Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

The first offering from the firm’s mass-market Onvo brand is specifically targeting the e-SUV global best seller

The ‘Tesla killers’ was a somewhat light-hearted name given in the early ’20s to a group of mainly US EV pure play start-ups, including Rivian, Lucid, Fisker and Lordstown, that aimed to knock the Elon Musk-led firm off its perch at the zenith of its sales and value growth. None of these challengers succeeded in doing so; two of them have collapsed into bankruptcy.

But 2024 China looks very different to the US market of a few years ago. Chinese firm Nio’s targeting of the Model Y with the L60, the first offering from its Onvo mass-market brand, may prove a more credible threat to a Tesla having to fight for every inch of the market share it has carved out in China.

“We have announced a pre-sale price, which is RMB219,900 ($31,000). That is around RMB30,000 cheaper than Model Y,” says Nio CEO William Li, emphasising how the new product is taking aim at the Tesla bestseller in particular.

Great expectations

The L60, which started pre-sales in mid-May, is due to be officially launched in less than a fortnight. Frst deliveries to customers are due by the end of this month, although September deliveries will be “not in a very significant volume”, Li cautions.

Nio plans to be able to produce 10,000 units/months of the new vehicle by December of this year, rising to 20,000 units/month next year.

The first L60 rolled off the lines in mid-August and “the head of sales of the Onvo brand is actually driving this very first mass-produced car, having a road trip in China”, Li says. Social media content from this trip has “received a lot of attention from the public — every day there are several millions of views of the broadcast”, the Nio chief reports.

“In terms of the pre-order intake, it actually is pretty good and has surpassed our expectations. So, we are quite confident with overall competitiveness of this project.”

The firm is still considering whether it can price the new vehicle even more competitively to further ramp up pressure on rivals such as the Model Y. But it warns that its wiggle room is somewhat limited.

“Before the official launch of the project on 19 September, we still have some time and room for final price adjustments and decisions. But, overall speaking, we will try to strike a balance between the vehicle margin and the price point of the product to find the sweet spots. In general, we will not be very aggressive as we need to realise a reasonable margin for the project,” Li says.

The firm is aiming for a 15pc margin on the L60, although it stresses that “against the fierce competition, we have also reserved some room for the variable marketing of the product so that we will be more flexible in the competition”. But “as the product itself is designed for efficiency and cost, 15pc vehicle margin is a reasonable target for this model”, Li maintains.

Scaling up

But it is not just the L60, Nio has wider growth ambitions — for the Onvo brand as a whole; its third planned marque, Firefly, making "smooth progress" towards launch next year; and even doubling the sales of its eponymous Nio brand.

Onvo allows Nio to serve “a much larger market with a total car parc of more than 8mn”, according to the firm’s CFO Stanley Qu. “So, for Onvo products, they do have a bigger potential for a higher sales volume month-over-month,” he continues. Qu also confirms that, as well as the BEVs on which the Nio brand has thus far concentrated, Onvo will look to also launch PHEVs and extended range EVs (EREVs)

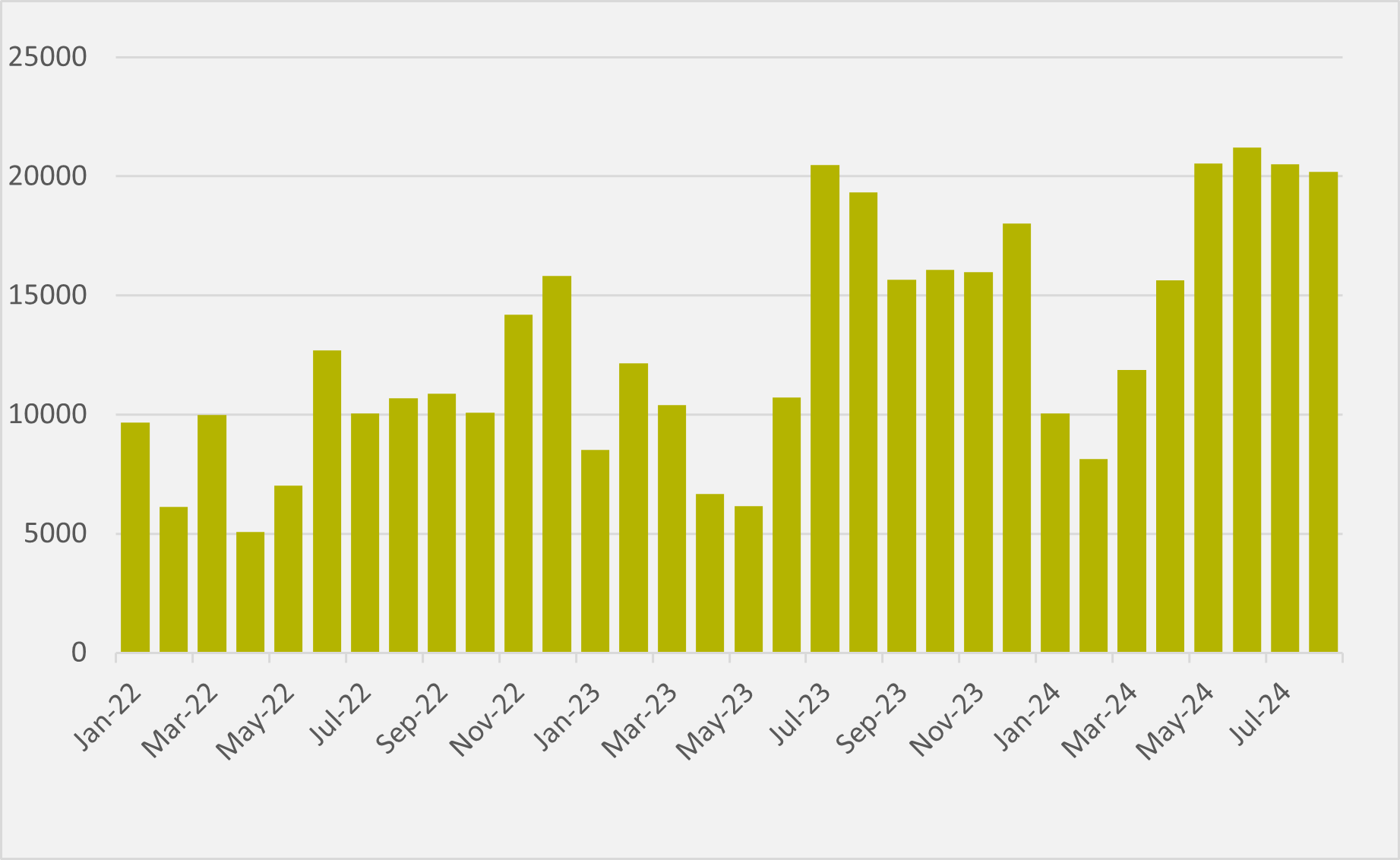

The Nio brand has, as of the end of August, achieved 20,000+ unit sales for four consecutive months (see Fig.1), having only topped that figure in a single month previously, leading Li to declare that the marque “had over 40pc market share among all BEVs with a transaction price higher than RMB300,000” in Q2.

September sales are also expected to come in at just over 20,000 units. New York-based brokerage US Tiger Securities has revised its expectations of Nio's full-year deliveries up by 6pc to just 225,000, which would represent year-on-year volume growth of more than 40pc.

“The Nio brand has been realising a pretty stable market share in the premium segment for years,” says Li. “This is mainly because we have a diversified and rich product portfolio to offer for the premium segment. Many of these products are also leading the sales volume in their respective BEV product segment — not to mention that, for some niche products like ET5T, EC7 or EC6 in their respective segments, their volume is even higher than some of the ICE competitors.”

Rosier financials, but still red ink

But he is targeting not just stability, but also improvements in sales volumes — as the Chinese premium EV market is further "enlarged" through displacement of ICE sales — and margins for the brand. The long-term goal is to double Nio brand sales to 40,000 units/month.

And, on margins, the ambition for the premium marque is to hit 25pc. Nio profitability has been increasing, both on vehicle and gross margins. The former was 12.2pc in Q2, up from 6.2pc for the same period of 2023 and from 9.2pc in Q1.

Decreased material costs were the main driver for both the year-on-year and quarter-on-quarter improvement, with the annual change offset to some extent by discounting. The Nio brand is targeting 15pc vehicle margins by the end of the year.

More revenue from aftersales services and from no longer bundling lifetime free battery swaps with sales of new cars aided gross margins. They rose to 9.7pc in Q2, compared with 1pc in Q2’23 and 4.9pc in the previous quarter.

But these improved financials are still insufficient to stop Nio losing money. The firm’s total revenues in Q2 were RMB17.4bn, up by 99pc year-on-year and by 76pc quarter-on-quarter. Yet operating losses remained RMB5.2bn in the quarter, albeit representing a decrease of 14.2pc year-on-year and of 3.4pc quarter-on-quarter. Net loss was slightly lower at RMB5bn.

Ex-China pivot

It may also be rethinking its international ambitions somewhat, given that “exporting costs from China to Europe becomes more expensive”. Nio will focus on the existing five European counties it has already entered — Germany, the Netherlands, Norway, Sweden and Denmark — rather than chasing further expansion.

“We also know that to establish Nio [as] a premium brand in the European market will also take a longer time, and we are very patient with that,” says Li. “But in the meantime, it does not mean that we have stopped our activities there.”

In contrast, the firm is in bullish mood about potential elsewhere in the world, such as the Middle East. It launched its UAE sales website last month and anticipates first customer deliveries in Q4.

“Last year, we received $3bn strategic investment from the Abu Dhabi government. Market entry into UAE is part of the plan,” Li explains.

“Starting next year, a big difference is that we not only have Nio brand and products, but also products from Ono and Firefly, which are more suitable for the global market,” he forecasts.

Insider Focus LTD (Company #14789403)