Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

But study finds that more work will need to be done as BEV penetration increases, and calls for even great ambition

Most EU countries had already met their 2024 EU targets for public charging infrastructure by the end of 2023, according to analysis of national charging networks and projected EV fleet growth conducted by Brussels thinktank Transport & Environment (T&E).

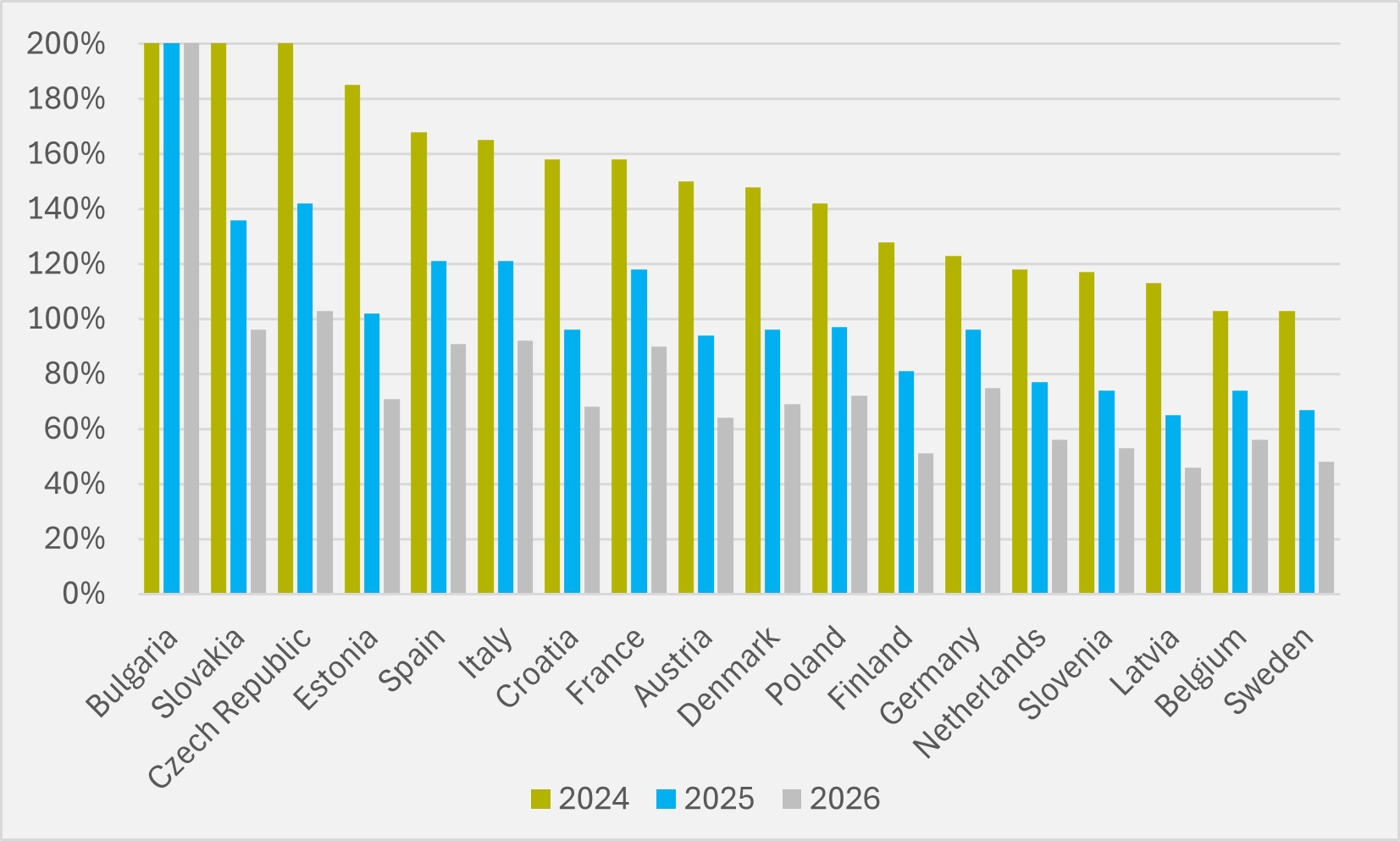

But, with more BEVs expected on the road with every passing year, charging installation momentum will need to be maintained to continue to meet requirements (see Fig.1).

Under the EU Alternative Fuels Infrastructure Regulation (Afir), which entered into force this month, each EU member state has annual targets based on a ratio of total charging power output and the number of electric cars on the road.

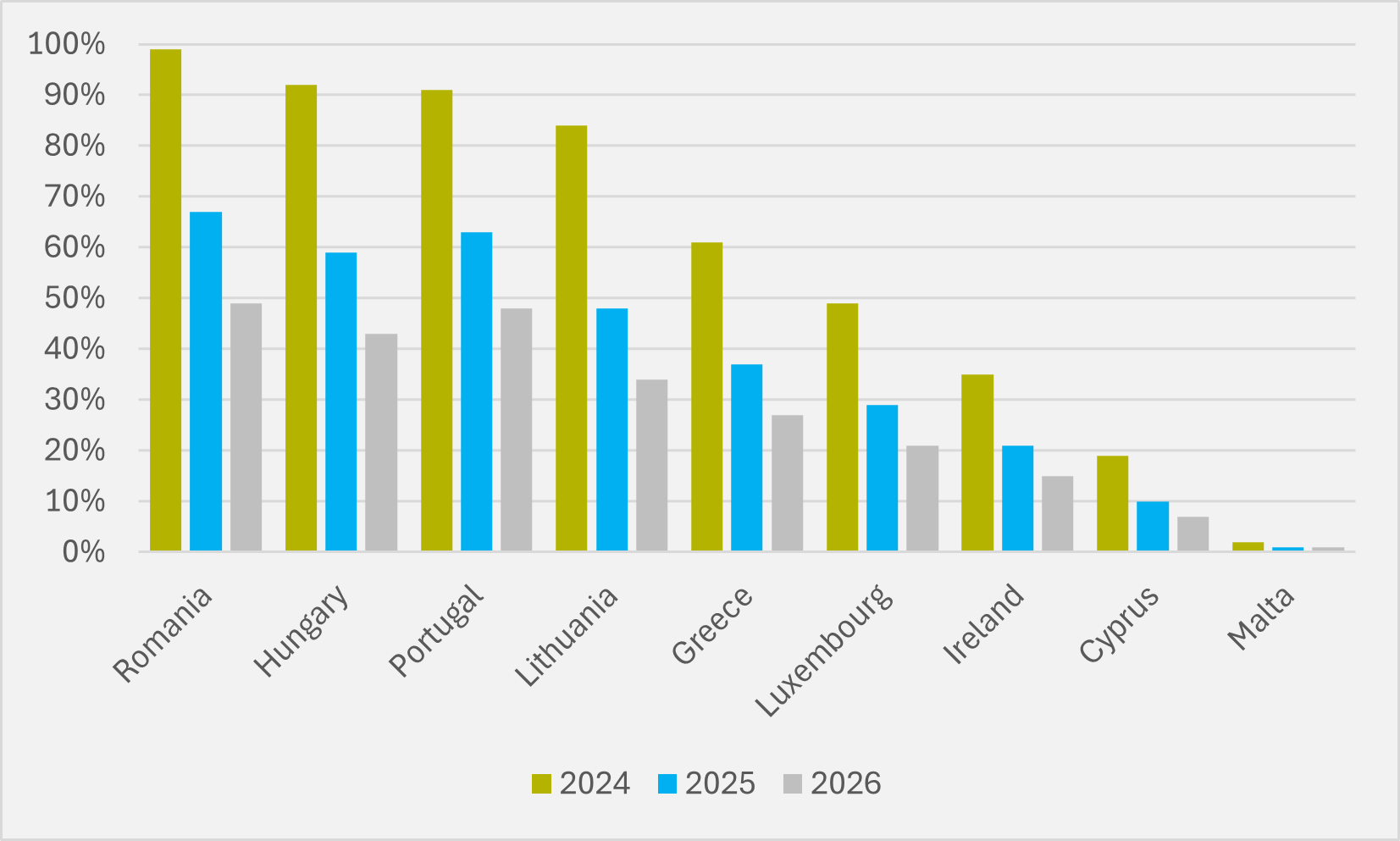

Just seven EU states had not met their 2024 Afir target by the end of last year (see Fig.2), T&E finds. Of these laggards, it expects Portugal, Hungary and Lithuania to catch up by the end-of-December deadline. Luxembourg, Cyprus and Malta also lag behind, “but can easily achieve the targets with modest amounts of new chargers due to the small size of their EV fleets”, the thinktank concludes.

Greece and Ireland “have the most work to do but can still meet their targets by rapidly building infrastructure this year”.

“Charging is perceived as one of the biggest barriers to people switching to electric vehicles, but the picture is improving fast,” says Fabian Sperka, vehicles policy manager at T&E. “Now, governments need to go beyond the strict requirements of the EU targets if they are to convince more drivers.

“More capacity needs to be installed where the actual traffic is and payments should be made simpler. There also needs to be a clampdown on broken chargers,” he continues.

While things look rosy for this year, expected growing BEV penetration means that the current infrastructure swiftly becomes insufficient for expanding all-electric car parcs. Just six countries will meet their 2025 Afir target with just the chargers they have now, falling to two for 2026.

Going further

And T&E is asking for even greater ambition than the Afir targets. It wants EU member governments to better anticipate where future demand for charging will occur, “to avoid gridlocks along the way” and to deploy fast-charging hubs every 60km along main roads by 2025, rather than the 2030 deadline under Afir. It also believes Afir targets should be extended to other major national roads.

The thinktank suggests implementing the national charging targets in a decentralised way, in order that deployment of charging more closely follows BEV uptake at regional or even provincial level.

It is also calling for a commitment to fix broken infrastructure, including requiring charge point operators to achieve minimum uptime of at least 98pc annually at public chargers. And it wants to limit red tape for grid operators by harmonising permitting and administrative procedures across the EU, as well as focusing public financial support where market failure occurs — e.g. where infrastructure is needed but might be underutilised and thus not attract private investment.

The number of chargers across the EU has increased by more than 260pc from where we stood at the end of 2020 to December ’23, T&E finds, with the number now topping 600,000 (see main image). The number of slower AC chargers has gone up by around 250pc over that period to c.550,000, while faster DC chargers have mushroomed by almost 350pc to top 80,000.

Last year alone, AC charger numbers increased by 37pc and DC chargers by 88pc, with the charging network growing faster last year than the electric vehicle fleet, T&E says.

Insider Focus LTD (Company #14789403)