Musk offers bittersweet glimpse into what might have been

Tesla could still be a contender. But only if its CEO faces a few home truths and reprioritises

The Detroit firm’s all-electric business is stable but sustained growth is proving elusive

Ford’s US BEV sales were building nicely back in 2022. As the F-150 Lightning e-truck and E-Transit van joined the existing Mustang Mach-E in the product line-up, sales rose steadily each quarter — from under 8,000 in Q1 to over 12,000 in Q2, 15,000+ in Q3, and through the 20,000 barrier in Q4.

Then came the disastrous first quarter of last year, when a planned halt to Mach-E production to expand capacity was joined by an unplanned outage in F-150 Lightning output owing to a battery issue. Ford’s quarterly US BEV sales slumped back to under 11,000.

It took another two quarters to build them back to just over 20,000 again in Q3, and Q4 of last year saw the promise of finally getting back on track to grow further by reaching almost 26,000 units (see main image).

But Q1’24 — admittedly allowing for the first quarter of a year being traditionally slower — has served as a reminder that Ford is still struggling to maintain any strong momentum in its home market to grow away from the c.20,000 quarterly units it first achieved some 15 months ago. The firm shifted 20,223 BEVs, a figure it has outperformed in four previous quarters.

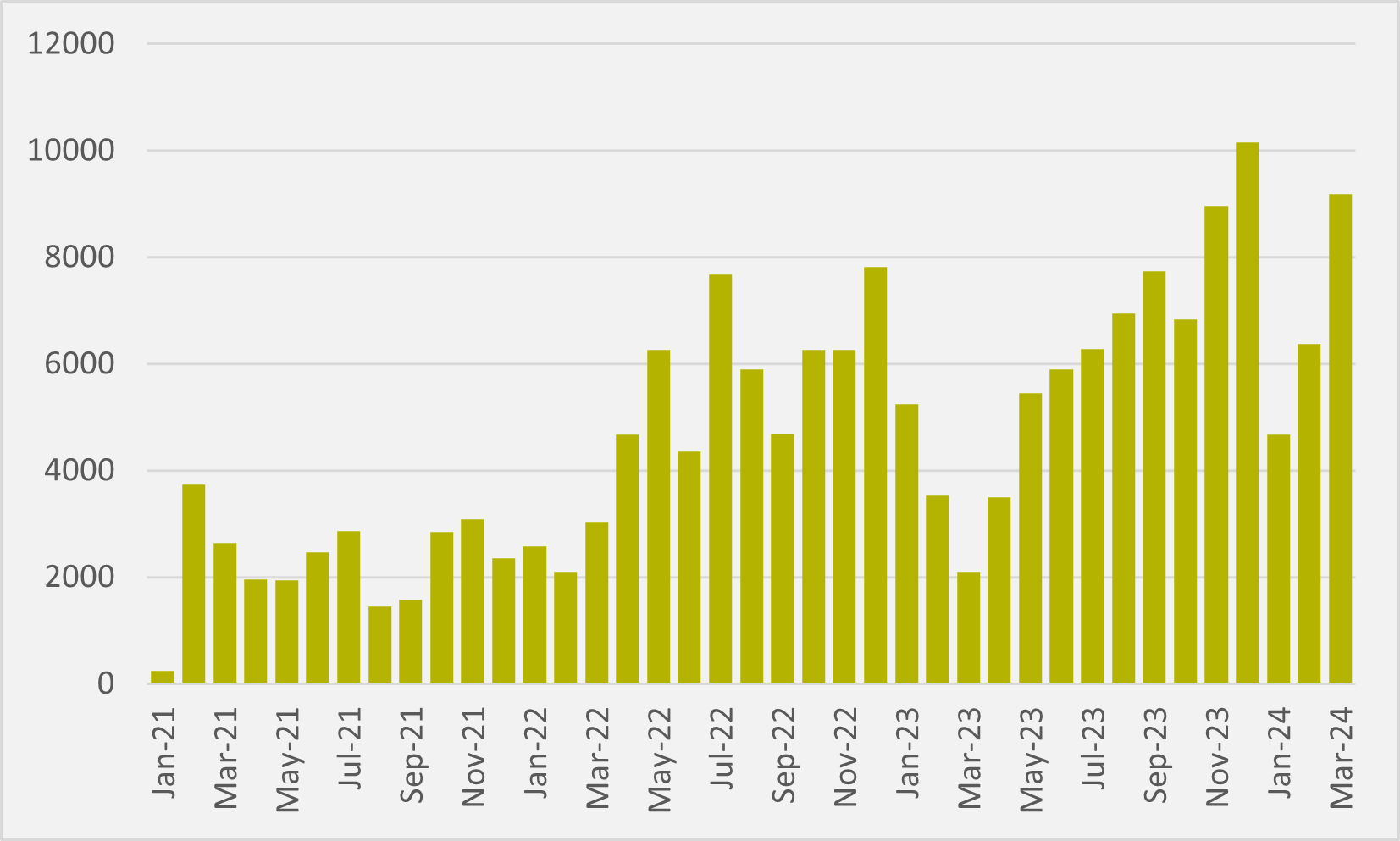

There are some grounds for optimism that Ford could enjoy additional growth later in the year. March sales of over 9,000 represent the firm’s second best-ever month behind December of last year (see Fig.1). The E-Transit had its best-ever quarter, selling almost 3,000 units, while the F-150 Lightning had its second best.

But sales of the Mustang Mach-E were more sluggish, with Q1 deliveries of below 10,000 failing to match any of the periods Q2-Q4’22 or Q3-Q4’23 — albeit March did see a significant uptick after a notably weak January and disappointing February, with 5,346 deliveries representing a second best-ever month for the product. Interestingly, the firm made no new Mach-Es in March, relying entirely on inventory to meet deliveries of 5,000+ and reducing its US stocks of the vehicle from 20,000 at end of February to 15,000 at end of March.

Ford may have to wait for new models to really fire its growth, either the second generation line-up it has been developing conventionally or the smaller, cheaper BEVs promised by its ‘skunkworks’ project. Until then, BEVs remain an underwhelming 4pc of all Ford’s US sales in Q1.

Insider Focus LTD (Company #14789403)