Musk offers bittersweet glimpse into what might have been

Tesla could still be a contender. But only if its CEO faces a few home truths and reprioritises

Growth figures withstands German decline with smaller markets tipping the scales

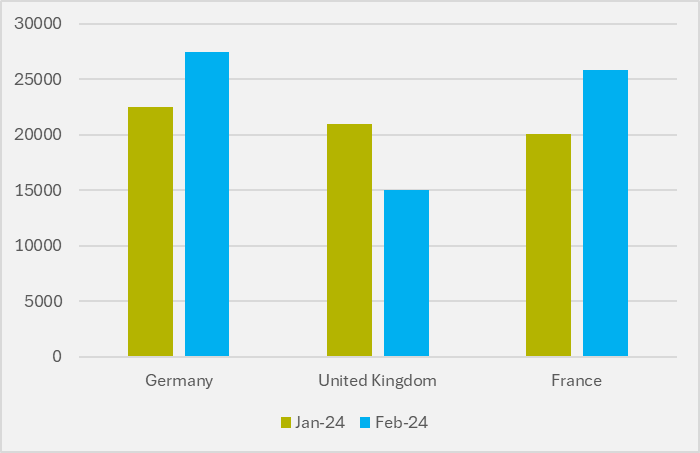

Sales of BEVs in the EU, UK and Efta region exceeded 131,000 units in February at 10.3pc year-on-year growth. This is despite sales in Germany, usually the region's biggest market, declining sharply by 15.4pc.

Overall European growth was able to withstand the hit taken in the German market due to stronger sales in France (+31.8pc), Belgium (+66.9pc), and the UK (+21.8pc).

The German market was widely expected to contract throughout 2024 after the removal of the country's EV incentive legislation in December 2023. But the 27,479 BEV registrations in the country in February constitutes the sharpest decline of any European market.

If Germany had managed to maintain the 24pc year-on-year growth that the country saw last month, it would have seen over 40,000 BEV sold.

But despite the large year-on-year drop-off, Germany's year-to-date sales are only 1.3pc behind the same point last year, and month-on-month growth from January was a strong 22.2pc.

As Europe's biggest market declined in February, smaller markets propped up continent-wide growth, with Denmark and Portugal posting 58.2pc and 66.9pc year-on-year growth respectively.

European BEV sales have been largely dependent on the three biggest markets – Germany, France, and the UK – which together made up 56pc of all BEV registrations in the continent.

Combined registrations in the ten biggest markets grew just over 1pc, compared to over 10pc growth across all regions, showing that greater momentum in smaller markets is beginning to materially tip the scales on a continent-wide scale.

ICE displacement

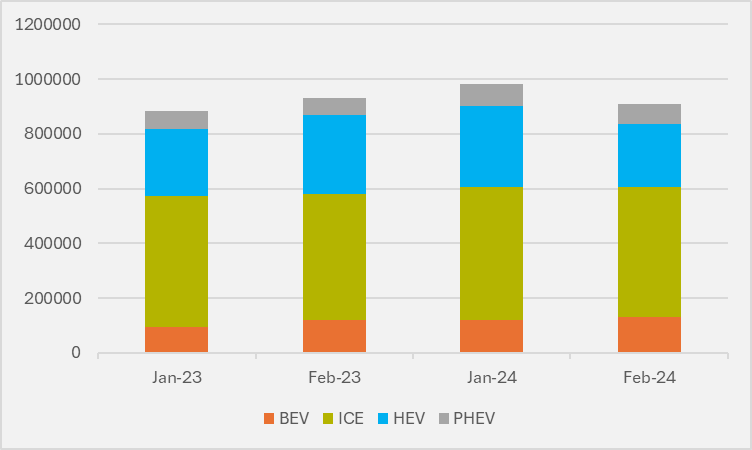

While EV market share is down from its peak last year, petrol and diesel cars made up only 47.6pc of registrations across the EU, UK and Efta region in February.

The market share of petrol and diesel cars is declining relatively quickly, having fallen 3pc month-on-month, and 4pc year-on-year.

Linear EV growth is less important than the rate of ICE vehicle displacement, according to a recent report from Acea, which found that in total, only 1.2pc of cars on Europe's roads are all-electric.

In the race to displace ICE, however, BEVs lost some ground to hybrids, which saw 24.2pc growth from the same period in 2023 – capturing 28.9pc of all registrations in February.

Enjoying EV inFocus? Hit follow on Google News to get us in your feed.

Insider Focus LTD (Company #14789403)