No Kathleen Valley stope this month – Liontown

The firm is aiming to shift to underground production next month, and maintains everything is on schedule

ICE is predicted to suffer accelerating losses in its slice of the pie in the US’ northern neighbour

Battery vehicles made up greater than 10pc of all light-duty vehicles (LDVs) sold in Canada in the third quarter as over 42,000 BEVs were sold in the country, according to new research from consultancy S&P Global.

“The third quarter of 2023 marked a significant milestone in the Canadian automotive industry, with BEV volumes reaching unprecedented levels,” the research says.

And while the LDV market shrank overall, showing a contraction of 5.7pc on a quarterly basis, the spike in BEV market share is not simply a result of other sectors declining. Rather, absolute BEV sales volumes rose by 22.4pc quarter-over-quarter, S&P says.

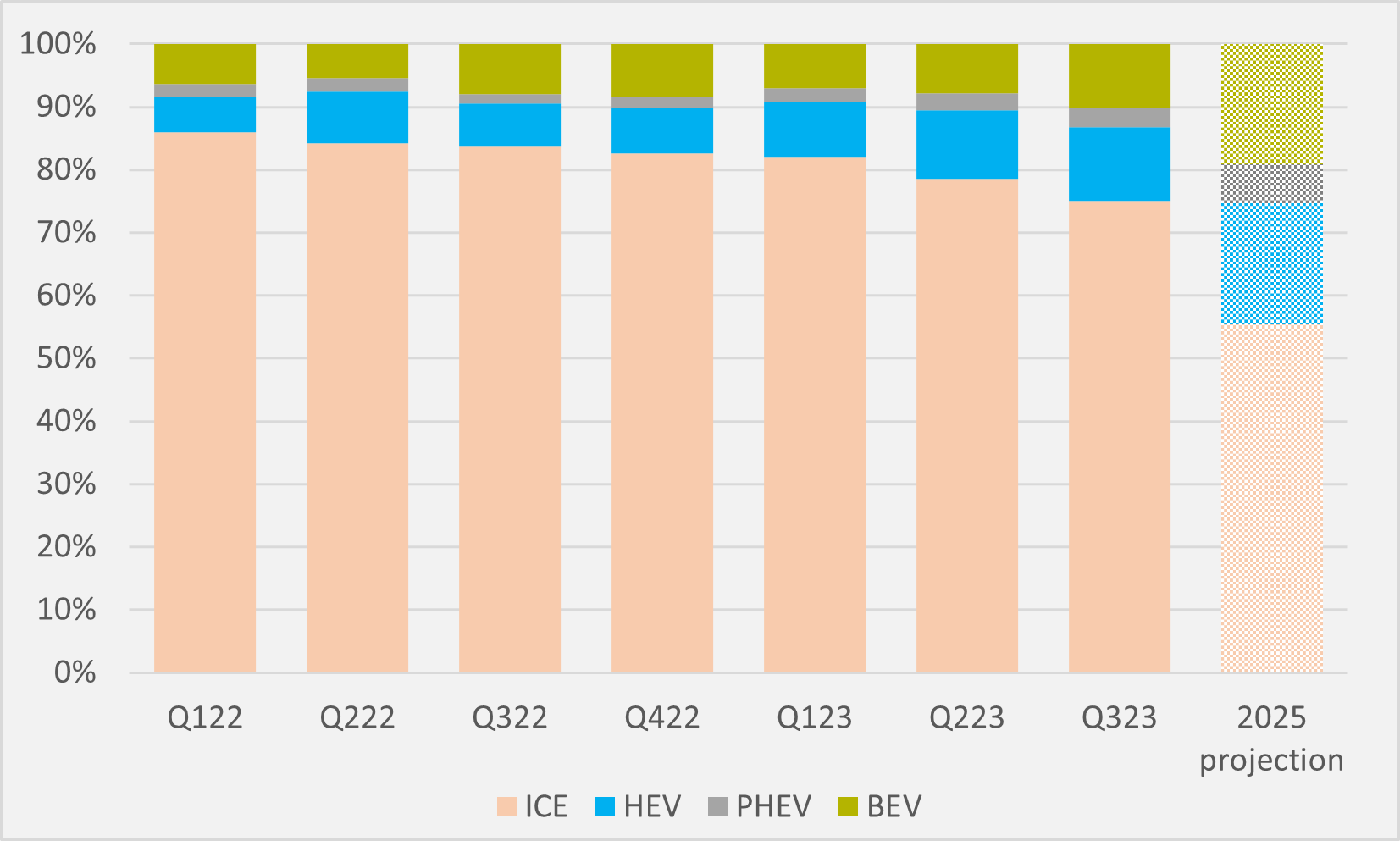

The year-on-year increase in market share for BEVs is two percentage points, however, slightly smaller than the 2.4 percentage point year-on-year increase seen between Q2 of 2022 and 2023. But that is largely driven by the fact that Canada’s BEV market penetration jumped in the second half of last year, moving from under 6pc into a 7-8.5pc range that it maintained for four quarters before the further step up in Q3’23 (see Fig.1).

Amongst non-ICE vehicles, BEVs still trail HEVs in terms of market share. HEVs accounted for 11.6pc of new light vehicle sales in the quarter, the research finds. BEVs are more closely behind HEVs in Canada than in the US, although the gap between BEVs and HEVs has widened since the beginning of 2023.

ICE decline

Inversely, ICE vehicles saw their lowest market share ever at 75.1pc, down by 3.5 percentage points from the previous quarter, the only fuel type to decline in market share both quarterly and year-on-year. In Q1’22, S&P recorded ICE market share in Canadian new LDV sales of 86pc.

According to S&P projections, ICE market share is set to tumble even more rapidly in the coming years with the growth of the ZEV market. ZEVs — which include BEVs and PHEVs but exclude HEVs — are set to make up at 13.5pc of LDV sales by year-end.

That would be roughly flat to their Q3 market share. But S&P suggests that reaching this target would “represent a significant increase from the current level and indicate a strong trend towards the adoption of ZEVs”.

This suggests that it means 13,5pc would be a full-year figure. Given that Q1 and Q2 ZEV market shares were 9.2pc and 10.1pc respectively, a full-year 13.5pc figure would require another material jump in penetration levels in Q4. S&P further predicts that, by 2025, ZEVs will account for a quarter of light vehicle sales in Canada, with an estimated 25.3pc market share.

With BEVs making up 76pc of ZEVs in the third quarter of 2023, assuming similar proportions by 2025 — although BEV market share may well rise further at the expense of PHEVs as proportion of ZEVs — S&P’s calculations therefore imply BEVs making up 19.2pc of LDV sales by 2025.

And, considering that HEVs have tracked slightly above BEVs in terms of sales in recent quarters, another possibly conservative assumption of rough parity between BEV and HEV sales by 2025 suggests ICE vehicles are expected by S&P to capture only a c.55pc market share by 2025.

Tesla China pivot

S&P also calculates that 99pc of the Tesla Model 3 and Model Y vehicles registered in Canada in the third quarter were imported from China, a significant increase from 42pc recorded in the second quarter.

“This shift in Tesla's global manufacturing and supply chain strategy could have a number of implications, potentially affecting price competitiveness and margins due to the lower costs of manufacturing in China,” the firm says.

Insider Focus LTD (Company #14789403)