No Kathleen Valley stope this month – Liontown

The firm is aiming to shift to underground production next month, and maintains everything is on schedule

As tax credits end for the Mustang Mach E and demand wobbles, Ford is still banking on the SUV to buoy its EV division.

Detroit legacy OEM Ford saw its US BEV sales top 10,000 for the first time in December. But the firm's year-on-year growth rate is still lagging behind the national average, mainly due to to its Q1 horror show.

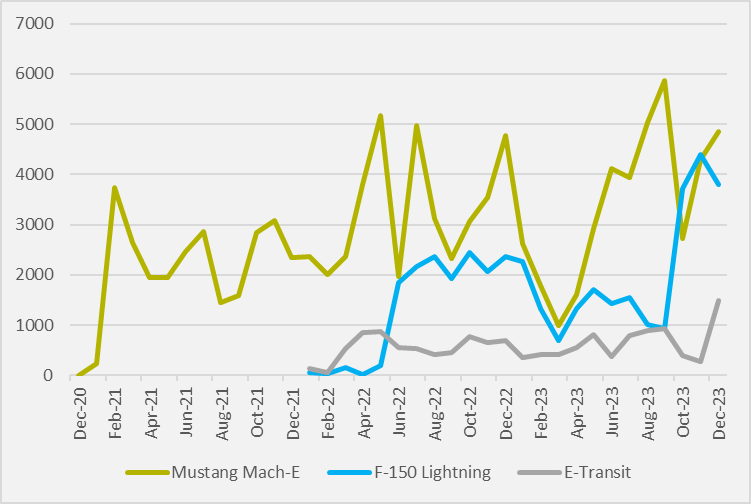

The firm was able to put together a fifth-best ever month on its top-selling Mustang Mach-E, a second-best ever month to its F-150 Lightning e-pickup and the best sales month for its E-Transit van to deliver a five-figure performance in December.

And it represented an eighth month out of nine of month-on-month growth since Ford's March nadir, when production halts on both its passenger BEVs saw sales slump to c.2,000 (see main image).

The Mach-E, sold 4,863 units, nearly 600 units improved over November, and up by 44pc versus October. Despite the Mach E only seeing sales rise 1.8pc rise year-on-year, Ford CEO Jim Farley characterised 2023 as the vehicle's "best year ever".

The E-Transit van — a vehicle which has previously been something of an afterthought on Ford's BEV sales releases — saw its December deliveries rocket by 448pc month-on-month to reach 1,485 units (see Fig.1).

The F-150 Lightning is the only Ford BEV to decline month-on-month in December, with sales 13.5pc below their November levels. That said, sales are still significantly above levels seen throughout most of 2023 and are only down relative to a peculiarly strong November.

In a broader context, the Lightning is performing relatively strongly. It averaged a 47pc share of Ford's EV sales across the Q4 months as a whole, compared to just 17pc in Q3, despite overall Q4 sales being 25pc higher.

"The F-150 Lightning is America's best-selling electric pickup after a record fourth quarter, and demand continues to grow," Ford says.

But Ford is now set to test that demand by upping the price of the Lightning's most affordable trim. The firm has confirmed that starting prices have been raised by $5,000 to around $55,000.

The company is "making adjustments to pricing, production and trim packages to achieve the optimal mix of sales growth, profitability, and customer access to the IRA tax benefit", it tells EV inFocus.

Ford has previously admitted that it cannot go lower on price for its BEVs, given its profitability problems on its first generation of vehicles that has motivated the firm's deferral of $12bn in EV investment.

And it may looking to take advantage of the fact that two of its competitors in the e-pickup space — the Tesla Cybertruck and the GM Silverado EV — have at least temporarily lost eligibility for their $7,500 tax credits that, as of January, can be applied directly at time of purchase. Ford may be gambling that, by raising prices, it can effectively pocket $5,000 of the incentive for itself and still see the label price for the customer go down by $2,500.

Lagging the wider market

While Ford US BEV sales certainly seem on a healthier footing than they were even at the end of Q3, it cannot be denied that 2023 in the round has been a relatively disappointing US sales year, even aside from the mid-year screeching strategic U-turn.

For example, Ford sold 40,771 Mach-E units in the US in 2023, a year-on-year growth rate of only 3.3pc compared to 2022. While the firm is still hailing its car as the second best-selling e-SUV in the US, that is anaemic annual growth.

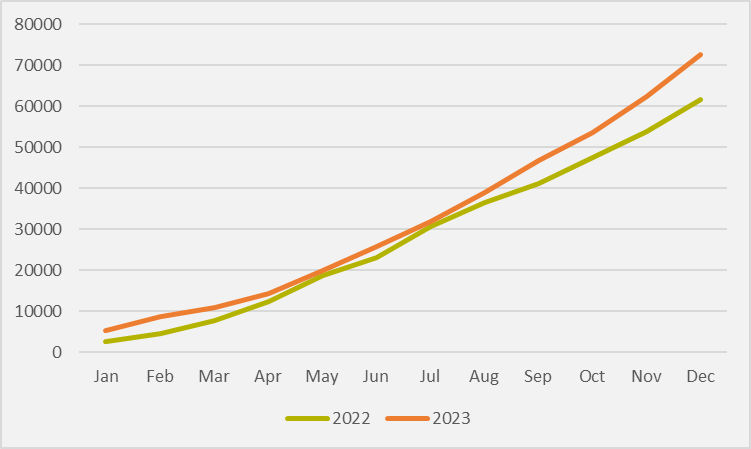

And Ford finishes 2023 with its total BEV sales up by only 17.9pc year-on-year (see Fig. 2). This is relative to a total US BEV market which was up by 27.4pc compared to 2022 to the end of November, according to the latest data from the Department of Energy's Argonne National Laboratory.

So, in other words, Ford's US BEV sales growth has underperformed the wider market. And this will be a cause for concern — even if the year's final month, and indeed final quarter as a whole, give cause for some greater optimism heading into 2024.

Insider Focus LTD (Company #14789403)