Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

One of the country’s leading OEMs expects impact from September tightening of the rules

Europe’s largest national BEV market will face a test next month as the German government excludes further buyers from a price subsidy scheme. And one of the country’s largest carmakers, Bavarian heavyweight BMW, is expecting some impact.

From 1 September, subsidies — where the government would rebate €4,500 (c.$4,850) off EVs with a list price up to €40,000 euros, and a further 50pc manufacturers discount on top; and €3,000, plus 50pc manufacturers’ discount, of EVs with a list price between €40,000 and €65,000 euros — will be limited only to private buyers, rather than those buying through employer schemes.

This could be a material change in the German BEV market. According to analysis by European automotive industry analyst Matthias Schmidt, German’s July BEV sales were around 80pc to non-private sales. He forecasts the loss of subsidy to a segment of the market representing such a large majority of buyers will contribute to a “few months of negative growth” in German BEV sales.

“September will be an interesting market to monitor for sure,” says the analyst.

And Schmidt is not alone in expecting an impact. “The reduction of the environmental bonus will, of course, have an effect on our business, which we cannot yet assess in full,” BMW tells EV in Focus. Peers Mercedes and VW were also approached for comment, but both declined to speculate on potential future impact.

BMW also had some advice for the German government in the post-subsidy environment. “Adequate expansion of the private and public charging infrastructure is necessary for the continued market success of electromobility. Because customers will only buy electric vehicles if they can charge reliably,” it says.

“Against this background, it would make sense to gradually redirect the funds to charging infrastructure from the middle of the decade, since the demand for electric cars must be able to develop even if subsidies decrease.” With Germany’s transport ministry now working on a new charging masterplan, it appears its pleas may have found receptive ears.

When Germany’s federal ministry of economics and climate protection (BMWK) announced the September changes to eligibility back in July 2022, it said that it would consider leaving small businesses and non-profit organisations eligible as well as just private buyers. But it has confirmed to EV inFocus that no such extension of eligibility will be offered.

“There are currently no plans to extend the authorisation to apply to small businesses and non-profit organisations,” says the BMWK.

“In a mass procedure such as the environmental bonus, with tens of thousands of applications per month, the provision of evidence and the effective control over small business statuses would exceed the capacities of the Federal Office of Economics and Export Control administration, and the tax authorities of the federal states, and generate a disproportionate administrative burden. In addition, an abusive claim by companies that are only founded for the purpose of filing an application could not be ruled out with legal certainty,” it continues.

Impact

While both Schmidt and Mercedes expect a negative impact, at least temporarily, the key question will be how much buying appetite might decline, and for how long.

Germany’s PHEV market does not bode particularly well. From 1 January this year, PHEVs were no longer eligible for their environmental bonus.

And the impact has been marked. In the first six months of 2022, according to data from the European Automobile Manufacturers’ Association, or Acea, the market share of PHEVs in Germany’s new sales averaged 11.2pc, whereas in the same time frame in 2023, the average dropped to 5.7pc, almost halving PHEV’s slice of the German new sales pie.

But PHEVs are not BEVs, and there are reasons to be more optimistic in this sector. For one thing, German BEVs have already experienced reductions in subsidies at the start of the year — the €4,500 and €3,000 government discount disappearing for non-private buyers in September were €6,000 and €5,000, respectively, until the end of last year.

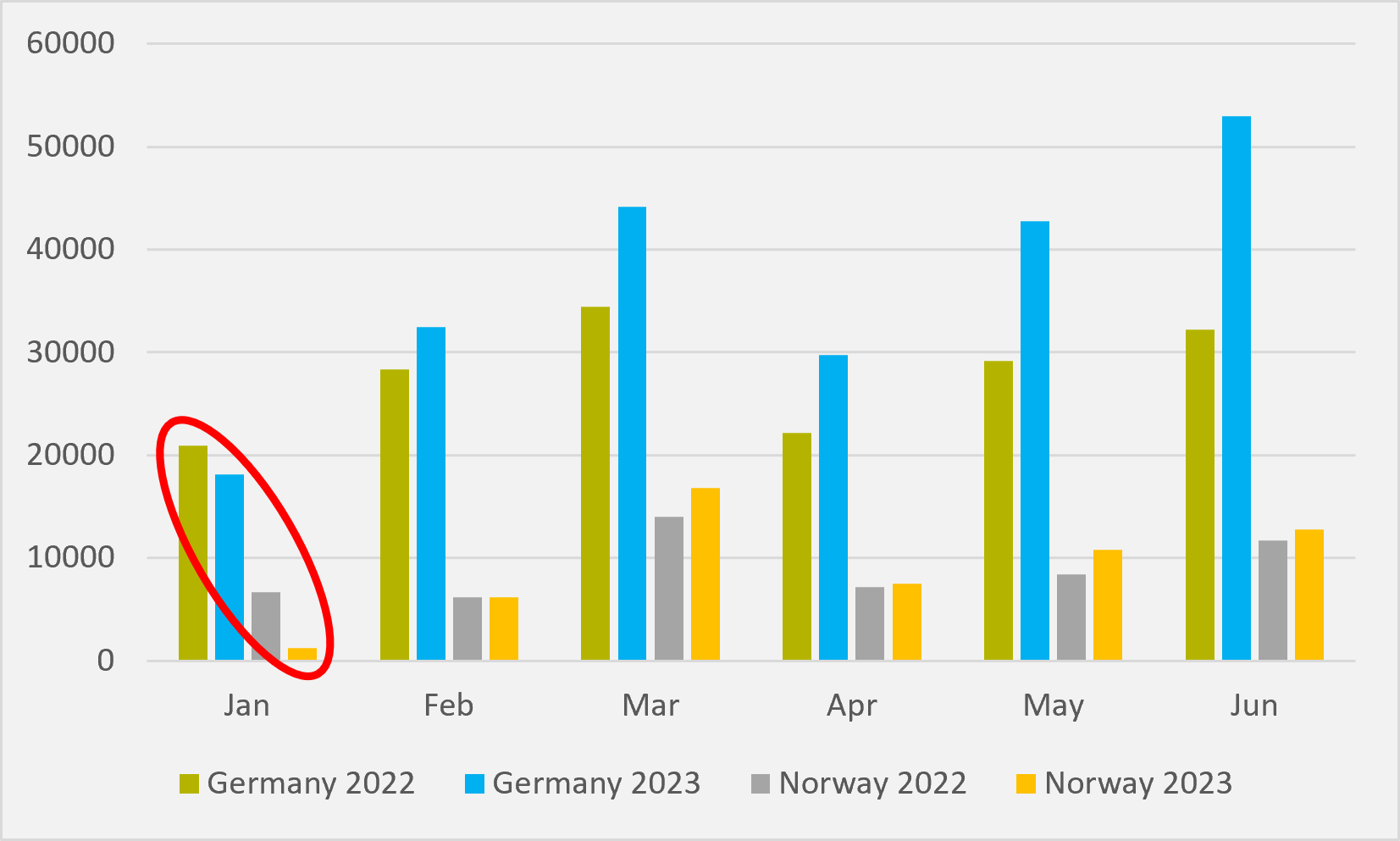

And this had an effect, but only a temporary one. Germany’s January 2003 BEV sales were down slightly year-on-year, at slightly over 18,000 compared to just shy of 21,000 in January 2022 (see Fig.1). But the deficit was more than wiped out in February and every month thus far for which Acea has released data has seen year-on-year increases in German BEV buying, topping out at over 20,000 more all-electric passenger vehicles in June when Germany become the first European national market to see monthly BEV sales above 50,000.

Norway saw a similar phenomenon, with its January BEV sales plunging after the withdrawal of generous subsidies. Again, though, it has bounced back as confidence as returned to the BEV market and sales are also once again ahead of last year.

And, while subsidies for non-private buyers of BEVs will be going, tax advantages still remain until at least 2030. These apply both to those buying cars and leasing them in company schemes. So it is much too early to predict a deep and prolonged slump in German BEV interest from the end of this month.

Insider Focus LTD (Company #14789403)