No Kathleen Valley stope this month – Liontown

The firm is aiming to shift to underground production next month, and maintains everything is on schedule

OEM might hope that May kickstarts a similar growth streak as seen in 2023, but it remains odds against

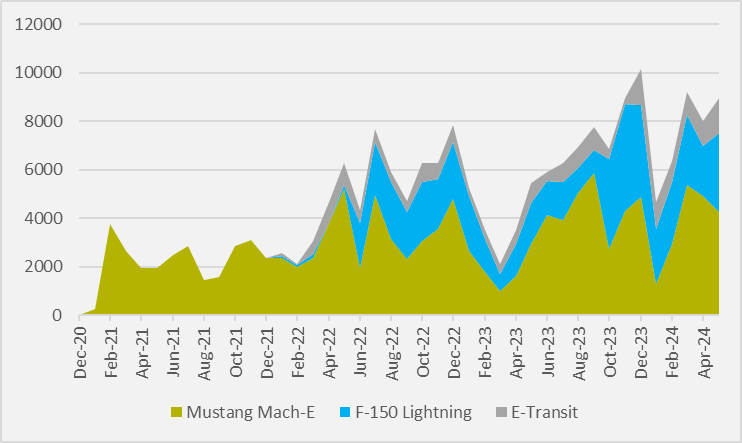

Detroit automaker Ford grew its new US all-electric deliveries by 65pc year-on-year in May. Last month was the company's third strongest ever month for total BEV deliveries in its home market, as the OEM sold 8,966 units (see main image).

The solid growth belies the managed phase-out that the company is currently overseeing with its first gen EVs, after CEO Jim Farley recently told analysts that the firm's next EVs have forced the firm to "totally change the design standards for our EV components".

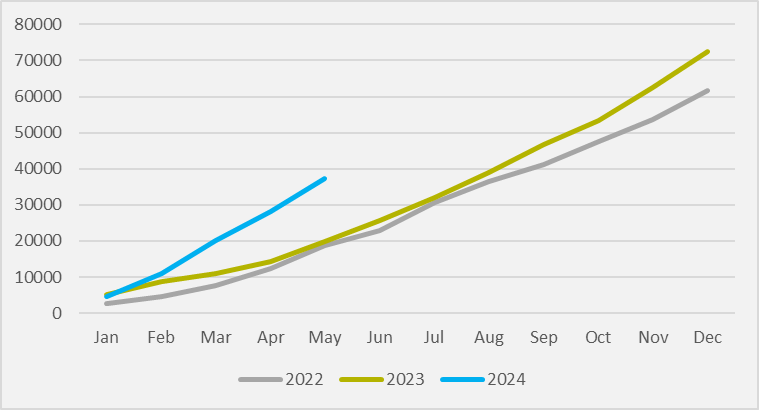

May trails only March and December of last year in terms of absolute EV deliveries, which sees Ford's year-to-date US all-electric sales up by 88pc compared to 2023 (see Fig.1).

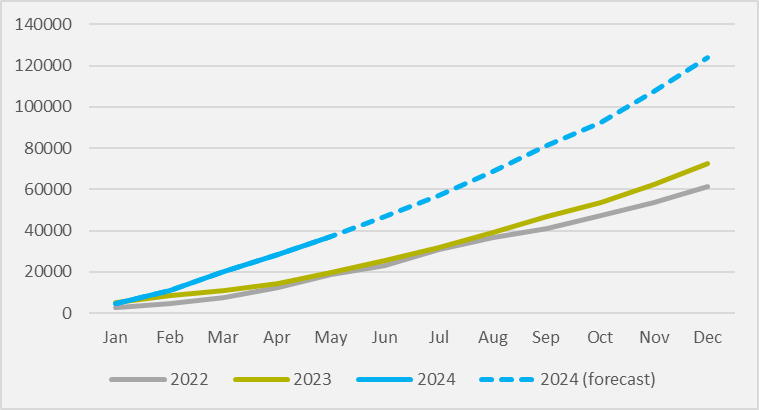

May of 2023 kicked off a substantial run of month-on-month growth for Ford which the company largely sustained for the remainder of the year, as it put behind it a dreadful Q1'23 markeds by production interruptions on both the Mustang Mach-E and F-150 Lightning. In the unlikely event the company can replicate the same trajectory in 2024 that was followed from May last year, the firm will register over 124,000 EVs in the year (see Fig.2).

More realistically, bearing in mind that Ford's North American BEV portfolio is based on the same three products that it sold last year and also the broader EV market growth slowdown, Ford nevertheless could hope to normalise at c.8,000-10,000 EV registrations/month for the remainder of the year.

The F-150 Lightning e-pickup saw the biggest increase in its share of Ford's total US BEV sales as it made up 36pc of May deliveries. In contrast, the Mustang Mach E's share of sales fell to 47pc after two months in which it accounted for approximately 60pc of Ford's US BEV registrations (see Fig.3).

This crossover in fortunes saw a sequential decline in volumes April-to-May. And partly because of these lower sales, Ford saw inventory of the vehicle rise by 2,000 units in only a month. Gross stock of the Mach E now stands at 17,600, Ford says.

This jump in inventory is greater than the increase in production of 1,522 units seen between April and May, perhaps indicating that Ford anticipated greater demand for the vehicle than materialised in May.

The 64.7pc year-on-year growth seen in Ford BEV sales marginally pips the growth rate seen in the US for the company's hybrids. CEO Jim Farley recently indicated that Ford may look to hybrids, not only as compliance stopgaps, but rather saying that "we should stop talking about it as transitional technology on the powertrain side".

Insider Focus LTD (Company #14789403)