Musk offers bittersweet glimpse into what might have been

Tesla could still be a contender. But only if its CEO faces a few home truths and reprioritises

ICE market share falls to half of new sales on the back of BEV and HEV growth

BEV registrations in Europe rose at over double the rate of the wider car market in January, according to new data from the European Automobile Manufacturers Association (Acea).

Battery-electric car sales rose by 28.9pc to 92,741 units, significantly outpacing the 12.1pc growth seen across the whole auto market.

As a result, EV market share saw steady year-on-year growth to 10.9pc from a figure of 9.5pc in January 2023.

However, BEVs still saw a significant dip in market share compared to December 2023, in which 18.5pc of new car registrations were BEVs.

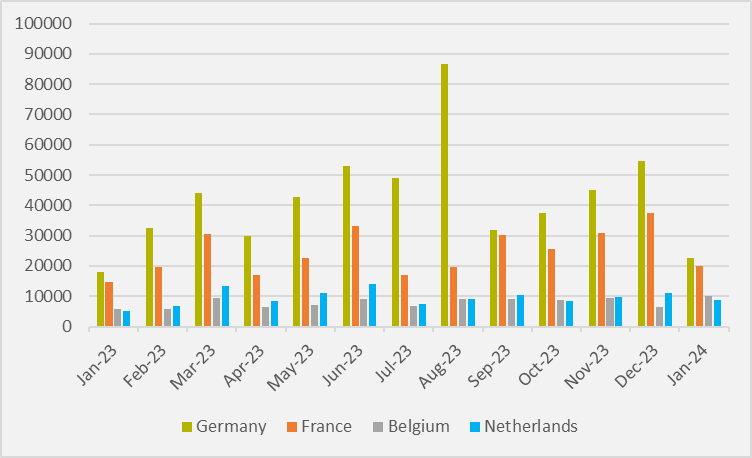

Figure 1 shows the high seasonality of the European BEV market, with a view across full-year 2023 revealing that the final month of each quarter is typically the strongest, with the exception of September. The first month of each quarter is typically far weaker.

In the context of gloomy demand outlooks for BEVs, the moderate year-on-year growth is a positive sign for the industry – whereas the month-on-month decline could be a function of seasonality.

And the four biggest automotive markets on the continent all saw healthy EV growth in January.

"The four largest markets in the region – together covering 66pc of all battery electric car registrations – recorded robust double-digit gains: Belgium (+75.5pc), the Netherlands (+72.2pc), France (+36.8pc), and Germany (+23.9pc)," Acea says.

Growth rate emphasis

A recently published report from Acea suggests that the EV industry should benchmark itself on the number of ICE cars displaced by EVs, as opposed to an absolute number of EV sales.

These findings came amid concern that EV sales growth was only proportional to the growth of the wider car market, and that new EVs were only supplementing ICE vehicles, rather than replacing them.

But the January data shows that petrol and diesel cars fell to make up only 50pc of all new registrations in January, down from 54pc, driven by a surge in both BEVs (on a year-on-year basis) and hybrids.

"Hybrid-electric cars commanded a share of nearly 30pc, solidifying their position as the second most preferred choice among EU car buyers. The combined market share of petrol and diesel cars totalled almost 50pc in January 2024, marking a decline from 54pc one year ago," Acea says.

Enjoying EV inFocus? Hit follow on Google News to get us in your feed.

Insider Focus LTD (Company #14789403)