The darkest hour is before dawn

Reasons to be cheerful as well as fearful for the year ahead

The Amsterdam-headquartered conglomerate joins Renault and Tesla in Teutonic turmoil

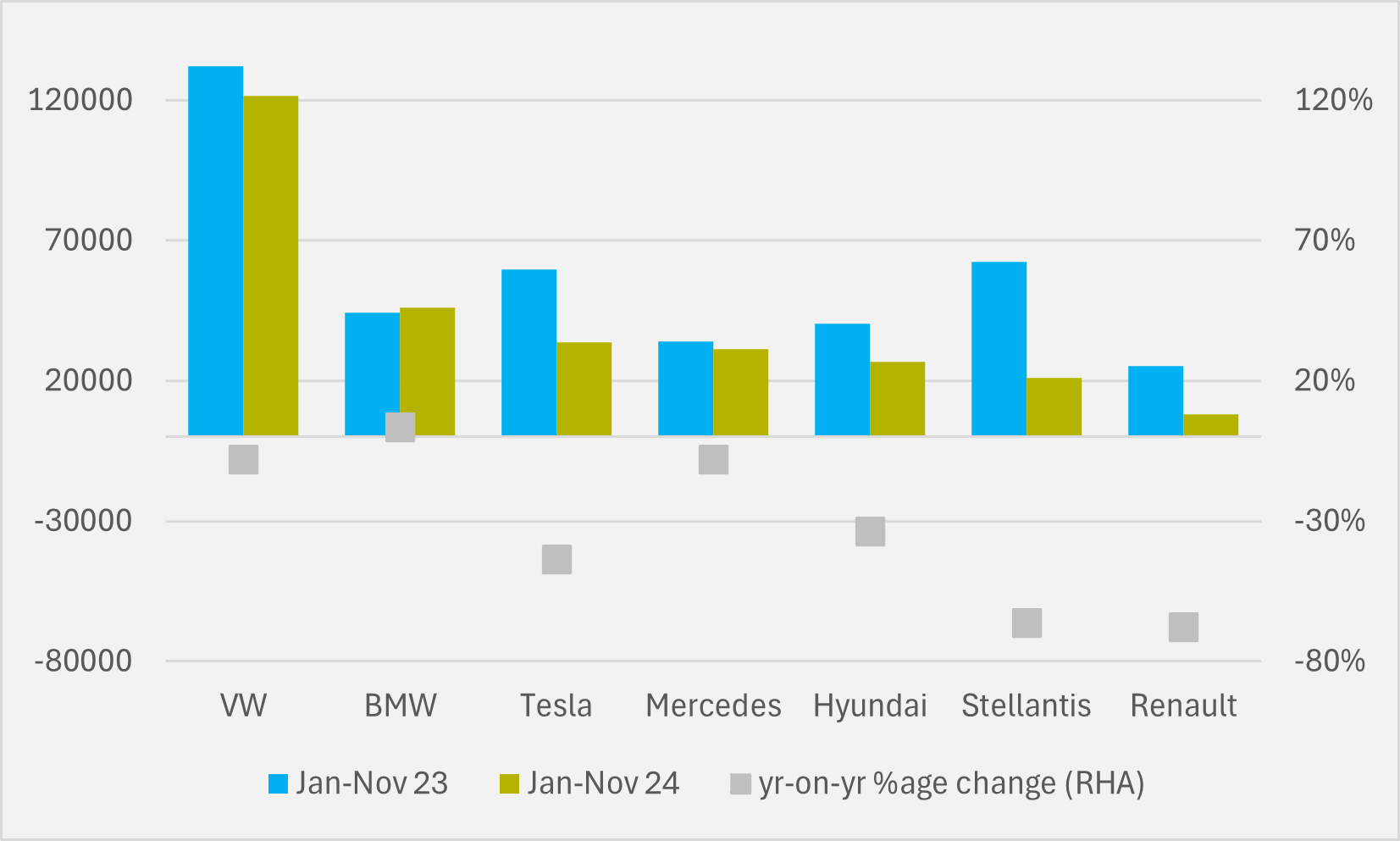

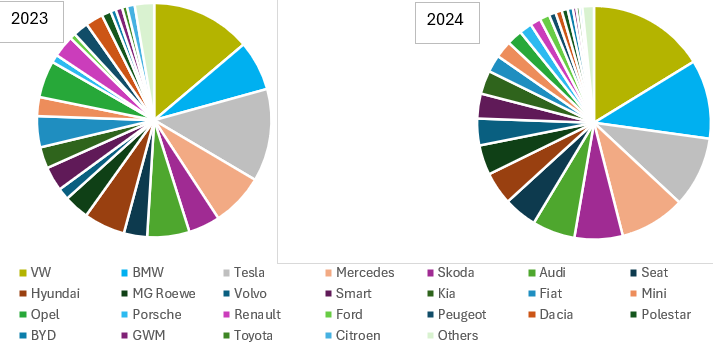

It is no secret that the German BEV market has been incredibly tough going in 2004, as the double whammy of subsidies withdrawn at the end of August and, unexpectedly, in December last year has sent Europe’s largest all-electric national market into a tailspin. But not all OEMs have suffered equally.

And the worst performer in terms of combined drop in absolute volumes and relative annual fall in sales is Franco-Italian automaker Stellantis. Others with a noticeably poor German report card include France’s Renault and US EV pure play Tesla.

Beating the market, not in a good way

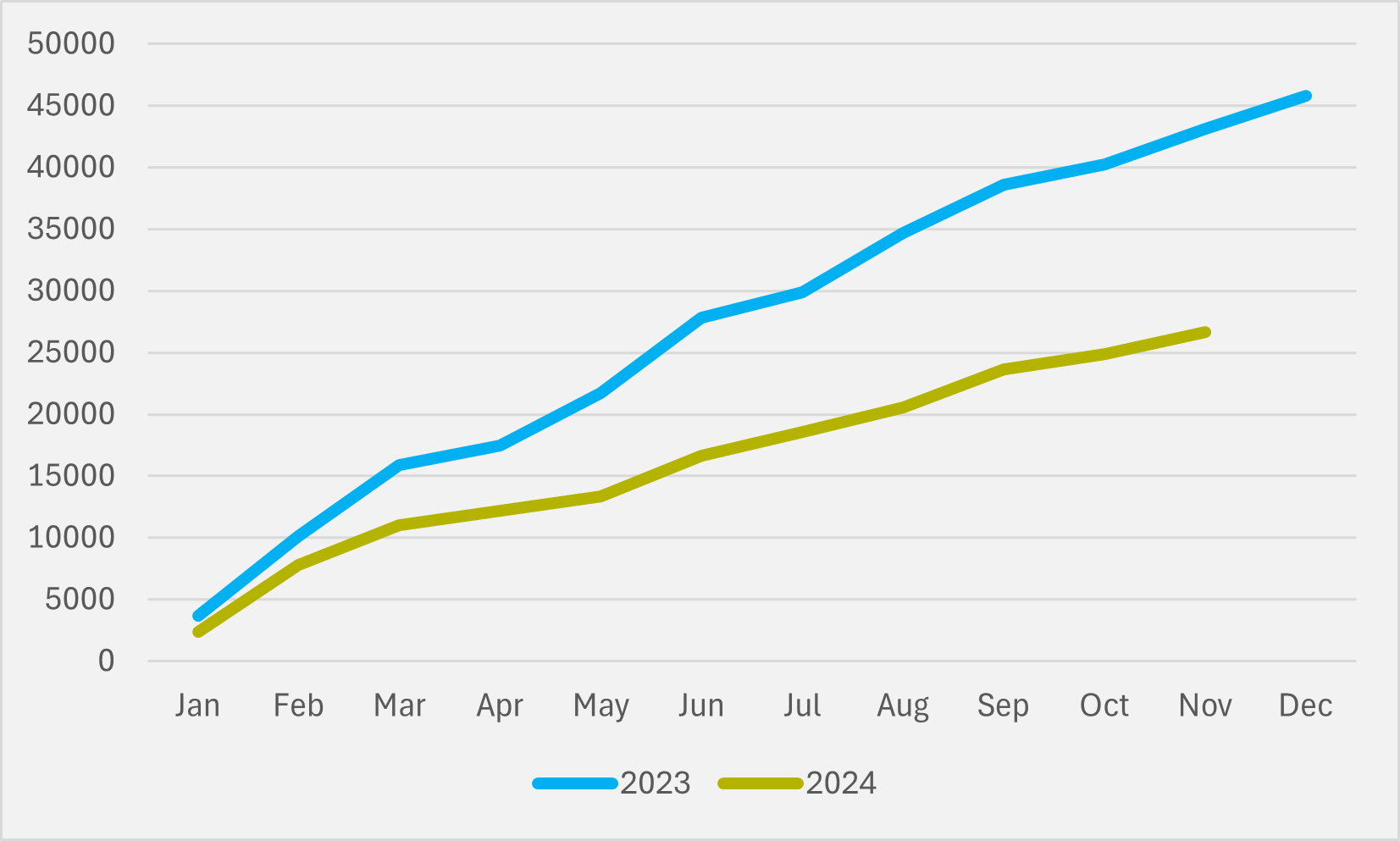

The German BEV market as a whole over the first 11 months of the year has dropped by 26.1pc as sales have fallen from almost 470,000 units to less than 350,000 units. But Stellantis’ underperformance has far outstripped that trend.

In the Jan-Nov ’24 period, the firm’s myriad brands have sold just shy of 21,000 all-electric units. That represents a 66.4pc year-on-year decline from the same period last year, when Stellantis marques shifted over 62,000 BEVs in Germany (see main image).

And perhaps the most worrying aspect for the conglomerate — which parted company with long-serving CEO Carlos Tavares a few weeks ago — is that the accepted ‘megatrend’ in the global EV market of slow-moving legacy OEMs having their lunch eaten by more nimble Chinese competitors is largely unapplicable in Germany. With the exception of Volvo Cars, the Swedish brand controlled by China’s Geely, Chinese OEMs have yet to barely scratch the surface of the German BEV market.

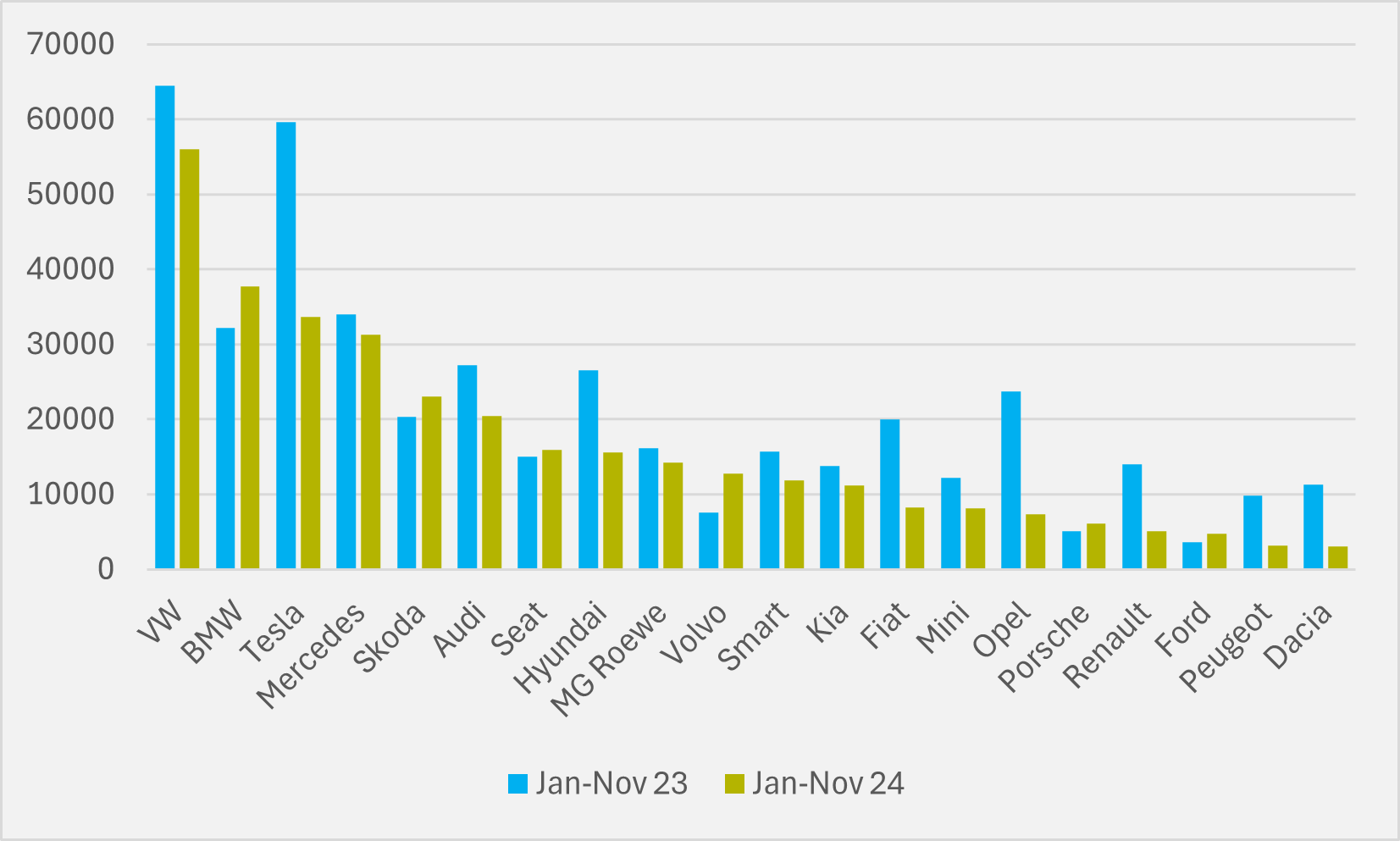

Stellantis is losing out to some of its peers — BMW German BEV sales are up by 3.5pc even in a shrunken overall market, while Mercedes and VW Group volumes are down by around 8pc, far lower declines than for the country as a whole (see Fig.1). Nor can this be attributed purely to a safety blanket offered by nationalistic preference; Stellantis’ identifiably German marque, Opel, has been among its worst performers.

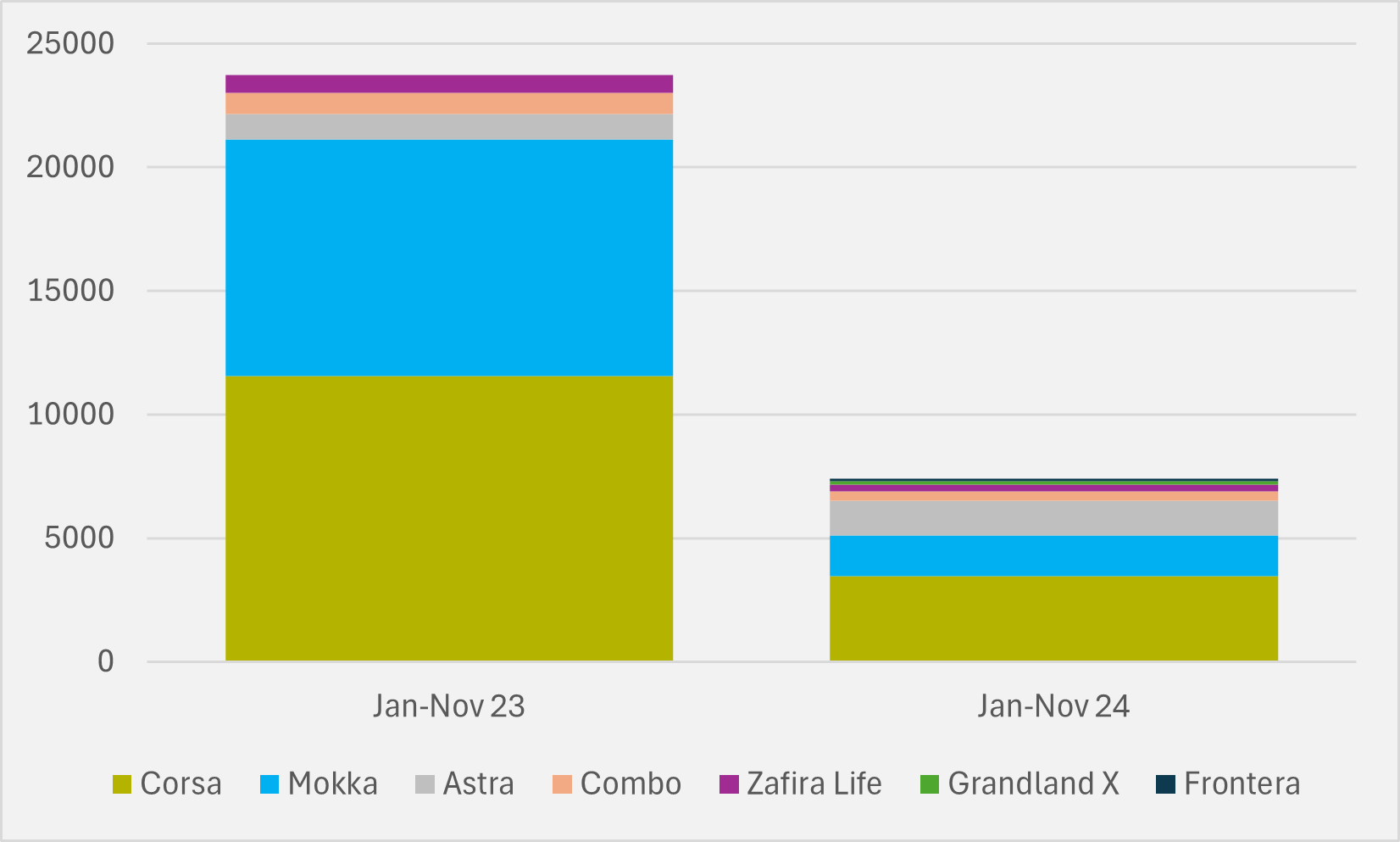

Opel BEV sales have slumped by 69pc year-on-year up to the end of November, going from being Germany’s seventh most popular all-electric brand with sales of close to 24,000, to less than 7,500 units sold and 15th place in Jan-Nov ’24 (see Fig.2).

The brand’s major issues are collapses in demand for the electric versions of its Corsa (-70pc) and Mokka (-82pc), which have sold a combined 16,000 fewer models so far this year (see Fig.3). The firm’s hope for a better year in 2025 will be pinned firmly on the recently launched BEV versions of its Grandland and Fronterra. These have, though, only shifted a combined 221 units in Germany since launch, so there are no guarantees as yet that they will help power an Opel revival next year.

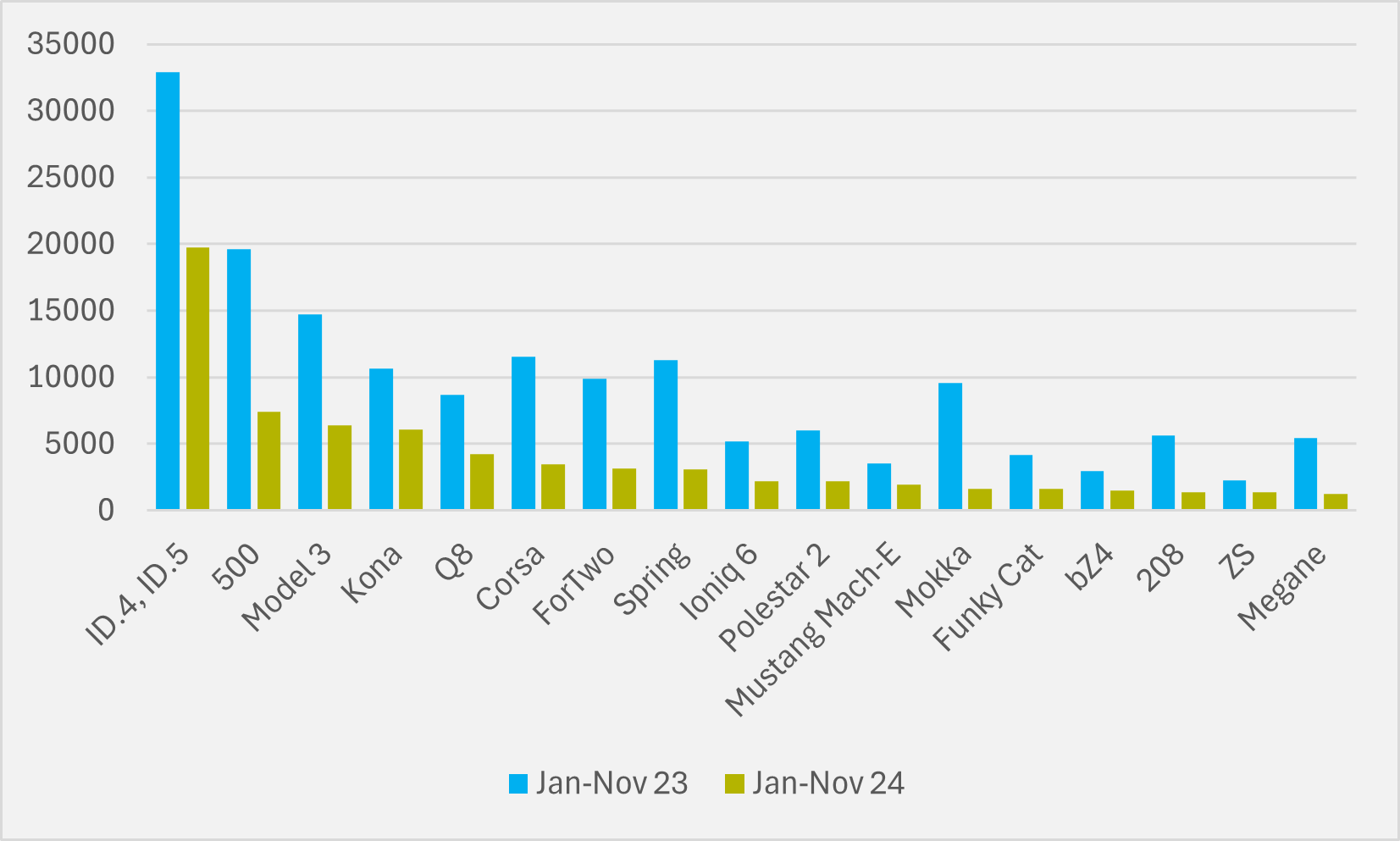

And Opel is not the only Stellantis volume brand toiling in Germany. Fiat’s BEV sales in the country are down by almost 60pc Jan-Nov, from just over 20,000 units to under 8,200. A slump of Fiat 500e volumes is by far the major contributor, with the model attracting fewer than 7,500 German buyers year-to-date, compared to over 19,500 in the same period last year (see Fig.4).

Stellantis’ French marques have also seen reduced appetite. Peugeot’s German BEV sales have dropped by two-thirds year-on-year from close to 10,000 units to around 3,200, with drops of 75-80pc in volumes of its e-208 and e-2008 particularly hobbling the brand.

Citroen has fared little better from a much smaller base. Its Jan-Nov ’23 all-electric sales of just under 5,000 vehicles have plunged by 74pc annually to less than 1.300, with the e-C3 and Berlingo e-van the most culpable model.

Doing okay

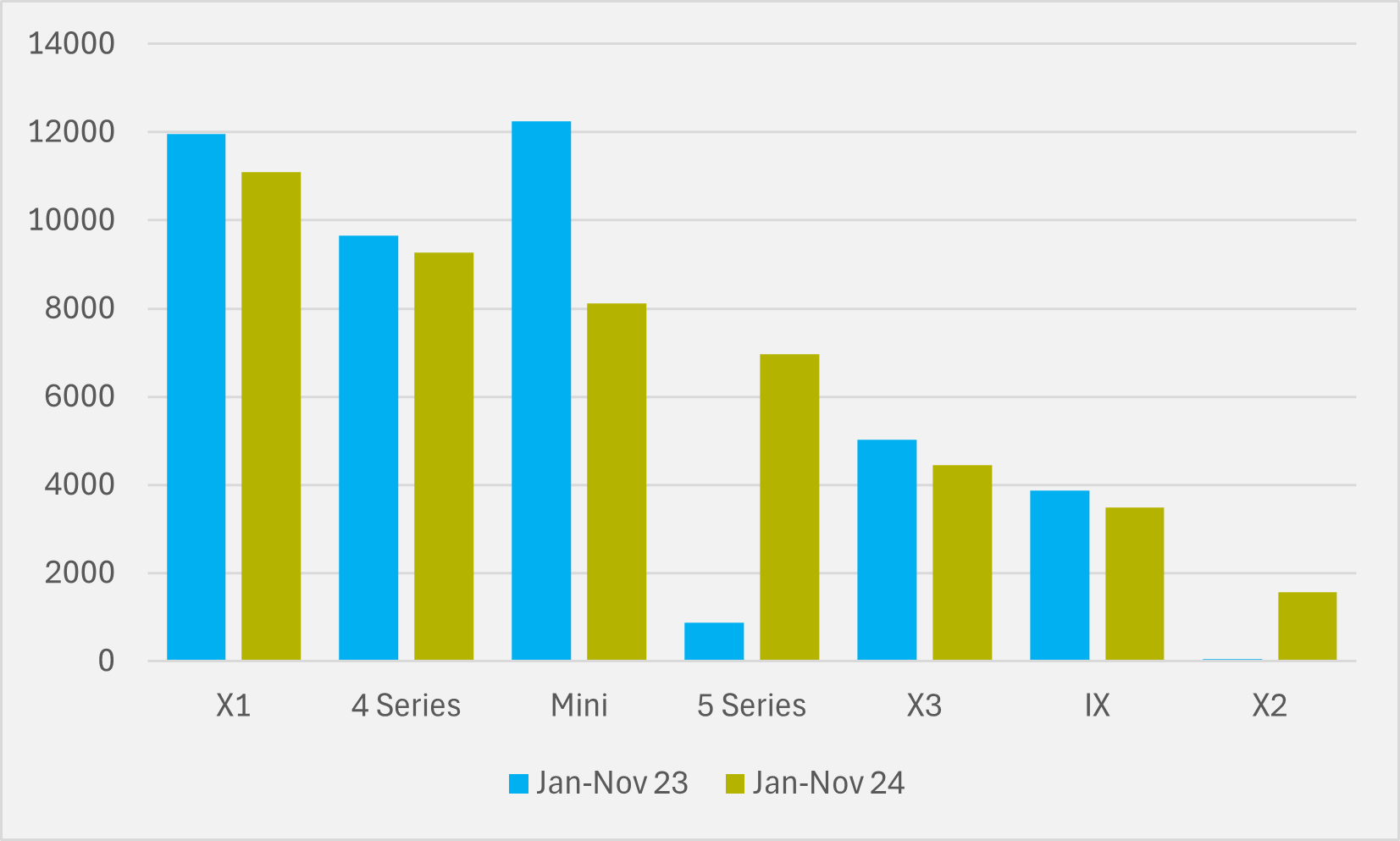

BMW is the only volume seller of BEVs in Germany 2023 to make ground this year, driven mainly by the eponymous brand. Sales of all-electric BMWs in their home market in the first 11 months of 2024 have risen by over 17pc to almost 38,000, offset somewhat by volumes of Mini BEVs sold dropping by just over a third.

The BMW i5, which launched only in the final quarter of 2023, is a material factor in the Bavarian OEM’s bucking of the downward trend. It has added more than 6,000 additional sales year-on-year, while the i4, iX, X1 and X3 BEVs have all limited annual declines to sub-12pc levels, substantially better than the market as a whole (see Fig.5).

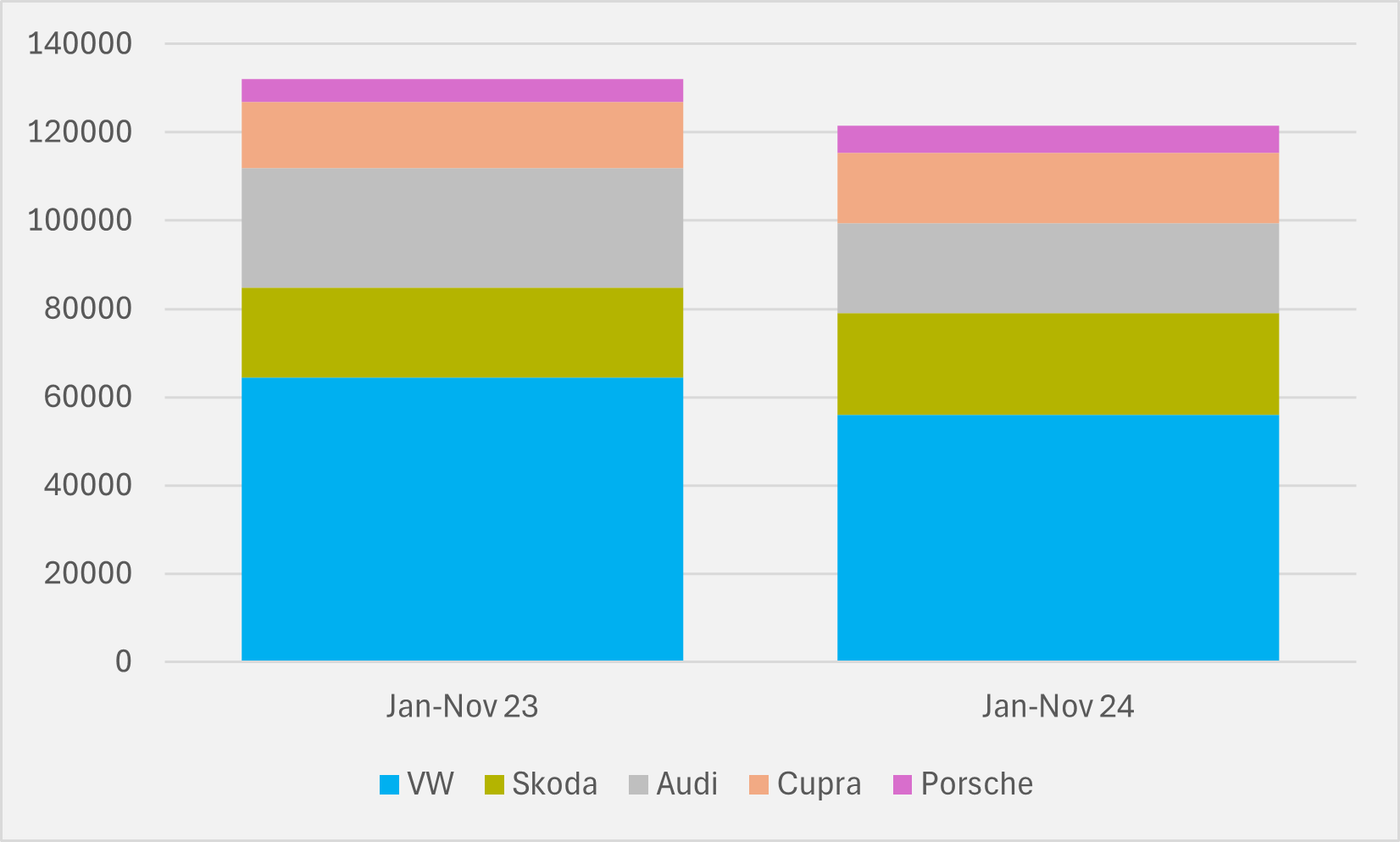

Also outperforming the mean are fellow German OEMs Mercedes (not including its 50pc-owned Smart, of whom more later) and the VW Group. But, as if to emphasise that the more robust performance of these German-based automakers cannot purely be pinned on the country’s BEV buyers preferring German-made, the latter’s standout brand in terms of volume sales relative to Jan-Nov ’23 was the Czech Skoda marque (see Fig.6).

Skoda volumes rose by 13pc from just over 20,00 units in Jan-Nov ’23 to top 23,00 in the same period this year, overtaking VW’s Audi as well as South Korea’s Hyundai and Opel to move from Germany’s eighth to fifth in Germany’s most popular all-electric brands.

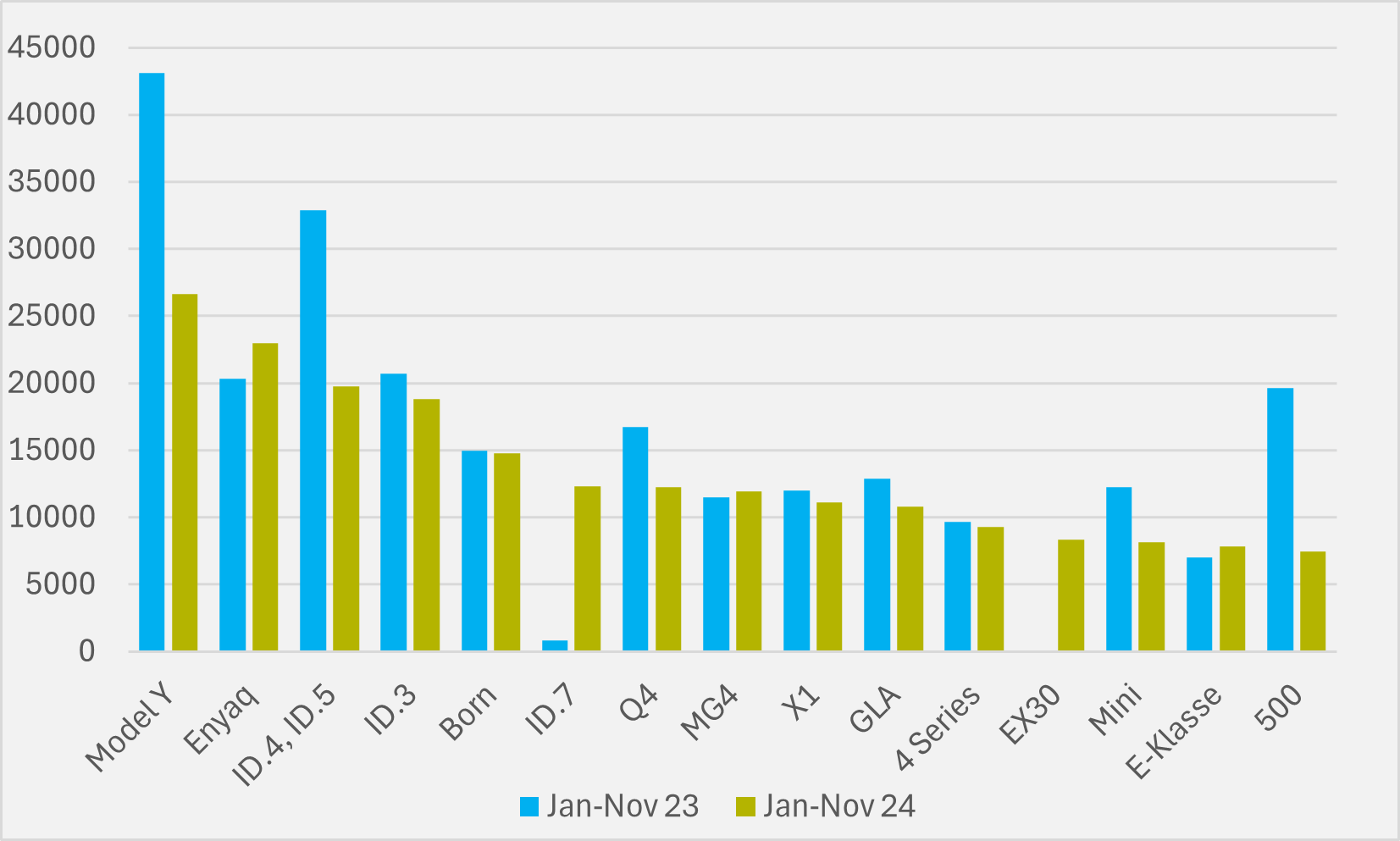

Its main BEV offering, the Enyaq, has proven Germany’s second best-selling BEV over the last 11 months after the Tesla Model Y, leaping above the VW ID.4&5 and ID.3 that outsold it in the same period last year (see Fig.7). The recently launched Elroq is also now providing additional volumes and could help maintain Skoda momentum in 2025.

The other VW volume brand to record a year-on-year increase in German BEV sales is the Spanish Cupra brand, although its German luxury marque Porsche has also seen a 19pc increase in volumes, from c.5,000 to c.6,000 units, with sales of the Macan launched early this year offsetting a drop in appetite for the Taycan.

Similarly, Cupra’s rise in sales is the result of the launch of the Tavascan, with interest in its Born largely flat year-on-year. Even standing still, though, represents progress in this year’s German market with the Born moving into the top five of German BEV models by sales.

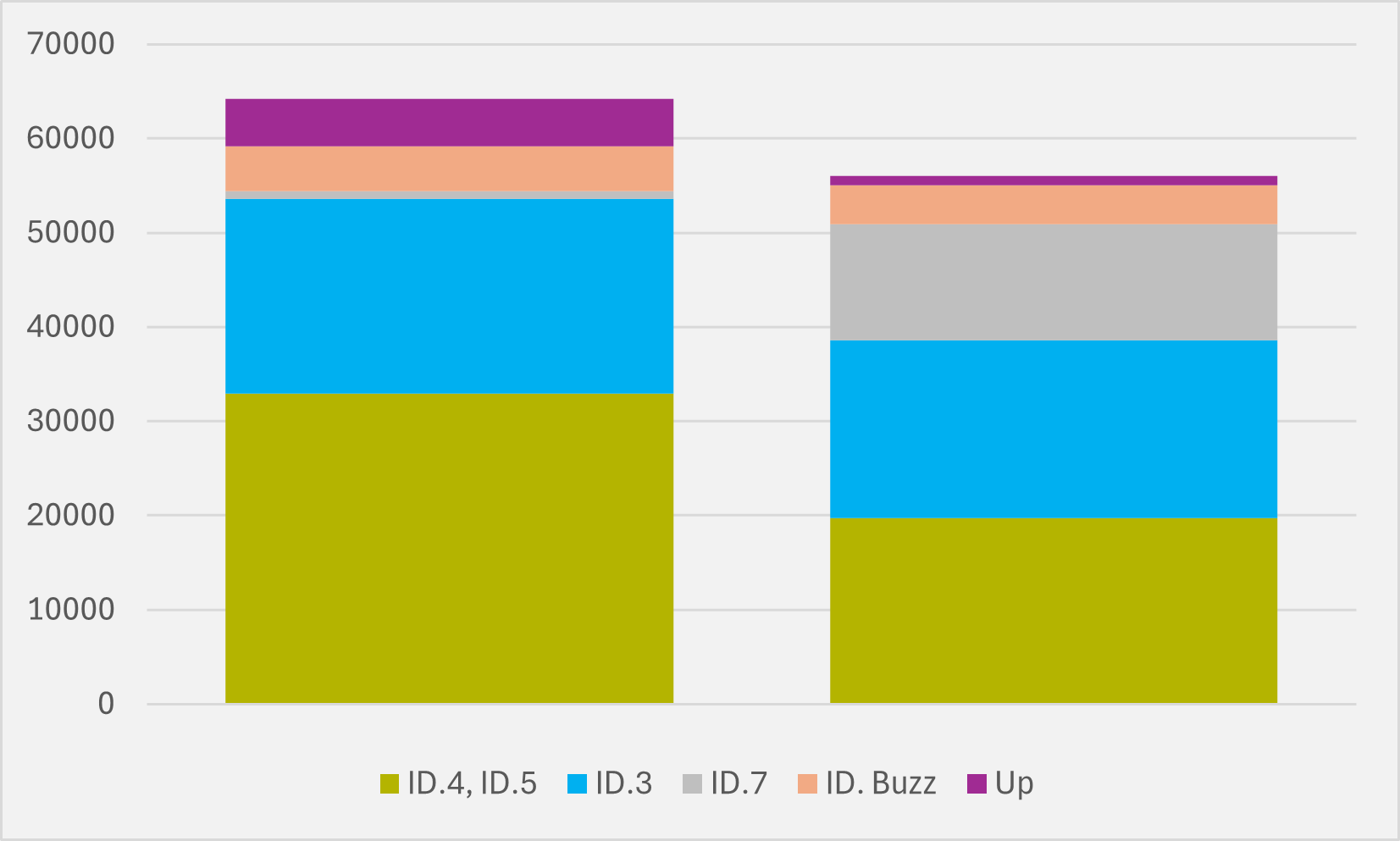

VW Group products in fact occupy every spot from second to seventh on the bestseller list (see Fig.7). But the VW brand itself has seen its Jan-Nov ’24 volumes slide by just over 10,00 units. A 40pc drop in ID.4&5 sales is the major culprit, although reduced sales of the now discontinued Up (-81pc), ID.Buzz (-13pc) and ID.3 (-9pc) have also contributed. Offsetting that, the ID.7 launched in late 2023 has added some 11,500 units to VW’s German BEV tally in its first full year of sales (see Fig.8).

VW’s premium Audi marque has been the worst performing of its volume brands year-to-date, with overall sales to German all-electric customers falling by a quarter. A halving of demand for the Q8 and a 27pc drop in appetite for the Q4 have done the material damage, with the launch of the Q6 failing to staunch the Audi bleeding.

Mercedes’ German BEV sales have remained robust above the 30,000 mark, as its biggest sellers have either made marginal gains — the E-Klasse up by 11pc and the GLB by 5pc — or limited their losses — the GLA down by 16pc. The recently launched G-Klasse G 580 may make a greater contribution next year.

Bad year

While Stellantis’ combination of volume and relative year-on-year losses is particularly bleak, it is only the worst performer in the first category. Its nearest contender for the crown for largest drop in absolute sales year-to-date goes to Tesla, but the largest year-on-year decline of any OEM that sold more than 25,000 BEVs in German in Jan-Nov ’23 has been recorded by Renault.

Tesla has dropped behind BMW but remains the third largest seller of all-electric vehicles in Germany by both brand and OEM, while the Model Y is still the most popular model. But the US firm’s sales to the end of November are down by some 26,000 units — second only to Stellantis' 41,000+ decline — a slump of almost 44pc.

Its share of the German BEV market has been compressed to 9.7pc, down three percentage points from the slice of the pie it could claim in Jan-Nov '23 (see Fig.9).

German buyers signed up for more than 43,000 Model Ys in the first 11 months of last year but less than 27,000 have taken the plunge so far in 2024, a drop of 38pc. The only good news for Tesla is that Elon Musk’s controversial embrace of US president-elect Donald Trump — unlikely to resonate with large swathes of the German BEV-buying demographic — in the second half of the year does not seem to have accelerated the decline in interest in Model Ys (see Fig.10).

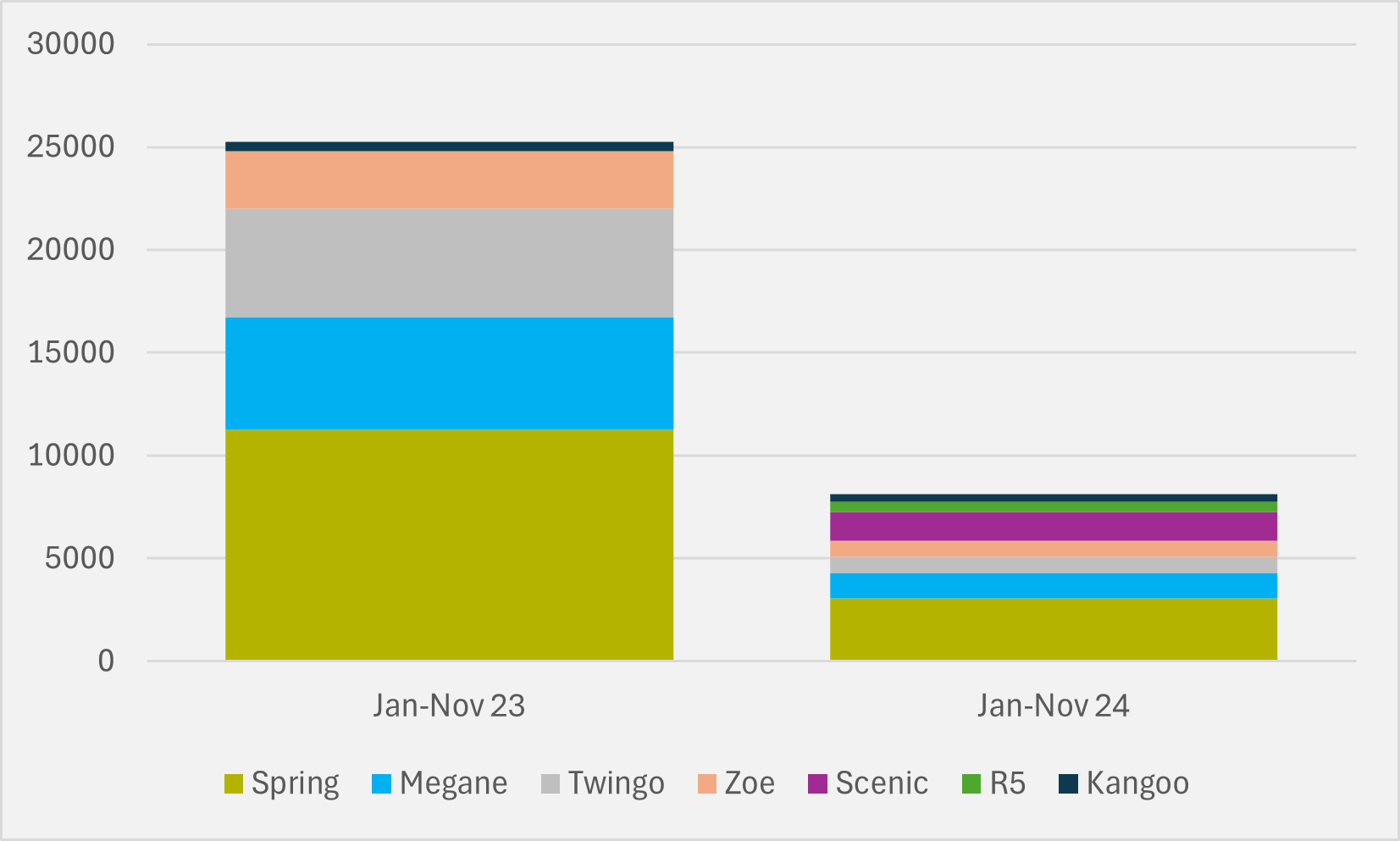

Renault has also had a tough year in Germany, both with its eponymous brand and with Dacia. Even before the imposition of additional tariffs on vehicles imported from China in October, the Chinese-made Dacia Spring — Europe’s cheapest BEV — had experienced a material decline in popularity. From having sold over 11,000 Springs up to November last year, Dacia has shifted only just over 3,000 so far this year, a fall of more than 70pc (see Fig.4).

All-electric Renaults have also toiled, dropping by 64pc year-on-year. While some of the decline can be attributed to understandable falls in sales of end-of-life Zoes and electric Twingos, of more concern to the French OEM will be a 77pc slide in demand for the Megane E-Tech, the first in its new generation of BEVs (see Fig.11). On the plus side, the new Scenic E-Tech and Renault 5 launched this year are beginning to contribute and will likely add more sales in 2025.

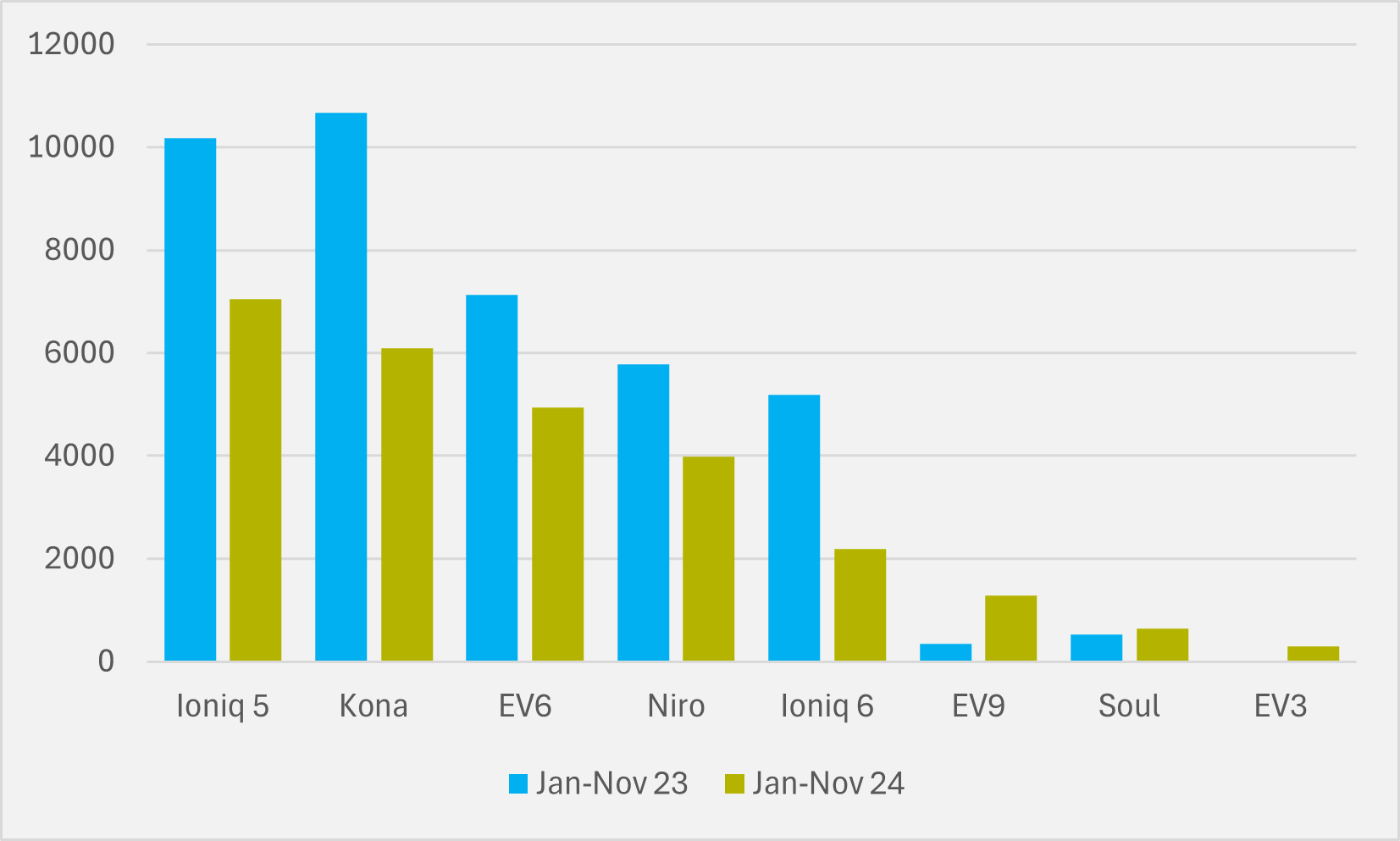

The narrative for Hyundai in other BEV markets, particularly in the US, may be a positive one, but not in Germany this year. While not performing as poorly as Stellantis, Renault or Tesla, group sales are down by around a third.

Its eponymous brand is the main cause of its struggles, with Jan-Nov deliveries down by c.10,000 units and by over 40pc. All three of its volume-selling models have struggled, with annual declines of 31pc, 43pc and 58pc respectively for the Ioniq 5, fully electric Kona and Ioniq 6.

Appetite for Kia BEVs has been more robust, albeit its volumes are still down by 19pc. The EV6 and Niro have both seen 31pc drops in sales over the first 11 months of the year relative to the same period in 2023, compensated to some extent by a full year of sales of the EV 9 launched late last year (see Fig.12). The recent debut of the EV3 raises the possibility of a similar tailwind going into 2025.

China becalmed

One other macro global trend not reflected in the German market as yet is legacy OEMs being squeezed by Chinese insurgents. Volvo — Gothenburg-headquartered and with Swedish heritage but in essence a Chinese automaker controlled by Geely — is the exception, with its EX30 B-segment e-SUV propelling it to a 70pc year-on-year increase in German BEV sales up to the end of November.

That said, older Volvo models have suffered, with 38pc and 51pc respective drops in demand for the XC40 and C40. And Volvo’s total German all-electric sales in Jan-Nov remain below 13,000 and it only just sneaks into the top 10 bestselling electric brands, albeit the just launched EX90 might allow it to make further progress next year.

It is too simple to suggest that Volo profits from a winning combination of Chinese EV knowhow and a recognisably European heritage, although it is clearly a helpful combination. Other brands with the same mix have found the German going rather harder.

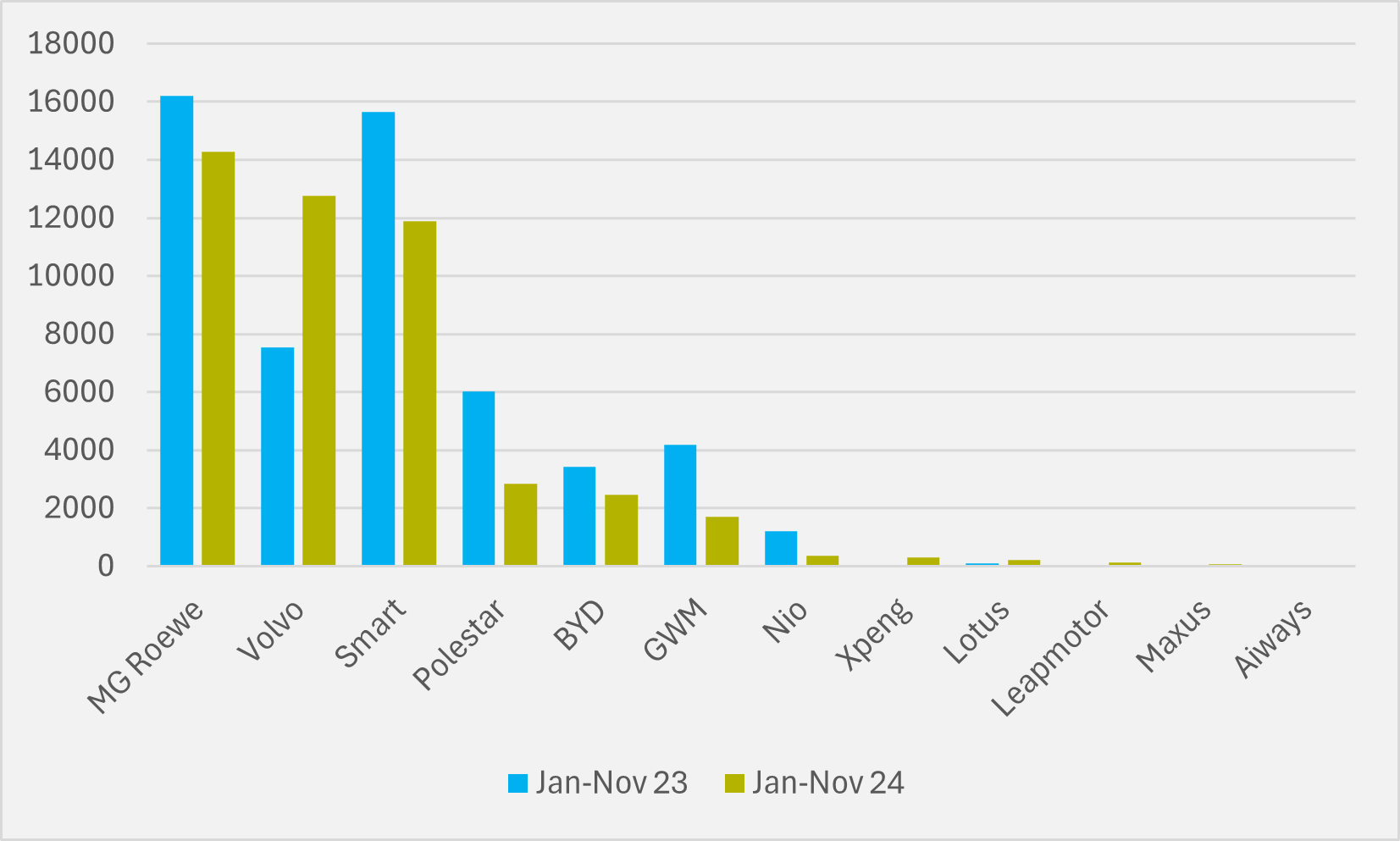

MG Roewe, the marque owned by China’s Saic but with roots in the UK car industry, sits one place higher than Volvo as Germany’s ninth bestselling BEV brand. But its progress has stalled somewhat with a 12pc slide in Jan-Nov sales (see Fig.13).

Similarly, Smart, the 50/50 joint venture EV pure play between Geely and Mercedes, has also suffered a reversal in German sales, which are down by 24pc year-to-date. And Polestar, once Volvo’s motorsport brand and also under the Geely umbrella, has lost 53pc of its German custom year-on-year, although it will be hoping for a ramp-up of Polestar 3 and 4 volumes to aid a rebound in 2025.

But even these struggling Chinese-European hybrid marques dwarf the sales achieved by Chinese brands entering Germany independently. BYD’s international ambitions might be giving legacy OEMs sleepless nights across Asia-Pacific but German auto executives, at least for now, will struggle to see the Chinese behemoth in their rear mirrors.

BYD has sold 28pc fewer cars in Germany in the first 11 months of the year, with total sales below 2,500. Yet this is still material compared to the efforts of other Chinese entrants such as GWM, Nio, Leapmotor and Aiways, which between them have sold less than 2,500 vehicles and, notably, almost 3,000 less than in the same period last year. The Chinese are not coming anytime soon in Germany.

Not big from Japan

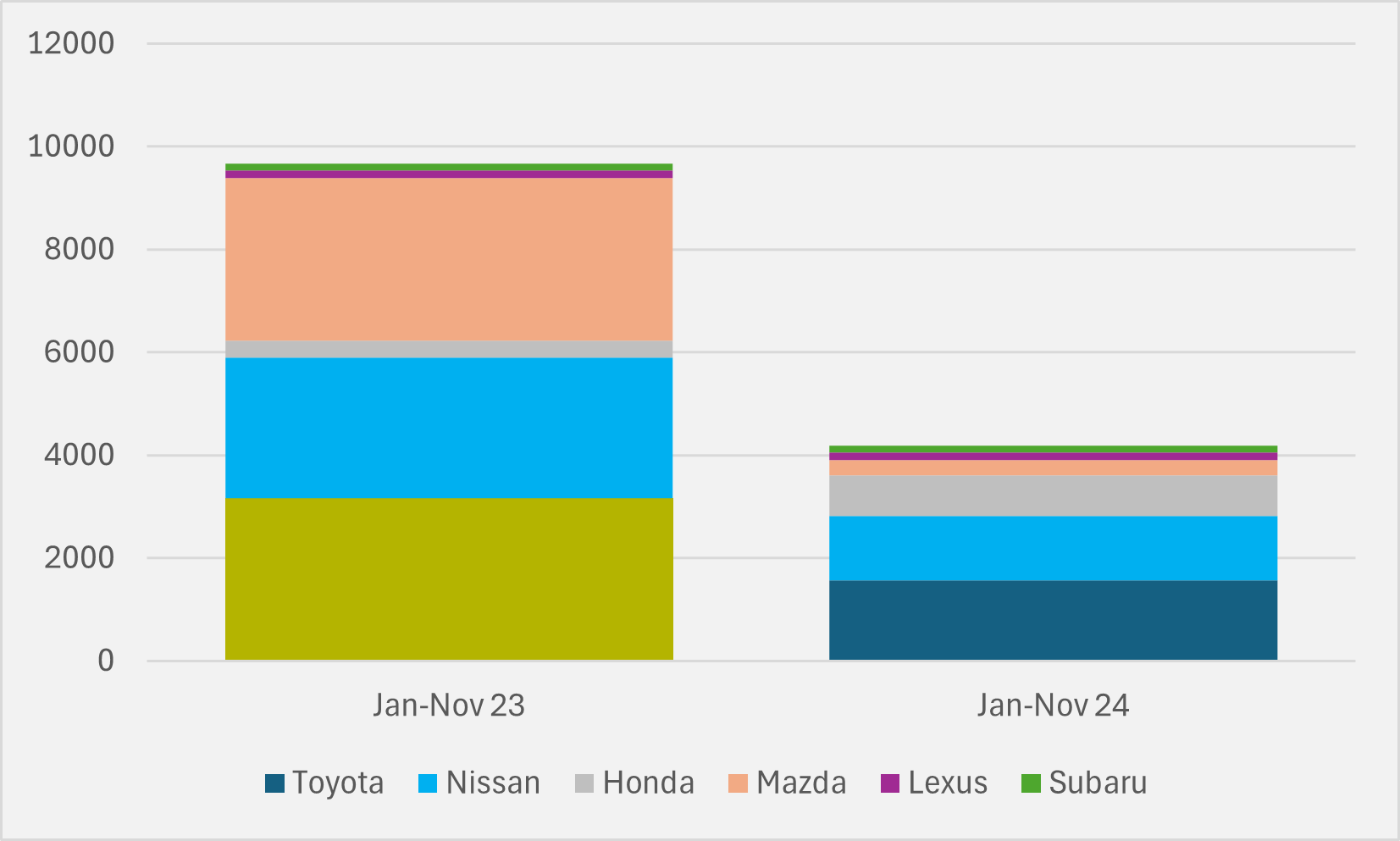

Nor, despite having combined German sales of all types of passenger vehicle this year of almost 220,000 and an 8.5pc market share, are any of the seven largest Japanese OEMs. Between them, Toyota, Nissan, Honda, Mazda, Lexus and Subaru sold less than 4,200 BEVs in Germany Jan-Nov, fewer than half of the volumes they sold in the same period last year (see Fig.14). Mitsubishi and Suzuki do not even offer any all-electric models for sale.

There is potentially an argument that sitting out the preliminary rounds of loss-making or thin margin BEVs before entering the market in earnest later in the game when technology is improved and pickings might be richer. But successfully pulling that off requires a laser focus on getting desirable and profitable products to market at the right time and the ability to generate momentum from largely a standing start, neither an easy task.

Japanese OEMs instead exhibit signs of multiple distractions, including questionable faith in a hugely extended runway for hybrids, a fascination with the dead end that is hydrogen as a personal mobility solution, and a preference for hail Marys like rapid switching to solid state batteries rather than putting in the hard yards with existing proven technology.

Add in the prospect of extended corporate consolidation that might ultimately shrink seven independent OEMs into two monoliths (Honda/Nissan/Mitsubishi and Toyota/Mazda/Subaru/Suzuki) and the huge current disadvantage for Japan’s automakers in the EU’s largest national BEV market might be the harbinger of more woes to come.

In particular for firms like Toyota, with the Prius, and Nissan, with the Leaf, that had such early mover advantages in the electrified and fully electric markets, it must be a source of great frustration for their shareholders that they find themselves so far behind in the race towards what will be the dominant automotive technology of the next few decades.

Insider Focus LTD (Company #14789403)