Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

The US brand is celebrating orders for its e-SUV but the playing field is only going to get more competitive

Jeep, a US marque within the Franco-Italian Stellantis conglomerate, has received more than 40,000 European orders for its new Avenger B-segment e-SUV since its launch at last October’s Paris Motor Show. But the firm is only going to face hotter competition in a European small BEV market that is set for a series of launches over the next few years.

Over 40pc of all confirmed customer orders for the Avenger are for BEVs, rather than its hybrid variant, which Jeep says is “a testament to customers’ growing interest in the all-electric version”.

“The Jeep Avenger has been designed to perfectly fit the needs of European customers and this is proven by the impressive results that the Avenger is achieving all over Europe,” says Eric Laforge, head of the Jeep brand in Europe.

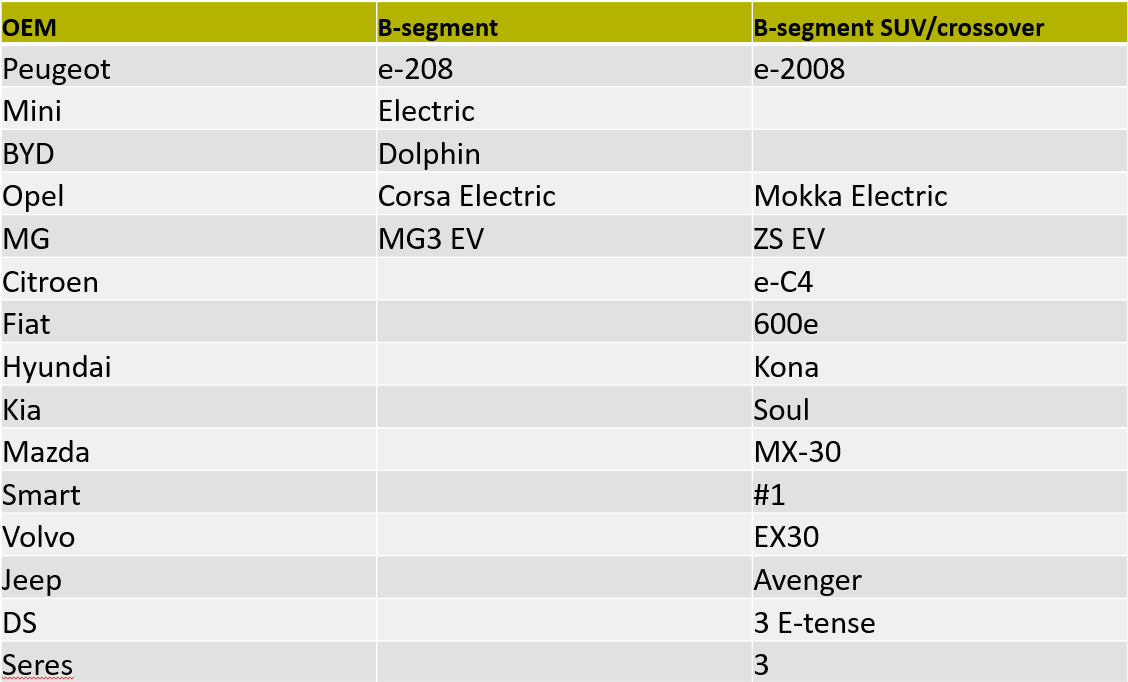

But the Avenger is trying to establish a niche in an already fairly crowded market. OEMs including its Stellantis stablemates Opel, Citroen, Fiat and DS already have offerings in Europe’s B-segment BEV SUV/crossover space. And there are also options from Japan’s Hyundai and its South Korean subsidiary Kia, fellow Japanese OEM Mazda and four Chinese-backed competitors: Sino-Swedish Volvo, Sino-German Smart and China’s MG and Seres (see Fig.1).

Not are things likely to get any easier. Japan’s Honda will begin sales of its e:Ny:1 e-SUV in October. And the next three years will see at least one more rival arriving each year.

Yet another Stellantis subsidiary, Italy’s Alfa Romeo, plans to debut its entry-level e-SUV in 2024, while Germany’s VW is also eyeing a launch in the space in 2025. And the following year is the target for the 4ever from France’s Renault.

Hotting up in hatchs

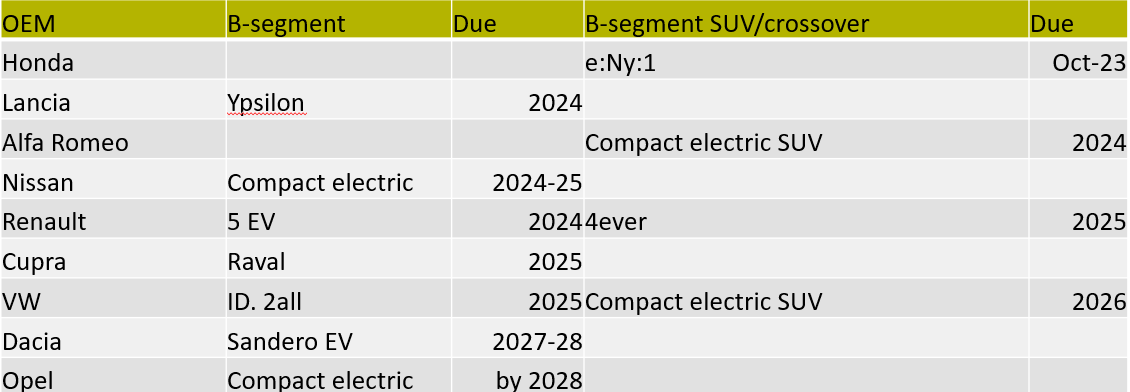

Europe’s B-segment BEV hatchback is currently a less crowded space than its SUV equivalent. But it is shaping up to be even more hectic in terms of new arrivals to join current incumbents such as Opel and its Stellantis sibling Peugeot, Germany’s Mini, MG and fellow Chinese OEM BYD (see Fig.2).

Next year should see the Ypsilon from Stellantis’ Lancia and the new electric Renault 5 join the ranks. Germany’s Volkswagen showed off the ID. 2all concept in March, which will evolve into its entry-level car slated for a 2025 launch. And that year should also see Volkswagen’s Cupra deliver the Raval.

Japan’s Nissan this week showed off its 20-23 concept car in London, which foreshadows an all-new compact EV which will succeed the Nissan Micra as the entry-level vehicle in the Nissan line-up in 2024 or 2025. The Japanese OEM has committed that all models from now will be BEV in Europe — notwithstanding lifecycle upgrades to current models — as part of a goal to sell 100pc BEV on the continent by 2030.

“[B]EV is the ultimate mobility solution. There is no turning back now,” says Nissan CEO Makoto Uchida. “Nissan will continue to champion [B]EV as the best way to provide cleaner, simpler and more affordable mobility,” adds Guillaume Cartier, Nissan chair for Africa, Middle East, India, Europe and Oceania.

BEVs represent 16pc of Nissan’s current total sales in Europe. EVs of all hues makes up 50pc of its European sales mix and it predicts this will rise to 98pc over the next three years.

It will introduce 19 BEV models globally by 2030 and is also aiming to launch all-solid-state batteries (ASSB) by 2028. ASSB promises to reduce charging times to one-third of current levels and to bring down battery costs to $75/kWh by 2028 and later to $65/kWh to achieve ICE parity.

Later in the decade, Renault’s Dacia subsidiary is planning a BEV version of its Sandero hatchback targeted for 2027 or 2028. And the Munich IAA Mobility event earlier in the month saw Opel showing off its Experimental concept, which is a step towards a new entry-level BEV to replace the Corsa by 2028 at the latest.

Insider Focus LTD (Company #14789403)