No Kathleen Valley stope this month – Liontown

The firm is aiming to shift to underground production next month, and maintains everything is on schedule

What Tesla looks like by the end of the decade could be radically different

The CEO of an automaker should intrinsically want to sell more cars. He or she may have short-term reasons why that aim is unlikely or a low priority — be it production constraints or a product line-up that is not geared towards stimulating demand or selling at an attractive margin — but the medium-to-long-term idea is primarily to shift more units.

Tesla’s Elon Musk, on the other hand — while cursorily referencing “staying focused on maximising volumes” in his firm’s Q4 analyst call — gives off a strong impression that, if 2023 turns out to be the peak of Tesla’s vehicle sales, he will not be particularly bothered. Tesla global sales fell by 1pc last year from 1.81mn in 2023 to 1.79mn in 2024 (see main image).

Musk suggests that battery production is the reason why Tesla sales have fallen. “Our current constraint is battery packs this year, but we are working on addressing that constraint,” he says. “Right now, the constraint we are trying to solve is battery production, as opposed to demand.”

This not something that Tesla commentators have suggested is behind Tesla selling fewer vehicles. Nor does it mesh particularly well with what the firm is saying about inventories and margins.

CFO Vaibhav Taneja says that “coming into the fourth quarter, our focus was to reduce inventory levels in the automotive business”. That does not sound like a company which is having to dampen the pace of deliveries to expectant customers owing to a manufacturing constraint.

“We accomplished that by ending the quarter with the lowest finished good inventory in the last two years,” Taneja continues, but admits that the inventory reduction was “a result of offering not only attractive financing options but also other discounts and programmes which impacted average selling prices (ASPs)”. In other words, Tesla sold fewer cars in 2024 compared to 2023, despite efforts to stimulate demand with incentives.

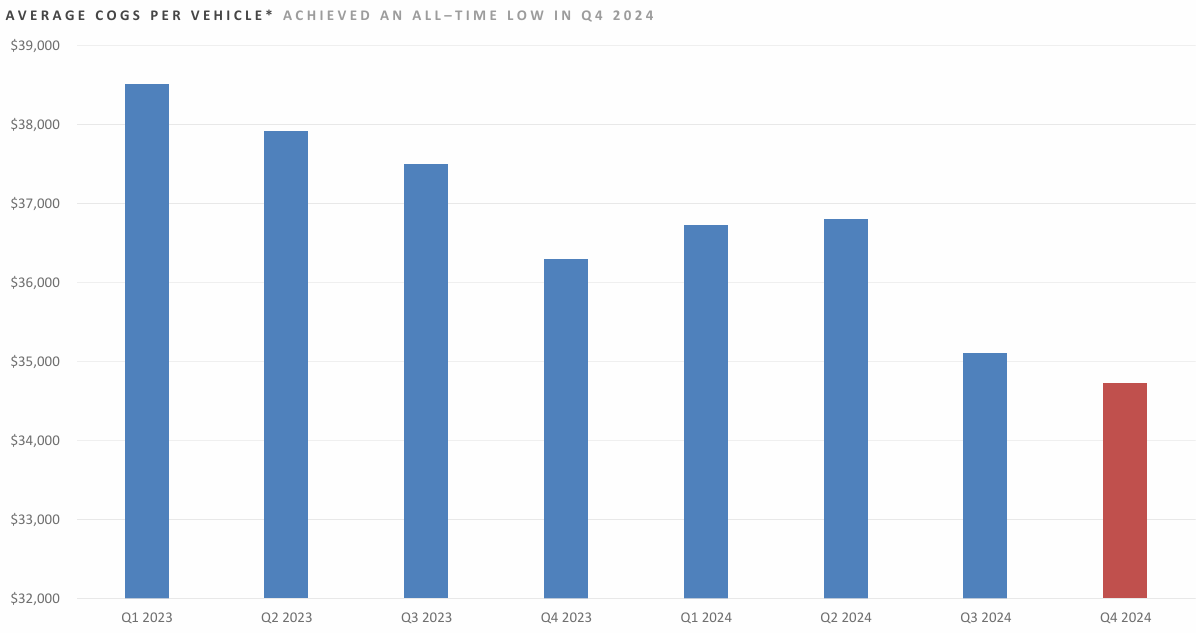

“On the automotive margin front, we saw a quarter-over-quarter decline primarily due to lower ASPs,” the finance chief further admits. And these lower margins were despite Tesla getting its production costs lower, to under $35,000 average cost per car on the back of lower prices for raw materials input (see Fig.1). So, Tesla price slashing was outstripping its cost savings.

Under pressure

Tesla does not officially break down its global sales by geography. But Taneja reveals that, in Q4, the firm “hit a new record for deliveries in the Greater China market”, which he sees as “an encouraging trend since we grew volume in a highly competitive BEV market”.

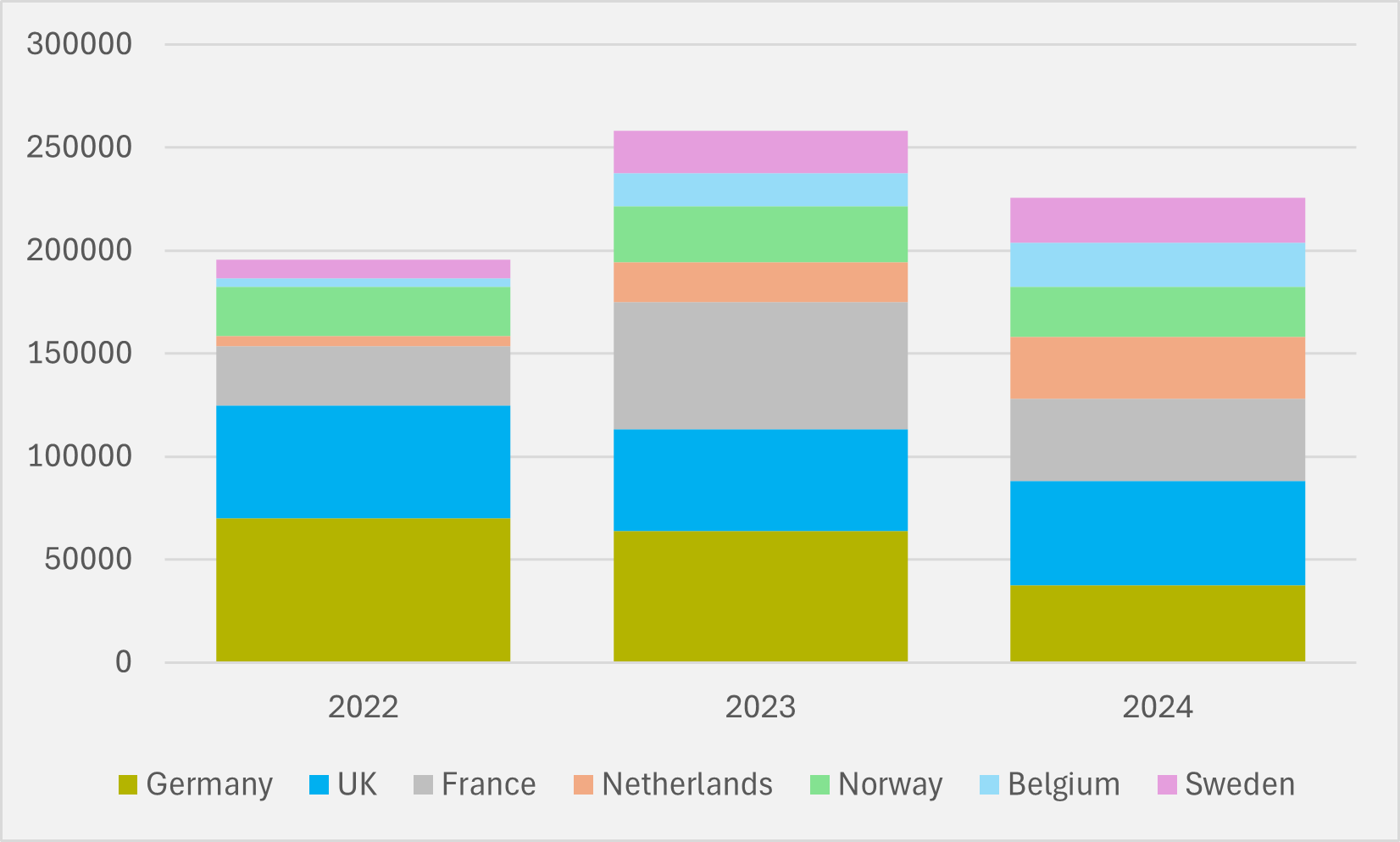

This China growth suggests that other markets were under greater pressure than Tesla’s overall global rate of sales decline. In Europe’s seven largest national markets for BEV sales, for example, volumes were down by 12.6pc year-on-year in 2024, in an overall market where BEV sales slipped by just 2.5pc.

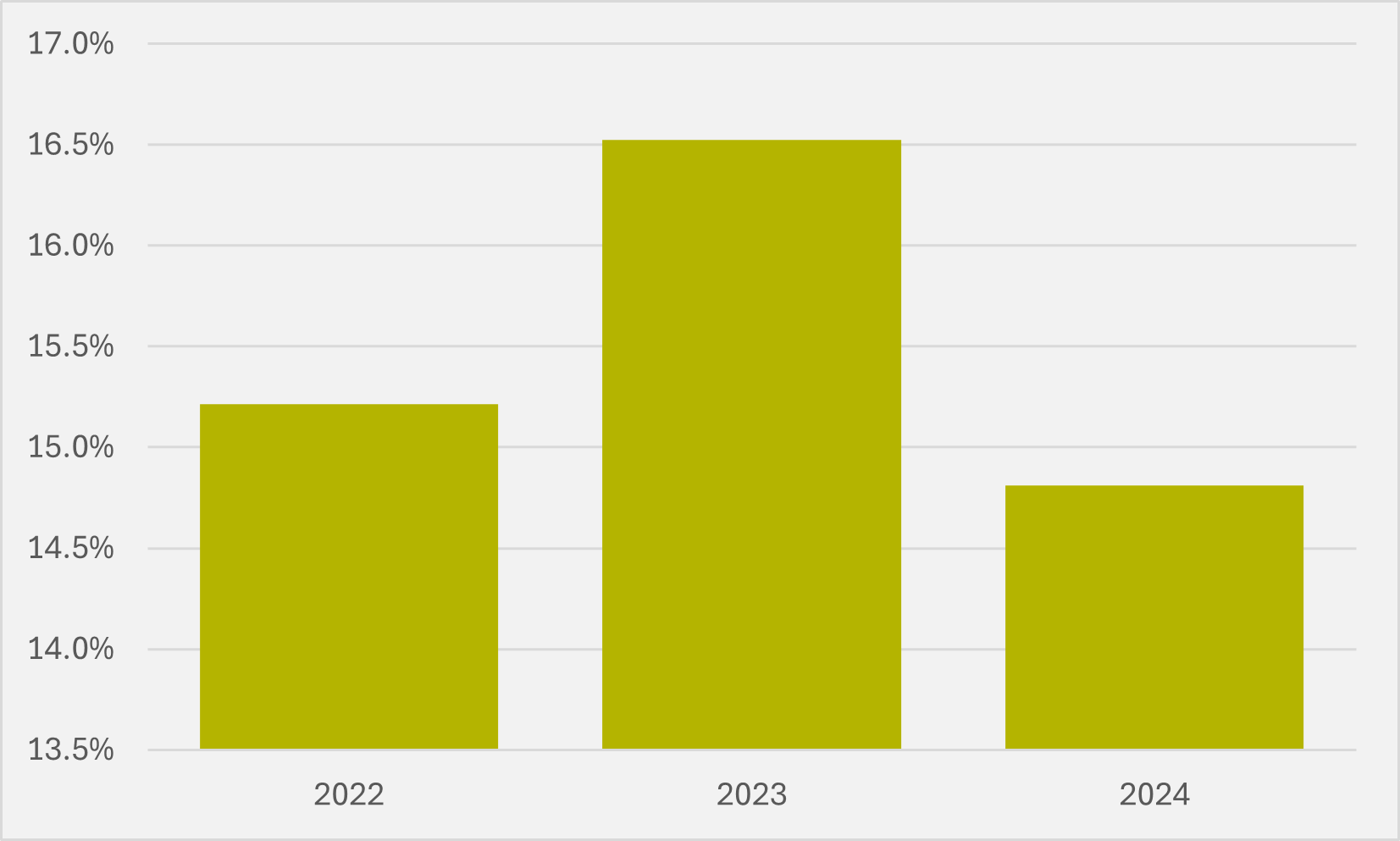

Across Germany, the UK, France, the Netherlands, Belgium, Norway and Sweden, Tesla sold just over 225,000 vehicles last year, compared to almost 260,000 in 2023 (see Fig.2). That saw its share of the all-electric market across the seven countries fall from 16.5pc to 14.8pc, lower even than the 15.2pc share it could boast in 2022 (see Fig.3).

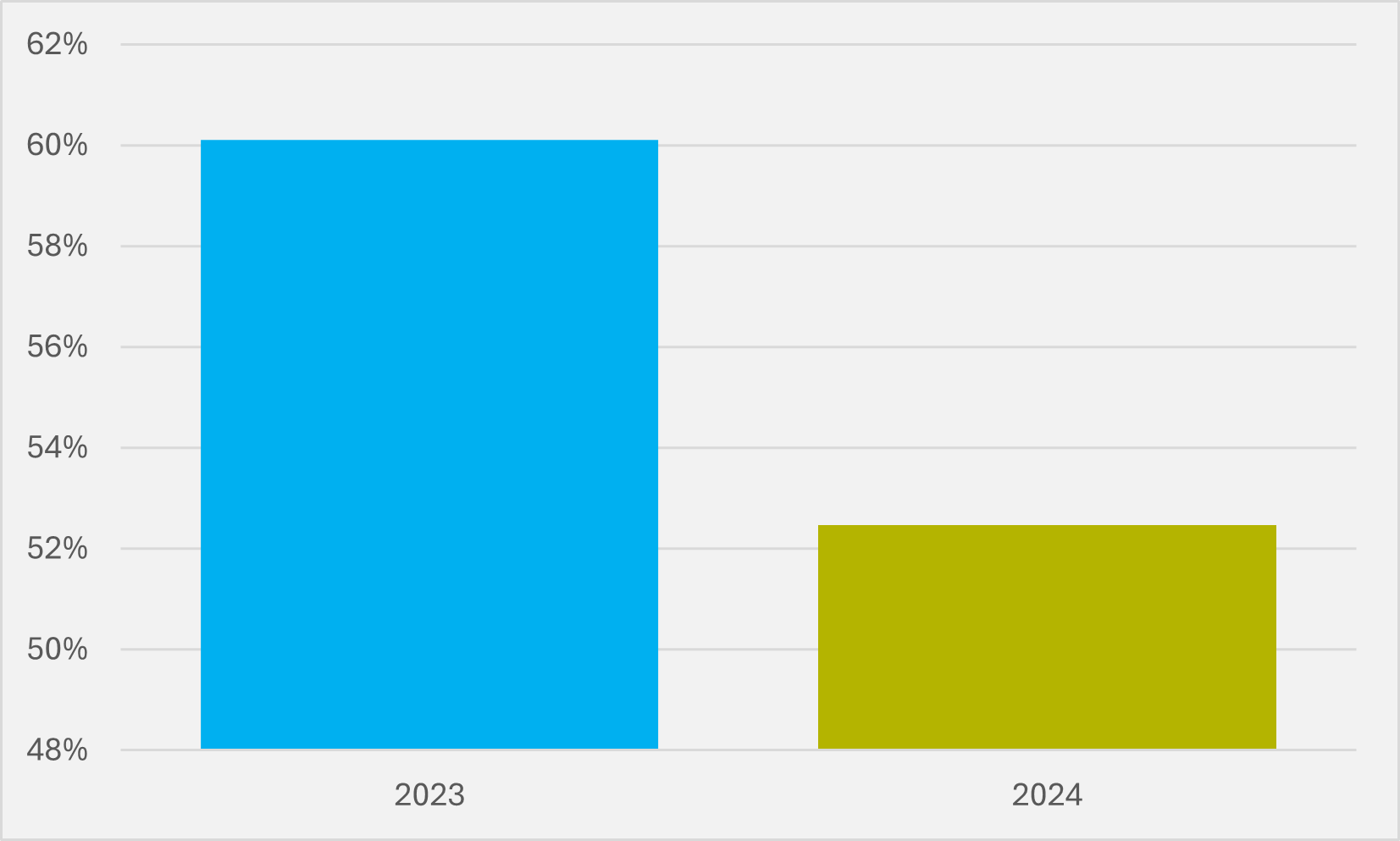

In California, according to data prepared by consultancy Experian Automotive for industry group the California New Car Dealers Association, Tesla sales fell by 11.2pc year-on-year in the state, the US’ largest BEV market, in 2024, even as total all-electric sales in CA crept slightly higher. The firm shifted just over 203,000 units for a 52.5pc market share of California’s BEV sales, compared to more than 230,000 and a 60pc market share in 2023 (see Fig.4).

Analysts have touted three reasons other than Musk’s proffered battery constraint for Tesla’s lower sales: more competitive BEV offerings from other OEMs; Tesla’s ageing line-up outside of its Cybertruck e-pickup that has thus far proven doubters right about being a niche product; and Musk’s political lurch to the far right deterring the largely more liberal buyers of all-electric vehicles.

Tesla obviously cannot stop competitor innovation, so this is a factor largely out its control. In contrast, Musk’s political posturing is entirely on him. Given that last week he was telling neo-Nazis in Germany — where Tesla has already lost a corporate customer for political reasons — they should fell less guilty about Hitler, we can safely assume he has no plans to stop alienating left-leaning potential buyers of his current main product.

Product refresh

Tesla is, admittedly, doing something about its range, with the Model Y refresh rolling out in H1 this year to join the Model 3 update launched in late 2023. But, while the firm has been continuing to cut Model 3 and Cybertruck lease prices in the US to try to stimulate demand, it is not being aggressive on price across the board — which could impact sales momentum.

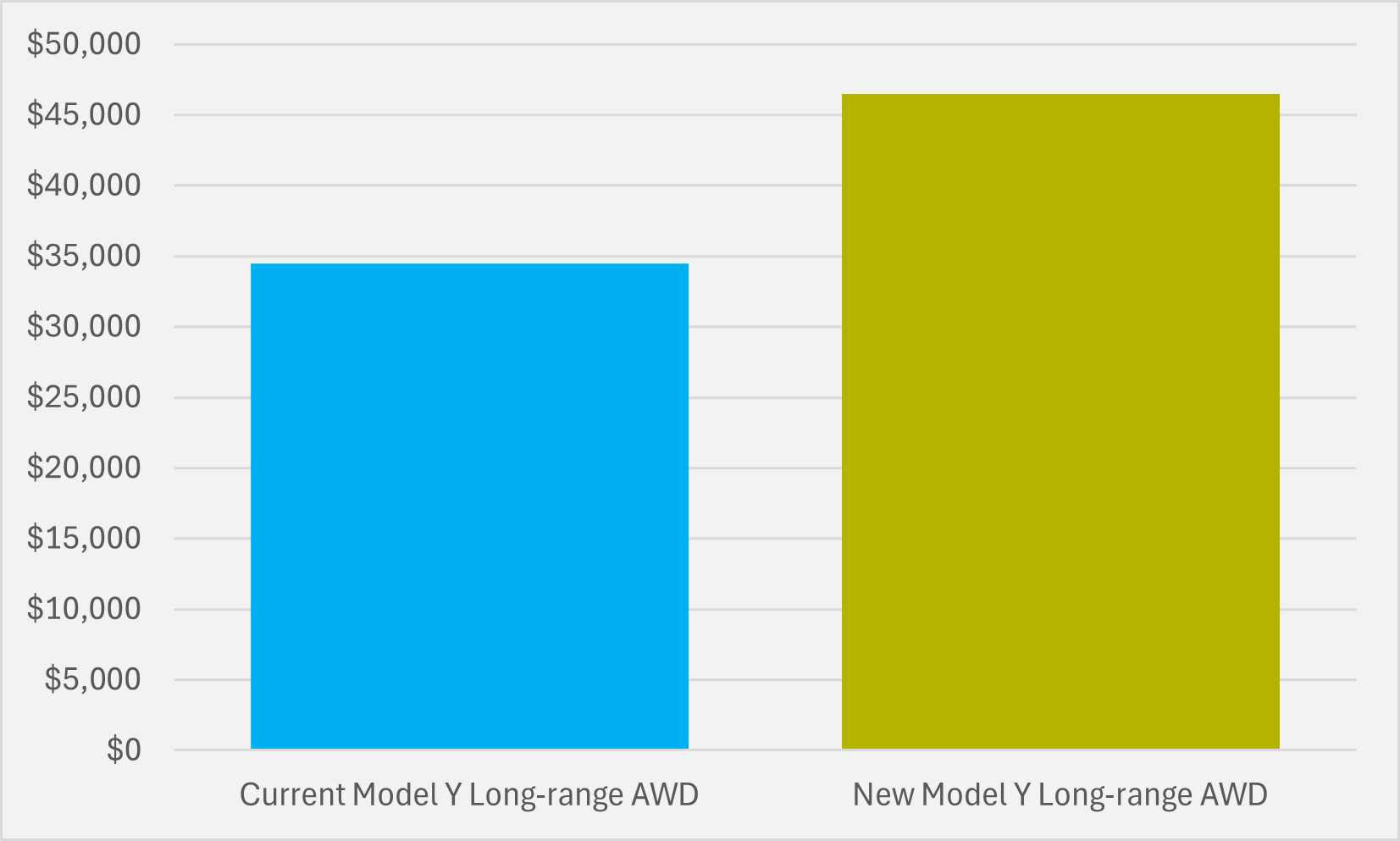

In Canada, for example, it has announced C$4,000-8,000 ($2,800-5,550) price rises from early February across the 3, Y, S and X. And US pricing for the new Y long-range AWD will have a sticker price of $61,630 including destination and order fees, but excluding taxes and any other fees, and will offer upgrades that will increase the price.

Even after Tesla discounts the $7,500 federal tax credit and its estimate of $6,000 in savings from not having to purchase gasoline over five years, it gets to a price of $46,490, compared to $34,490 for the comparable current model. In other words, the new Y carries a 35pc premium that is likely to temper the impact of the refresh on customer appetites (see Fig.5).

Unusually reticent

There is a perhaps telling reluctance from Musk to quantify any possible increase in 2025 sales — albeit he cannot resist predicting sales “going to go ballistic next year, and really ballistic in ’27 and ’28”. “We are working hard to grow our annual volumes,” is all he offers for this year.

And when Barclays analyst Dan Levy suggested that there could now be a disconnect between Tesla previously being “willing to sell cars at effectively no margin to get the cars out there and “a comment in the release today [that] the rate of acceleration of autonomy efforts does impact volume growth”, Musk pointedly ducked the question.

“We expect the vehicle business to return to growth in 2025,” Tesla officially says. “The rate of growth will depend on a variety of factors, including the rate of acceleration of our autonomy efforts, production ramp at our factories and the broader macroeconomic environment.”

The firm then goes on to emphasise its lack of clarity on two more occasions. “We will manage the business such that we maintain a strong balance sheet during this uncertain period,” it says, then highlights its ability “to prudently grow our vehicle volumes in a more capex efficient manner during uncertain times”.

Hardly the usual unrestrained bullishness we have come to expect from the Musk-led company. And CFO Taneja is equally cautious, specifically about the potential impact of the new Y.

“While we feel confident in our team’s abilities to ramp production quickly, [we] know that it is an unprecedented change and we are not aware of anybody else taking the best-selling car on the planet and updating all factories at the same time,” he warns. “This changeover will result in several weeks of lost production in the [first] quarter.”

He is also worried about the potential impact of a trade war, ironically likely to be sparked by his boss’ new BFF Donald Trump.

“There is a lot of uncertainty around tariffs. Over the years, we have tried to localise our supply chain in every market, but we are still very reliant on parts from across the world for all our businesses,” Taneja says. The imposition of tariffs, “which is very likely”, therefore “will have an impact on our business and profitability”, he admits.

Model 2.5

Musk continues to suggest a mid-year launch for a more affordable Tesla — which could obviously help with 2025 sales momentum, should it appear on schedule — but with a marked lack of any great enthusiasm. It is also worth noting exactly what this plan entails, and what it does not.

Following the reveal of the Cybercab — a two-seater, self-driving robotaxi — in October, some analysts have continued to suggest that the so-called Model 2 could be a version of it with a back seat and steering wheel. But Tesla remains explicit that the next launch will be modified version of existing products, a Model 2.5 if you like, not something derived from Cybercab.

“Plans for new vehicles, including more affordable models, remain on track for start of production in the first half of 2025,” it says. “These vehicles will utilise aspects of the next generation platform as well as aspects of our current platforms and will be produced on the same manufacturing lines as our current vehicle line-up.

“This approach will result in achieving less cost reduction than previously expected,” it continues, while it also “should help us fully utilise our current expected maximum capacity of close to 3mn vehicles, enabling more than 60pc growth over 2024 production before investing in new manufacturing lines”. In contrast, its “purpose-built robotaxi product Cybercab will continue to pursue a revolutionary ‘unboxed’ manufacturing strategy and is scheduled for volume production starting in 2026”.

In other words, the ‘new’ more affordable Tesla is definitely not going to be all-new. And any drivable variant of Cybercab, should it ever appear, is years down the track.

Semi-excited

Pretty much the only automotive sales prospect Musk seems enthused about — given there was almost no mention at Q4 results of the Roadster despite it supposedly be due to ship this year; the slide deck has it “in development” but without even confirmation of where it will be built — is the Semi heavy-duty e-truck. Closing out the walls of its Nevada factory was achieved in late January, and Tesla is now preparing for mechanical installation of the facility’s equipment over the coming months.

“The first builds of the high-volume Semi design come late this year in 2025 and begin ramping early in 2026,” says Lars Moravy, Tesla’s vice-president, Vehicle Engineering. “The Semi is a total cost of ownership (TCO) no-brainer”.

Based on this TCO advantage, “it is much, much cheaper than any other transportation you can have”, Moravy contends. “When we are at scale, it will meaningfully contribute to Tesla's revenue.” And he suggests that the price will be “set by how much people [are prepared to] pay”.

“It is a several billion a year opportunity,” adds Musk. “These days, does several billion a year matter? I think it does. It is not nothing. It is probably like a $10bn/yr thing. That is $1bn/month at some point probably.”

But even his enthusiasm for Semi is tied up with autonomous driving (AD). “I do think that Tesla Semi, again with autonomy, is going to be incredibly valuable. That we actually have a shortage of truck drivers in America is one of the limiting factors on transport,” he suggests.

“When you consider there are more people leaving truck driving as a profession than entering it, well, we are going to have a real logistics problem as time goes by. So, autonomy will be very important to meet that need.”

Priorities

This reflects the overarching theme of Musk’s Q4 narrative: making vehicles is relatively small fry; perfecting AD software and scaling Tesla’s Optimus robotics are where the real future value of the company lies.

“I was going to say doubling down on autonomy, but really… autonomy is like 10x-ing,” Musk contends. “Optimus has the potential to be north of $10trn in revenue. It is really bananas,” he adds.

EV inFocus is an e-mobility intelligence service, so we are not qualified to prognosticate on Tesla’s autonomous robotics ambitions. But AD is something about which we have thought a lot.

Our view remains that, in the short-to-medium term, the greatest value for those developing AD capability will be to monetise it in non-public settings — within closed transport routes, manufacturing facilities, ports and logistics depots, the passenger side of transport hubs, or defined locations such as educational campuses that choose to go AD-only — rather than on public roads, where it may not become material until closer to 2040, rather than 2030. But this is just our take.

Musk’s is different. And it is worth digging into his vision in some detail, to fully understand the roadmap he has in mind. He aims to introduce unsupervised Full Self-Driving (FSD), in other words Level 4/5 AD, in Austin in June, i.e. in less than five months’ time.

“Sometimes people say, ‘Elon's always late,’,” he responds to understandable scepticism on this timetable. “Actually, no, the problem is that the media reports on when I am late, but never reports when I am early. So, sure, I am optimistic, but I am not that optimistic.” He cites factory completions, such as Shanghai, as examples of Tesla hitting or even bettering deadlines.

Unsupervised FSD will then roll out to “several other cities in America by the end of this year, then probably everywhere in America next year, everywhere in North America at least”. But what does that really mean?

Musk says that the Tesla internal fleet will be initially “testing” unsupervised FSD. “That is our sort of toe in the water. We will be scrutinising it very carefully, make sure [there] is not something we missed. But it will be autonomous ride-hailing for money in Austin in June.”

Not-so-quietly confident

Just to clarify, before the end of June, Musk expects not only to be in a position for some Tesla-owned vehicles to be doing Level 4/5 AD in public, but a not-yet-launched ride-hailing app will also be monetising this activity. That would be quite some achievement.

Not that Musk thinks so, either on the AD tech or the ride-hailing platform. “We would want to prove to ourselves, and also prove to regulators, that the car is unequivocally safer in autonomous mode than not. And we are not far off. This is like low single-digit months,” he says of rolling out L4+ autonomy.

As for an app, “it is not like we are splitting the atom here”. “It is just a bunch of work that needs to be done to make sure the whole thing works efficiently; that people can order the car, it comes, it is [in] the right spot, does exactly the right thing; all the payment systems work, the billing works,” the Tesal chief assures.

Yet there appears to be a caveat to his confidence. “I expect us to be… doing unsupervised activity with our internal fleet in several cities by the end of the year,” he continues. Which is notably not a commitment to ride-hailing anywhere outside of Austin.

Reinventing the owner-car relationship

In 2026, the ride-hailing service, presumably once it has expanded out of Texas, is then planned to be opened up so that private drivers can add their Teslas with unsupervised FSD into the pool to act as robotaxis when they are not driving them. The Tesla chief remains evangelical on the potential to reinvent owners’ relationship with their vehicle.

“A passenger car typically has only about 10 hours of utility per week out of 168, very small percentage,” Musk says. “Once that car is autonomous, my rough estimate is that it is in use for at least a third of the hours of the week. So, call it 50, maybe 55 hours of the week. And it can be useful both for cargo delivery and people delivery.

“Even, let us say, people are asleep, you can deliver packages in the middle of the night or resupply restaurants or whatever the case may be, whatever people need at all hours of the day or night. That same asset — these things that already exist with no incremental cost change, just a software update — now have five times or more the utility than they currently have. I think this will be the largest asset value increase in human history,” he enthuses.

EV inFocus is unconvinced more than a relatively small minority of people will want to use their cars like that. After all, to use the Airbnb example of which Musk is fond, these tend to be a range of self-contained, holiday or additional properties, not rooms within the houses where people actually live, despite many households having spare bedroom capacity.

Simply because people largely do not want strangers within their everyday spaces, into which category their primary vehicle will also likely fit. Even when Musk is trying to equate Airbnb to his vision, he talks about “if you are traveling for a month… that other people use your house”, rather than making a home, or indeed a car, available on a routine basis.

And this natural reluctance is only going to be compounded by the rise of V-2-X capabilities, when it will become ever easier to extract value from a BEV parked in one’s garage as an alternative power source for one’s home and/or a grid flexibility option.

Software-as-a-service

Perhaps something else to note about Musk’s FSD comments is licensing. “What we are seeing is, at this point, significant interest from a number of major car companies about licensing for Tesla FSD technology,” he says.

“We are only going to entertain situations where the volume would be very high,” Musk continues, while also putting off “laborious discussions with other engineering teams” until Tesla has rolled out Level 4+ AD throughout the US. But Musk’s future vision is clearly one where unsupervised FSD is a monopoly software product.

“I think the interest level from other manufacturers to license FSD will be extremely high, once it is obvious that, unless you have FSD, you are dead,” he predicts.

And there has already been an interesting pivot of business model within Tesla, namely its rooftop solar product. “Solar roof is a core part of the residential product portfolio. It draws a lot of customer interest despite it being a premium product,” says Michael Snyder, Tesla’s vice-president Energy and Charging, in response to a question on whether the firm has abandoned ambitions to scale that business.

“More recently, rather than direct installation, we are focused on growth through our nationwide network of certified installers,” Snyder says. “That has actually turned out to be a much better way... [to] just supply products to the roofing industry,” adds Musk. So, Tesla has proven itself open to tweaking a plan of doing it all in-house to outsourcing at least some of the work.

Musk’s passion for manufacture remains. But it appears focused almost exclusively on Optimus. With the potential exception of Semi, his fire for building vehicles, just like his fire for putting solar panels on customers’ roofs, has largely gone out.

A future where Tesla makes autonomous robots and heavy-duty lorries that can be driven autonomously where allowed, while producing AD software as a symbiotic corollary to those businesses as AVs penetrate first through the non-public, and eventually the public, realm —but does not actually make cars anymore — is by no mean means inevitable but equally has never felt more realistic. Whether that vision supports a $1.2trn valuation as of now is perhaps anyone’s guess.

Insider Focus LTD (Company #14789403)