No Kathleen Valley stope this month – Liontown

The firm is aiming to shift to underground production next month, and maintains everything is on schedule

Ambitious pan-European CPO targets next national market entry

Dutch charge point operator (CPO) Fastned has reversed a downward trend in its charging installation with a strong fourth quarter. And it is also preparing for expansion into Spain.

Q4 charging revenue rose by 26.7pc on a quarterly basis and by 44pc over the fourth quarter of 2022. During the quarter, Fastned says it "counted nearly 1.3mn charging sessions, generating €19.2mn ($20.9mn) of charging revenue".

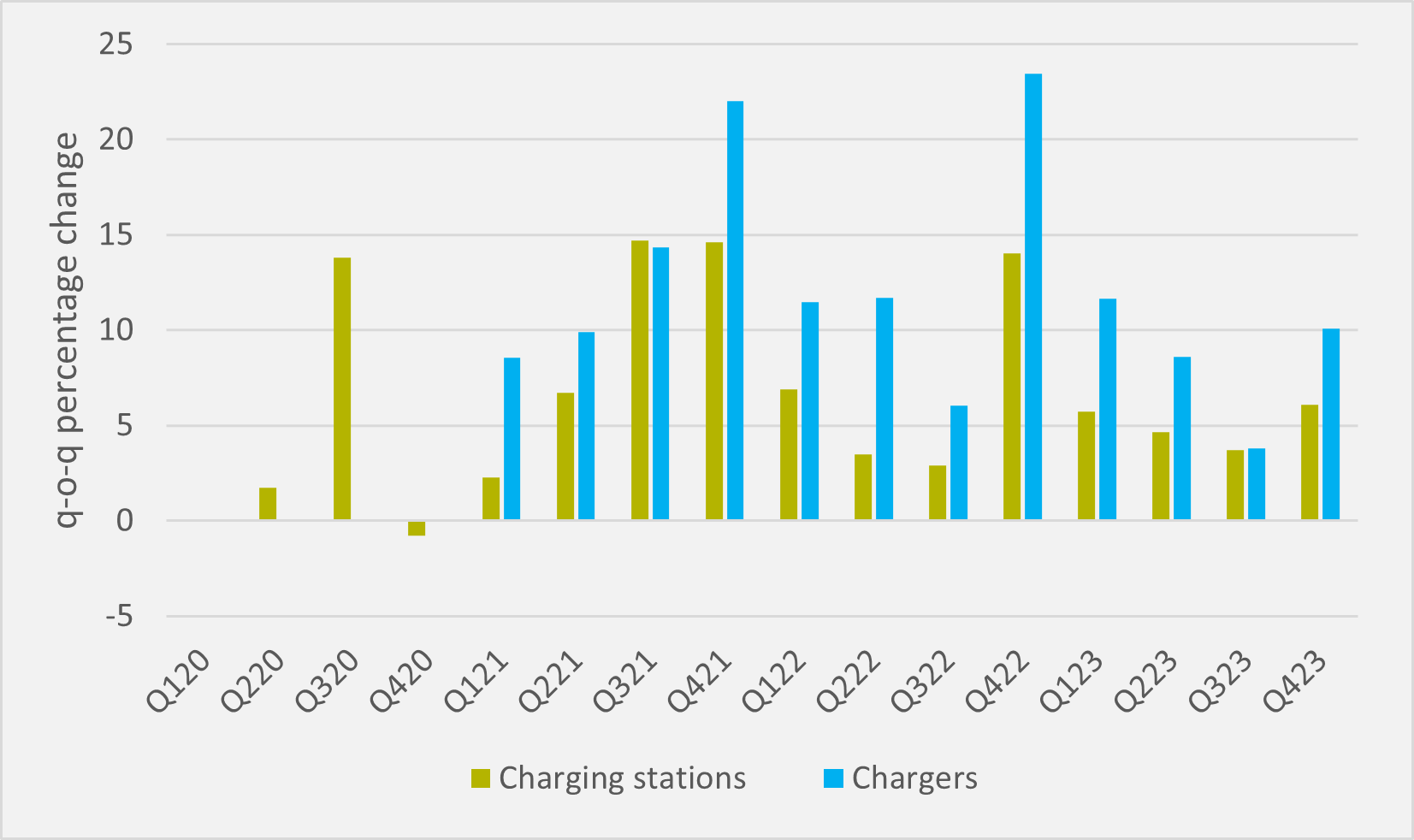

Quarter-over-quarter growth is back on track for Fastned, recovering from the third quarter of 2023 in which both station locations and charger installations grew by less than 5pc.

Q4 growth is the strongest since the first three months of 2023, although 2023 as a whole failed to live up to the breakneck speed of expansion that the company saw in 2022 (see Fig.1). And previous years have, admittedly, seen a much greater spike in fourth quarter growth

Mediterranean ambitions

These additions bring Fastned's total locations to 297 across seven countries, with expansion into Spain upcoming. The company has signed a contract for the construction and deployment of its first fast charging station in the southern European country.

The firm will install its first site in a highway location in Casarrubuelos, a municipality of Madrid, and the station will have eight chargers, with each a power of up to 400kW, Fastned says.

Spain provides a large addressable market for Fastned, with Langezaal saying that "Spain still has a long way to go in terms of electric mobility".

"At the same time," he acknowledges, "2023 has been a good year for electric vehicle uptake in Spain: 70pc more electric vehicles were sold in 2023 compared to the previous year."

According to the latest data from Acea, Spain lags behind other major European nations with an EV market penetration of only 7.7pc of Jan-Nov '23 sales. The country also faces a relative charging shortfall, making it a potentially strong growth market for CPOs.

Fastned competitor Instavolt, for example, has a plan to roll out 5,000 chargers across Spain and Portugal. But it may not be a straightforward market to enter.

"The main obstacle to [Spanish] charge point deployment is not a lack of commitment, but the inefficiency of the installation processes. It can take up to two years to obtain authorization or connect to the network, which has meant that 20-25pc of total public charging points already installed cannot operate," says Juan Luis Vilchez of automotive consultancy Roland Berger.

"As a result, the charging infrastructure is currently well behind the government's target of 100,000 charge points by 2023."

Insider Focus LTD (Company #14789403)