No Kathleen Valley stope this month – Liontown

The firm is aiming to shift to underground production next month, and maintains everything is on schedule

A call very different to Acea’s earlier this month

A group of 50 companies and organisations ranging from automakers to battery firms to financial services providers have spoken out rejecting any changes to the EU’s CO2 emission standards for cars and vans, which culminates in a ban of sales of ICE light vehicles in 2035.

This is in strong contrast to the line taken a few weeks previously by lobby group the European Automobile Manufacturers Association, or Acea, asking for regulations to be watered down.

“The 2035 target gives a clear direction that will allow us businesses, alongside all other stakeholders, to focus on delivering the transformation required,” executives from the firms, which have come together under the banner of Industry for 2035, says. “It also provides the much-needed investment certainty on the future of the automotive industry in Europe.”

“We therefore call on decision-makers to not reopen the recently adopted car and van CO2 standards in 2026 and thereby maintain the 100pc zero-emission car target in 2035,” Industry for 2035’s declaration states.

It also points out that the 2035 ban “received a democratic mandate from EU governments and MEPs in March 2023”. Its preferred solution is that “rather than reopening already agreed legislation… efforts should instead be focused on implementing what has already been agreed: targeted industrial policy and investment support for a sustainable local battery value chain, rolling out charging and clean electricity supply, greening corporate fleets and re-skilling workers for the electric transition”.

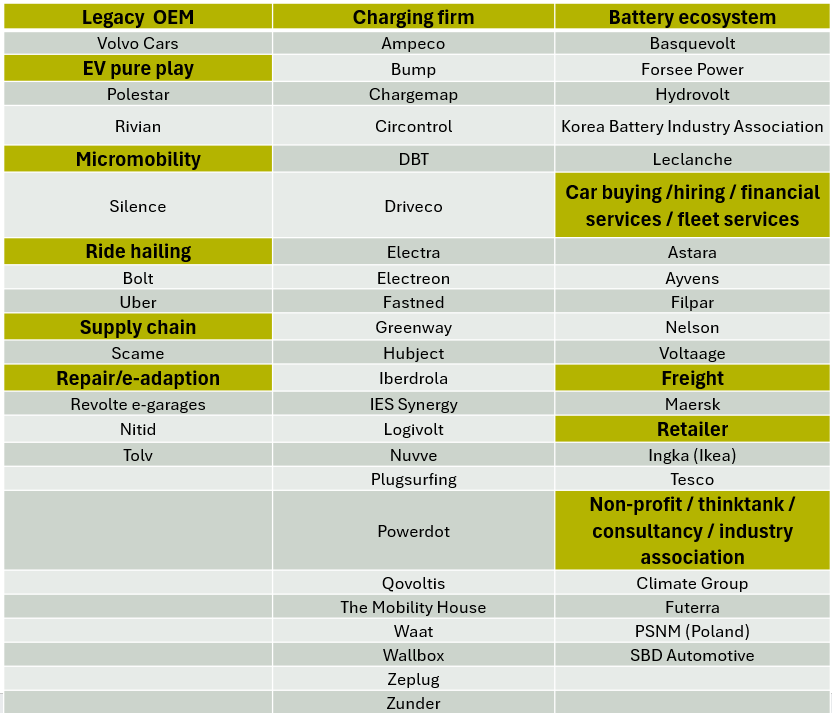

It is worth noting that only one legacy OEM is currently part of the group (see Fig.1): Sino-Swedish automaker Volvo Cars, which has been able to leverage its relationship with its largest owner, China’s Geely, to take a leading role in electrification compared to its European OEM peers. Amsterdam-headquartered Stellantis has also rejected Acea’s call for changes, but is not part of the new initiative.

“Electrification is the single biggest action our industry can take to cut its carbon footprint. The 2035 target is crucial to align all stakeholders on this journey and ensure European competitiveness. We urge EU policy makers to focus on what actions we need to take to get there, rather than reopening legislation just agreed on,” says Volvo CEO Jim Rowan.

Two other automakers are signatories, but both are EV pure plays. Another firm under the Geely umbrella, Gothenburg-headquartered Polestar, has signed up, as has the US’ Rivian. Firms involved in ride-hailing, micro mobility, supply chain, and repair and EV adaption sectors have also signed up.

“Electric vehicles are the only credible, scalable solution to help shift our industry towards carbon neutrality,” says Polestar CEO Michael Lohscheller. “However, further investments in material and technology innovation, as well as charging infrastructure, are needed. That is why consistency in decision-making is key to the car industry’s success in this transformation.”

“Europe helped lead the world when it set a target for automakers to eliminate tailpipe emissions from its vehicles by 2035. Delaying that target would reintroduce regulatory uncertainty for our industry, undermining the long-term investment climate we operate in. It’s important Europe continues to lead the world on climate issues, so we encourage policymakers to retain the 2035 zero-emissions target,” adds Alan Hoffman, chief policy officer at Rivian.

Eggs in one basket

But almost half of the firms — 23 out of the 59 — that have joined the initiative are involved in the charging sector, which is perhaps unsurprisingly most concerned about any relaxing of the EU timetable. Their business models would be most at risk from slower-than-expected EV adoption on the back of watered-down targets, given they are totally reliant on greater numbers of EV drivers to grow their businesses.

“Keeping the EU's 2035 ambition for transport electrification is an imperative. The targets are a catalyst for innovation and economic growth across the EV value chain, including in the EV charging infrastructure sector where Europe's industry leadership is demonstrated globally,” says Orlin Radev, CEO of charging firm Ampeco.

“We are committing over a billion euros to develop an extensive fast-charging network. As a key player in infrastructure investment, we require industry stability, underscored by clear guidelines and well-defined milestones.

"The path to 2035, including specific CO2 milestones, was established in 2014 and 2019. We rely on this stability to make informed and effective investments and ask the legislator to not change the rules during the game,” adds Aurelien de Meaux, co-founder and CEO of charging firm Electra.

“Maintaining the 2035 zero-emission target is essential – not just for a sustainable future, but for securing Europe's competitive edge in the global mobility and automotive industries. By leading the charge toward zero emissions, Europe can set the standard for innovation and sustainability, says Matt Ersin, senior director for government and public affairs at charging firm Fastned.

The battery ecosystem is also well represented, with five actors as signatories, again reflecting the importance of EV adoption rates for battery makers.

Other stakeholders joining up include those involved in car sales and leasing, fleet management and financial services, a freight heavyweight in Maersk, and two major retailers, as well as industry associations, non-profits, thinktanks and consultancies.

Insider Focus LTD (Company #14789403)