Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

Detroit Three automaker GM is sounding increasingly upbeat about its US BEV operations. This week it told analysts of an “improving financial outlook” for the business and trailed both a move to profitability on its all-electric portfolio and a huge sales quarter in Q4.

“Our attractive portfolio is taking EV market share from our competitors and pulling in many new customers. And we are making rapid progress toward EV profitability,” the firm says.

“Our EV economics will improve as volumes increase and we are nearing the crossover point to profitability for EV sales. What has been a headwind to earnings will soon become a tailwind,” it continues. GM cites “declining battery cell costs — thanks to the quality, efficiency, and scale of our joint venture cell plants — as well as the other efficiencies driven by our purpose-built EV platform” as drivers in this improved financial performance.

It has also “been aggressive on reducing fixed costs, which have come down by $2bn over the last two years, net of depreciation and amortisation”. And its EV bottom line should also benefit from having “already made many of the large investments required to grow our EV business”.

Give the customer what they want

GM claims, with some justification, to have “the most diverse EV portfolio in the industry, which is helping drive our growth”. The firm sells three e-trucks, the Chevrolet Silverado and Sierra and GMC Hummer, which also boasts an e-SUV version.

But it also has three other e-SUVs, the Cadillac Lyriq and Chevrolet Blazer and Equinox, as well as two Zevo e-vans. “No matter what you like to drive, there’s a GM EV for you,” the firm says.

It will add two more Cadillac e-SUVs, the Vistiq and Optiq, and the relaunched Chevrolet Bolt hatchback over the next 12 months.

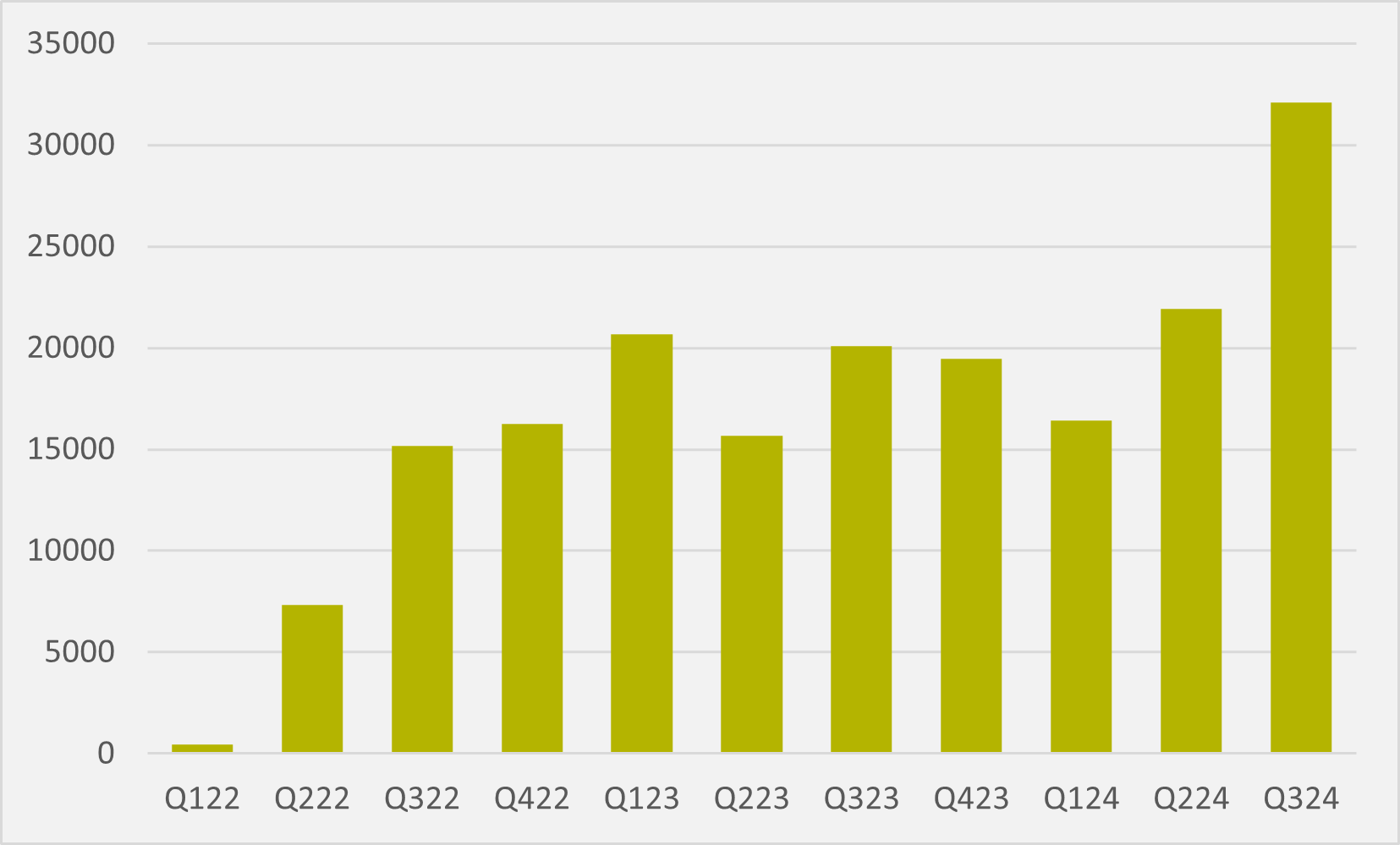

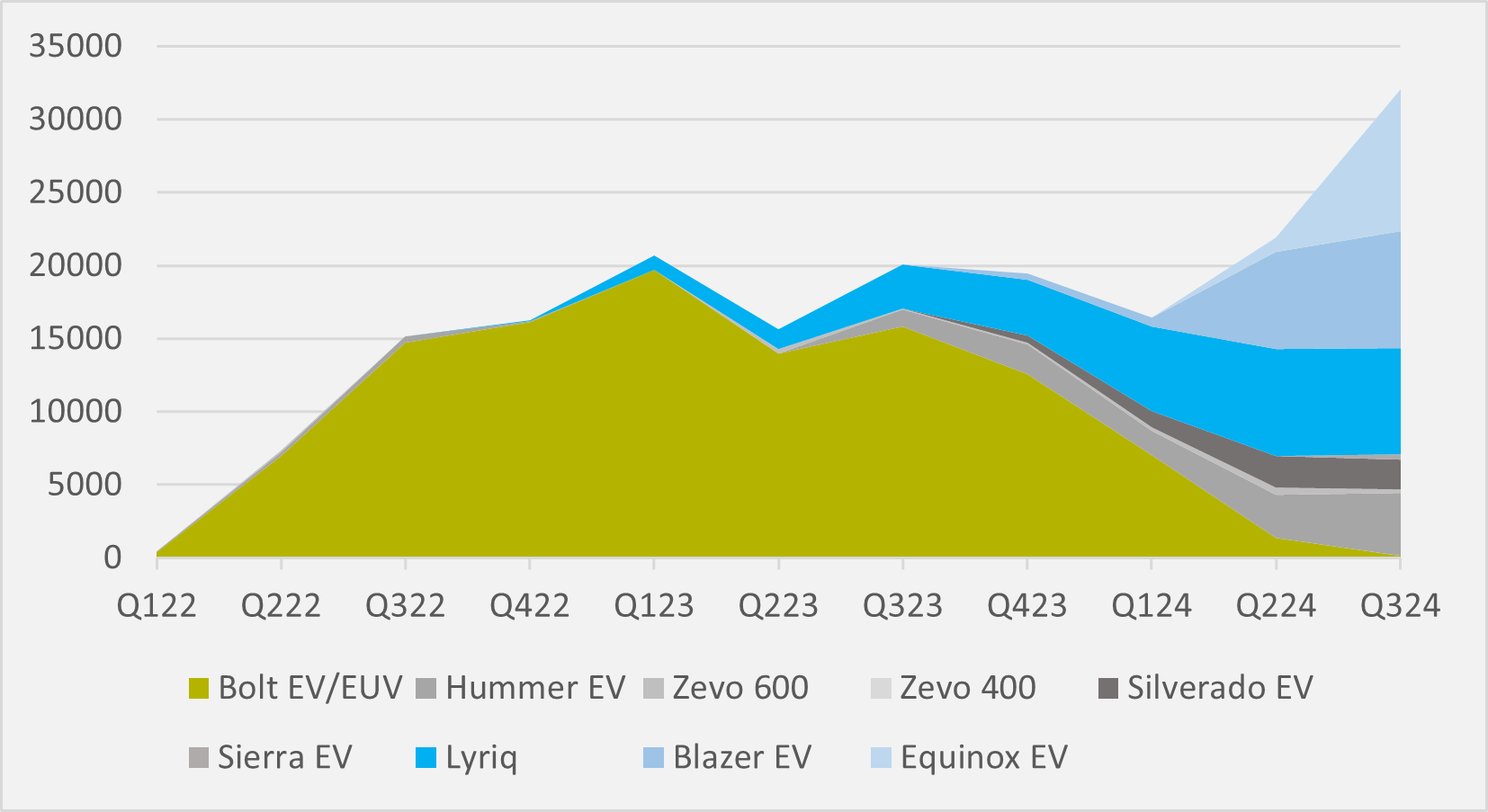

A strong US Q3 sales has GM congratulating itself as the number two seller of BEVs in North America in the quarter. The firm sold a new quarterly record high of just over 32,000 all-electric vehicles in Q3 (see Fig.1), up by 60pc year-on-year and well ahead of the c.23,500 sold by traditional rival Ford in the US over the same period.

And that has also nudged it ahead of its Detroit neighbour in year-to-date sales. GM has now sold over 70,000 BEVs in the US over the first three quarters of the year, while Ford can only boast just shy of 68,000 units.

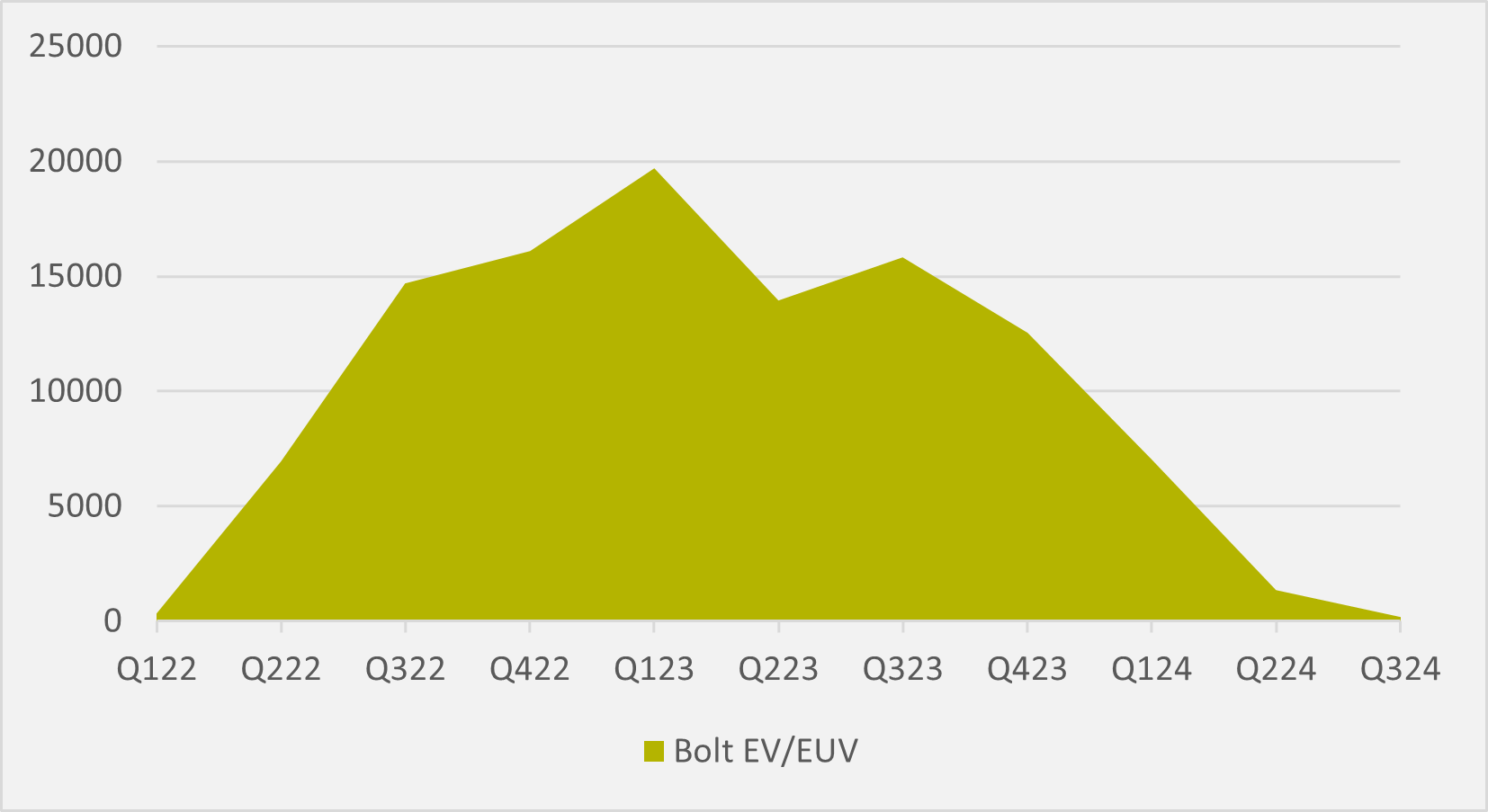

GM’s US all-electric progress is even more impressive when broken down by model. It is worth noting that, as recently as Q3 of last year, the now discontinued Bolt made up around three-quarters of GM’s total US BEV sales, shifting c. 15,000 or its c.20,000 overall sales (see Fig.2).

Those sales have now declined to all but zero. Q3 this year saw just 168 Bolts delivered to US customers.

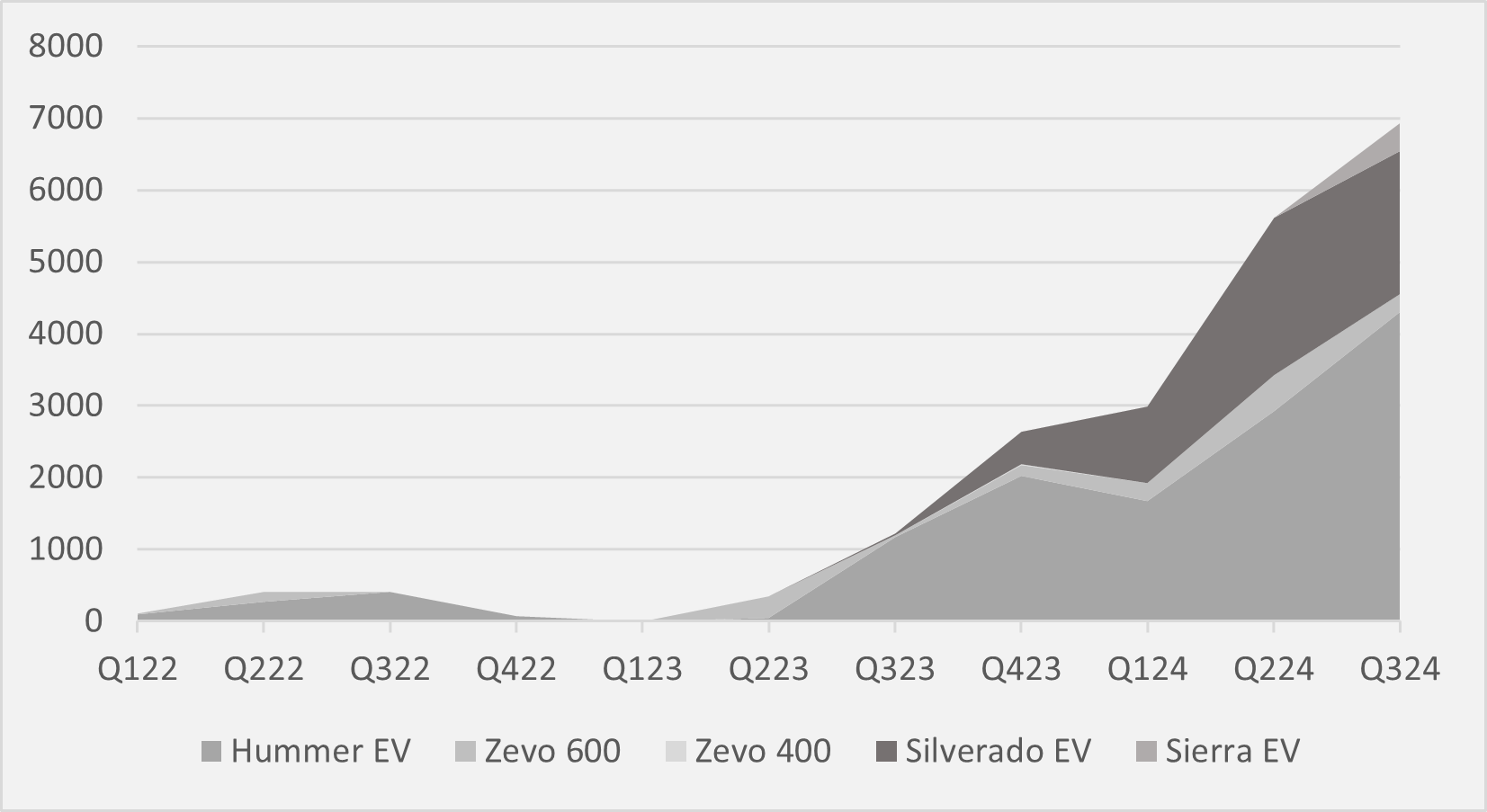

And GM’s electric truck and van sales have continued to prove limited, reinforcing the impression that these segments of the US market are proving relatively reluctant to embrace full electrification. Hummer EVs sales (which include the e-SUV model) did enjoy a record quarter in Q3 (see Fig.3), but still remained around the 4,300 mark, lower than any other GMC model except the Sierra EV, which shifted less than 400 units in its debut quarter.

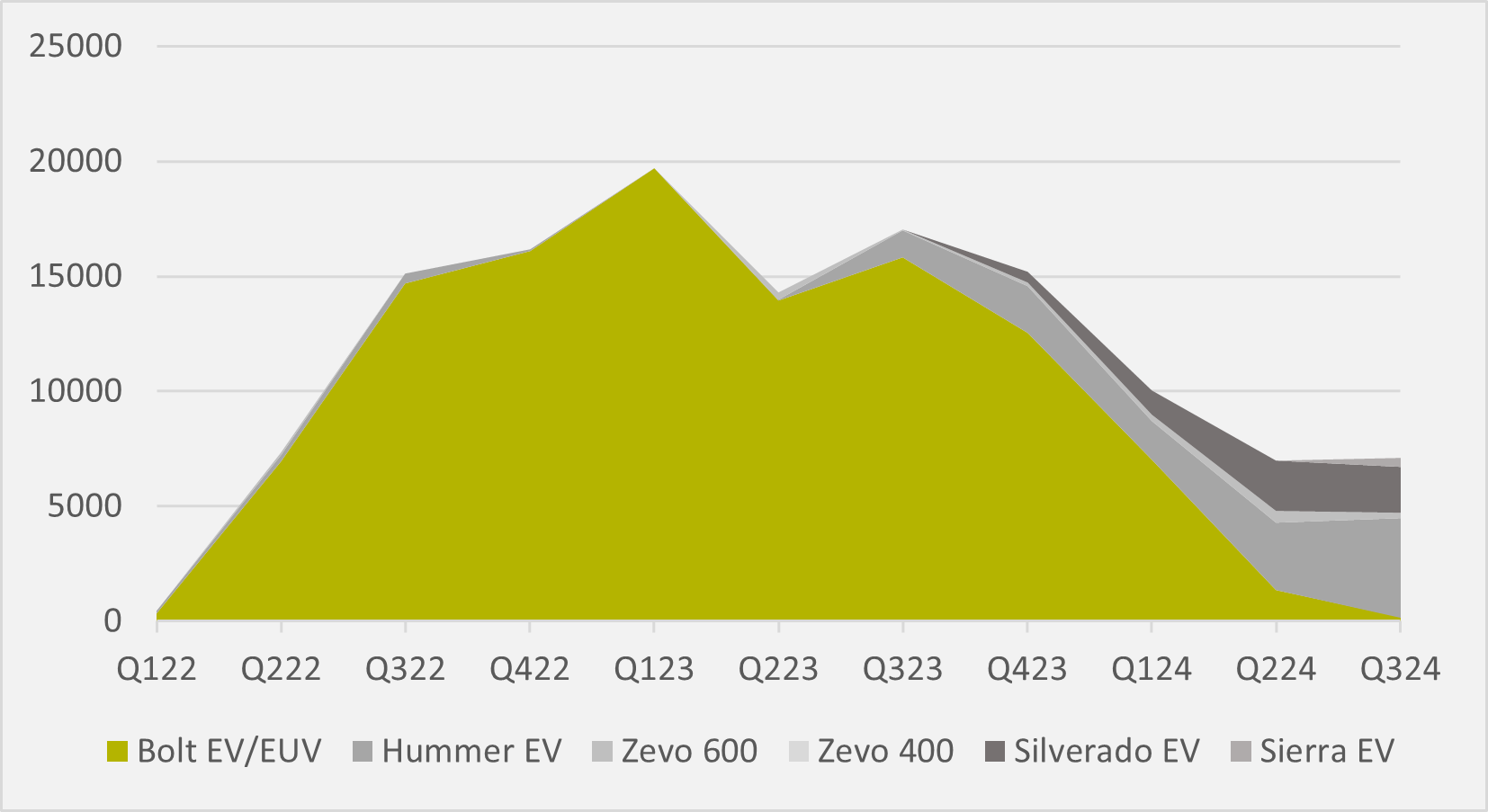

Deliveries of the Silverado e-truck stabilised at just under the 2,000 mark in Q3, while the Zevo 600 e-van remains a marginal product. These larger BEVs are certainly not enough to offset the loss of Bolt volumes (see Fig.4).

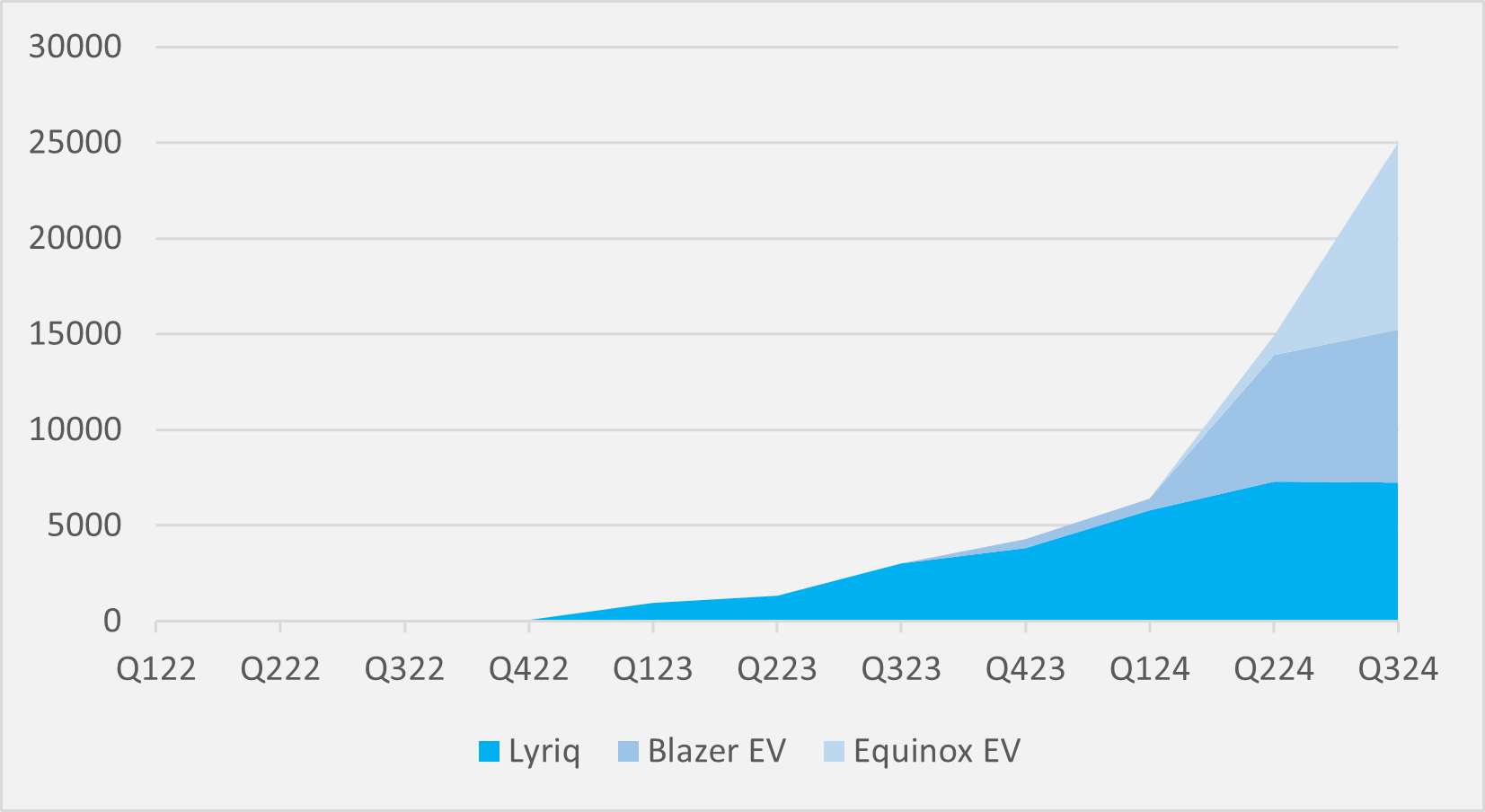

Instead, it has been left to GM’s new e-SUV portfolio to more than fill the gap left by the Bolt. Growth from the Lyriq stalled somewhat in Q3, but the vehicle has built over two years from a standing start to over 7,000 deliveries a quarter (see Fig.5).

Blazer deliveries continued to rise in Q3, almost reaching 8,000 units., But the star of the show was GM’s most affordable BEV, the Equinox, which became the firm’s best-selling BEV in its first full sales quarter, shifting 9,772 units.

It is the performance of these three models that has driven GM BEV delivery growth even as Bolt volumes have dried up (see Fig.6). And the firm is confident of more to come, as it forecasts it “remain[s] on track to build and wholesale about 200,000 GM-branded EVs this year”.

Production and wholesale is, of course, not analogous to customer deliveries. But the two must prove relatively in parallel to avoid significant inventory build-up.

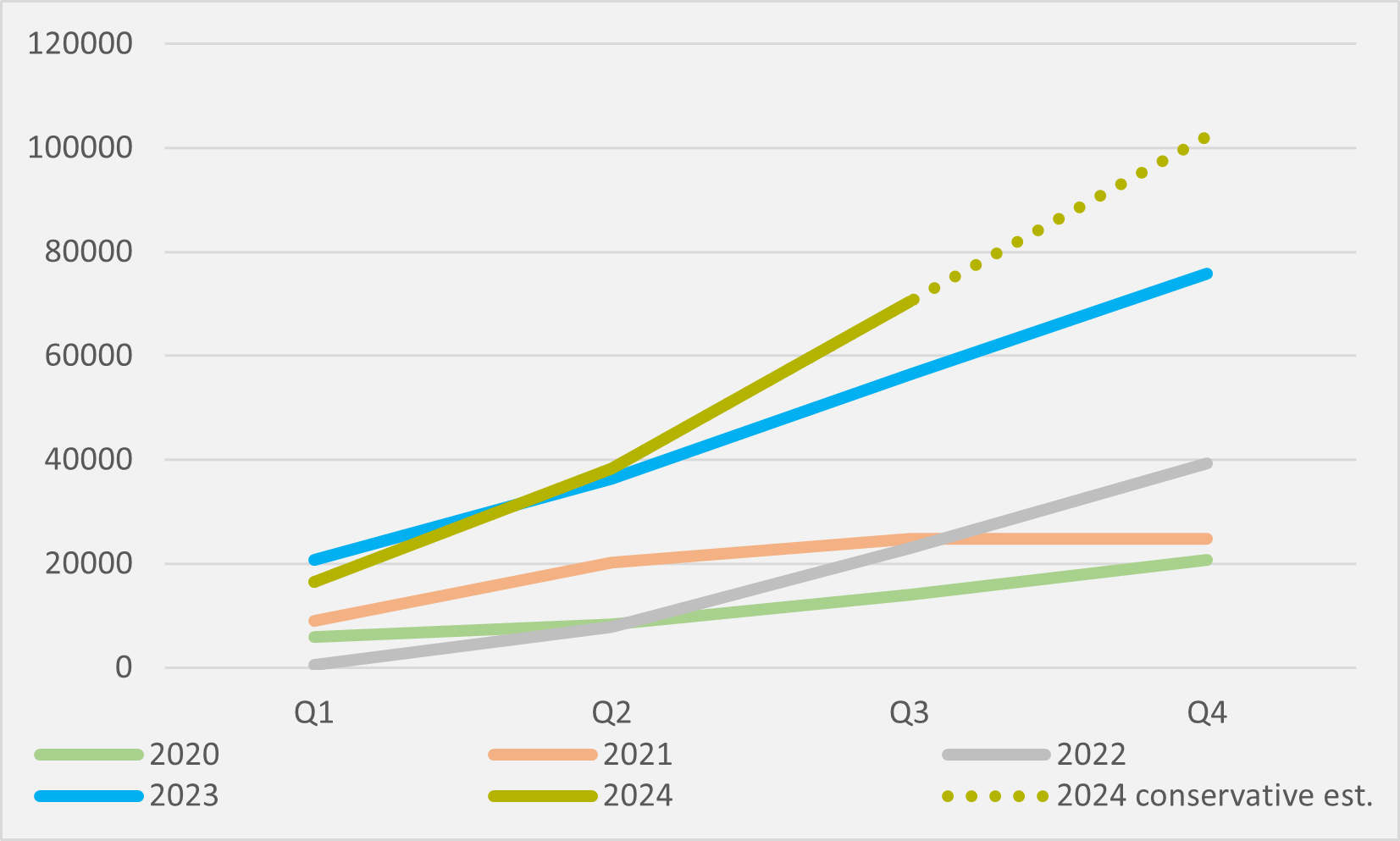

And GM’s cumulative deliveries this year suggest that the firm must be expecting another bumper quarter in Q4 to give it the opportunity to produced 2mn BEVs. While US sales in 2024 thus far are only just a fraction below the whole of 2023, they are still only just over 70,000 units (see Fig.7).

In the first half of the year, GM wholesaled c.75,000 BEVs, but US deliveries were only just over half of that. Even assuming for the same ratio for the year as whole, that would require GM to produce another 30,000+ quarter in Q3.

But the firm is expecting that to improve, or to revise its production plans if not. “We acknowledge that Ultium wholesales outpaced customer deliveries by about two-to-one for the first half of the year. This, however, is common when introducing a new vehicle given the need to build availability, options, and customer awareness,” CFO Paul Jacobson said at Q2 results time.

“As time goes on, if customer deliveries were to continue lagging wholesales, we will take proactive steps to balance production levels.” Given that GM is now sticking to its 2mn guidance, all the signs point to another big record for US BEV sales in Q4.

Insider Focus LTD (Company #14789403)