Musk offers bittersweet glimpse into what might have been

Tesla could still be a contender. But only if its CEO faces a few home truths and reprioritises

EViF peels back the curtain on ADAS and AD, and why Elon Musk thinks it is the future of Tesla

Autonomous driving (AD) is the future: get in your car, say your destination; let the car do the work. Arrive fresh and focused 30 minutes later. Think about what you can do with the time — work, relax, doom-scroll social media... The choice is yours.

But who can confidently state they know the difference between Level 2+ advanced driver assistance systems (ADAS) and Level 5 AD? This article is here to tell you what you need to know about AD. Why does it matter? What do the levels mean? When can I have a sleep at the wheel?

If you just want the quick bullets, there is the EV inFocus super-short summary:

But that is just the basics. We urge you to read on to fully understand the levels, and why AD is so critical to the future automotive value chain...

Given the vast potential and tech intrigue, it is no wonder that Elon Musk at Tesla has emphasised the central role that ADAS and AD will play in the long-term value propositions of his company and other EV makers.

Musk made waves by pronouncing at Tesla’s Q2 results in 2023 that Tesla’s so-called Full Self Driving (FSD) feature would lead to a five- or tenfold valuation increase in Tesla vehicles and Tesla as a company.

“I think the Tesla fleet value increase at the point which we can upload full self-driving and is approved by regulators will be the single biggest step change in asset value, maybe in history,” Musk said.

Tesla’s FSD “will be better than human by the end of [2023]", he boldly predicted That came with a caveat, however — Musk conceded, “I have been wrong in the past; I may be wrong this time.”

Musk pushes the safety statistics of AD as a key to why he thinks it will grow exponentially. GM's AD subsidiary Cruise also hangs its hat on its safety statistics, saying that its vehicles were involved in 65pc fewer collisions overall, as well as in 94pc fewer collisions as the primary contributor, and 74pc fewer collisions with meaningful risk of injury.

And many analysts also agree that AD is the key to unlocking material growth and valuation increases for automakers in the age of the software-defined vehicle. German engineering heavyweight Siemens, for example, in a recent whitepaper said that “the growth of the autonomous vehicle market is forecast to be worth $7trn of new economic activity by 2050”. Consultancy McKinsey also forecasted in January 2023 that AD and ADAS could generate $300-400bn in revenue by 2035.

But AD projects have also been beset by problems over recent years. Cruise suspended all operations in the wake of a scandal over a corporate lack of transparency after one of its driverless ‘robotaxis’ striking a pedestrian knocked into its path by another collision, misinterpreting the point of impact and thus inadvertently dragging the injured pedestrian 20 feet along the road.

Tesla has controversially named its Level 2+ ADAS feature “Autopilot” despite the software requiring full driver attention at all times. After several lawsuits surrounding crashes of Tesla cars which had the supposed autopilot engaged, Tesla was recently forced to recall 2mn vehicles and justify its use of the name, which critics have called dangerously misleading.

And stepping back... haven't we been talking about AD for nearly a decade now? Uber's venture capital proposition was partially built on removing the driver and retaining the revenue. Google has been developing driverless cars since 2009. And shouldn't we be getting USB cables and other essentials delivered by Amazon drones already?

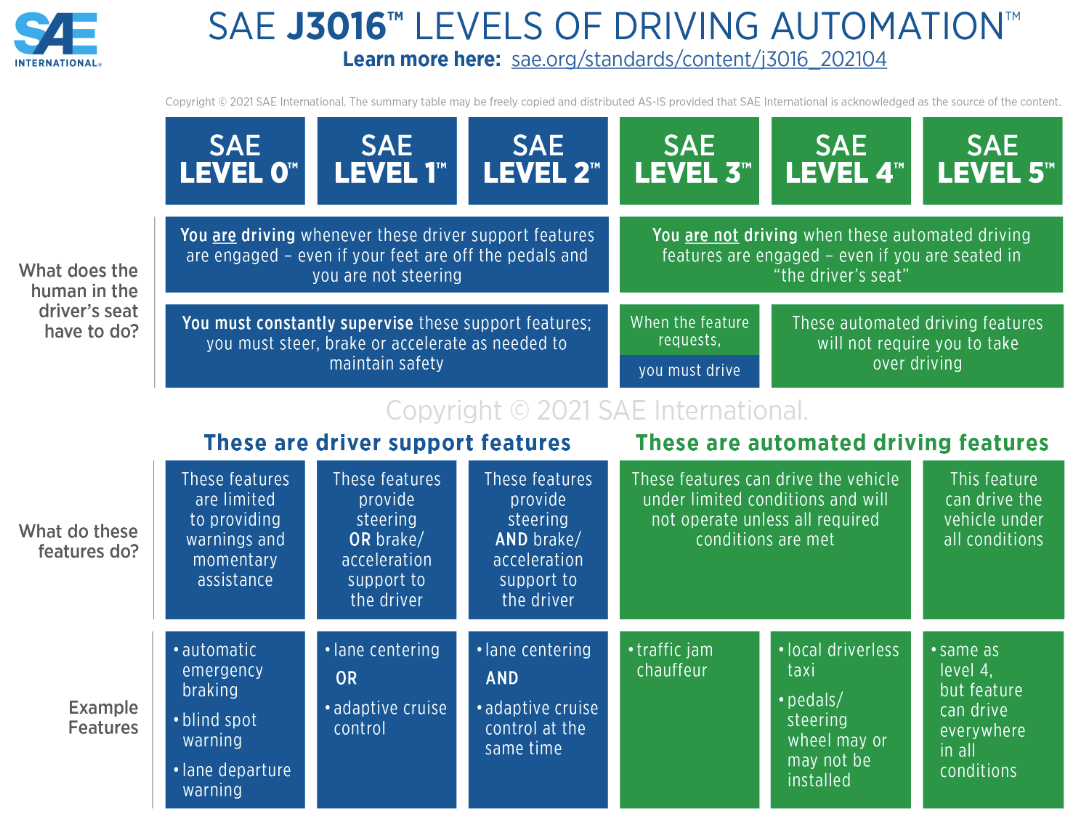

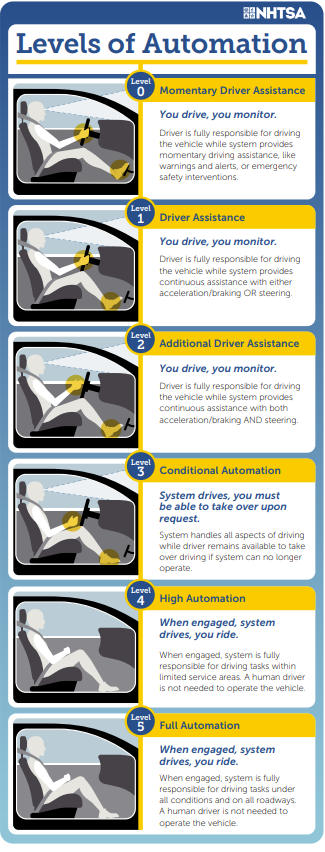

Well, it turns out that AD is pretty challenging, firstly at a technological level, and secondly (but not for this article) at a regulatory level. The language has therefore developed, and we now have five levels of autonomous driving as defined by international standards body SAE.

The levels range from minimal cruise control features all the way up to fully driverless vehicles. So what exactly is Musk talking about when he says that automation is the future of the industry?

What do terms like 'autopilot', 'FSD', and 'robotaxi' mean? Which are OEMs are leading the charge towards autonomy? And what are the five levels of autonomous driving?

Level 1 (driver assistance)

These features provide steering OR brake and acceleration support to the driver. Examples include either lane centring (in the case of steering support) or adaptive cruise control (in the case of acceleration and braking support). At this level of ADAS, the person in the driver's seat considered by SAE to be driving the vehicle even when the features are engaged, and must supervise these features.

Level 2 (partial automation)

This is similar to Level 1, but combines both steering and braking/acceleration support, where Level 1 only provides either of the two. Examples of Level 2 autonomy is an EV which can support the driver with both lane centring and adaptive cruise control of the vehicle's speed.

An example of Level 2 automation from a major OEM is Ford's Blue Cruise, which is advertised as letting drivers enjoy hands-free driving. This, however comes with a laundry list of caveats:

— Only remove hands from the steering wheel when in a hands-free blue zone

— Always watch the road and be prepared to resume control of the vehicle

— Does not replace safe driving

Ford's Detroit rival GM, fresh off the Cruise debacle, is also reported to be considering cancelling its Level 2 Ultra Cruise feature.

And caveats in the small print have regulators concerned. Tesla's Autopilot is classified as L2 by SAE, and has recently been the subject of lawsuits over crashes, and even deaths of Tesla drivers who crashed while the feature was engaged.

Tesla insists that in Autopilot mode its its customers are made fully aware that they remain in control of the vehicle. But in the recent recall of 2mn Teslas, the National Highway Traffic Safety Administration ruled that the feature is too easy to misuse and at times unclear if it is engaged or not.

You will also see the term Level 2+, which is not defined separately by SAE, but has made its way into common industry parlance nonetheless.

To some extent, Level 2+ is Level 3 without jumping through the hoops — i.e. through combining various Level 2 tools, it allows drivers to briefly take their hands off the wheel and feet off the pedals in certain situations. But OEMs do not have to meet all the criteria of Level 3-certified AD to market their systems as Level 2+.

Level 3 (conditional automation)

Level 3 is the first level at which SAE considers the person in the driver's seat not to be driving the vehicle. However, Level 3 refers to functionalities which fully autonomously drive the EV but only in specific circumstances, and require that the human driver be ready to take over at any point at a moment's notice. As such, although the driver is not propelling or steering the vehicle, they must be paying attention and ready to step in at all times.

An example of Level 3 autonomy is so-called traffic jam chauffeuring, a feature defined by AV tech company L3 Pilot as when "on motorways and similar roads the car takes over the driving in traffic... up to 60km/h". When the detection of slow driving vehicles in front indicates a traffic jam, the function can be activated — enabling, for example, the car to change lane to react to a slower vehicle ahead.

Level 4 (high automation)

Level 4 and above is the point at which a person will never be required to take over driving the vehicle in any circumstance. In theory, vehicles may be built without any human controls like pedals or a steering wheel, such as the Cruise Origin, which has been announced as the vehicle for an upcoming robotaxi collaboration in Japan between legacy OEMs GM and Honda.

Robotaxi services like GM's Bolt subsidiary and Google's Waymo business are examples of driverless ride hail services. This is the level that Tesla's Elon Musk means in his prediction of Tesla EVs becoming five or ten times more valuable, and which the CEO presumably sees as a key driver in his lofty "most valuable company in the world" goals for Tesla's market cap in the next decade.

It is worth noting that, currently, Tesla is a long way behind AD market leaders like Cruise, Waymo and China's Baidu. The firm does, though, have one potentially huge trump card in its ambitions to catch up — no company can compete with the sheer volume of video footage of vehicles actually being driven that Tesla collects.

And Musk, unsurprisingly, remains bullish on his firm's progress. "For full self-driving, we have released Version 12, which is a complete architectural rewrite compared to prior versions," he said at presentation of Tesla's Q4'23 results.

"This is end-to-end artificial intelligence — basically photons in and controls out — and it really is quite a profound difference. This is the first time AI is being used, not just for object perception, but for path planning and vehicle controls. We replaced 330,000 lines of C++ code with neural nets. It is really quite remarkable."

But, after the revocation of Cruise's license by the California DMV and subsequent withdrawal from all of its US markets, the near-term prospects of L4 robotaxis may have been set back somewhat, at least in Western countries.

Even in China, there are some analyst fears of a negative Cruise impact. But firms that can prove their AD projects meet safety legislation are still highly likely to press on

In the US, for example, Google's Waymo has recently announced that its robotaxis will become the first to operate on freeways, after several years of offering ridehail services in US cities like San Francisco and Phoenix.

Level 5 (full automation)

Level 5 automation can drive a vehicle fully in all conditions and locations. As with Level 4, the person will never be required to take charge of the vehicle and the vehicle may have no manual controls.

The major difference between Level 4, which is being trialled, and Level 5, which largely exists only in theory, is geographical limit on application. Level 4 AD would operate only in certain pre-defined areas (which is why it is ideal for localised robotaxi ridehailing services, for example).

But Level 5 promises a future where you could jump in an AV and it could take you anywhere you wanted to go, even a cross-country road trip, without any input from you beyond specifying your destination.

Differing views

To add even greater complexity to the debate, the SAE definitions are not the only show in town. For example, the US' Department of Transport's National Highway Traffic Safety Administration (NHSTA) takes a similar level-based approach, but with what one AD expert describes as a "nuance of difference in their explanation".

But Israeli AD firm Mobileye, which develops ADAS and AD technology including cameras, computer chips, and software, argues that — while when introduced back in 2014, the SAE levels-based approach provided a good reference for the initial conceptualising of AD — "as we move forward with the productisation of autonomous and highly automated systems, it is evident that the current Level 1-5 taxonomy cannot form a basis for a product-oriented description that is clear for both the engineer and the end customer".

It is worried both about "vague and unclear definitions from an end-user perspective" and what it sees as an "unnecessary distinction between Level 3 and Level 4". It proposes simplified language that defines the levels of autonomy based on four differentiations:

i) Eyes-on/eyes-off

ii) Hands-on/hands-off

iii) Driver versus no-driver

iv) Minimum risk manoeuvre (MRM) requirement.

This would, in Mobileye's opinion, create four product categories covering the entire spectrum of automated driving.

Many insurers simplify the issue even more — does the driver have control, or does the vehicle? At least one AD expert EV inFocus has spoken to sees it distilling further: perhaps, he sugests, we will eventually simplify to one question: does it have a steering wheel or not?

What are the applications?

The most common vision for a future involving autonomous vehicles is the use case of robotaxis, driverless cars that can be hailed remotely by consumers just like any current taxi service. But some AD exports are less convinced that robotaxis are the big future show in town, identifying the logistics sector as the major win for AD going forward.

Interestingly, data suggests that technology is not the limiting factor to the proliferation of the robotaxi use case — and to some extent this will apply to last-mile logistics too — but rather it is consumer attitudes towards AVs.

Musk proffers a use case for AVs that he compares to Airbnb, in which owners of AVs can sometimes travel in their own EV, but at other times allow the EV to drive itself to collect other passengers, who pay the owner of the vehicle for their travel.

"If the vehicle is able to operate autonomously — either dedicated autonomous or partially autonomous — like Airbnb, maybe sometimes you allow your car to be used by others. Sometimes you want to use it exclusively; [or] just like doing Airbnb with a room in your house. The value is just tremendous," Musk says.

But the model may not work as Musk suggests, warns Stephan Kochen, founder of German car-sharing platform Leih dir mein Auto. Musk's scenario will favour "gig economy people who have several cars on rent" over those who want to mainly own their own car but monetise its downtime, he cautions.

"You need trust-building systems like ratings, algorithms, good service," Kochen acknowledges. But he fears that "professional renters will always end up on top of list because they are the ‘most trustworthy’”.

Furthermore, a study from the Transportation Research Interdisciplinary Perspectives Journal has identified four psychological barriers to collaborative car sharing: loss of autonomy, privacy invasion, interpersonal distrust, and data misuse. These concerns act as barriers to car-sharing platform, autonomous or otherwise, and Musk has not provided an explanation how he thinks consumer appetite for AD will overcome them.

Other road users are also resistant to real-world AD testing, which could prove a further stumbling block.

"Findings show that only 27pc of non-riders are comfortable sharing the road with robotaxis and just 20pc of all consumers nationally are comfortable with AV technology being tested on streets and highways near them," finds consultancy JD Power.

The AD industry recognises this potential aversion amongst the public for AV technology, and has in response set up the Partners for Automated Vehicle Education (Pave) campaign. Pave is a coalition of industry, nonprofits, and academics that aims to bring the conversation about AVs to the public "so everyone can play a role in shaping our future".

Despite the roadblocks, robotaxis remain a technological fascination. And, as with all nascent tech, it is sure to experience a boom from enthusiastic early adopters.

How long is takes to move from niche applications that are necessarily limited in scope to mass-market implementation is another story. But long-term optimism still remains.

“The dream of seeing fleets of driverless cars efficiently delivering people to their destinations has captured consumers’ imaginations and fuelled billions of dollars in investment in recent years. But even after some setbacks that have pushed out timelines for AV launches and delayed customer adoption, the mobility community still broadly agrees that AD has the potential to transform transportation, consumer behaviour, and society at large,” McKinsey says.

Distant future

Another future stage of development for robotaxi tech could focus on space efficiency. Current robotaxi projects use modified medium-sized cars, like Waymo's electric Jaguar I-Paces. Without the need for a driver, these cars often therefore run with three or four empty seats, and the ratio of 'road space: energy used: passengers carried' is inefficient. This could lead to smaller form factors becoming the norm for vehicles in the future, although this will have to overcome the increasing shift towards large-bodied cars like SUVs, which has defined the automotive market in recent years.

AVs could also change the face or our cities and fundamentally alter the way we design the built environment, with a study from the UK's Manchester University finding that a single shared autonomous car can replace up to 11 conventional cars and four taxis, meaning that some road and parking space capacity could become superfluous.

A level above

While many OEMs work away at ever-improved Level 2/Level 2+ automation, this is not the area that will stoke a great boost for the auto industry. Indeed, many consumers already have variations of low-level automation in their vehicles and may not be aware of it. If the automotive industry is to see a significant value boost from AD it will come from level 4.

The next step towards this will be if a robotaxi service like Waymo receives an extended license to operate in more cities and is able to reach scale and visibility amongst conventional ridehailing competition. GM and Honda's Japan robotaxi JV will also be an acid test for consumer appetite for AD, which consultancy JD's Power's inaugural Robotaxi Experience Study finds to be meagre.

The only factor positively affecting consumer attitudes to high level automation is direct user experience. Beyond early adopters, AD has not cracked the wider market. And only first-hand experience — which requires a proliferation of robotaxi service licenses across different cities — will likely soften consumer attitudes to high-level AD.

"Consumer confidence in AV technology is fragile and positive first-hand experiences tend to build consumer trust. Among riders, 47pc gained trust during a ride and 51pc maintained their already high level of trust in the technology during a ride. It is notable that only 2pc of riders lost trust in robotaxi capability during a ride experience," JD Power finds.

Insider Focus LTD (Company #14789403)