Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

Significant proportion of car buyers in four of the West's largest national markets have swallowed up anti-EV propaganda

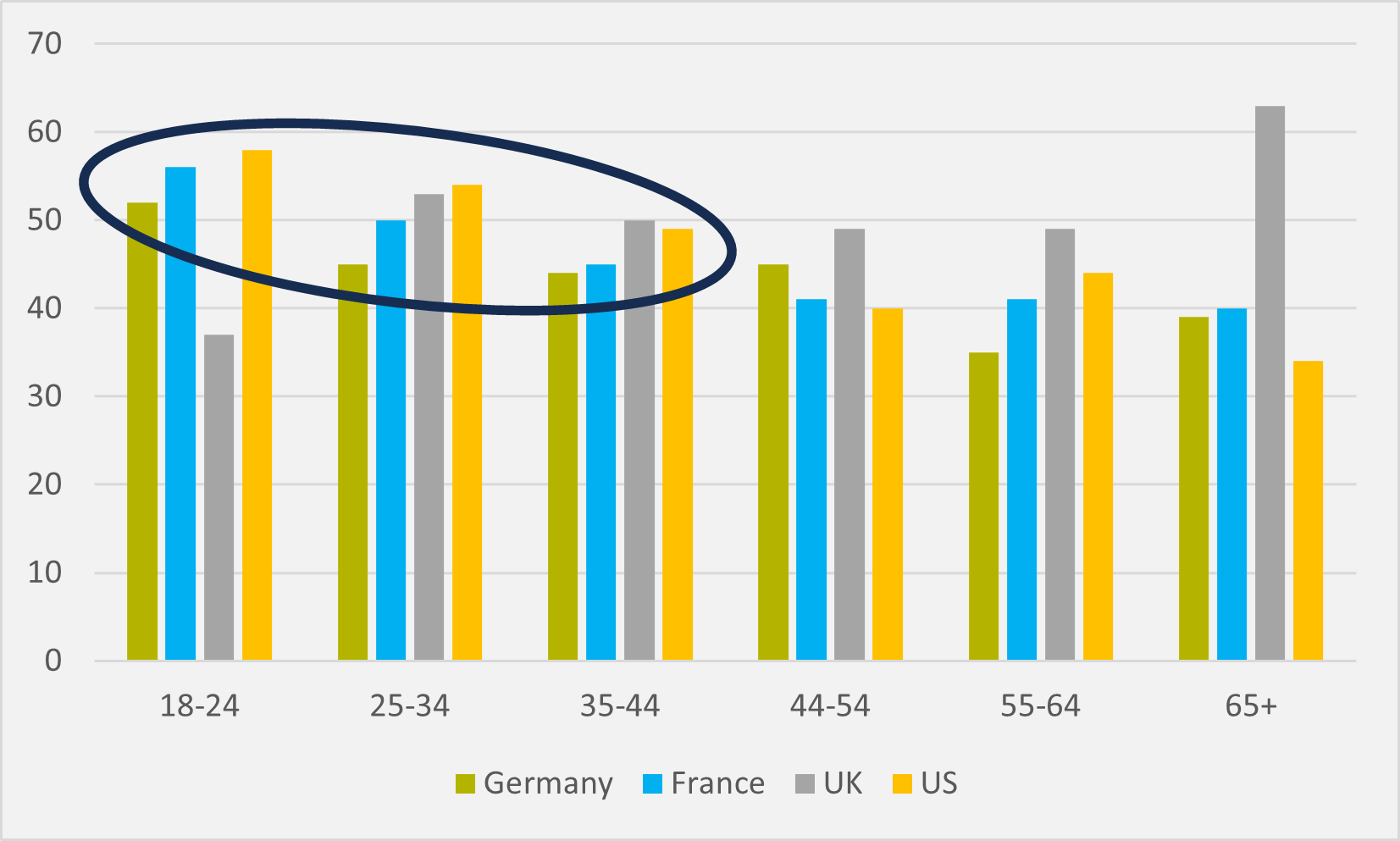

More than 40pc of survey respondents in the US, Germany, the UK and France believe five of the common myths spread about problems with EV adoption, according to new data from market research agency Electrify Research (see main image).

And well over 30pc in each of the four countries have also swallowed the untruth that somehow tyre wear on EVs is harder than ICE vehicles of comparable weight.

The most widely believed myth is that the pollution problem and carbon footprint from extracting, refining and transporting the gasoline and diesel used to fuel ICE cars is equalled by similar environmental issues from mining lithium and cobalt for EV batteries and a lack of end-of-life recycling of dead batteries. Across the four countries, 62pc of respondents agreed or strongly agreed with this nonsense.

“While it is true that there are some environmental concerns with the mining, production, recycling and disposal of batteries, the scientific consensus is that the impact is minor in comparison to that of drilling, refining, distribution, and burning of petroleum products,” Electrify Research says, citing UK climate journalism service Carbon Brief.

The prevalence of buy-in to this most accepted myth increases with advancing age. Among respondents aged 18-24, the rate is down at 51pc, increasing to 56pc for those aged 25-34. But, for the 35-44 age bracket, it rises to 61pc, while those aged 65+ recorded the highest level of agreement at 68pc.

Intuitive and counter-intuitive

There are other trends that also seem relatively intuitive: for example, respondents who deemed themselves concerned about climate change proved less prone to believing the myths compared to those who declared themselves less concerned. And, on an issue of EVs being a more serious fire risk than EVs, those with university-level education were, at 54pc, less likely to be fooled than those with only school-level education (59pc).

But not every trend was as unsurprising. The demographic pattern was reversed regarding a myth that EV batteries will wear out sufficiently quickly as to crater resale values, when in fact EV batteries will last longer on average than ICE drivetrains.

Younger respondents were more inclined to agree with this — 52pc agreement amongst 18-24-year-olds — than older respondents, where there was 42pc agreement amongst those aged 65+. This may reflect greater market familiarity from those with decades of car ownership behind them, compared to those who are much earlier in their car ownership journey.

But it also reflects the skill of anti-EV propagandists, finding different buttons to press to tap into various areas where knowledge might be lacking.

The age demographic also skews younger on belief that EV chargers are unreliable and regularly broken. Again, younger respondents proved more inclined than older to agree with this myth — 52pc agreement amongst 18-24-year-olds versus 42pc amongst those aged 65+.

This may be because younger homeowners are more likely to be in properties that increase their exposure to public charging, i.e. they do not have at-home provision. It is certainly noticeable that (with the exception of a outlier among UK 18-24-year-olds that may be due to small sample size) those aged 44 and below across all four countries have a minimum of 44pc belief, rising to a high of 58pc, belief that public charging is unreliable (see Fig.1).

The UK has overall the highest belief that chargers are likely to be broken, at 52pc. This might reflect wider dissatisfaction with charging provision outside London and England’s southeast.

But it is interesting to note that, despite much commentary that US charging outside of the Tesla supercharger network is not fit for purpose, US belief in widespread issues around charging reliability is on a par with France at 44pc and only just higher than Germany’s 42pc.

Electrify Research polled over 1000 respondents in each of the four countries, with the sample representative by age, gender and region per country based on quotas derived from Eurostat (for France and Germany), ONS (UK) and US Census Bureau (US). All respondents are homeowners who agree that they are “typically involved in making major home improvement decisions", e.g. buying a car.

Insider Focus LTD (Company #14789403)