Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

The energy forecaster predicts continuing all-electric dominance

The good news for those backing hydrogen FCEVs to play a material role in the future of road transport is that Paris-based energy forecaster the IEA sees, in its central case, FCEV sales rising from 16,300 vehicles in 2023 to 608,000 in 2035.

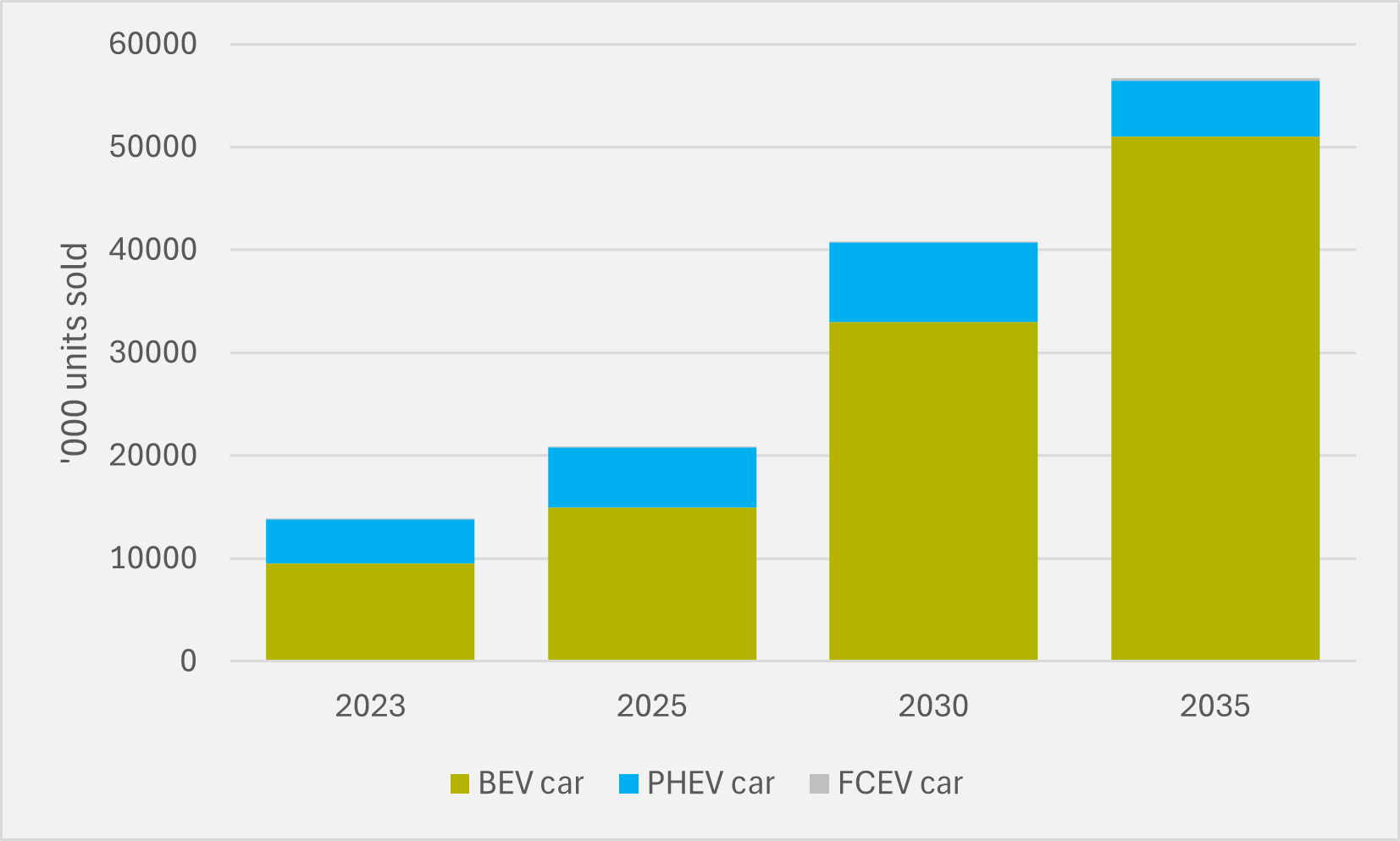

But that is pretty much the end of any good news. In the same period, the IEA sees BEV vehicle sales rising from 2023’s 10mn to 68mn by the middle of the next decade. For PHEVs, the increase is forecast to be from 4.3mn to 5.8mn. So overall FCEV sales in 2035 will, by the IEA’s reckoning, barely register on the chart (see main image).

A significant chunk of the discrepancy between forecast all-electric and hydrogen sales is, admittedly, in passenger cars (see Fig.1), a segment where all OEMs except those based in Japan (and possibly BMW) have already accepted there is no future for FCEVs.

Slow learners continue to harbour dreams about hydrogen-based e-fuels as they call for ‘technology-neutral’ roadmaps to zero emissions vehicles. But the chances of CO2-free hydrogen being able to be produced in any of the world’s largest car markets at economics that would make e-fuels cost-competitive with BEVs for the mass market is hugely far-fetched.

Not even for HDVs

Those advocating for hydrogen playing a role have tended to concentrate on medium- and, particularly, heavy-duty vehicles. But the IEA offers few crumbs of comfort in these segments either.

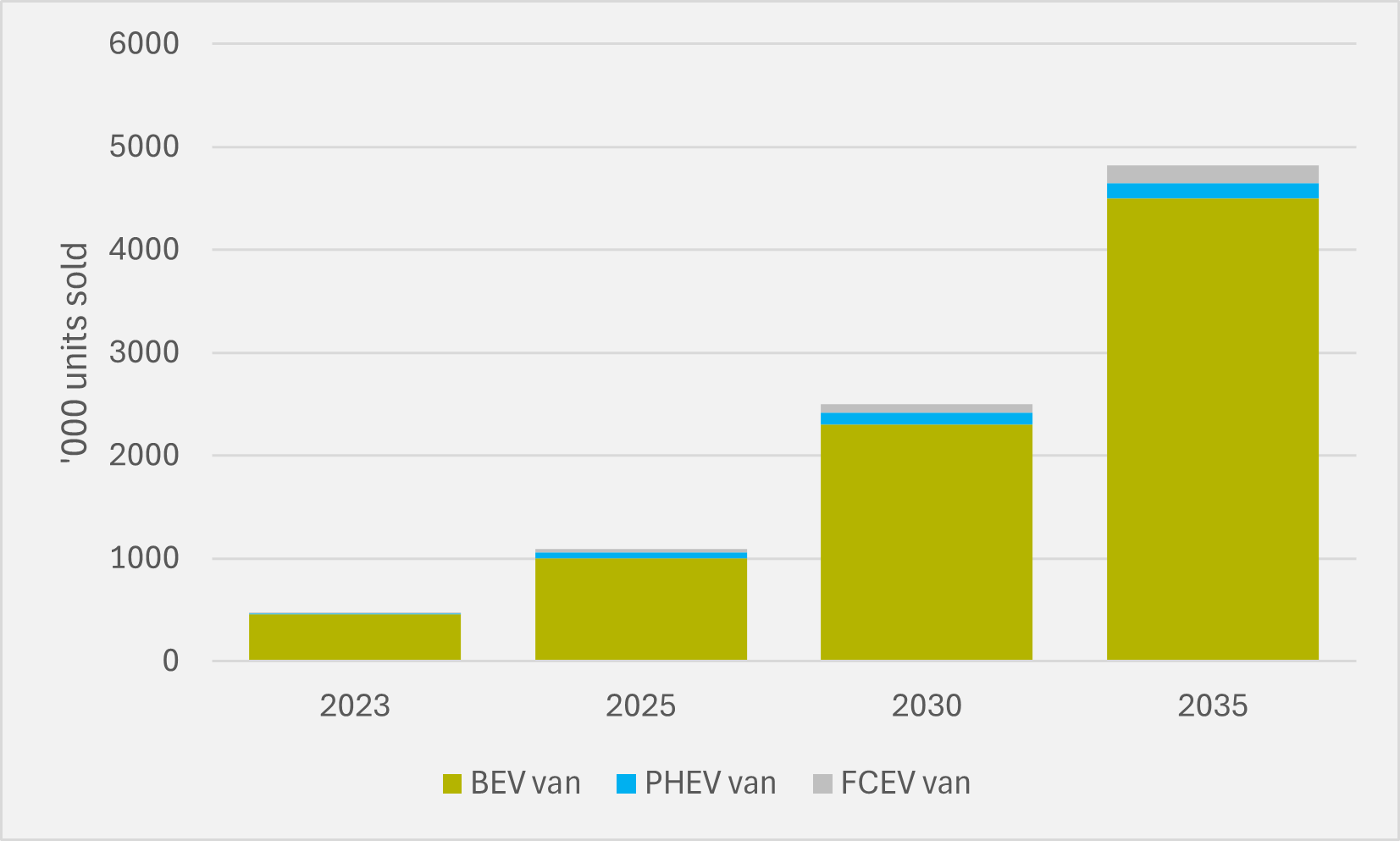

In its STEPs scenario, which models progress based on existing legislation, it forecasts that BEVs will dominate the electrified van space with 4.5mn units sold in 2035. In contrast, FCEV vans are predicted to shift just 170,000, albeit slightly more than PHEVs, which will also be a marginal van technology by then (see Fig.2).

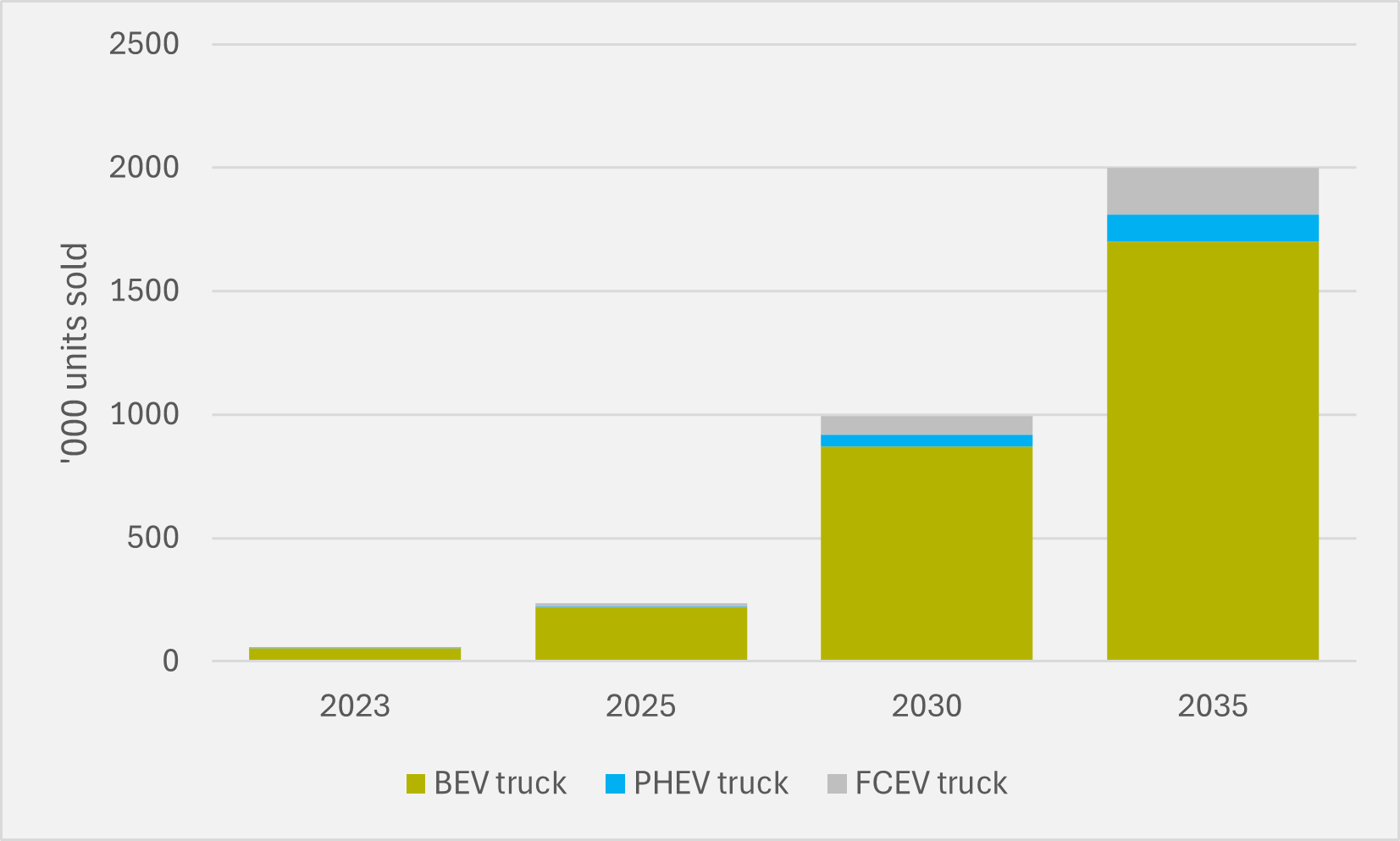

And it is a similar story for trucks. The IEA foresees all-electric truck sales of 1.7mn in 2035. FCEV trucks will shift just 190,00 units, it predicts, although again slightly larger volumes than PHEV (see Fig.3).

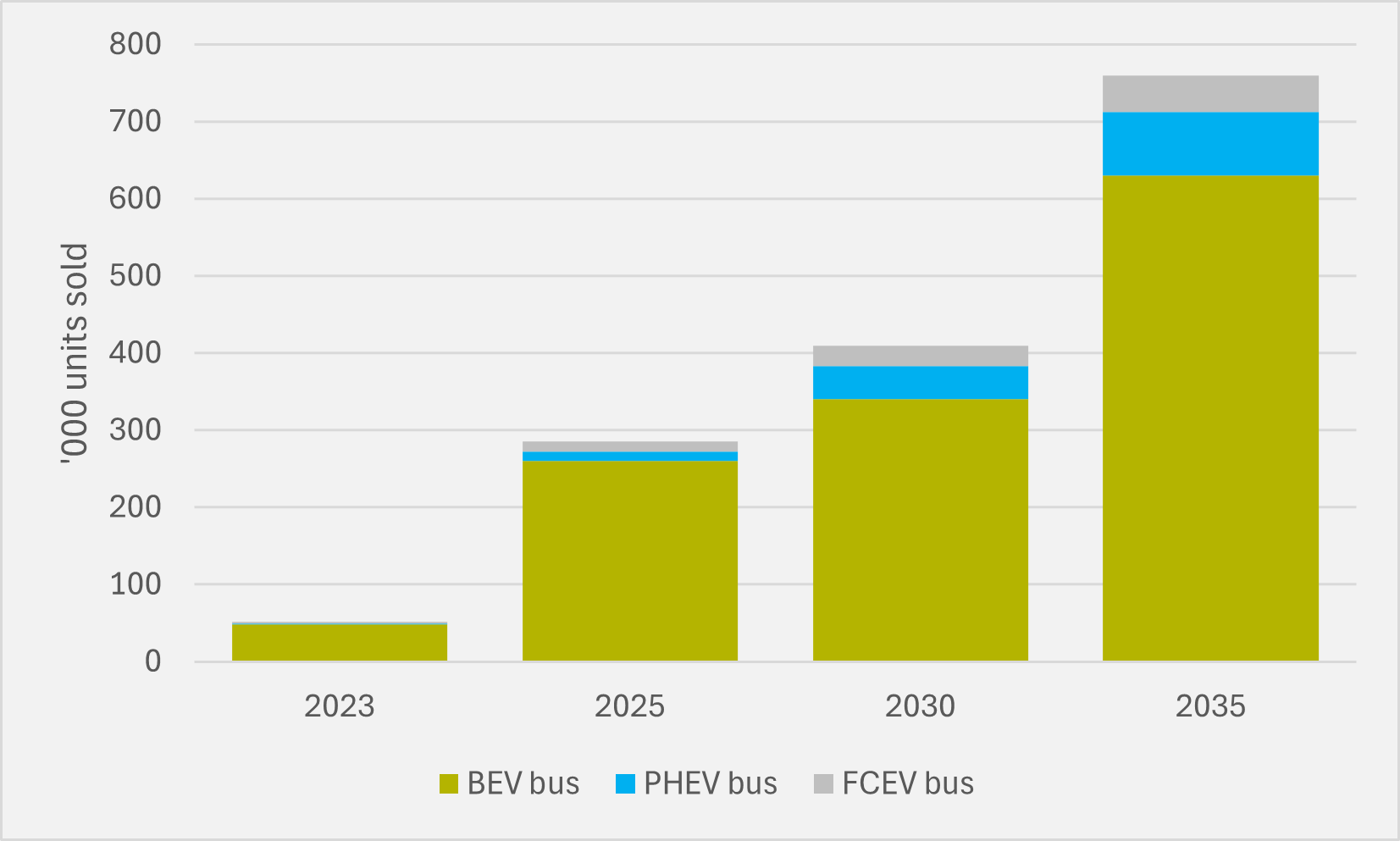

For buses, again battery electric is expected to be the big winner, with the IEA modelling 630,00 BEV sales in 2035. The FCEV option trials in a sorry third with just 48,00 buses sold (see Fig.4).

The question is whether OEMs, be they makers of passenger cars or commercial vehicles, continuing to pursue FCEVs with enthusiasm will look at these projections and take them on board, or conclude that they know better than the IEA’s forecasters. Even if they continue to think the latter, they may swiftly find their shareholders deem it not worth the risk of continuing to bet against such overwhelming technology winner conclusions.

Insider Focus LTD (Company #14789403)