No Kathleen Valley stope this month – Liontown

The firm is aiming to shift to underground production next month, and maintains everything is on schedule

The EREV maker has left previously comparable rivals far behind

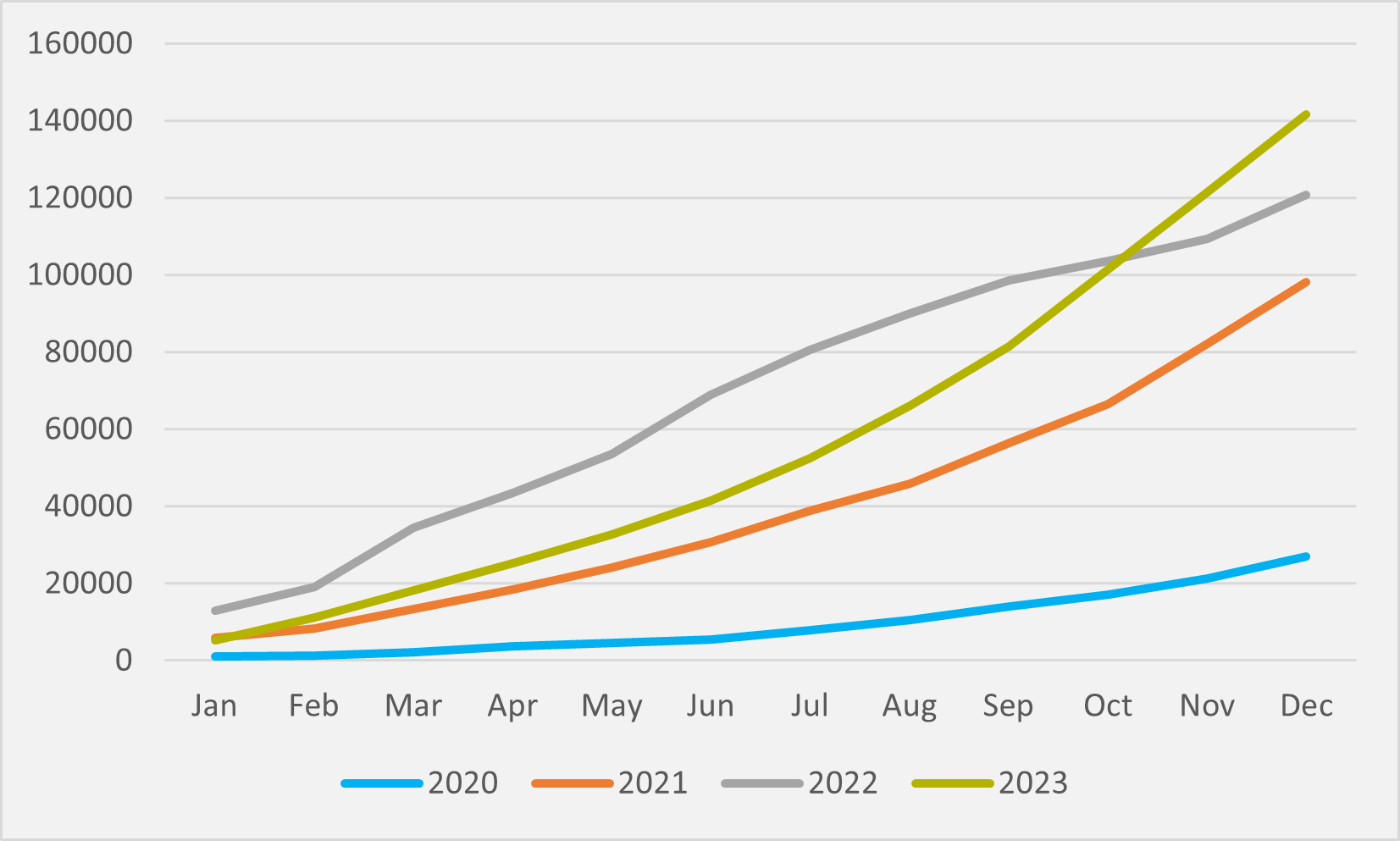

China’s Li Auto sold just over 133,000 vehicles in 2022. Peers Nio and Xpeng recorded similar numbers — c.122,000 and c.120,000 respectively.

But a cursory glance at 2023 numbers tells the story of how different a year Li has had comparted to its competitors. Nio recorded a year-on-year sales increase of 31pc to 160,000. Xpeng’s growth was 17pc to slightly over 140,000.

In contrast, Li posted a 180pc+ increase in annual sales to over 375,000, leaving its rivals far behind (see main image). And the firm ended the year both by posting record sales for a month and a quarter and announcing a material increase in the firm’s Chinese store footprint.

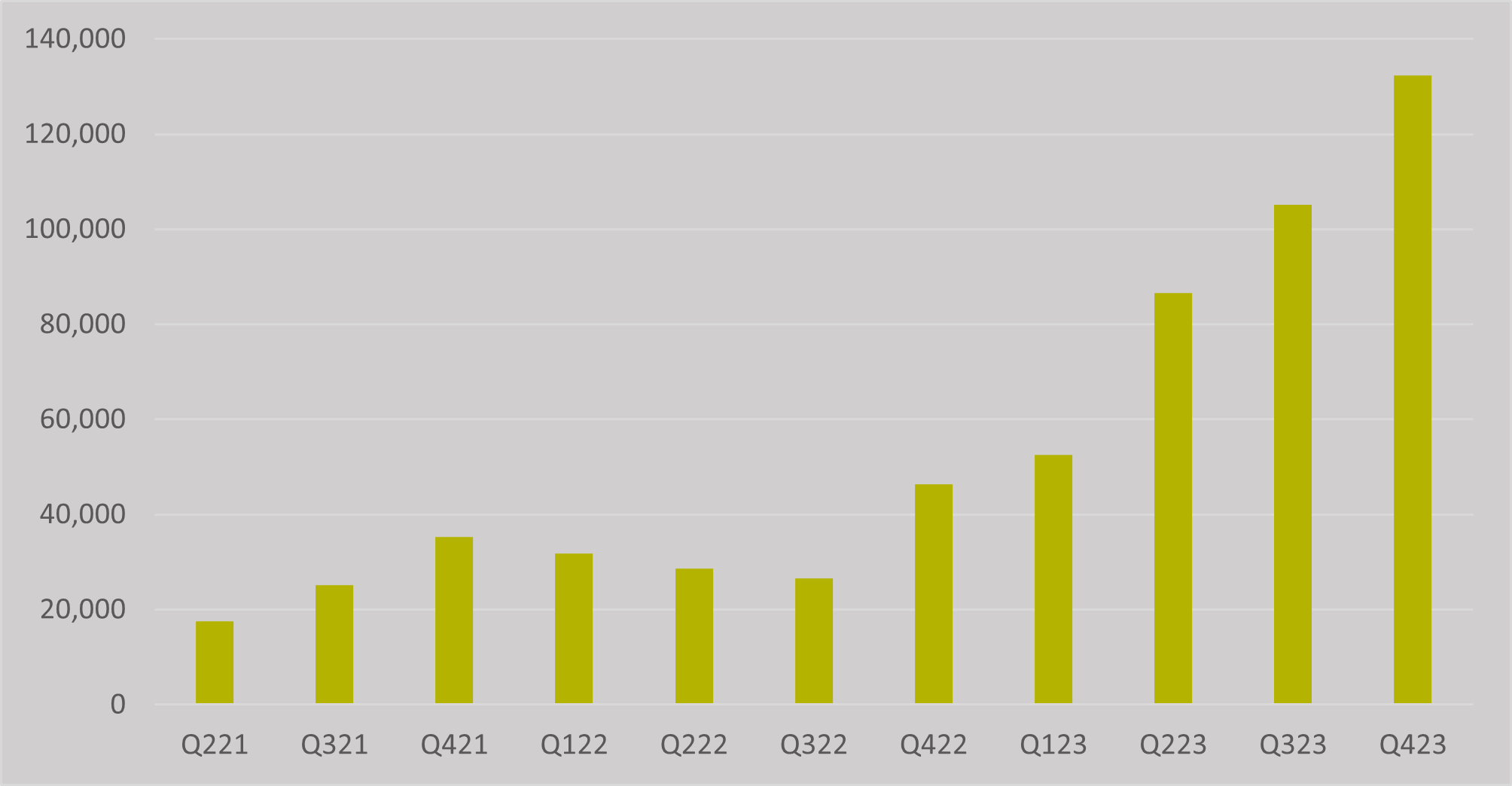

Li sold over 50,000 vehicles in a month for the first timer in December. And Q4’23 sales in total were just over 132,000 — meaning that every quarter of the year hit a new milestone, with Q1 its first 50,000+, Q2 its first 75,000+, Q3 its first 100,000+ and Q4 its first 125,000+ quarter (see Fig.1).

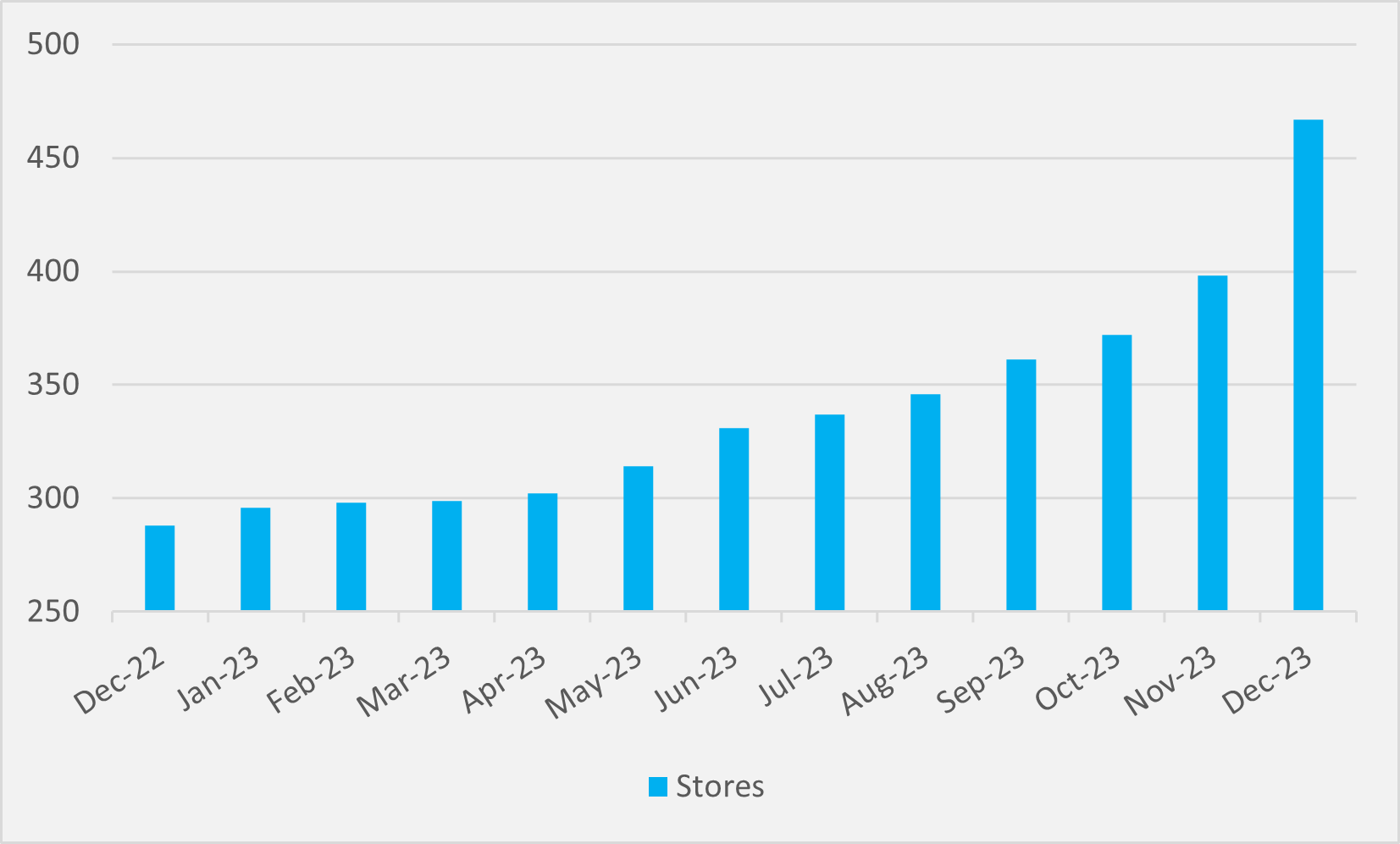

At the end of December last year, Li had 288 stores in 121 Chinese cities. To the end of November, that had increase steadily to 398 stores in 136 cities, adding 110 stores over the course of those 11 months.

But the pace of store expansion accelerated markedly in December, when Nio added another 69 new stores in a single month, taking it 467 stores across 140 Chinese cities (see Fig.2).

The firm’s particular focus is its software innovation. It boasts that, since its L series first commenced deliveries, it has completed over 20 over-the-air (OTA) upgrades. And its OTA version 5.0, which was officially released in December, has 145 new functions and 100 optimised features, which Li describes as “a comprehensive revolution in autonomous driving and smart space”.

Li is unusual in that it currently only makes extended range EVs (EREVs), a type of light hybrid where an ICE does not power the vehicle itself at any point but can be used to replenish the battery, rather than pure BEVs. But it plans to launch its first fully electric vehicle, the Li Mega MPV, at the start of March. Three further BEV launches are slated by the end of 2024.

Missed target

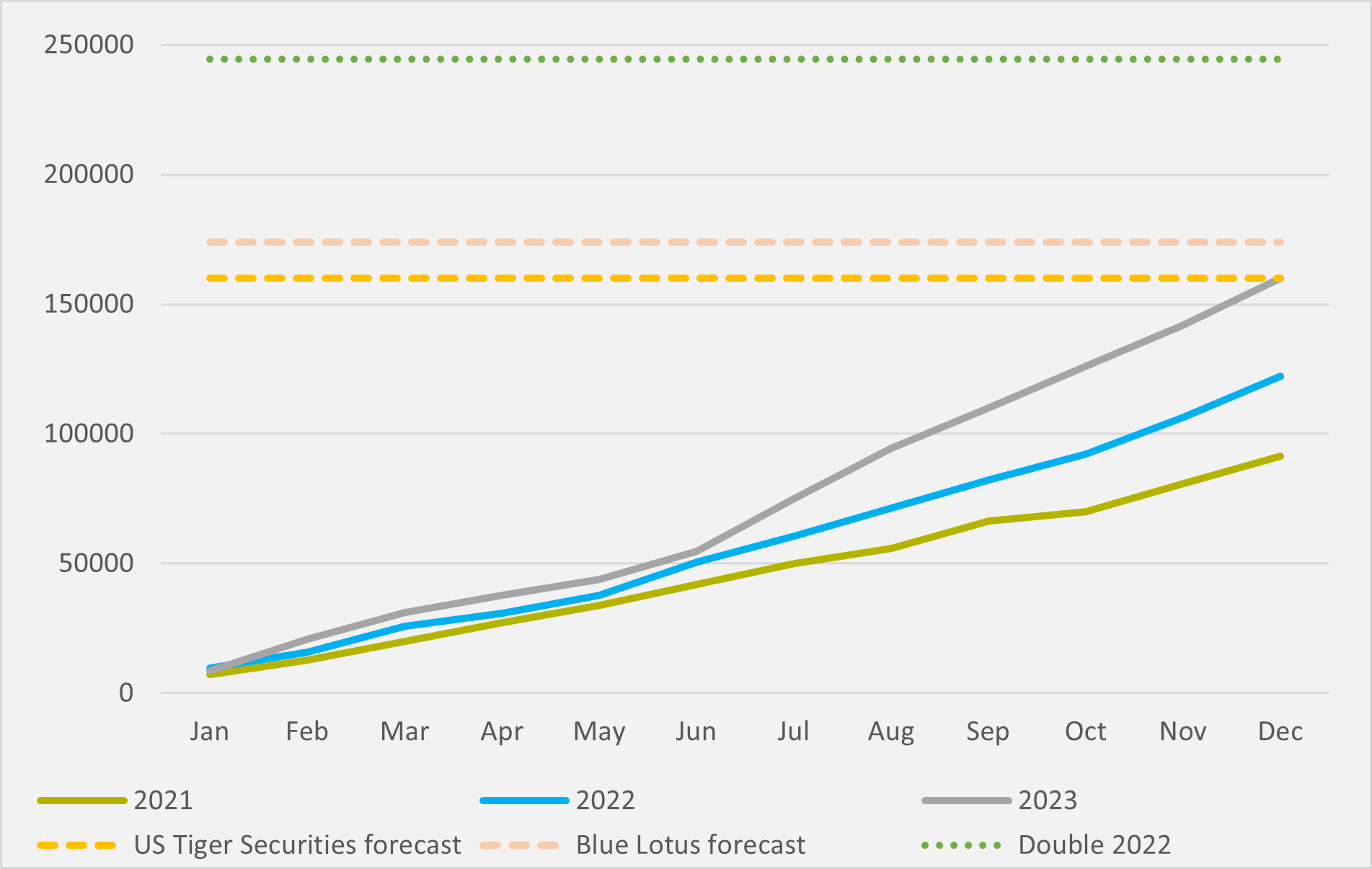

In the first half of the year, all-electric Chinese OEM Nio had been forecasting it could double its 2022 sales in 2023. It fell well short of that target, although it did manage to come in just ahead of an annual sales forecast by New York-based brokerage US Tiger Securities — while missing a slightly higher target from Chinese equity research house Blue Lotus (see Fig.3).

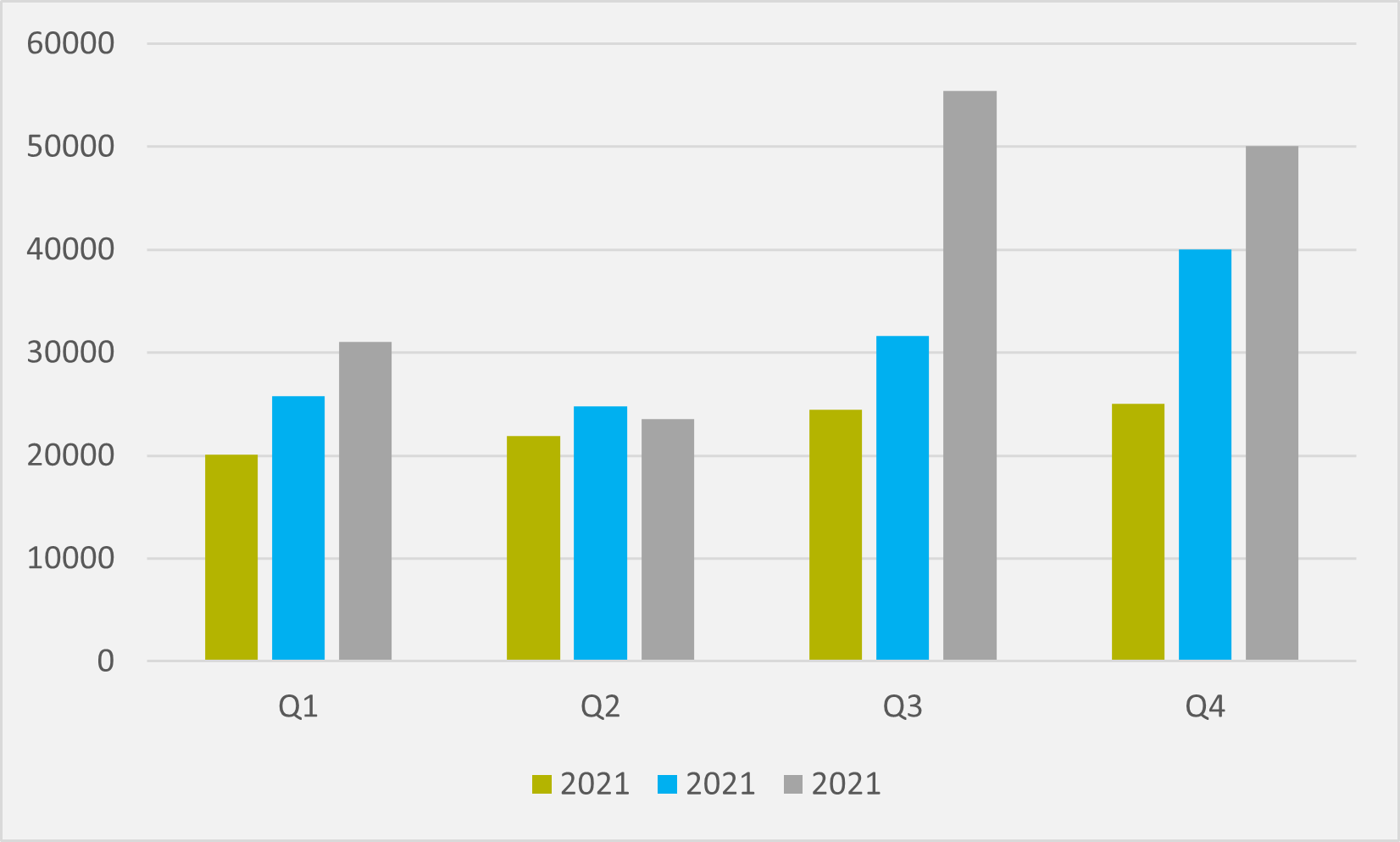

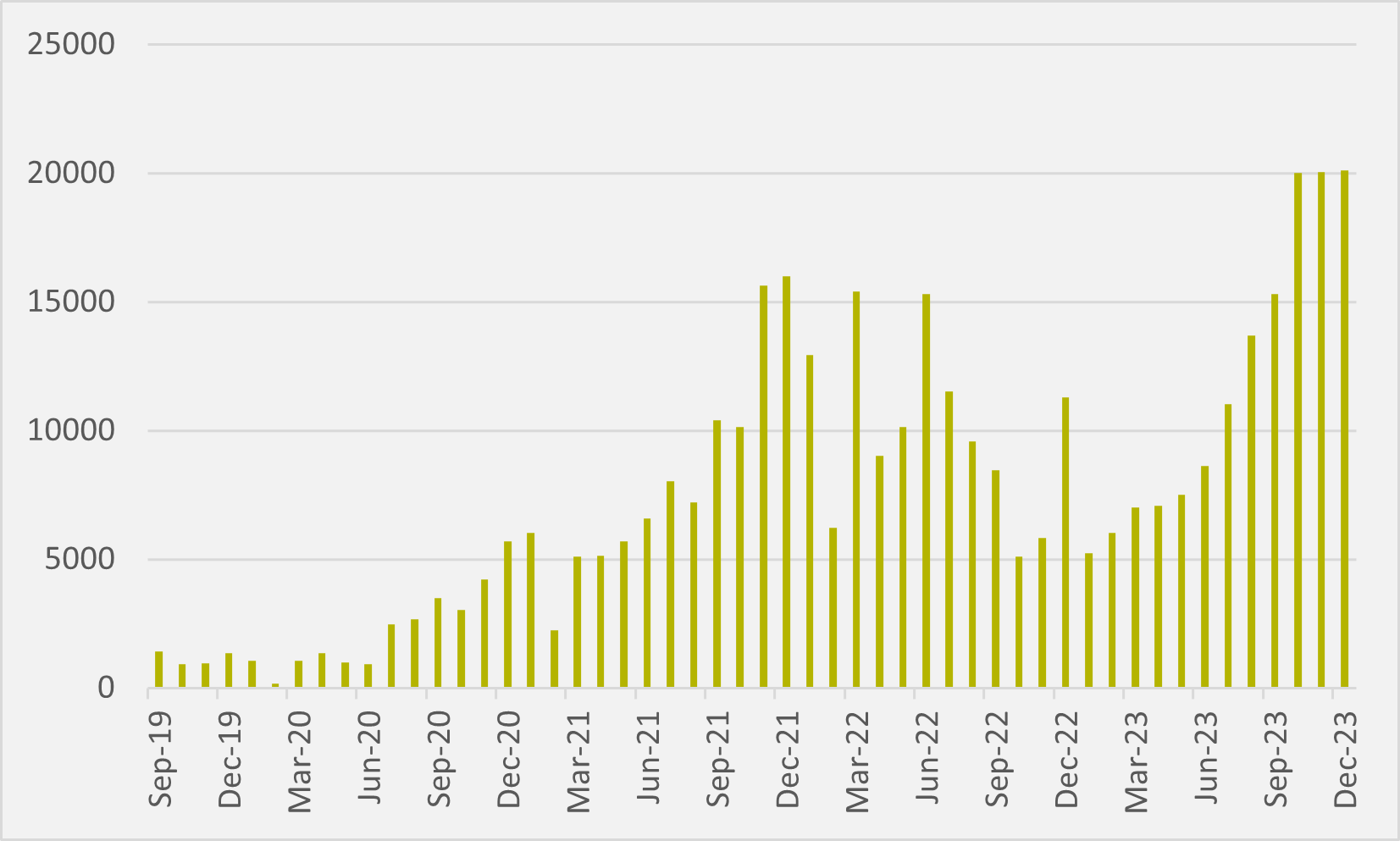

December sales of 18,000 BEVs did represent a best month in four for the firm. But its Q4 sales of 50,000 represented a slide from over 55,000 unit shifted in Q3, as the firm failed to get back to the 19,000-20,000 sales months it enjoyed in July and August (see Fig.4).

The firm’s ET9, which it describes as “a smart electric executive flagship”, will not offer any boost to sales momentum this year, as it is due to launch in the first quarter of 2025.

Regaining ground

China's Xpeng eventually shrugged off a challenging first half of the year to post an increase in sales compared to 2022, no mean achievement when units shifted by the end of July were some 28,000 behind where they stood at the same point in 2022 (see Fig.5).

Each of Q4’s months have seen sales of just over 20,000, with December’s 20,115 meaning a third consecutive record sales months — as well as neatly rounding off 2023 as year where sales increased consistently month-on-month from January through to December (see Fig.6).

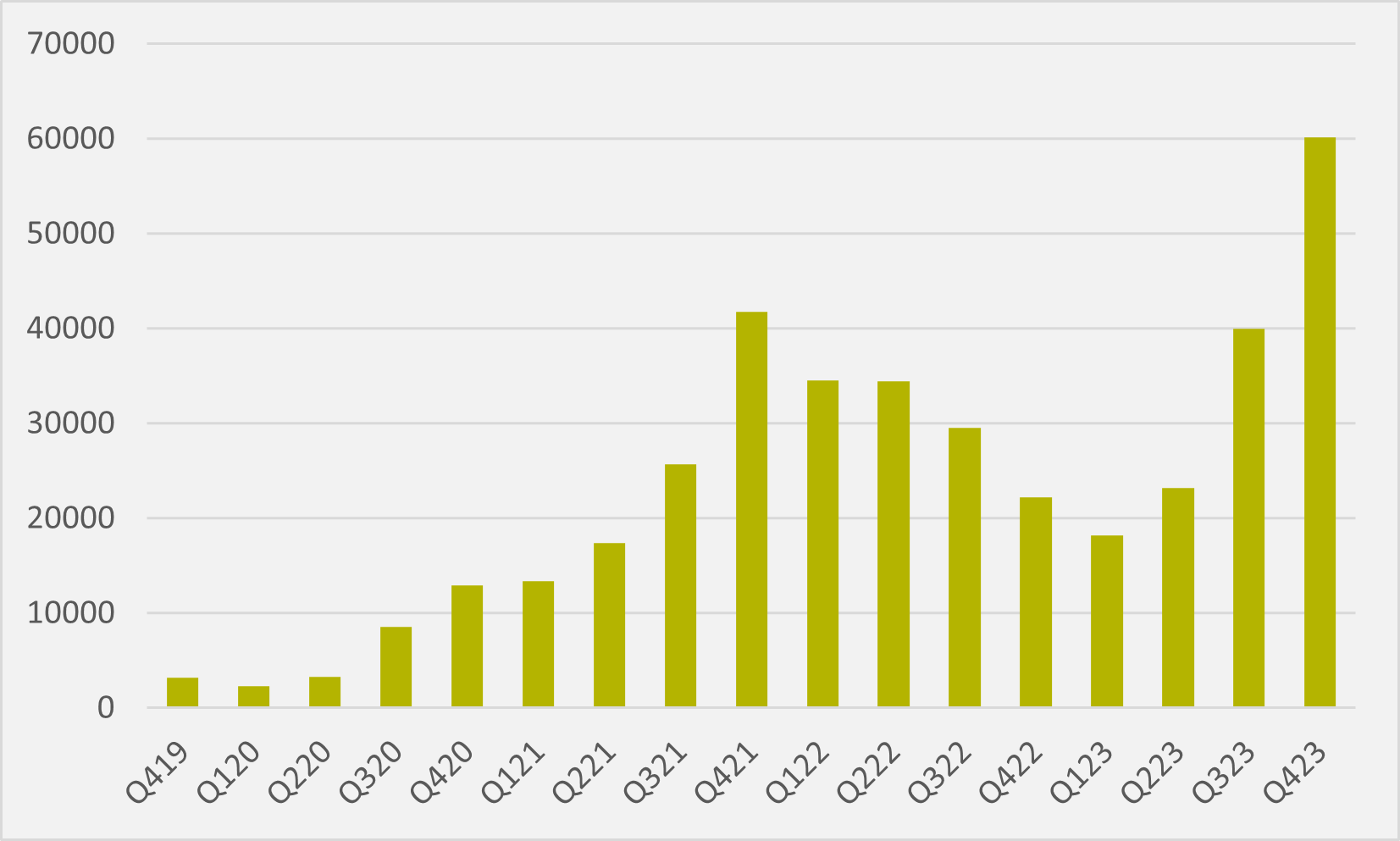

Unsurprisingly, this also meant Q4 as whole was by far Xpeng’s best-ever quarter, eclipsing a previous high set back in Q4’21 (see Fig.7).

Like Li, Xpeng is betting big on its software advantage. At the end of November, it rolled out another OTA update through its Xmart OS 4.4.0 smart cockpit operating system. And a month later, it deployed its XNGP advanced driver assistance system to customers in 27 more cities, again via an OTA update.

Newly added cities include Tianjin, Chengdu, Xi'an, Wuhan and Changsha, expanding Xpeng’s coverage that is not reliant on HD maps to a total of 52 cities in China. By early 2024, the firm is targeting XNGP to be available in a total of 200 cities across China.

High hopes

And, unlike Nio, Xpeng has a new flagship model ready to launch. In mid-November, it officially showcased its X9 seven-seater MPV built upon its Sepa 2.0 architecture at the Guangzhou auto show. Presale pricing for the X9 started from RMB388,000 (c.$54,000), while it now offers versions priced in an RMB359,800-419,800 range.

In December, test drives of the X9 started for Chinese customers nationwide. And customer deliveries of the vehicle are set to commence immediately after a launch event that took place on Monday of this week.

The X9 has an 800V high-voltage silicon carbide platform and 3C battery cells. Its maximum range is 702 km CLTC, while energy consumption can be as low as 16.2kWh/100km. A 10-minute charge can add up to 300 km of range.

Its powertrain system delivers a maximum power of 370kW and a peak torque of 640Nm. The vehicle can accelerate from 0 to 100km/h in 5.7 seconds, and generate a top speed of up to 200 km/h.

Insider Focus LTD (Company #14789403)