No Kathleen Valley stope this month – Liontown

The firm is aiming to shift to underground production next month, and maintains everything is on schedule

F-150 Lightning fires – admittedly modest – Cybertruck warning with record sales

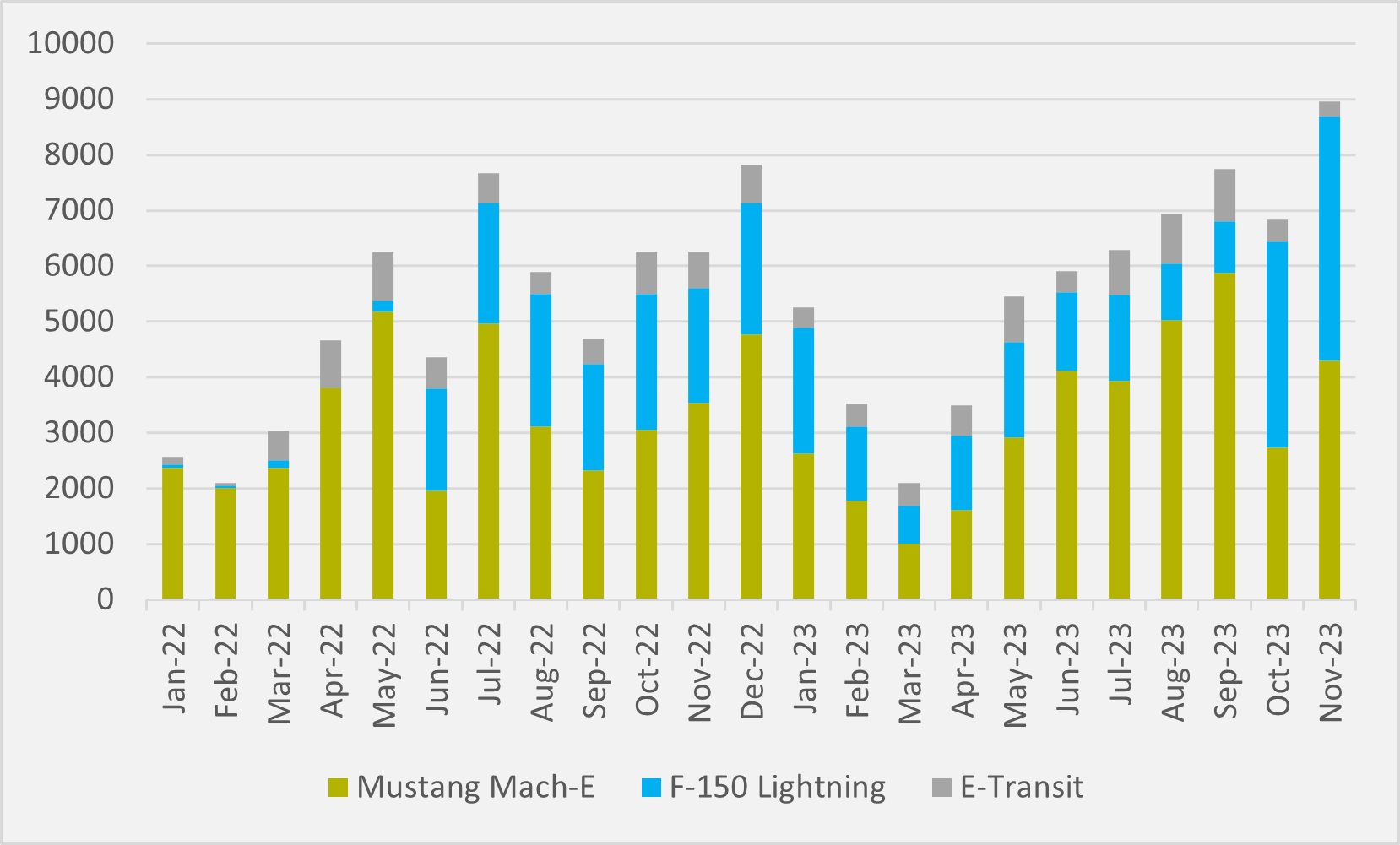

Detroit legacy manufacturer Ford sold a new high of 8,958 BEVs in the US in November as it was finally able to put relatively healthy sales of the Mustang Mach-E together with growing appetite for its F-150 Lightning e-pick-up in the same month.

The firm’s previous monthly high was 7,823 seen in December 2022. Year-on-year growth for November is 43.2pc, while year-to-date growth over 2022 stands at 16.2pc.

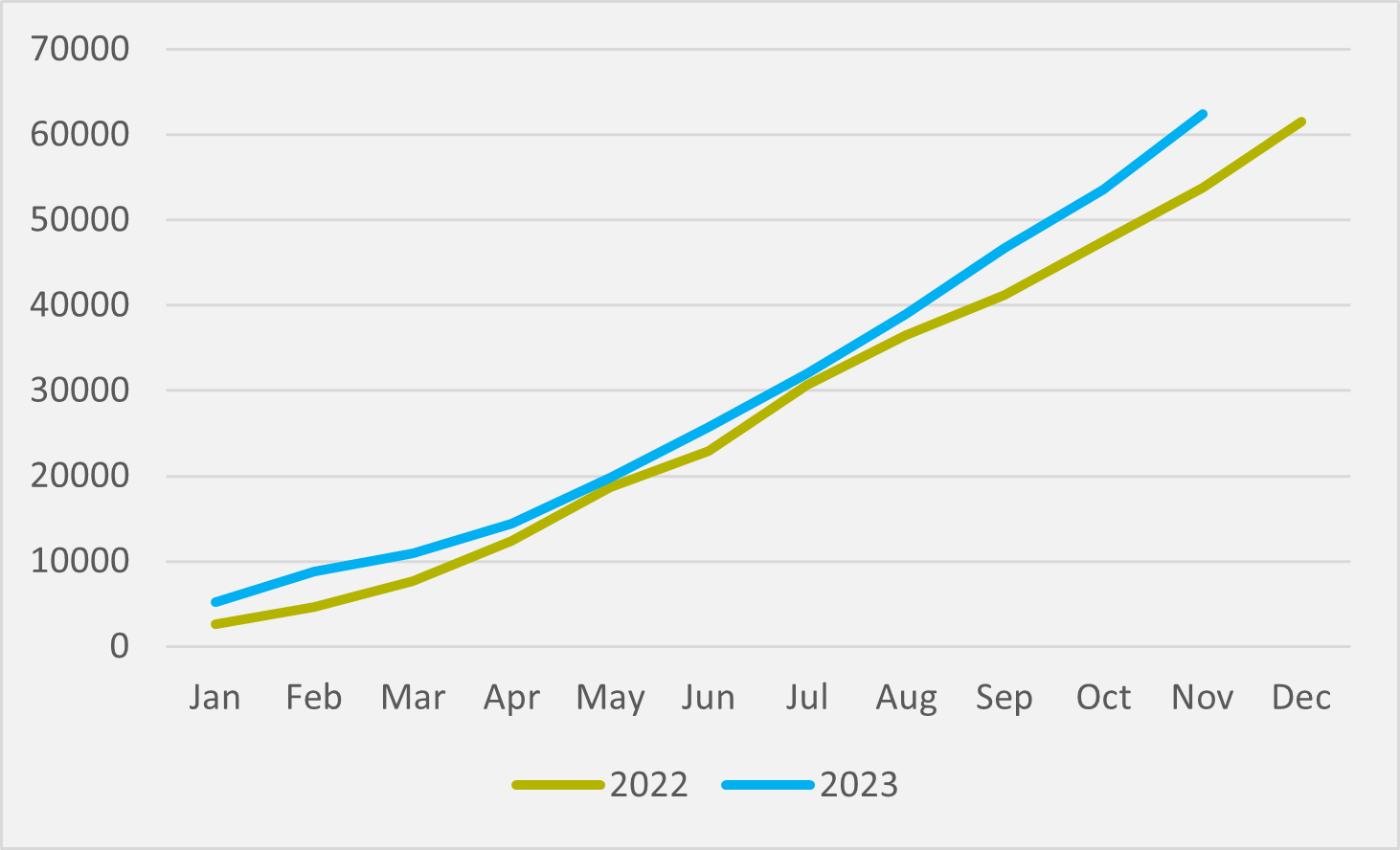

And cumulative sales of just shy of 62,500 means that Ford has now sold more BEVs in the US than it did last year (see Fig.1). That said, in a US BEV market as a whole that has grown by 59pc year-on-year in its first ten months, Ford’s progress compared to 2022 still looks relatively anaemic.

Ford will still welcome a reverse of October’s slide, when its US BEV sales dropped 11.8pc over the previous month, putting an end to six months of sustained month-on-sales growth (see Fig.2).

But the challenge for the firm is that its sales numbers remain stubbornly low and its so-called ‘first generation’ vehicles have largely been written off by management as terminally unprofitable. And this could prove ever more painful if US BEV sales increase next year once Inflation Reduction Act subsidies of up to $7,500 can be applied direct to sticker prices.

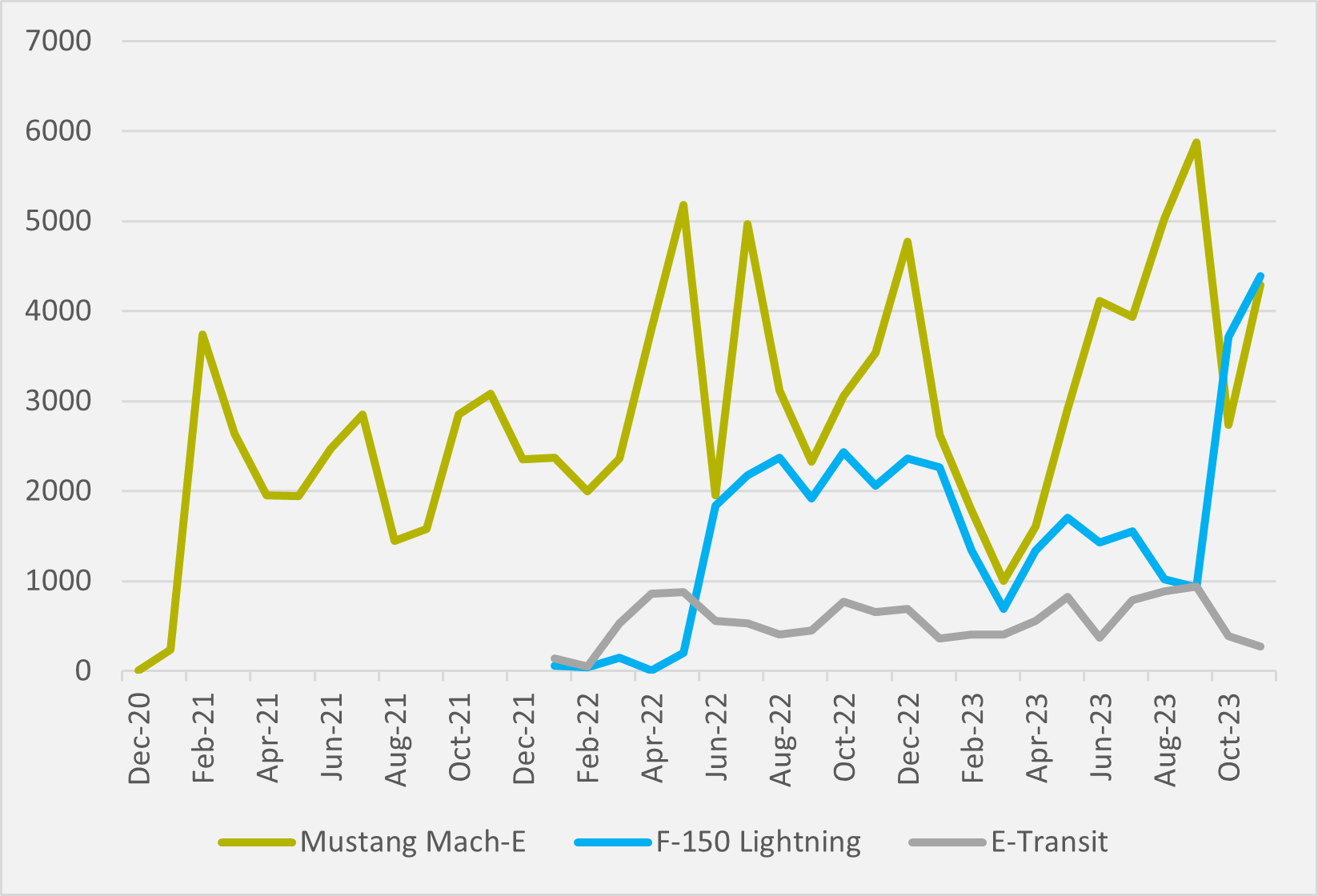

After the F-150 Lightning overtook the Mustang Mach-E in October to be the company’s US best-selling EV for the first time, the latter’s sales rebounded materially to 47.9pc of Ford’s BEV deliveries in November (see Fig.3). It still marginally trails the Lightning, however, which claimed 49pc of November sales.

But Mach-E sales are still significantly below their September peak, when Ford sold 5,872 units in the US.

The Lightning’s rise means more than 20,000 units sold in 2023-to-date, even after a production stoppage in Q1. But the numbers are still small.

If Ford could match November sales across 2024 as a whole, it would still only shift just shy of 53,000 F-150 Lightnings. Tesla’s 50pc+ higher prices for the Cybertruck than previously trailed could well open a door in the US e-pickup market — if potential buyers held off for its release but might now look elsewhere given the pricing details.

But Elon Musk’s target of 200,000-250,000 Cybertrucks rolling out each year — albeit not before 2025 and with no guarantees that either these production levels can be reached or that buyer demand at the new price list will be there — put Ford’s numbers into sharp perspective. In a US e-pick-up market that is only going to get more crowded, with GM’s Silverado and Sierra and Chrysler’s Ram 150 also n the horizon — Ford’s failure to scale in its first 18 months is a potential advantage tossed away if Cybertruck disappoints.

That CEO Jim Farley continues tout his excitement not about the F-150 Lightning but an as yet sketchy second generation e-pickup is unlikely to help the existing vehicle’s cause either.

Insider Focus LTD (Company #14789403)