Umicore draws capex flak

The European battery metals processor remains under fire despite reining in spending

The best the company's battered shareholders may hope for is majority shareholder the PIF taking it private sooner rather than later

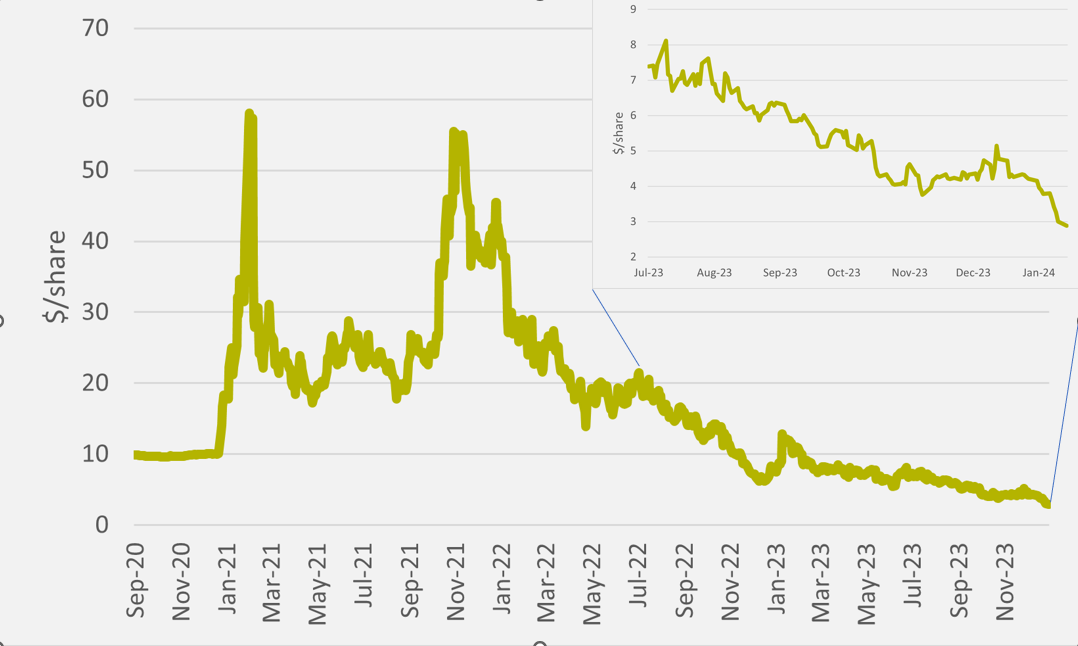

Shares of US EV pure play Lucid fell to their lowest-ever point this week (see Fig.1) after the firm disclosed underwhelming delivery numbers for the fourth quarter and full-year 2023. And — despite continuing fandom for its best-in-class technology — faith in the firm's ambitions to scale its business and positive margins in 2025 is ebbing away.

On a full year basis in 2023, Lucid produced 8,428 vehicles and delivered 6,001 vehicles, and in the fourth quarter the company produced 2,391 vehicles and delivered 1,734 — a performance research form Fox Advisors describes as "subdued".

And those Q4 production numbers likely include at least some EVs which were largely produced prior to the quarter. Lucid's manufacturing process at its Saudi Arabia plant sees vehicles are reassembled after partial construction at its Arizona facility. CEO Peter Rawlinson acknowledged at the firm's Q3 earnings call that 700 vehicles were part-manufactured that quarter, but would "only be counted towards production upon final assembly", so probably in Q4.

Biggest backer

While Lucid's financial results are still to come, Q4 deliveries are up by only 19pc over Q3 — likely translating to meagre revenue growth for offsetting against the company's continuing Ebitda losses.

Not everyone is seriously concerned that Lucid's current strategy is rapidly running out of road. "Losses like this are not unusual in the automotive start-up world nowadays," says investor Li Eason. "The reality is that there are many companies burning through cash just like Lucid.

"Rivian currently is at a cash-burn rate of $1.62bn per quarter; Fisker and Canoo, both companies with more debt than cash, had a cash-burn rate of $636mn and $358mn per year, respectively," Eason adds.

One thing giving the firm's continuing supporters solace is that Lucid's largest shareholder, Saudi Arabian sovereign wealth fund the PIF, is likely to be willing to step in to plug any gaps if Lucid's cash burn grows to unsustainable levels — albeit a drip-feed of funding, rather a full takeover, risks further dilution and/or share price pain.

But continuing PIF support by some means certainly seems more probable than the Saudis simply letting Lucid slip into bankruptcy after an investment put at c.$5bn.

However, unless vehicle deliveries pick up substantially for Lucid to offer a path towards being a profitable, scaled-up automaker, it is "getting harder for investors to see that future as they struggle to sell vehicles," says Chris Pierce, automotive analyst at investment bank Needham.

Lucid's recently unveiled Gravity SUV is on paper a more competitive EV than its current Air range. But Needham warns that "while quite enthusiastic on the vehicle and its technical specs, we struggle to see it being a near-term driver of investor enthusiasm given production is scheduled to be a late ’24 event".

Licensing

As sales have disappointed, Lucid management has indeed been hinting at a strategic pivot to put EV powertrain licensing at the forefront of the company, as openly trailed by CEO Peter Rawlinson. The company already has a licensing deal to supply its powertrain to UK premium automaker Aston Martin, which it says generates higher margins than its auto sales.

But it is worth acknowledging that Aston Martin has also received substantial funding from the PIF, which owns over 20pc of the firm. No other OEM without links to Lucid's owner has yet to sign up as a licensing customer. Needham's Pierce, while a fan of Lucid's technology, is not convinced of future success in this field.

"While our initial math is likely far from exact, it does lower our confidence in Lucid striking a deal with a legacy OEM to license their EV technology given the dollars per vehicle Aston Martin is potentially paying," Needham says.

"Lucid is working to develop lower priced and lower performance technology, and we are optimistic it will succeed given its market leadership from an EV efficiency standpoint, but see a low likelihood of a more mass market or higher absolute dollar value licensing announcement in the near term," he continues.

Full buyout?

Instead of simply funding the automaker on an emergency basis, a complete buyout of Lucid by the PIF could be an appealing option for the sovereign wealth fund, Eason suggests.

Enjoying this article? Take control of your Google News feed and follow us!

Backing out of its big Lucid gamble at this stage would be "difficult", he suggests. Rather, in his view, "a buy-out is possible for its 361 global patents and a talented team of engineers".

"All in all, I do not think bankruptcy would be an issue for Lucid, and with it also offering a great product," Eason believes.

This is not the first time that such a takeover has seemed possible. Last January , reports emerged that the PIF were working with bank JP Morgan on a deal to for a complete takeover, says Nasdaq analyst Thomas Hughes.

Insider Focus LTD (Company #14789403)