Musk offers bittersweet glimpse into what might have been

Tesla could still be a contender. But only if its CEO faces a few home truths and reprioritises

US FEOC legislation could offer a route for South Korean and Japanese manufacturers to win back ground

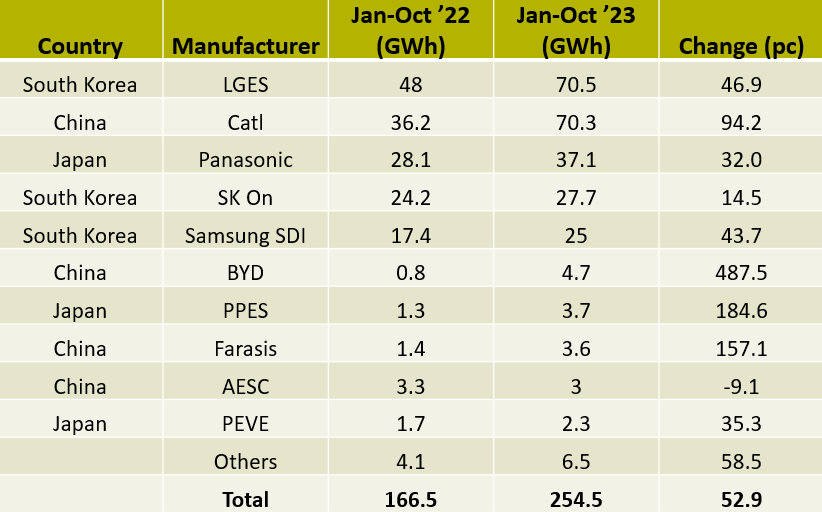

China’s Catl increased its market share to 27.6pc in EV battery sales outside China in the period Jan-Oct ’23, just 0.1 percentage points behind South Korean market leader LG Energy Solutions (LGES) with 27.7pc, according to a new report from South Korean battery consultancy SNE Research.

Over the first four months of the year, Catl had a 26.5pc slice of the ex-China pie, compared to LGES’ 27.8pc. So the Chinese challenger is getting ever closer, but LGES is still clinging on in the lead.

And a US EV supply chain that faces tightening restrictions from legislators which aim to squeeze Chinese batteries out of the US EV supply chain could offer a chance for LGES and its South Korean and Japanese peers to try to make up ground lost mainly to Catl but also other Chinese battery firms like BYD and Farasis.

EV batteries deployed outside of China rose significantly in the first ten months of the year. “Battery installation for global electric vehicles (EV, PHEV, HEV) excluding the Chinese market sold from January to October 2023 was approximately 254.5GWh, a 52.8pc year-on-year growth,” SNE says.

Chinese consolidation

But while ex-China battery installation grew, the market share of the largest South Korean and Japanese manufacturers slipped slightly as three of China’s four largest battery firms went from strength to strength. Catl posted 94pc year-on-year growth, as its 36.2GWh of Jan-Oct ’22 sales rose to 70.3GWh in the same period of 2023, putting it just shy of LGEs’ 70.5GWh (see Fig.1).

Compatriot BYD recorded the strongest year-on-year growth rate at 525pc, albeit from a relatively low starting point. And Farasis also posted a year-on-year sales growth of 150pc+, albeit China’s AESC actually saw a slight dip in sales.

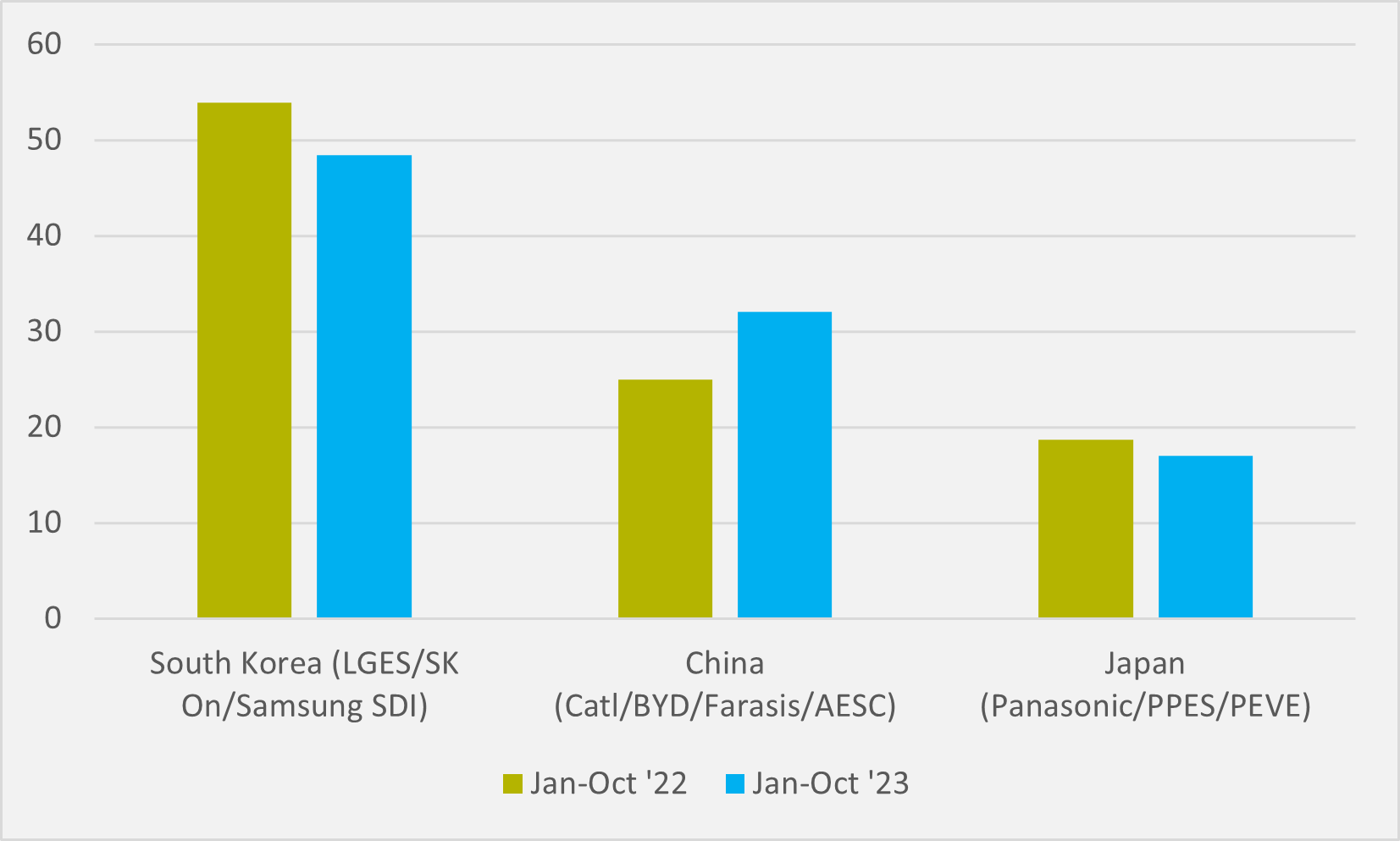

This was not enough, though, to stop the ex-China market share of the four Chinese firms increasing from 25pc in Jan-Oct ’22 to 32pc in 2023. In contrast, the three largest south Korean firms — the so-called K-trio of LGES, SK On and Samsung SDI — fell from almost 54pc last year to under 48.5pc (see Fig.2).

Japan’s three runners, Panasonic, PPES and PEVE trickled down from 18.7pc to 17pc. “Panasonic registered the battery usage of 37.1GWh, 31.7pc up from the same period of last year. Panasonic, which is one of the major battery suppliers to Tesla, has most of its battery usage installed in Tesla models in the North American market. While the sale of Tesla Model 3 slowed down a bit as its facelift model is about to be in the market soon, Tesla Model Y with a year-on-year growth in sales has driven the growth of Panasonic,” SNE says.

“Along with Catl, some of the Chinese companies showed even higher growth in the non-China market than in the domestic market of China, rapidly expanding their presence in the global market. Catl’s battery is installed to Tesla Model 3/Y(made in China and exported to Europe, North America, and Asia) as well as vehicles made by major OEMs such as BMW, MG, Mercedes, and Volvo,” SNE says.

A recent Kona model by South Korean automaker Hyundai and the Ray EV model from compatriot Kia have Catl’s battery inside, “proving that the Chinese battery giants have been gradually influencing the domestic market in [South] Korea”, the research also finds.

FEOC lifeline

But last week’s US Treasury guidance on ‘foreign entity of concern’ (FEOC) stipulations may offer a boost to non-Chinese battery makers. It defined the term in law such that batteries or components from firms with any ties to China — including as little as having board or equity control in China — cannot qualify for US tax credits.

The interpretation of FEOC leaves the future of some Simo-American battery joint ventures uncertain and will likely see US OEMs increasingly turn to non-Chinese battery partners where possible.

South Korean firms have the most-established pedigree in battery manufacturing outside of China, but South Korean battery knowhow has typically been in NMC chemistry, a more expensive option to the LFP cells preferred by US automakers like Ford and Tesla, for which they have turned to Chinese partners like Catl and BYD but now face FOEC implications for these choices.

Recent announcements from SK On and LGES of plans for new facilities to build LFP batteries will have the US industry hopeful that IRA-compliant LFP batteries can be supplied at a cost comparable to that offered by Chinese firms.

SK On has six battery plants either operational or under construction in the US as part of its joint ventures with Ford and fellow South Korean OEM Hyundai. For the US industry, hoping to source more affordable IRA-compliant non-Chinese batteries, the potential payoff will be if the K-trio can capitalise on LFP intentions.

Insider Focus LTD (Company #14789403)