No Kathleen Valley stope this month – Liontown

The firm is aiming to shift to underground production next month, and maintains everything is on schedule

Firms need to look at access to both primary metals and processed battery materials

European auto manufacturers must do more to accelerate the EV value chain in the region as well as secure a greater supply of the raw materials they need to grow, according to a study by European non-governmental organisation (NGO) Transport & Environment (T&E).

The largest challenge for the 12 automakers analysed in the study will be securing the critical minerals they need amidst fierce global competition.

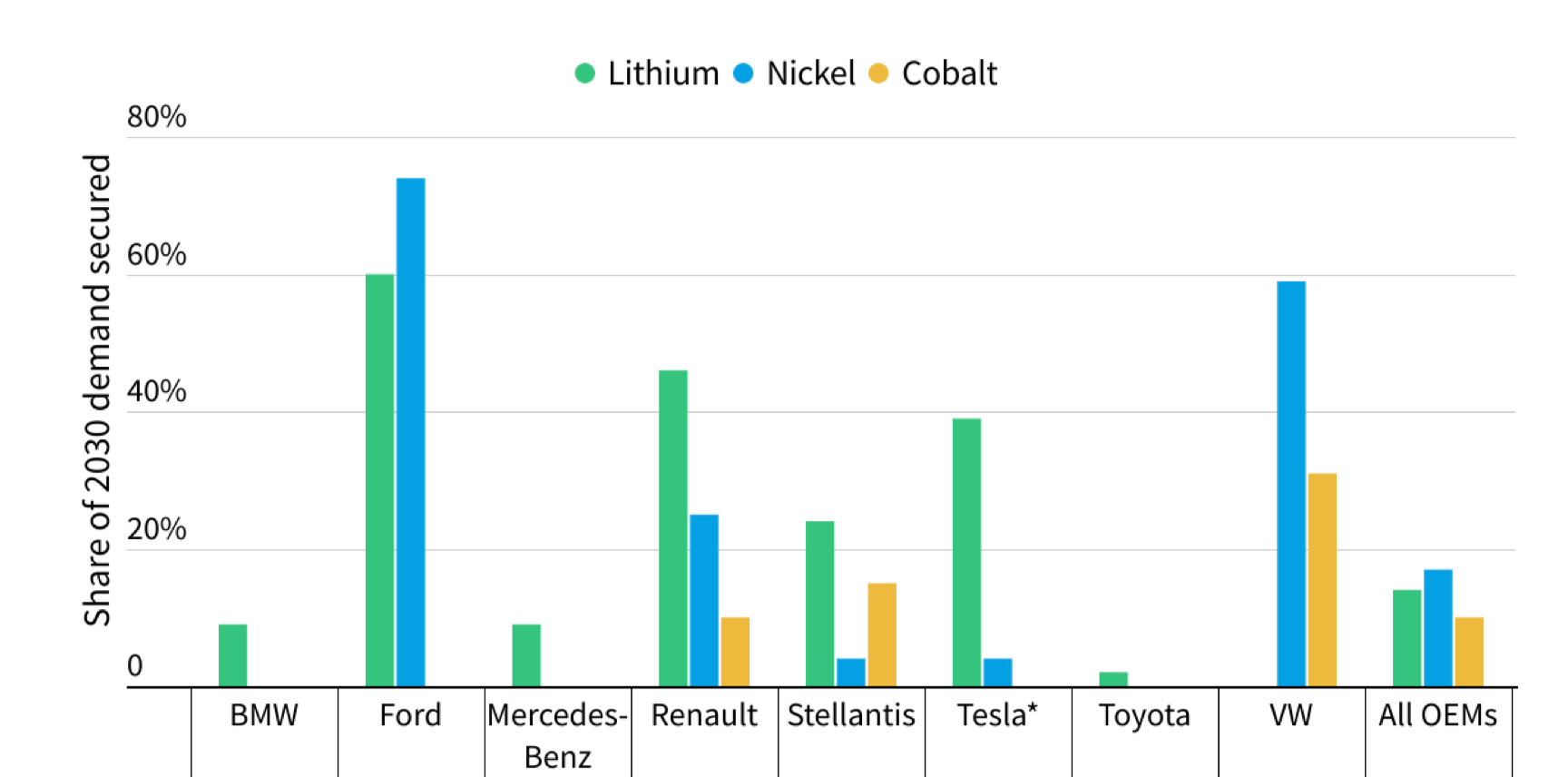

Overall, only 14pc of the estimated required lithium demand, 17pc of the estimated required nickel demand and 10pc of the estimated required cobalt demand to 2030 has been secured by the firms.

To quantify this, T&E relied on the publicly disclosed data, as well as asking automakers to give feedback on the findings. Aggregating the three metals, 16pc of the raw material demand to 2030 is secured – or less than a fifth of what is required.

“There is a clear disconnect between carmakers’ electric vehicle goals and their critical mineral strategies. Tesla and BYD are way ahead of most European players who are only waking up to the challenge of securing battery metals now," says Julia Poliscanova, senior director for vehicles and e-mobility supply chains at T&E.

Carmakers have differing strategies. Some having no contracts publicly disclosed at all, while others – such as US OEM Ford – disclose contracts and the quantity of material secured on a regular basis.

And there are also differing approaches to contracting. Franco-Italian conglomerate Stellantis, for example, has been enthusiastic in taking direct minority stakes in the mining projects that will supply its required minerals. In contrast, Germany's Mercedes takes the view that, particularly in politically stable jurisdictions, an offtake contract is more than sufficient to guarantee the desired volumes.

T&E finds that only six companies – Tesla, BYD, VW, Ford, Renault and Stellantis – have long-term contracts for each of the three key NMC metals or plan to change battery chemistries to end their dependence on the metals.

Given that the global competition on BEVs is intensifying, securing critical mineral supply should be central to manufacturing strategies, according to the T&E report, entitled: 'Pedal to the metal, How prepared are European carmakers for EV value chain transformation?'

Critical minerals supply today is highly concentrated in Asia, posing risks to European OEMs going forward, the report notes.

Another key message from T&Eʼs analysis is that European OEMs should do more to help Europeʼs efforts to scale domestic supply chains.

It notes that only four automakers – Mercedes, Renault, Stellantis and VW – currently support nascent EU start-ups in battery components and minerals processing.

Supporting local refining and battery component factories – via vertical integration or investing into start-ups – is critical to supply chain resilience, according to the report. OEMs that have strong links with battery makers can secure their production volumes in advance.

Tesla is the best prepared in this regard as it as its own cathode material production projects and supply contracts for precursors and anode materials. BYD, VW, Ford and Mercedes are all involved in some part of the midstream supply chain through subsidiaries, joint ventures or direct investments.

But Stellantis and Toyota are less involved and only have supply agreements for cathode active material. And Renault, BMW and Hyundai have made no public announcements at all for this part of the supply chain.

“Carmakers’ supply chain strategies will make or break the EV transition in Europe, and render some companies obsolete. Supporting local refining and battery component factories will be critical to their own resilience," says Poliscanova.

Insider Focus LTD (Company #14789403)