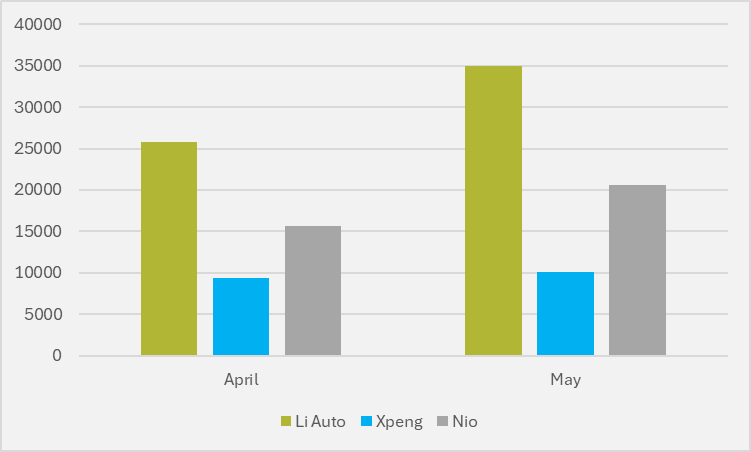

Li and Nio post strong growth in mid-level and premium segments but Xpeng shows signs of a Q2 slowdown

Chinese OEM Li Auto has recovered from disappointing April deliveries to post 23pc year-on-year growth to just over 35,000 sales in May, driven by the launch of its new L6 extended range EV (EREV).

This was part of a broadly solid month of growth for emerging Chinese firms, including Li rivals Nio and Xpeng, although the latter looks at risk of dashing any expectations for high sequential quarterly growth after two months of Q2.

Q2 is a seasonal stronger quarter than Q1 — which is impacted by New Year celebrations — in the Chinese market. And all three firms do look set to post sequential quarterly growth, with Nio having already exceeded Q1's sales in the first two months of Q2.

Li says it has delivered over 15,000 L6 NEVs since deliveries began on 24 April, hailing "a record pace for our newly launched models". But CEO Xiang Li stresses that, while the rollout is seeing encouraging progress, the company still has room to improve the speed of deliveries further.

"We are fully committed to securing the supply chain and ramping up production of Li L6 to ensure users receive their vehicles at the earliest possible opportunity," he says.

Li is not directly competing with the affordable mass Chinese market, selling its mainly EREVs at an intermediate price point between affordable players like BYD and premium players like Nio. As such, Li sees encouraging gains so far in 2024 in the RMB200,000 ($27,600) and above segment,.

“Our market share in the RMB200,000 and higher NEV market continues to experience healthy year-over-year growth, expanding to 13.5pc for the period between January to April and strengthening our top position among Chinese auto brands."

However, Li moved to negative margins at the end of Q1 as it posted a $81mn loss for the quarter, driven by a significant hike in operating expenses that more than offset strong growth in the company's deliveries. It remains to be seen if May's better delivery performance will translate into improved Q2 profitability.

Rival Xpeng posted 35pc growth year-on-year, but from a much lower starting point, meaning that it delivered 10,146 EVs in May. However, the firm's sales show almost flat growth on a sequential basis, compared to its two rivals, which both saw significant month-on-month increases in line with seasonal expectations (see Fig.1).

This relative sequential stagnation for Xpeng could dent its overall Q2 numbers, which typically see large jumps over Q1 in the Chinese market. Indeed, Xpeng delivered just over 9,000 EVs in March, and has yet to meaningfully grow beyond this level in Q2. Nevertheless, the firm is currently just short of its Q1 total after May.

Meanwhile, fellow Chinese automaker Nio delivered 12,164 electric SUVs and 8,380 electric sedans, equalling 20,544 units for the month. While Nio may be able to boast of 234pc year-on-year growth, this is in relation to a much lower starting point. However, the firm's premium positioning means that volume is les of a priority for Nio that it is for mid-level players like Li.

Nio's ET7 starts at RMB486,000, or around $67,000, while its cheapest EV sells for the equivalent of over $41,000.

Insider Focus LTD (Company #14789403)