Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

Equity commitments within software JV could add up to a substantial minority stake, while working relationships are only going to get closer

German OEM Volkswagen will own c.22pc of US EV pure play Rivian based on the former’s equity commitments to the latter as part of their software joint venture (JV), EV inFocus calculates based on current share prices. And, while not an exact science, a stake anywhere near this size will likely only add to speculation that the endgame of the collaboration may be a VW takeover of the US firm.

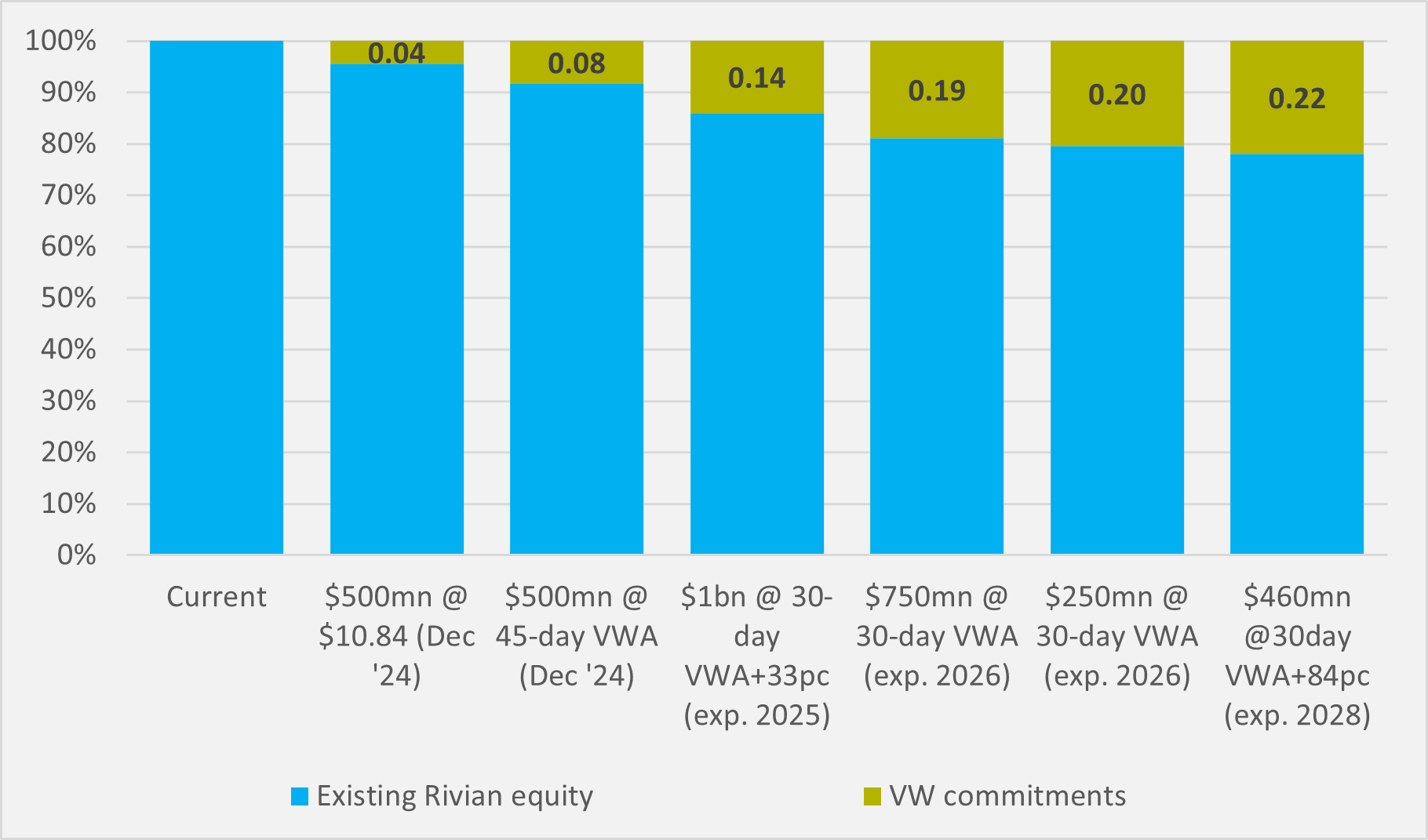

It is not possible to calculate exactly how much of Rivian VW will end up owning for its commitment, subject to certain milestones, to inject $3.46bn into its partner’s equity. Beyond an initial $500mn tranche for which VW will pay $10.84/share, all other investments will be based on volume-weighted average prices (VWAPs) of Rivian’s share price in the preceding 45 or 30 trading days.

And Rivian CFO Claire McDonough explicitly says that these floating prices have been inserted to means that, if Rivian’s share price strengthens in coming years, there is a “reduction in dilution” of existing shareholders.

This looked like it might be playing out on a small scale earlier in the week, with Rivian shares jumping on Wednesday following news of the official consummation of the VW deal late on Tuesday. But, having jumped as high as $12/share at its peak, Rivian’s share price has now fallen back into single figures again.

Paying a premium

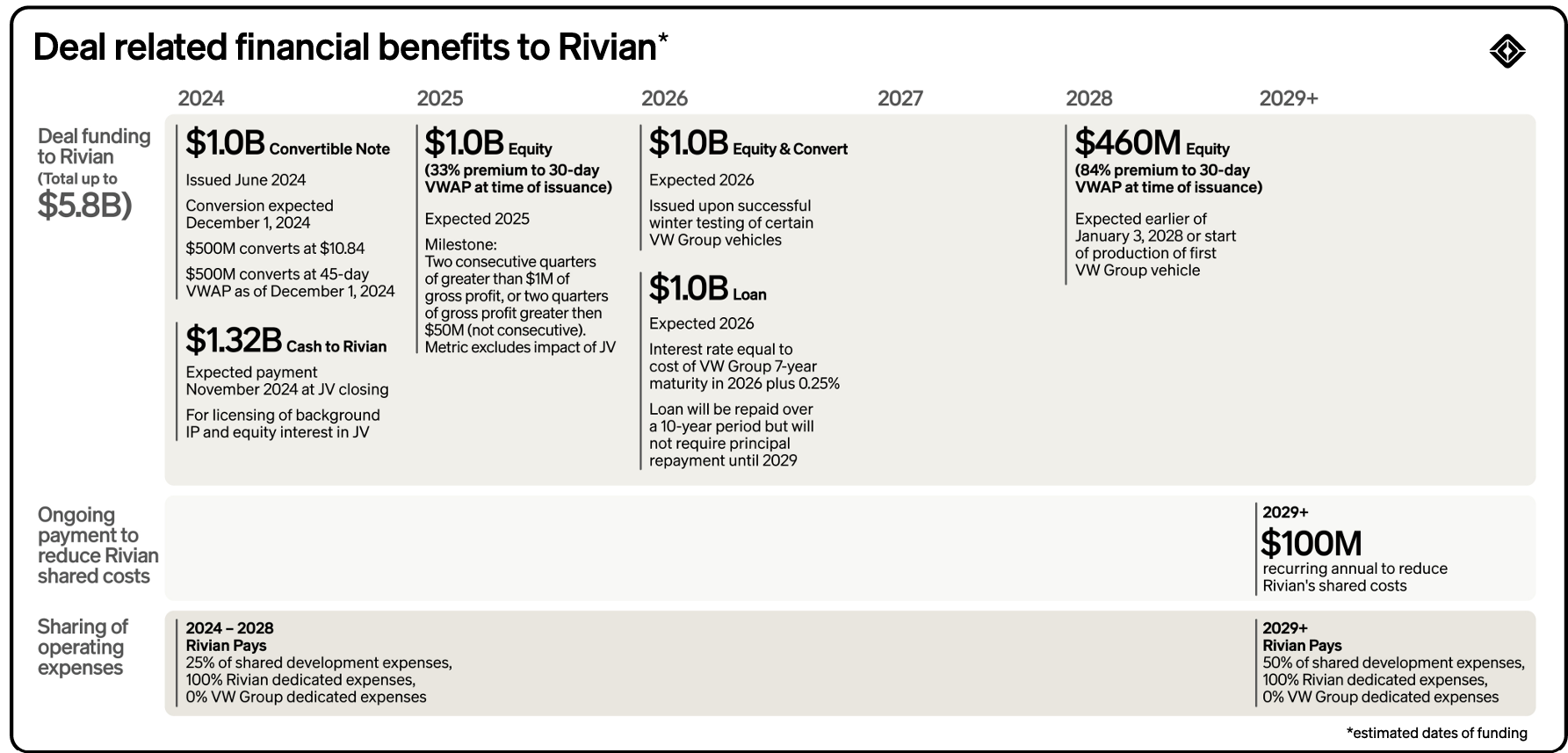

There are also premia to the VWAPs involved in two of VW’s future commitments (see Fig.1):

1) A 33pc premium over the 30-day VWAP on a $1bn injection no earlier than June 2025 and conditional upon Rivian’s achievement of, starting from Q4’24, either, i) two quarters of $50mn or greater of gross profit, excluding the accounting impacts of the JV, where the two quarters are not required to be consecutive, or ii) two consecutive quarters of $1mn or greater gross profit excluding the impacts of the JV;

2) An 84pc premium over the 30-day VWAP on a $460mn investment into Rivian equity at the earlier of January 2028 or first production of a saleable Volkswagen vehicle using the JV’s technology.

“First, we included an additional $320mn increase in the payment at the closing of the JV,” says McDonough on changes to the financial considerations since the deal was agreed in June. “In addition to that, we have added a 33pc premium in the 2025 equity investment.

“What this effectively means is that there is $750mn of economic value associated with the sale of $750mn-worth of shares, plus an $250mn overall premium which is reflected in the 33pc premium to the VWAP,” she continues. “We will still receive $1bn of capital, but that $1bn will be in exchange for $750mn in shares.

“We have also introduced a new equity investment in late 2027 or January of 2028 — depending on the milestone achieved,” McDonagh adds. In this, VW pays for an additional $250mn-worth of shares it did not get in its 2025 investment but, because of the 84pc premium here, pays an additional $210mn for the privilege.

Upping its stake

It is possible to calculate VW’s share buying based on current values of the relevant commitments, which — while not predicting the future VWAPs at which VW will buy equity — gives a guide to the extent of how much of Rivian the German OEM will own. Based on a current 1.1bn share count, VW’s $500mn injection at the start of December at $10.84 share will give it just over 4.6mn shares and a c.4pc stake.

While any resumption of a Rivian stock rally could bring the 45-day VWAP slightly higher, the additional $500mn due next month looks set to equate to another 4pc stake. The $1bn expected in 2025 would, again at current share price levels, bring VW’s stake up by another six percentage points to 14pc, while the two 2026 additions of a combined $1bn would further bolster that figure to 20pc.

Finally, the $460mn slated from late 2027/early 2028 would, at current levels, mean VW had amassed 22pc of Rivian stock (see Fig.2). And that has led to speculation that the German OEM could go further and launch a takeover bid.

Getting closer...

Both sides are keen to emphasise at this stage that there are strict parameters to the JV, which is limited to software and electrical architecture, but excludes not just vehicle development but also drivetrains and autonomy. However, while Rivan suggests that it could potentially sign deals with other partners for its technology, it is not in any rush to jump straight into bed with another OEM.

“So much trust had to be created because of the importance of this deal and, of course, the scale and scope of it for Volkswagen Group,” says Rivian CEO RJ Scaringe. “And so, while this represents a focused joint venture around software and electronics… certainly the depth of the relationship that we have built with Volkswagen and the senior leaders there — and the deep relationships that continue to be grow — represents an opportunity for us to look at other things together.

“But that is not, of course, covered in the joint venture and there is nothing to comment on specifically,” he stresses. Nonetheless, hardly the words of a man who does not see the likelihood of the VW-Rivian entwining increasing over time.

“We certainly have had discussions with others, and we believe the technology has wider-ranging applications beyond Rivian products or Volkswagen Group products,” Scaringe says of other possible future relationships. “But, to be clear, we have such a significant amount of activity… over the coming months just to execute on R2 and subsequently the Volkswagen Group products.”

So again, a distinct reluctance to look beyond VW as a partner. And lack of other third-party OEMs as Rivian technology buyers would, of course, mean fewer complications should VW want to launch a future bid.

It is also notable, if perhaps inevitable, that application of Rivian software in the VW Group will closely map the US firm’s product pipeline. Premium Audi and Porsche models on the Premium Performance Electric (PPE) architecture will be first, based on the technology being delivered for the R2.

Then, as Rivian moves more towards the mass market with its planned R3 model, then also a second stage of the JV will see software introduced into VW’s volume lines.

...but keeping things separate (for now?)

But the US partner is keen to stress that it is supplying back-end technology, and VW will be free to make its cars’ driver-facing interfaces distinct from those of Rivian. “The joint venture entails... all the vehicle software with the exception of anything around autonomy,” says Scaringe.

“The core zonals will be... the infotainment platform and the connectivity platform. But this often gets confused for design of the user interface. What the pixels look like on any screens in the vehicle, that is set by the respective brands,” he explains.

“In the case of a VW Group company, those individual companies will be setting the UI strategies and essentially arranging the pixels on their screens the way that they would like. A Rivian will feel like a Rivian, a Porsche will feel like a Porsche. The intent is not to have our design language in terms of user interface permeate across Volkswagen brands or vice versa.”

Rivian may be particularly sensitive to emphasise differentiation after commentators highlighted what they say as similarities between the first concept unveiled by VW’s US-only e-truck and adventure SUV brand Scout and the R1T (see Fig.3).

“From what we understood about the relationship, it had to do with electrical and software, but the car looks a lot like R1. To what extent can we expect there to be sort of a similar line-up from Volkswagen with regard to Rivian? How closely will you be cooperating on aesthetics as well as engineering?” George Gianarikas, analyst at investment bank Canaccord Genuity asked on Rivian’s Q3 earnings call earlier this month.

“Our platform is going to be used across a wide range of products and brands, and each of those products and brands will have decisions around what the vehicle itself looks like,” Scaringe assured him. “With regards to our role in any design decisions, those decisions remain with the brands… within Volkswagen Group.”

So Rivian may be keen to stress that it will not be providing vehicle templates for new VW EVs, or even the German firm’s screens and buttons configurations. But the sheer weight of VW’s investments into Rivian stock — and the inevitably closer relationships that the employees of the two firms working together within the JV will develop — all signpost towards an embrace with an outcome where eventual marriage seems like the short odds bet.

Insider Focus LTD (Company #14789403)