No Kathleen Valley stope this month – Liontown

The firm is aiming to shift to underground production next month, and maintains everything is on schedule

The long-time European all-electric national leader has lost its crown for now

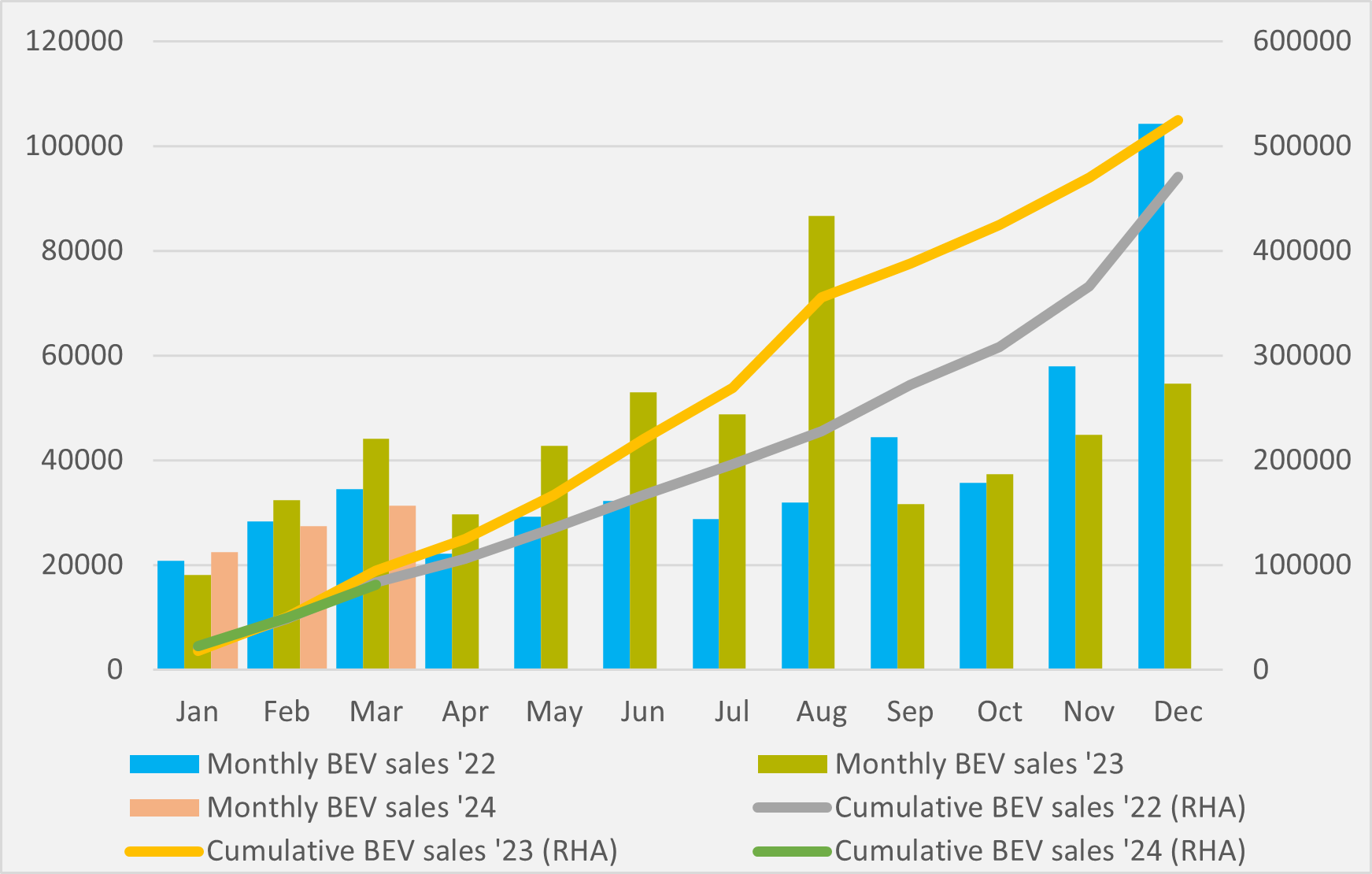

German new BEV sales totalled less than 31,500 in March, down by 29pc year-on-year. And that left all-electric sales in Q1’24 as a whole at less not just than Q1.23, but trailing Q1’22 as well.

Following on from the UK’s best-ever reported sales in the same month, it also saw the UK move head of Germany in terms of Q1 sales. Germany saw just shy of 81,350 new all-electric registrations for the quarter as a whole, down by 14pc year-on-year (see Fig.1).

In contrast, the UK shifted almost 11pc more units in Q1, meaning that a deficit to Germany of c.18,500 new BEVs in Q1’23 swung to surplus sales c.3,000 over the same three months. For 2023 as a whole, Germany sold about two-thirds more BEVs than the UK, Europe’s second largest national market.

And that 14pc deficit to last year for Germany in Q1 could ring alarm bells for the remainder of the year. In January, German automaker lobby group the VDA forecast that very same figure, 14pc, for year-on-year decline in German BEV sales for 2024 as a whole, in the light of a series of subsidy reductions last year.

But January and February data had not matched that extent of drop in appetite, with January actually seeing more sales than the same month last ear and 2024 thus far being broadly in line with 2023 and 2022 by the end of February. Based on conversations with analysts and the relative robust Jan-Feb performance, EV inFocus forecast last month that German BEV sales for the year as a whole would fall by 7pc.

If we are now on a trajectory more like the VDA’s 14pc trajectory (or worse; the association materially under-forecast the post-subsidy drop in PHEV sales last year), that would be bearish for overall European new BEV registrations this year.

Mixed Tesla messages

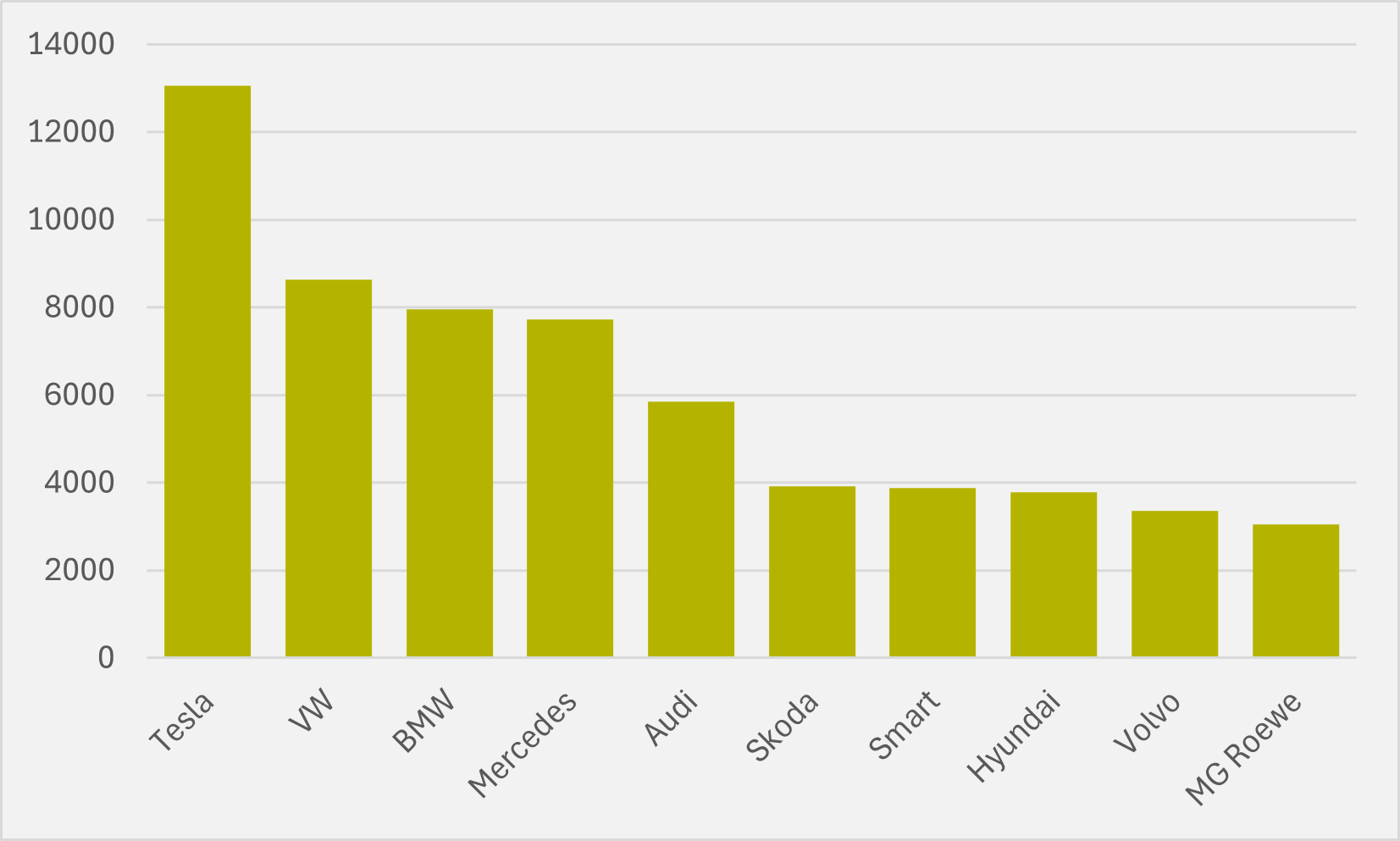

After a tumultuous few weeks, there will be plenty of attention on Tesla’s performance in Germany. The good news is that it remains the best performing brand in terms of BEV sales in the country, shifting over 13,000 units in the quarter to remain comfortably ahead of Volkswagen’s c.8,600 sales (see Fig.2).

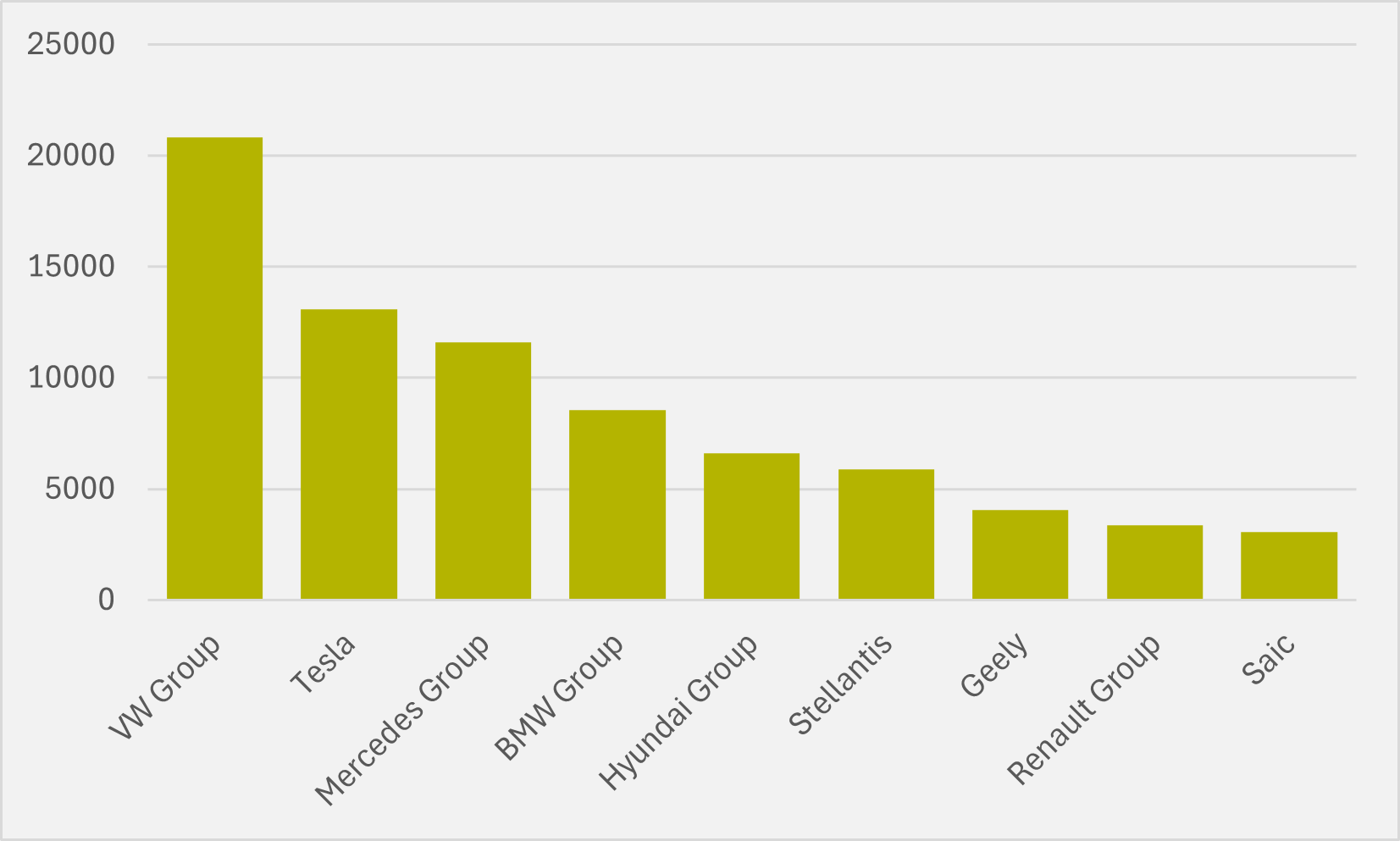

But, year-on-year, Tesla sales performed even worse than the overall German all-electric market, dropping by 37pc from above 20.500 sales in the first three months of last year. And, at OEM level, VW Group’s combined sales of all-electric Volkswagens, Audis, Skodas and Seats far outstripped Tesla in reaching close to 21,000 (see Fig.3).

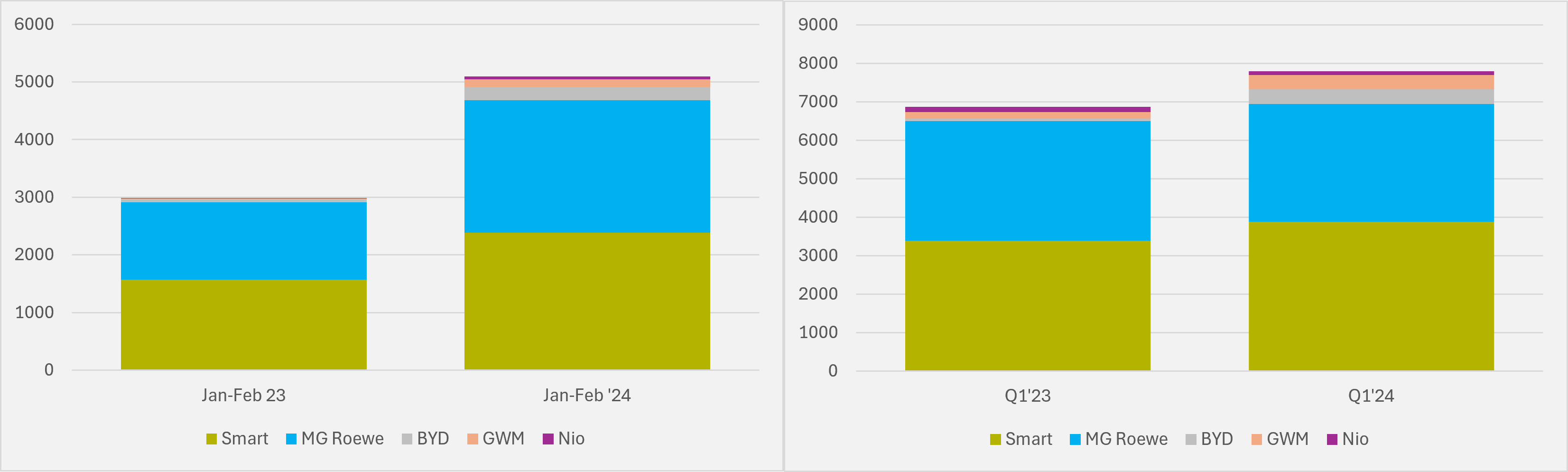

March’s sales tumble also put a significant dent in the fledgling progress of China-headquartered brands’ German BEV sales. At the end of February, year-on-year sales for the year across MG Roewe, Smart, BYD, Great Wall Motors and Nio was over 70pc higher year-on-year.

But March saw annual declines in units shifted for four out of the five, with only BYD selling more BEVs in March ’24 compared to March ’23. This sliced the cumulative advantage over last year back to just 13.5pc (see Fig.4).

We do not include Volvo Motors, or indeed its Geely stablemate Polestar, in those figures, as both are Swedish headquartered despite having a Chinese majority shareholder. But Volvo enjoyed a productive quarter, selling 47.5pc more new BEVs year-on-year in the quarter, in line with strong Europe-wide growth in its BEV sales. In contrast, Polestar sales dropped by 39pc.

Insider Focus LTD (Company #14789403)