Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

The consulting heavyweight sees China maintaining big lead in the challenger EV battery chemistry

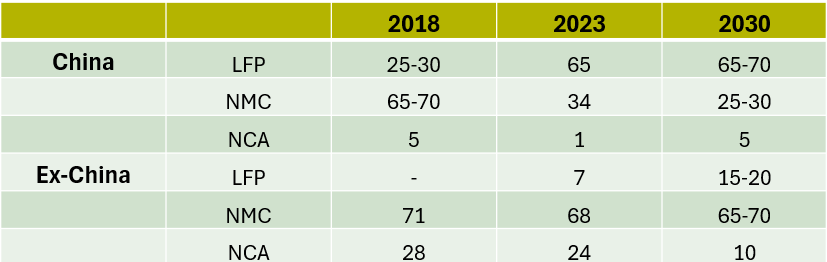

Adoption rates of lithium iron phosphate (LFP) cathode chemistry as an alternative to nickel manganese cobalt (NMC) in EV batteries will lag in Europe and the US compared to in China for the remainder of the decade, in the view of new research from consultancy Bain.

The firm notes that LFP has “taken significant share from NMC since 2018 due to improvements in energy density at sustained lower cost” (see Fig.1). And it predicts that, in China, LFP will become more dominant owing to “robust demand for mass-market EVs and established supply chains”.

The emergence of LFP variants with improved energy density, such as M3P and lithium manganese iron phosphate could accelerate the process.

But Bain sees a different picture for Europe and the US. For one thing, it sees domestic LFP production is “nearly non-existent”, while existing iron and phosphorous supply chains are “significantly less mature in these regions compared to those in China”.

“Consequently, the cost advantage of LFP versus NMC will be undercut by the costs of importing LFP from China,” it predicts. “This will be exacerbated by unfavourable economics of recycling versus NMC.”

It also sees interest in no- or low-cobalt NMC variants (including NMx, high lithium manganese and high-voltage mid-nickel) potentially further reducing the cost advantage of LFP. And it warns that import tariffs, particularly those already trailed in the US, and “broader geopolitical challenges” may make LFP less suited for western OEMs looking to build up more resilient supply chains.

The firm also forecasts that global BEV passenger vehicle sales will rise from 10mn and a 12pc market share in 2023 to 37mn and a 36pc market share in 2030. This in turn will drive installed global battery demand for transportation up from 820GWh to 3.485TWh in the same time period (see main image).

Lithium dominance

And Bain expects lithium-ion batteries to continue to dominate the global EV battery market at the end of the decade, as emerging technologies such as solid state and high-density sodium ion are “still in the prototype and pilot manufacturing stages”. The firm expects their market share to still be in single digits by 2030.

For solid state, it notes that the technology’s pioneers have “only recently been able to demonstrate initial proofs of concept following multiple delays”, leading it conclude that “commercialisation is likely three to four years away", a view shared by German OEM BMW among others.

While sodium-ion cells promise lower cost than lithium ion, along with improved safety and the ability to operate at lower temperatures, energy density has historically been substantially lower, constraining EV adoption. There has been progress on this front, Bain recognises, with prototypes delivering energy densities comparable with LFP. But it sees adoption of sodium ion contingent on the replication of prototype performance at scale, while continuing improvements in LFP energy density and decreasing costs could threaten the buzz around sodium.

Nonetheless, Bain does note that “multiple players have announced plans to scale production by 2025, with commercial deliveries of the first sodium-ion based EVs having already started”. On the other hand, it dismisses other emerging chemistries as unlikely to be commercialised at all in EVs by 2030.

Two potential contenders, lithium-sulphur and metal-air batteries, are in its opinion “still in the early stages of development”. With companies developing initial proofs of concept but not yet validated concepts at scale with OEMs, Bain suggests it will be “at least six years, if not longer, until they can commercialise these batteries”.

Tricky to navigate

But this clarity on lithium ion’s dominance does not, in the consultancy’s view, make it any easier for OEMs to formulate fool proof strategies for their battery procurement and development programmes. It warns that they still face tough decisions on which battery type to use and whether to develop batteries in-house or through collaboration with other companies.

“The lithium technology stack will see major shifts across cathode chemistries, anode chemistries, cell form factors and pack architecture,” it predicts. “OEMs are keeping a close eye on multiple innovations such as battery integration via cell-to-chassis technology, where the battery is built directly into the structure of the car; dry electrode manufacturing process, which reduces energy consumption and hence manufacturing cost; and AI-powered battery management systems that are increasing the longevity of batteries.”

Bain suggests that OEMs should attempt to retain as much flexibility as they can for as long as they can, given the potential fluidity of battery technology development and other external factors, such as geopolitical impact on the supply chain. There is also the risk other “elements of EVs, from autonomous driving to increased passenger connectivity, may ultimately matter more to customers than the vehicle’s batteries”.

It advises that firms should be aware of the pros and cons of opting for in-house development versus outsourcing battery making, and ultimately try to allow its product strategy to inform choices. But it does note that those opting for in-house development “do not depend on external partners for knowledge, and they have a stronger position to reduce battery costs and increase productivity in procurement”.

Again, though, fit with customer strategy is, in Bain’s view, key. “BMW, for example, is well known for offering a premium driving experience. The automaker has taken a large role in designing and developing its batteries, which directly affect the core driving experience,” it says.

It contrasts that approach with more mass-market ambitions of US legacy automaker GM, which has partnered with Suth Korean battery maker LG Energy Solutions (LGES). “LGES designs and manufactures the batteries while GM focuses on the integration of batteries into its vehicles and systems,” Bain concludes.

Insider Focus LTD (Company #14789403)