Musk offers bittersweet glimpse into what might have been

Tesla could still be a contender. But only if its CEO faces a few home truths and reprioritises

BEV+PHEV+HEV are now outselling gasoline+diesel for the year thus far

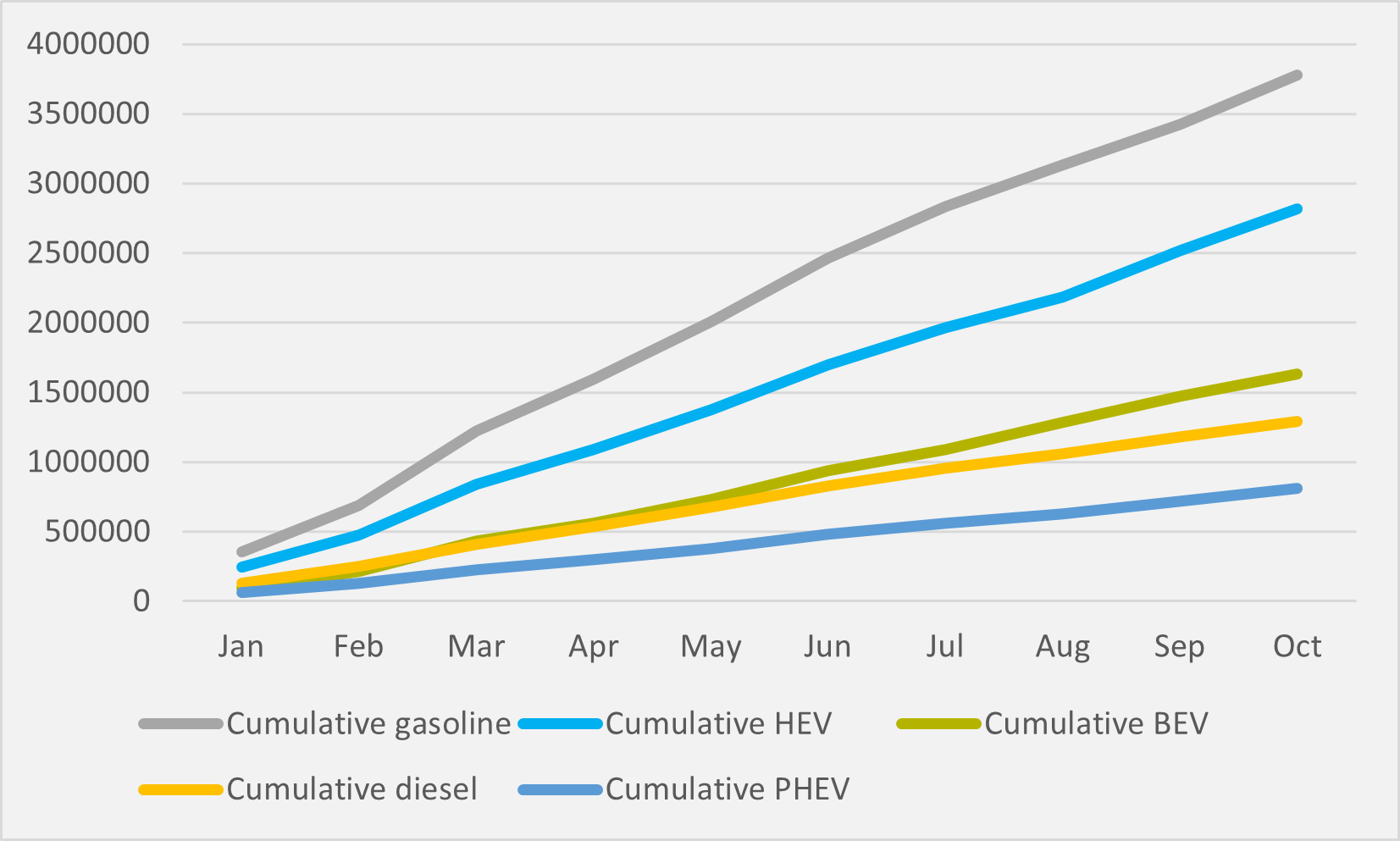

Sales of new electrified vehicles in the 31-country EU+Efta+UK bloc topped 5.25mn in the first ten months of the year, according to the industry lobby the European Automobile Manufacturers' Association, or Acea. In contrast gasoline and diesel ICE vehicles have racked up less than 5.1mn in new sales (see main image).

This is a significant turnaround even compared to last year. Over the first ten months of 2022, new ICE sales were at just above 4mn, while ICEs had shifted almost 4.8mn. So electrified vehicles have transformed a 750,000 deficit to ICE sales into a 180,000 lead over them in just 12 months.

A 30pc increase in cumulative new sales of electrified vehicles, compared to just a 6pc rise in new ICE sales is the driver for the switch around. All three categories of electrified vehicle — BEV, PHEV and HEV — have posted year-on-year growth in new sales, but falling appetite for diesel has weighed on a modest percentage rise in new gasoline cars.

In absolute terms, Europe still buys more gasoline new vehicles than anything else — 3.8mn compared to 2.8mn hybrids, 1.6mn BEVs, 1.3mn diesels and 800,000 PHEVs (see Fig.1). And HEVs have done the heaviest lifting in terms of units in pushing electrified vehicles above ICEs, selling an additional 625,000 year-on-year compared to BEVs’ 560,000 and less than 35,000 more PHEVs.

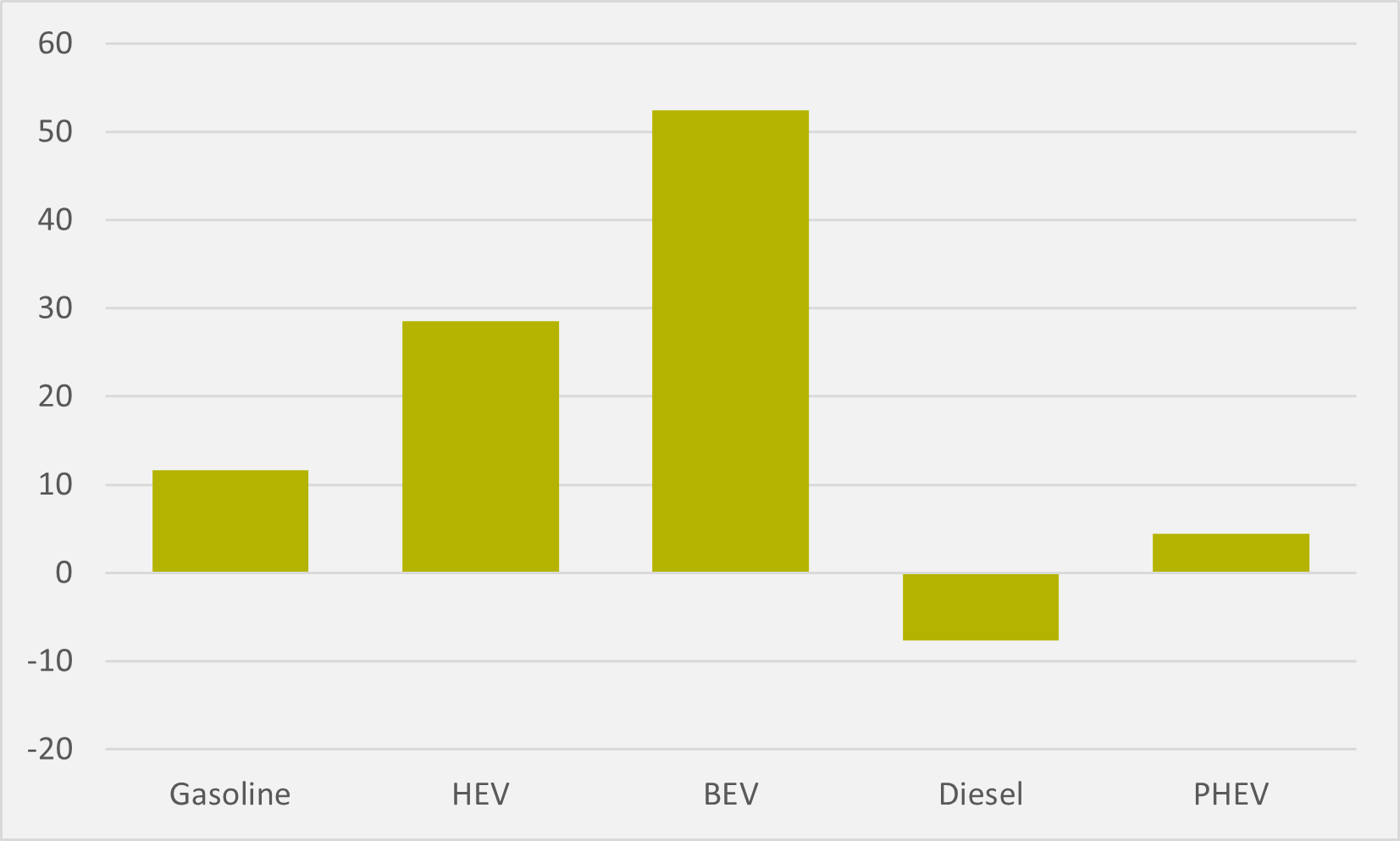

But, in percentage terms, there is a clear winner in growth in appetite. PHEVs have posted 4.4pc annual growth in Europe for the first ten months of the year, while gasoline sales have risen by 11.6pc, offset by a 7.7pc decline in diesel purchases (see Fig.2).

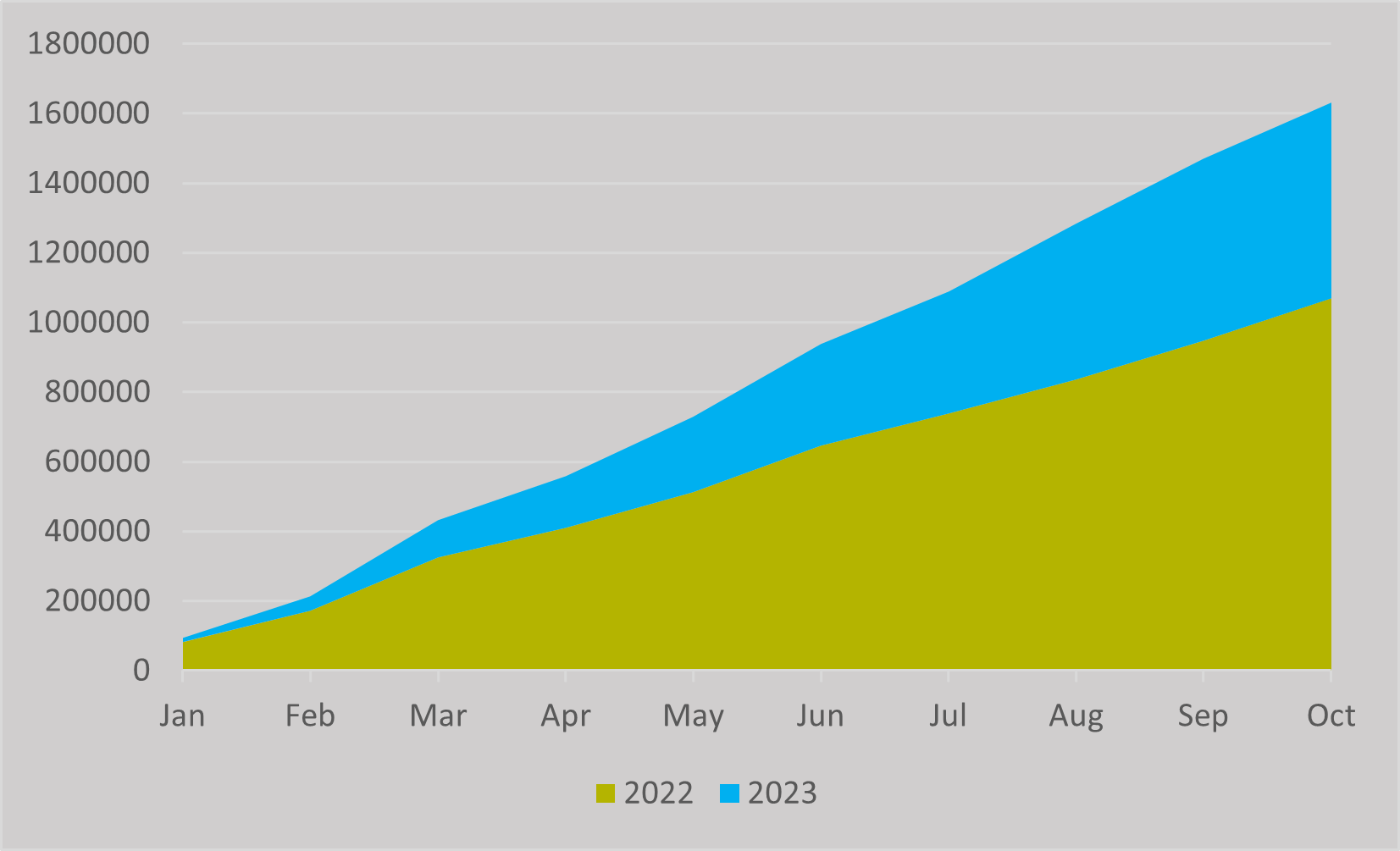

Hybrid sales have jumped by 28.6pc, but even this is dwarfed by the 54.6pc jump in transactions for new BEVs. Across the 31 countries, BEVs have now shifted over 1.6mn units compared to less than 1.1mn in the same period last year (see Fig.3).

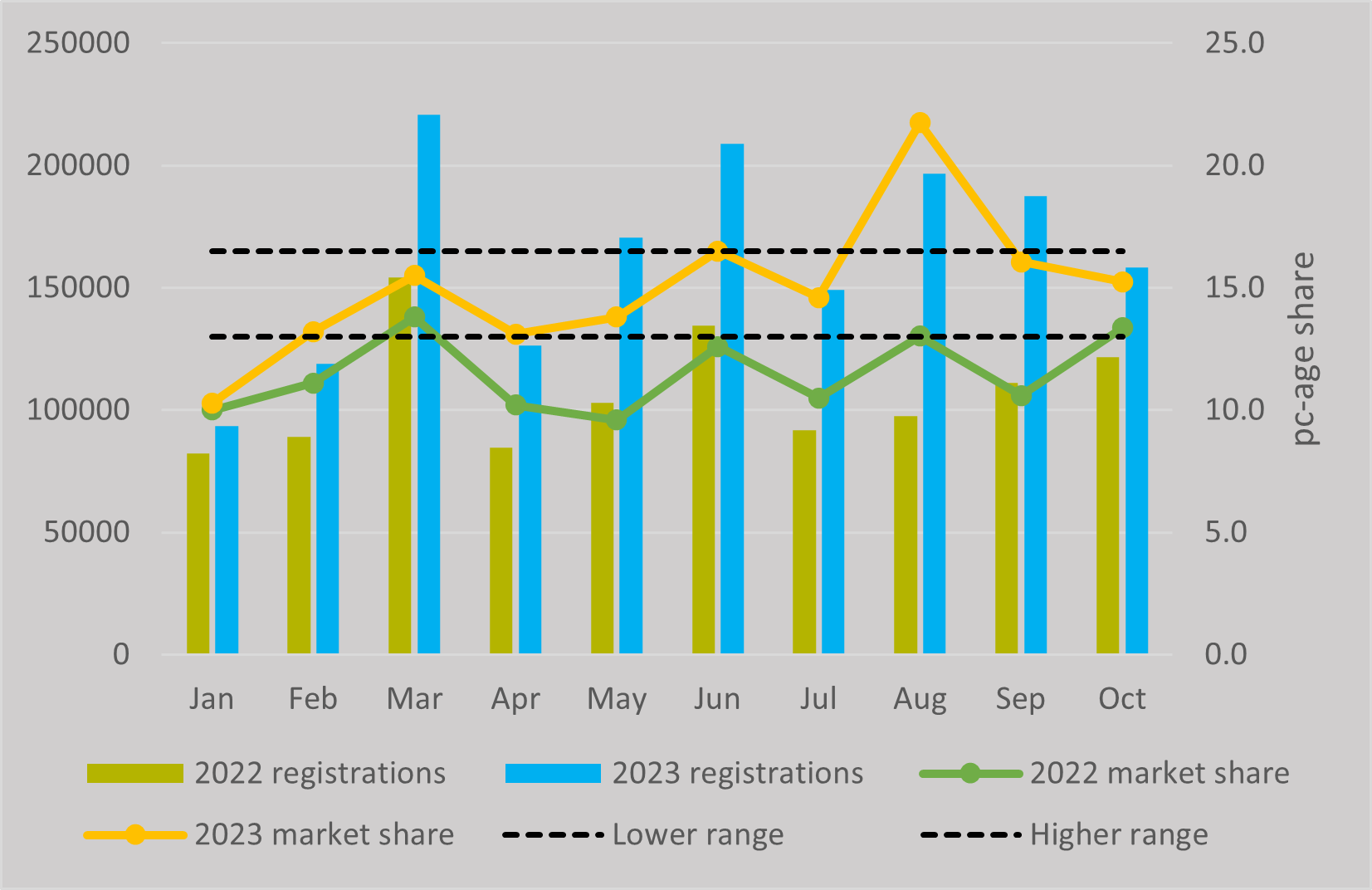

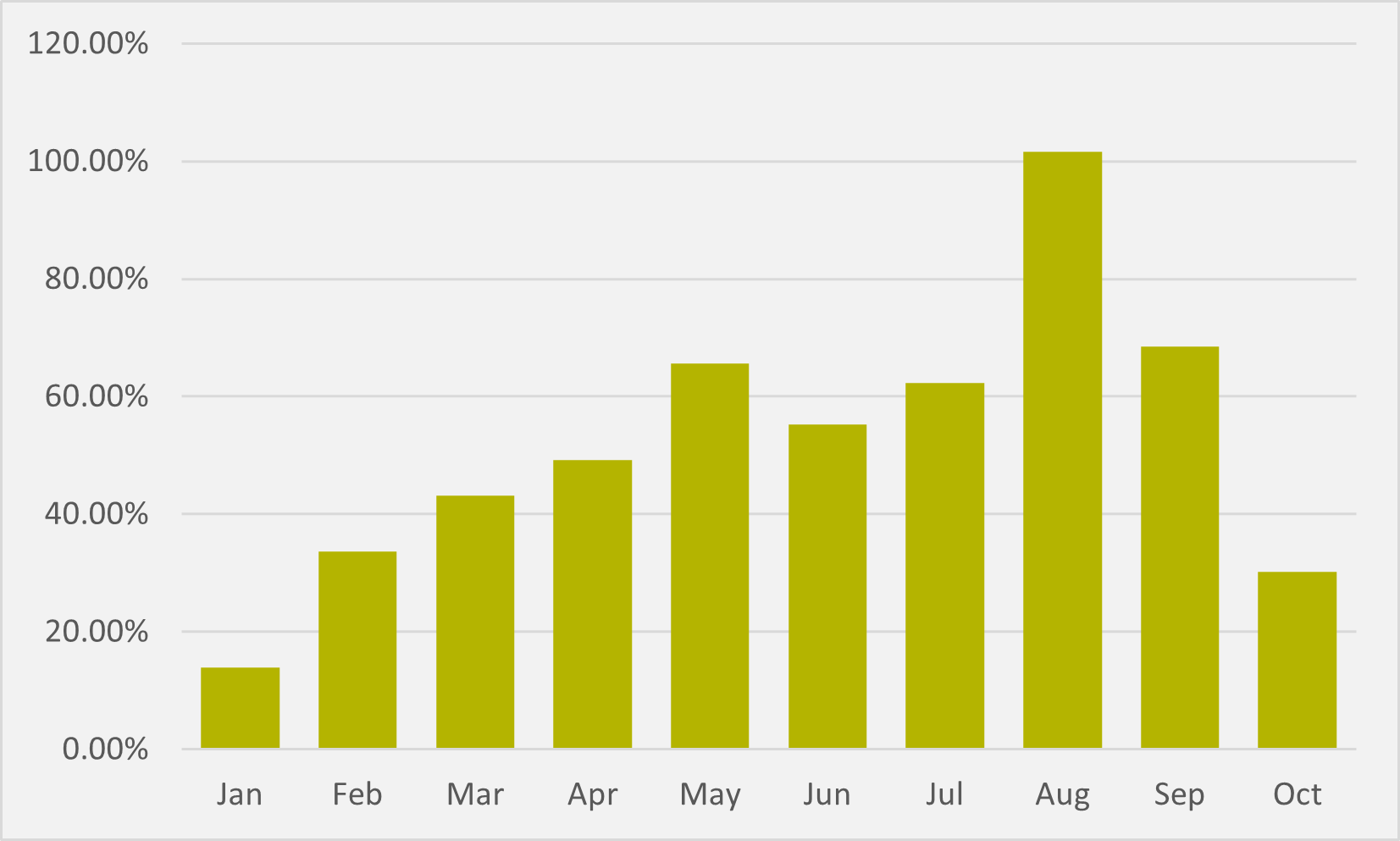

While year-on-year BEV growth continues to be stellar, the rise in the segment’s penetration of the overall European new sales mix does continue to plateau as 2023 progresses. With the exception of August, when the impending expiry of German subsidies for fleet sales roofed BEV sales to a 20pc+ slice of the European pie, market share figures have been in a 13-16.5pc market share range since February (see Fig.4).

In October, European BEV new sales dropped from almost 190,000 in August back to just shy of 160,000 in October and market share was trimmed from 16.1pc to 15.2pc. Year-on-year growth in the month of 30pc was the lowest since January (see Fig.5), when end-of-year subsidy changes in both Germany and Norway dragged BEV sales lower.

So, much as in the US, there is still plenty to be optimistic about in terms of European BEV sales progress. But it is worth acknowledging that headwinds are retarding the pace of progress matching levels seen earlier in the year.

Insider Focus LTD (Company #14789403)